Yo, Altie here! Ready to compare Hyperliquid and Binance when it comes to trading fees? Both of these platforms are making waves in the crypto world, but they cater to different types of traders.

Whether you’re into decentralized perpetual contracts with low fees on Hyperliquid or you need global liquidity and advanced features on Binance, I’ve got the breakdown for you. In this article, we’ll dive into the maker-taker fee structure, funding fees, and other costs to help you decide which platform gives you the most bang for your buck. Let’s get into it!

In the rapidly evolving world of cryptocurrency trading, both Hyperliquid and Binance have carved out their own niches. While they serve similar markets, they operate on entirely different models, one decentralized and the other centralized.

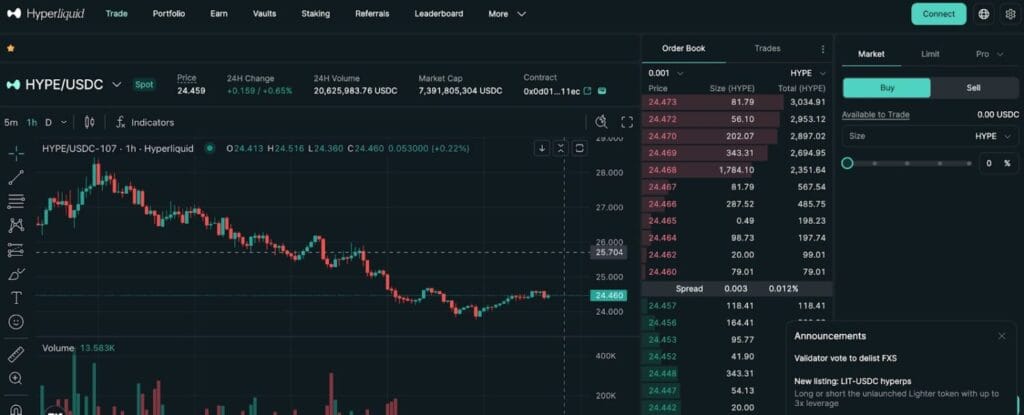

- Hyperliquid is a decentralized exchange (DEX) that specializes in low-cost, low-slippage perpetual contracts. It leverages efficient liquidity routing and ensures that users benefit from minimal transaction fees. Its decentralized nature allows traders to maintain full control over their funds, without relying on a central authority.

- Binance, on the other hand, is a centralized exchange known for its broad range of products, including spot trading, futures, perpetual contracts, and much more. Binance boasts industry-leading liquidity, making it a go-to platform for both retail and institutional traders. With a massive user base and advanced features like the VIP tier system and BNB discounts, Binance provides comprehensive trading solutions with significant advantages for high-volume traders.

This article will explore the fee structures of both platforms in detail, including maker-taker fees, funding fees, gas costs, and other hidden expenses that traders might encounter.

We will compare how Hyperliquid’s decentralized model stacks up against Binance’s centralized exchange in terms of costs, execution efficiency, and overall trading experience.

By the end of this article, you’ll have a clear understanding of which platform best suits your trading style, whether you prioritize low fees, decentralization, or liquidity.

Both platforms have gained considerable traction in the market, but they cater to slightly different types of traders.

Hyperliquid focuses on providing cost-effective trading for decentralized perpetual contracts, offering volume-based fee structures and the advantage of gasless transactions.

In contrast, Binance offers an array of services, including advanced derivatives and VIP tier discounts, appealing to traders who need high liquidity and fast order execution.

This article will provide an in-depth look at each platform’s fee structure and compare how these fees impact your trading costs, particularly for those involved in perpetual contracts and large-volume trades.

Table of Contents

Fee Structure Comparison

Hyperliquid operates under a maker-taker model that uses a volume-based fee structure. This allows users to pay lower fees as they trade more frequently, incentivizing high-volume traders with rebates. Hyperliquid’s fees are typically divided into the following categories:

- Perpetual Contracts: The platform’s typical fee for perpetual contracts is 0.015% for makers and 0.045% for takers. These rates are relatively low compared to other exchanges, making Hyperliquid an attractive choice for cost-conscious traders.

- Spot Trading: The platform also offers spot trading, and the fees in this area are competitive, though slightly higher than those for perpetual contracts. The maker-taker fee structure remains similar, with rebates provided for high-volume users.

- Gas Fees: One of the standout features of Hyperliquid is its gasless trading on its native chain. This means that users can avoid additional blockchain transaction costs, which are common on many decentralized exchanges. This feature significantly reduces the overall trading cost for traders who execute a high volume of trades, making it an excellent option for those who want to avoid the unpredictable costs of gas.

Binance operates a more traditional fee structure compared to Hyperliquid, with maker-taker fees that vary depending on the type of trade and the user’s VIP tier. Here’s how the fee structure works:

- Spot Trading: Binance’s maker-taker fees for spot trading begin at 0.10% for both makers and takers. While these fees are competitive, they can be reduced by holding BNB (Binance Coin) and using it to pay fees, giving users a discount of up to 25%.

