EdgeX is an Ethereum Layer-2 exchange delivering CEX-like speed with on-chain, self-custodial settlement. Trade via a familiar order book while keeping records. The ecosystem adds eStrategy, Earn, Portfolio, and Epicser, etc. In this article, we will explore EdgeX review.

Table of Contents

What is EdgeX?

- A faster, cheaper lane on Ethereum: EdgeX runs on top of Ethereum as a Layer-2. Think of it like an express lane: trades happen quickly and cheaply on L2, while Ethereum keeps the final records safe and verifiable.

- You keep control of your crypto: EdgeX is non-custodial. You trade from your own wallet, so you hold the keys. All activity settles on-chain, which means there’s a clear, auditable history of what happened.

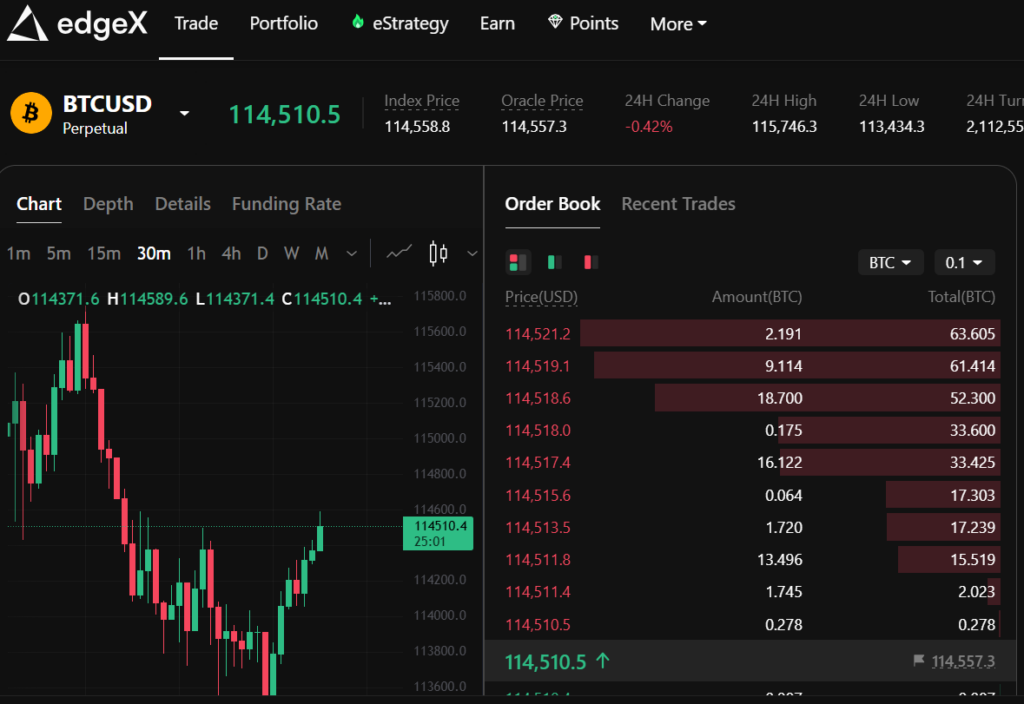

- Built for pro-style trading, but on-chain: It uses an order book (like big centralized exchanges) that can match trades extremely fast—targeting under 10 milliseconds—while keeping fair pricing and the advanced tools active traders expect.

- Where it started and where it’s going: Version 1 is a perpetual futures DEX that uses StarkEx tech and zero-knowledge proofs to prove trades were processed correctly. Version 2 aims to become a full “financial chain” with more markets and DeFi apps.

- Designed to be modular and open: The plan is to let teams launch new products and markets permissionlessly, governed by the community. Price data comes from oracles, helping keep “fair” prices during volatility and reducing the chance of manipulation.

Features & Products

- High-performance CLOB with L2 settlement: EdgeX V1 uses StarkEx to validate batches and post proofs on Ethereum, combining fast order matching with verifiable on-chain settlement. This balances the need for speed with the guarantees of decentralized infrastructure.

- Modular financial system for V2: The roadmap frames EdgeX as a financial chain offering plug-and-play modules for trading, liquidity, lending, insurance, leverage, UI/UX, and wallets—lowering barriers for builders and users to assemble products like Lego blocks.

- Trader-centric design and sub-accounts: V1 emphasizes professional UX, hedgeable bi-directional positions, and risk tooling designed for derivatives traders.

- Oracle-anchored price integrity: Independent oracle providers supply mark prices to protect users from thin-book anomalies, ensuring fair margin and liquidation behavior that reflects underlying asset values rather than momentary order-book noise.

