Having a huge market capital next to Bitcoin, Ethereum is about to go parabolic in the second half of this year for a wide variety of reasons. We shall discuss all possibilities or maybe at least a few that we have extensively heard of why Ethereum will hit $10000.

Ethereum, a prominent word in the crypto industry, has entirely changed the face of cryptocurrency or the way people think about crypto. The multi magnitude potential of Ethereum has opened doors to coders, creators, artists, craftsmen, etc.,

Table of contents

- Is Ethereum going to a big jump again?

- What is Ethereum?

- Whay should you be Bullish on Ethereum?

- Why is Ether is Ultra Sound Money?

- Ethereum or Bitcoin – Which is better?

- Ethereum Rainbow Price Chart: Log Scale

- Rising Ethereum’s Active Addresses

- Ethereum Balance on Exchanges

- Ethereum to Hit $10000: Conclusion

Is Ethereum going to a big jump again?

Just like Bitcoin, Ethereum has been declared dead on Twitter by so-called crypto analysts. If you were around March 2020, Ethereum has reached $130; the crowd’s ultimate short-term target was x2 or x3. Everyone was so panicked, frightened due to the Corona crash.

Very few believed that the ETH can see new highs, in fact, exponential highs. Ethereum, as you know, has surpassed $4000 and is trading at $ 2200 when writing this article.

If I had shared a thought that the ETH would do 100X when it was 100$, people would have laughed off, and now, it’s just 2.5x far from ATH to reach $10,000. So will you still be skipping it off?

Also, read Sharding: The brain of Ethereum 2.0.

What is Ethereum?

Ethereum is a blockchain platform with its own cryptocurrency, Ether (ETH) or Ethereum, and its own programming language, Solidity.

Ethereum, as a blockchain network, is a decentralized public ledger used for transaction verification and recording. Users of the network can create, publish, monetize, and use applications on the platform and use the Ether as payment.

It differs from Bitcoin because it is a programmable network that acts as a marketplace for financial services, games, and apps, all of which can be paid for using Ether and are free of fraud, theft, or censorship.

Ethereum- Summary

- Ethereum is an open-source blockchain-based platform used to create and share business, financial services, and entertainment applications.

- Dapps are paid for by Ethereum users. The costs are referred to as “gas” since they fluctuate according to the amount of computing power used.

- Ethereum has its own associated cryptocurrency, Ether or ETH.

Also, read Beacon Chain: Heart of Ethereum 2.0.

Whay should you be Bullish on Ethereum?

Ethereum to Hit $10000: London Fork

The critical Ethereum update, which is part of the blockchain’s London hard fork, has been suggested for mainnet activation on block 12965000, scheduled to occur between 13:00 UTC and 17:00 UTC on August 4.

Hard Fork aims to solve the problem of volatile transaction fees on the Ethereum network.

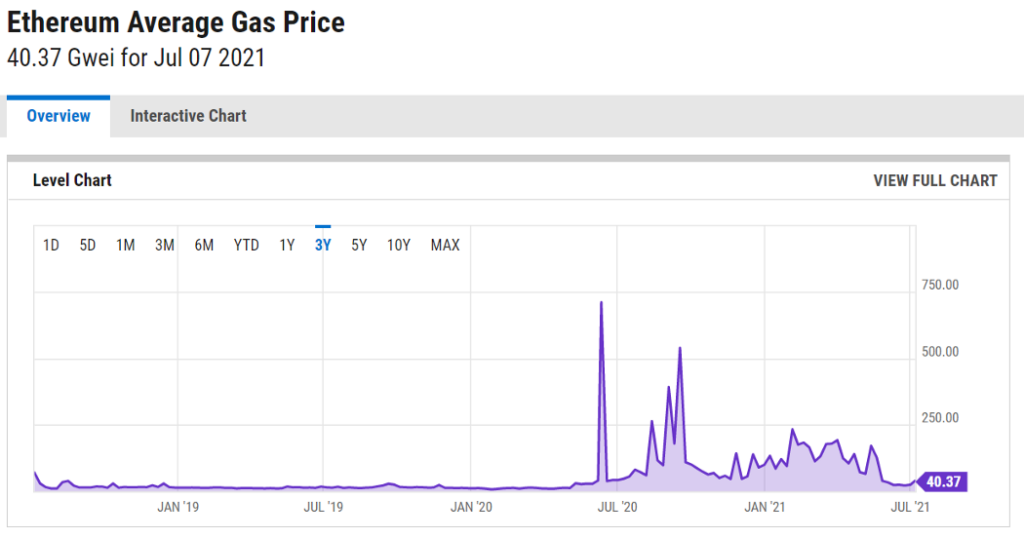

Ethereum’s network transaction fees is unpredictable and very volatile.