- Perpetual Contracts: For perpetual contracts, Binance charges 0.02% for makers and 0.05% for takers, which is quite competitive within the industry. These fees are lower for market makers, encouraging liquidity provision.

- VIP Tiers and BNB Discounts: Binance offers a VIP tier system that adjusts fees based on 30-day trading volume or BNB holdings. Traders can access discounts of up to 20% on trading fees, depending on their VIP status and the amount of BNB they hold. This makes Binance highly attractive for high-volume traders who can further reduce costs by leveraging the BNB discount system.

- Additional Costs: While Binance’s fee structure for trading is competitive, there are additional costs such as withdrawal fees, which can vary depending on the asset and network congestion. For example, withdrawing BTC from Binance incurs a fee of 0.0005 BTC, while ETH withdrawals cost 0.01 ETH.

Funding Fees Comparison

Hyperliquid’s funding fees operate differently from traditional centralized exchanges. Rather than having fees charged by the platform, Hyperliquid’s funding rates are calculated and paid hourly between traders in a peer-to-peer fashion.

This means that the funding fee is paid directly between users, with no intermediary taking a cut.

- Funding Rates: Hyperliquid’s funding rates are determined based on market conditions and are updated every hour. This system provides a more transparent and cost-efficient structure compared to centralized exchanges, where the platform typically takes a portion of the funding fee.

- Peer-to-Peer Funding: One of the main advantages of Hyperliquid’s model is the lack of platform-based fees. This peer-to-peer system can benefit traders who are looking to avoid platform-imposed costs. In addition, it offers more flexibility for traders, as funding fees can vary depending on market conditions and the positions held.

- Traders’ Advantage: Since Hyperliquid charges no additional intermediary fees, users only pay what they owe for funding, which can be significantly cheaper than centralized exchanges that often add a platform markup to these rates.

On Binance, funding fees for perpetual contracts are a key aspect of the platform’s operation, and these fees are charged every 8 hours.

Unlike Hyperliquid, where funding fees are calculated peer-to-peer, Binance’s funding mechanism is more traditional, with the platform determining the rates.

- Funding Rates: Binance’s funding rates for perpetual contracts can vary significantly based on the market and the asset being traded. For instance, BTC/USDT perpetual contracts often have a positive or negative funding rate, depending on whether the market is in backwardation or contango. Funding rates can fluctuate, and traders can track these rates via Binance’s funding rate chart.

- Liquidation Fees: In addition to funding fees, Binance also charges liquidation fees for positions that are forcibly closed due to insufficient margin. These fees depend on the leverage used and the type of asset involved. Liquidation fees typically range from 0.5% to 1% of the position size.

- Market Impact: Since Binance’s funding fees are more standardized and depend on market conditions, they can sometimes become unpredictable. However, Binance offers insight into funding rate trends, allowing traders to make more informed decisions based on future fee predictions.

Comparison of Additional Costs

Gas Fees

Hyperliquid and Binance handle gas fees differently due to their contrasting decentralized and centralized models.

- Hyperliquid Gasless Trading: Hyperliquid offers a gasless trading experience on its native chain, which eliminates the typical blockchain transaction costs. This feature is incredibly advantageous for traders who frequently execute trades or need to minimize the impact of transaction fees on their profitability.

- Traders on Hyperliquid do not need to worry about Ethereum gas fees, or other chain-specific costs, making it a cost-effective choice for users who trade often and want to avoid unpredictable gas charges.

- Binance Gas Fees: Since Binance operates as a centralized exchange, users must pay standard network fees for deposits and withdrawals. These fees vary depending on the asset and the network being used.

- For instance, ETH withdrawals cost 0.01 ETH, and BTC withdrawals incur a fee of 0.0005 BTC. These network fees can sometimes fluctuate depending on the blockchain congestion, especially during times of high network activity.

Withdrawal Fees

Withdrawal fees on both Hyperliquid and Binance vary depending on the asset being withdrawn and the network chosen.

- Hyperliquid: Since Hyperliquid operates on a decentralized model and handles fees in a more efficient manner, the platform does not impose withdrawal fees for assets traded on its native chain.

- For assets on other chains, users are still subject to network fees but do not pay any additional withdrawal costs imposed by the platform.

- Binance: Binance, being a centralized platform, charges withdrawal fees for various assets, which can sometimes be higher than decentralized platforms. For example:

- BTC withdrawals: 0.0005 BTC

- ETH withdrawals: 0.01 ETH

- USDT (ERC-20) withdrawals: 0.1 USDT

These withdrawal fees can fluctuate depending on network congestion, which means they are subject to change based on the demand for blockchain space.