- Rollup-level security with ZK proofs: Each batch includes zero-knowledge proofs validated on Ethereum L1, making trading logic and state transitions publicly checkable. This provides cryptographic assurance without imposing full L1 costs per transaction.

- Cross-chain deposits and withdrawals: EdgeX employs cross-chain messaging and canonical bridges, letting users move assets between chains while keeping self-custody. Non-Ethereum deposits route via asset pools, with notes on large transfer rebalancing delays.

- eStrategy (liquidity + strategies): EdgeX eStrategy is a liquidity engine and strategy library that feeds deep, reliable order-book depth into the exchange. It helps market makers deploy capital efficiently, automate tactics, and manage risk with modular, backtestable strategy components.

- Earn section (passive yield options): An “Earn” hub aggregates ways to put idle assets to work—think liquidity provision, points programs, or curated yield opportunities. Clear risk notes and projected returns help beginners decide how much to allocate and for how long.

- Portfolio (all positions in one view): A unified Portfolio tab shows balances, open positions, margin health, PnL, and funding. Filters and exports make it easy to track performance, reconcile activity at tax time, and spot risk before liquidation becomes a threat.

- Epicser (stake + mint NFT): Epicser lets users stake eligible tokens and mint NFTs tied to participation or tiers. Staking can unlock benefits like fee perks or points boosts, while NFTs function as on-chain badges for access, identity, or future program utilities.

- Blog (latest news and updates): The official blog publishes feature releases, security notes, market explainers, and roadmap updates. Reading it before big trades helps you understand parameter changes, maintenance windows, and new opportunities across strategies, staking, and liquidity programs.

- API for builders and bots: A documented HTTP and WebSocket API supports programmatic trading, quotes, funding data, and authentication. The docs flag beta status and encourage opening a Discord ticket for any integration issues encountered.

Fees

- Volume-tiered structure: EdgeX applies maker/taker fees using a rolling 30-day traded volume window, recalculated daily. Sub-account activity aggregates into the main account so larger traders benefit consistently across multiple desks or strategies. edgex-1.gitbook.io

- Maker versus taker definition: Makers add resting liquidity to the book, while takers remove it by executing immediately. The distinction affects fee rates and encourages deeper books for improved execution quality during volatile periods.

- Gas and settlement handling: The V1 documentation notes EdgeX covers settlement gas, reducing friction for frequent traders. Users still consider network costs on deposits or withdrawals depending on chosen chains and routes.

- VIP schedule externally posted: The detailed VIP fee ladder lives on the pro site, ensuring live, canonical rates. Traders should verify current tiers and any promotional structures before executing large strategy shifts.

- Funding and financing context: While fees are structural, net PnL also reflects funding between longs and shorts, liquidation penalties where applicable, and cross-margin effects—factors that should be assessed alongside posted fee tiers.

Security

- ZK-rollup settlement with proofs: Trades are validated off-chain, bundled, and proven on Ethereum L1, allowing cryptographic verification of state transitions and guarding against invalid executions or tampering by intermediaries.

- Self-custody by design: Users maintain control of assets, with withdrawals not requiring centralized approval. This reduces counterparty risk compared to exchanges where custody sits with a single operator.

- Oracle-based fairness: Independent oracle mark prices anchor risk logic, reducing manipulation from thin books and improving predictability of liquidation thresholds during disorderly market conditions.

- Audit transparency: Security reports for platform components and StarkEx are published for community review. Audits provide third-party scrutiny of key systems, though prudent users should read scope details and limitations.

- Withdrawal safety trade-offs: L1‐settled withdrawals may take hours due to batching and verification, trading speed for settlement security. Users can choose non-Ethereum routes with different fee and pool-liquidity constraints.

UI & UX

- Professional trading layout: The app surfaces an order book, charts, order ticket, positions, and risk details, easing migration from CEXs and aligning with workflows for active derivatives traders.

- Unified DeFi portal: The interface aspires to aggregate multi-chain liquidity and products in one place, reducing context-switching and simplifying complex cross-chain actions behind clearer buttons and flows.

- Retail-friendly onboarding: MPC-style email logins, social methods, and smoother deposits aim to remove early friction for newcomers while preserving non-custodial control and L2 settlement clarity.

- Mobile pathway: The documentation emphasizes mobile experiences as a bridge for CEX users, highlighting simplified flows and social logins to improve adoption and daily use for smaller, frequent trades.

- API visibility and beta notices: Clear endpoints and a Discord support path help builder audiences integrate safely, with upfront warnings that the API remains in active development and may change.