Why is the Ethereum network’s gas fee so inconsistent?

To incentivize miners to include the transaction in the block, Ethereum incorporates gas fees in transactions. The highest bidder model determines these fees. If the costs are set too low, other users may outbid your gas fee, and your transaction may take a long time to complete, remain pending, or be terminated or fail.

Therefore, Ethereum gas fees are unpredictable, and the transactions take time to get included in the block unless you pay big.

How does this change? The answer is Ethereum EIP 1559.

What is Ethereum EIP 1559?

Ethereum EIP 1559 is an improvement proposal that will change the fee market for the Eth 1.0 chain.

This eliminates the highest bidder model or transactions. Instead, the new model will charge fees depending on network utilization, with a variable “Base Fee” established by the Ethereum protocol based on usage and demand.

Ethereum to Hit $10000: Ether Burn

After Ethereum EIP 1559 upgrade, one of the core changes is burning the base fee.

Eth 1.0 miners get Block Reward for securing and processing the transactions in the existing system, but the new system will allow miners to get their block reward but not the base fee.

Why is Ether is Ultra Sound Money?

- Doesn’t inflate for ever like fiat.

- New reserves aren’t being discovered like a goat.

Eventually, the supply starts to go deflationary.

On the one hand, Bitcoin’s so-called proof of work rewards miners who are competing against each other to use computers and energy to record and confirm transactions on its blockchain. On the other, Ethereum’s plan to adopt the more efficient proof of stake model, which chooses a block validator at random based on how much ether it controls.

“The shift to proof of stake for block validation reduces carbon emissions by 99.9%, making Ethereum a green technology,” Kaspar explained. “So these two updates on the network alone could push Ethereum to a trillion-dollar market cap which is where bitcoin is at today — that would make Ethereum around $8,000 to $10,000 a coin.”

Goldman Sachs analysts feel that Ethereum, as the most popular platform for generating smart contracts, is now the asset with the greatest real-world potential.

Bitcoin may have a stronger brand, given its reputation as a pioneer; however, BTC lacks some of Ethereum’s real-world use cases. This is partly due to the low transaction speed.

Also, read How to buy Ethereum in India?

Ethereum or Bitcoin – Which is better?

In general, the price of 32 ETH will always tie to 1 BTC or close to it. Whenever there happened to be a deviation in the price between BTC and ETH, both catch up with each other. Bitcoin makes a move first; the rest all the other alts shall follow.

At this point, Ethereum is showcasing good stubborn dominance, but BTC’s dominance is plunging.

Dan Morehead, CEO of Pantera Capital, expressed his thoughts on Twitter:

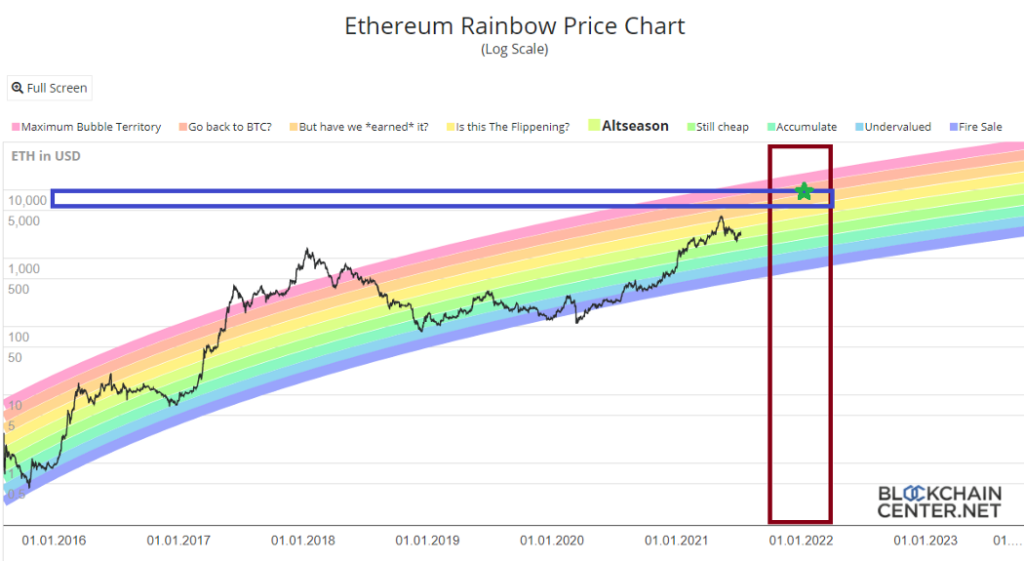

Ethereum Rainbow Price Chart: Log Scale

Considering that Bitcoin shall hit a minimum of $100 k by the end of the year.