However, these fees are often lower than what you would pay for decentralized platforms like Ethereum due to Binance’s centralized nature and the ability to aggregate withdrawals.

Real-World Trading Example

Let’s break down the real-world costs for a $100,000 notional trade on both Hyperliquid and Binance. This will help compare the overall trading costs, fees, and funding fees on both platforms.

Hyperliquid Example

For a $100,000 trade on Hyperliquid involving perpetual contracts, the typical fees would be:

- Maker Fee: 0.015% of $100,000 = $15

- Taker Fee: 0.045% of $100,000 = $45

If the trader is a high-volume user, they may receive maker rebates, which can further reduce fees.

Additionally, the gasless trading feature means that there are no extra transaction costs for using the platform, giving Hyperliquid a clear edge in terms of avoiding the high gas fees found on other decentralized platforms.

Binance Example

For a $100,000 trade on Binance Futures, the typical fees would be:

- Maker Fee: 0.02% of $100,000 = $20

- Taker Fee: 0.05% of $100,000 = $50

Binance also offers BNB discounts for users holding Binance Coin (BNB) in their accounts, which can further reduce these fees by up to 25%, depending on the user’s VIP status.

For example, if the trader uses BNB to pay fees, the maker fee could be reduced to $15 and the taker fee to $37.50.

Additionally, Binance imposes funding fees every 8 hours, which vary depending on market conditions. For instance, the BTC/USDT perpetual contract might have a funding rate of 0.01% for longs and -0.01% for shorts.

Comparison of Liquidity and Trading Costs

Liquidity is a critical factor when choosing a trading platform, as it directly impacts slippage and the ease with which orders can be filled.

- Hyperliquid: Hyperliquid’s decentralized liquidity model supports low slippage for perpetual contracts. The platform uses efficient liquidity routing to ensure that trades are executed with minimal price impact, even for large orders.

- However, since it operates as a decentralized exchange (DEX), liquidity can sometimes be more volatile compared to centralized platforms, particularly during periods of market turbulence or low-volume trading.

- Binance: Binance leads the industry in liquidity, thanks to its massive global user base and its ability to aggregate order flow from both retail and institutional traders.

- The exchange provides deep liquidity across multiple markets, ensuring that traders can execute large trades with minimal slippage, even in highly volatile conditions.

- Binance’s centralized infrastructure allows it to quickly adjust liquidity during market fluctuations, ensuring narrow spreads and efficient order matching.

Trading Costs for Large Orders

When executing large-volume trades, slippage can have a significant impact on the overall cost of trading. Here’s how Hyperliquid and Binance handle large orders:

- Hyperliquid: As a decentralized platform, Hyperliquid’s slippage can sometimes be more noticeable during periods of high volatility or lower liquidity. However, its efficient liquidity routing helps minimize this issue compared to other DEXs.

- Traders who execute large orders on Hyperliquid may experience slightly higher slippage than on Binance, but the gasless trading feature compensates for some of these costs by eliminating additional blockchain transaction fees.

- Binance: Binance is known for its ability to handle large-volume trades with minimal slippage.

- Its centralized infrastructure and vast liquidity pools allow for efficient order matching, making it a better option for institutional traders or those executing large trades.

- Binance’s global user base ensures that orders are filled quickly, even during periods of extreme volatility, with minimal slippage and tight spreads.

Conclusion

Choosing between Hyperliquid and Binance depends on your trading priorities. Both platforms offer unique advantages:

- Hyperliquid is ideal for traders who prioritize low fees, gasless trading, and decentralized perpetual contracts.

- It offers a low-cost, flexible trading environment for those looking to minimize transaction fees, especially with its peer-to-peer funding rates.

- The gasless feature is especially appealing for traders who make frequent trades on the platform and want to avoid unpredictable blockchain fees.

- Binance, on the other hand, is a perfect choice for traders who need global liquidity, advanced features, and institutional-grade trading capabilities.

- With its high liquidity, tight spreads, and VIP tier discounts, Binance is the go-to exchange for high-volume traders looking for a comprehensive trading platform with access to multiple markets.

- BNB discounts further lower fees for large traders, making Binance a competitive option for those who prioritize speed, liquidity, and low-cost trading on a centralized platform.

If you are focused on decentralized perpetual contracts with low fees and gasless trading, Hyperliquid may be the best fit.

However, if you are looking for institutional-grade liquidity, advanced order types, and discounted fees through BNB, Binance remains a top choice for both retail and professional traders.

And that’s the lowdown on Hyperliquid vs Binance! Whether you’re all about low-cost decentralized trading or need institutional-grade liquidity, these two platforms have something to offer.

If low fees and gasless trading are your top priorities, Hyperliquid might be the way to go. But for traders seeking advanced tools and massive liquidity, Binance is hard to beat. Whatever your choice, keep it smart, keep it profitable, and keep those LEDs glowing! Until next time!