Referrals & Rewards

- EDGE VIP (tiered benefits): Trade more, unlock more. EDGE VIP is a tier system that rewards consistent activity with perks like lower fees, priority features, and occasional exclusives. Your tier updates automatically as your rolling activity crosses set thresholds.

- Rewards Hub (missions → prizes): Start in the Rewards Hub to see bite-sized tasks—trade, try features, learn basics. Complete missions, claim rewards, and level up your account. It’s a simple checklist that turns first steps into tangible benefits.

- edgeX Points (participation score): edgeX Points recognize genuine engagement across the platform. You earn points by trading, exploring features, holding open interest, and referring friends. Points may unlock VIP tiers, campaign perks, or future benefits tied to ecosystem growth.

- How points are allocated: Points come from several metrics: your trading volume, referral trading volume, open interest, and how often you use features. As products evolve, EdgeX can re-balance these weights, keeping rewards aligned with healthy, organic activity.

- Referral bonus (invite & earn): Share your link and earn 1 point for every 5 points your referees accumulate. The more they genuinely trade and use features, the more you earn—no spam needed, just real participation over time.

- Tips to maximize rewards: Focus on steady trading rather than bursts, complete Rewards Hub tasks weekly, learn new features to trigger usage points, and invite friends who will truly trade. Track progress in your VIP panel and adjust your routine accordingly.

Customer Support

- Docs first: The GitBook serves as the canonical reference for getting started, fees, order types, liquidations, APIs, and audits. It is the fastest route for answering common questions without waiting.

- Official links and policies: The “About” area lists official links, Terms, and Privacy, helping users verify domains and avoid phishing when connecting wallets or calling APIs.

- Discord for tickets: API docs explicitly direct users to open tickets in Discord for integration or reliability issues, reflecting an active support channel for builders and advanced users.

- Change logs and last-updated stamps: Pages include “last updated” metadata, signaling freshness and letting users check whether instructions align with current app behavior.

- Self-diagnosis tips: When seeking help, include wallet address, order or transaction IDs, device/browser, timestamps, and screenshots so moderators can triage quickly and reproduce errors.

How to Get Started

- Choose login method: Connect a standard wallet or log in using MPC/email for simplified onboarding, then verify you are on the supported network for trading and settlement.

- Deposit funds: Deposit USDT from Ethereum or supported chains; note confirmation counts and potential L1/L2 rebalancing delays for very large non-Ethereum deposits before funds appear.

- Understand fees and tiers: Review the 30-day rolling volume model, sub-account aggregation, and the VIP page so you know the effective economics as trading size increases.

- Learn order types: Study market, limit, stop, take-profit, and liquidation logic so you understand trigger sources, cross-margin effects, and mark-price behavior before committing larger positions.

- Plan withdrawals: Decide between Ethereum L1 settlement windows or multi-chain routes; confirm pool limits and per-route fees to avoid surprises when moving profits or rebalancing collateral.

Mobile App

- Android (Google Play): Download the official EdgeX app directly from Google Play for the easiest setup, automatic updates, and built-in security checks. Connect your wallet, place orders, and monitor margin health with a mobile-first trading layout.

- iOS (Beta): iPhone users can join the iOS beta to try new features early. Expect TestFlight-style invites, faster iteration, and occasional UI tweaks. Always install from official links shared on the EdgeX site or blog.

- Android APK (direct install): Prefer manual installs? EdgeX provides an Android APK for regions where Play access is limited. Enable trusted sources temporarily, verify the file hash, install, then disable unknown sources to maintain device security.

- Web Pro (browser terminal): Use Web Pro in Chrome, Safari, or Firefox for a desktop-grade terminal on any device. It mirrors app features—order book, ticket, positions, and risk panels—without an install, ideal for shared or work machines.

- Best practices: Enable biometrics and 2FA in your wallet, keep a small gas balance, and bookmark official download pages. Test tiny trades first, use reduce-only for exits, and double-check domains before logging in on new devices.

Conclusion

EdgeX blends pro-grade trading with on-chain safety, giving you CEX-like speed while you keep self-custody and a verifiable record. For beginners, that means a familiar order book, clear margin rules, and visible health metrics. For active traders, sub-10ms matching targets, robust liquidation logic, and evolving markets deliver serious execution without sacrificing transparency.The ecosystem adds practical tools: eStrategy deepens liquidity and standardizes strategies; Earn offers ways to deploy idle assets with clear risk notes; Portfolio centralizes balances, PnL, funding, and margin, etc. Start small, use reduce-only exits and placed stops, and budget for funding and slippage.

How fast are withdrawals?

Does EdgeX pay my gas?

Where do I find audits?

Audit links for the platform and StarkEx components are published in the docs, enabling users to review third-party assessments before depositing significant capital.