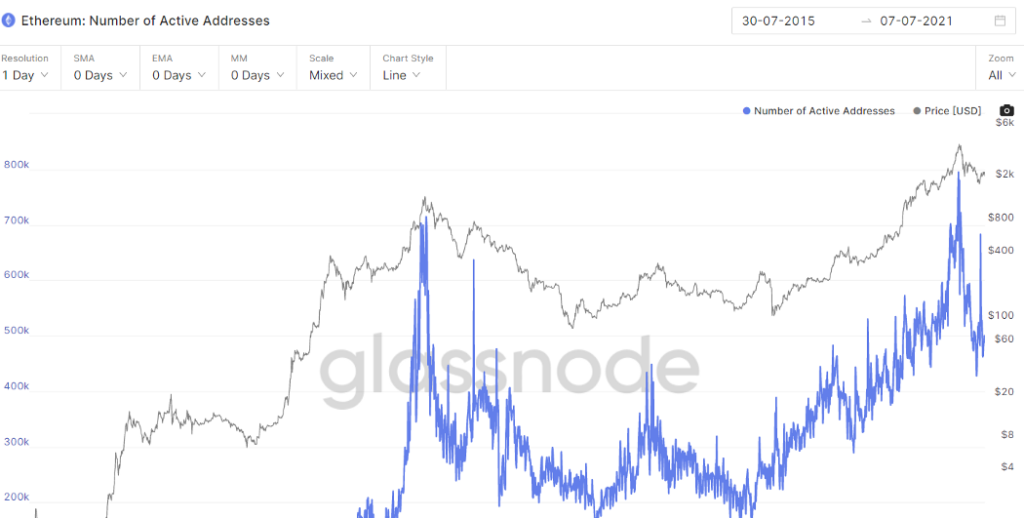

Rising Ethereum’s Active Addresses

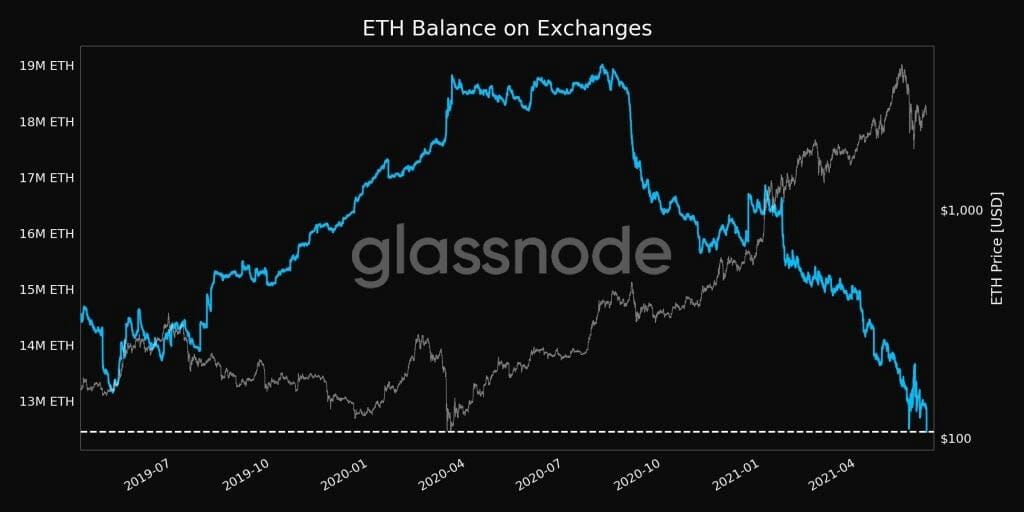

Ethereum Balance on Exchanges

The below chart depicts Ethereum’s Balance on Exchanges hits a 2-year low on the first week of June 2021.

Ethereum to Hit $10000: Conclusion

As we know, Ethereum has already outrun Bitcoin not by market cap but by its performance. The deflationary nature of the new London upgrade will take ETH to the next level.

Ethereum London upgrade, increase in the outflow of Ethereum from exchanges, and retail’s keen interest in Ethereum, all these together might shoot up the price of Ethereum.

- $100,000/ Bitcoin is 3x from here and 1.5x from ATH;

- $10,000/ Eth is 5x from here and 2.5x from ATH. Do you think it’s not possible? Think again!!

Thanks for reading.

Stay Bullish.

Author: Eth!c@l Aka Kumar

PS: Nothing in this article is Financial advice, and all the written texts are my own observations.

Sources of charts: Glassnode and Blockchain Center.

Also read,

![How to buy Ethereum in India? [Mobile and Website] 7 Buy Ethereum in India](https://coincodecap.com/wp-content/uploads/2021/03/Buy-Ethereum-in-India-768x432.png)