Dear Readers, hope all is well and you had a great week. I have decided to look at two indicators that I believe are important in regard to ETH.

Ethereum: Net Unrealized PnL [NUPL]

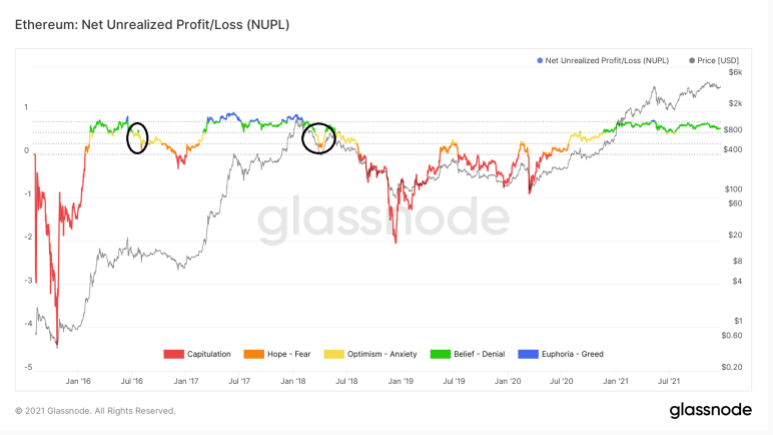

NUPL is an indicator that divided unrealized profits with unrealized losses. It measures the hypothetical profit/loss for investors’ fall coins were to be sold at the time. The indicator reached a yearly high of 0.77 in January.

NUPL fell twice below the 0.5 thresholds which at the time was seen as a sign of weakness since it indicated a weakening trend.

![Ethereum On-Chain Analysis 21-25 December 2021 1 Ethereum: Net Unrealized PnL [NUPL]](https://coincodecap.com/wp-content/uploads/2021/12/image-387.png)

Previously decreases below the 0.5 levels(black circles) have marked the end of the bull run. Therefore it is crucial that the indicator manages to hold n above this level.

Ethereum: Market Value to Realised Value [MVRV]

MVRV is an indicator that measures the ratio between the market and realized capitalization levels. It is used to determine if an asset is priced near its fair value.

High readings can be considered signs of tops, indicating that the market is overbought. Low readings can be considered signs of bottoms showing an oversold market. Historically the 1.9 levels seem to have acted as support for ETH.

This was the case in July and Sept 2017, since both the indicator and price bounced after a low close to 1.9 was reached(black circles). Therefore the reading was associated with a local low prior to the continuation of the upward movement.

Afterward, the levels acted as a resistance on Aug 2020 before turning to support afterward (black line). There is a significant deviation in July 2021, but the level was reclaimed shortly afterward.

Currently, MVRV is trading just above this level and could potentially initiate a bounce. Similar to the 0.5 level in the NUP, the 1.9 level in MVRV is very significant and it is crucial that ETH stays above it for the bullish trend to remain intact.

![Ethereum On-Chain Analysis 21-25 December 2021 3 Ethereum: Market Value to Realised Value [MVRV]](https://coincodecap.com/wp-content/uploads/2021/12/image-389-1024x576.png)

**Nothing in this article is financial advice, and you should only invest in the market you believe is suitable for your portfolio.