Key Takeaways

- As per Dr. Fabio Panetta, a member of the European Central Bank’s Executive Board, the ECB’s strategies for a primarily digital version of the euro will be intentionally scaled to not subvert the role of banks in the euro area economy while preventing the risk of Big Tech firms dominating payments.

- If European governments and the EU Commission support the concept, a digital form of the single currency might be deployed within four years, he said.

- Changes in technology, geopolitics, and consumer preferences should not signal the end of this delicate equilibrium, but rather an opportunity to extend it into the digital age.

- Digital currencies issued by central banks will allow public money to continue to play an important part in the payments system’s stability and performance. Private funds will add to the foundation’s innovation and diversity.

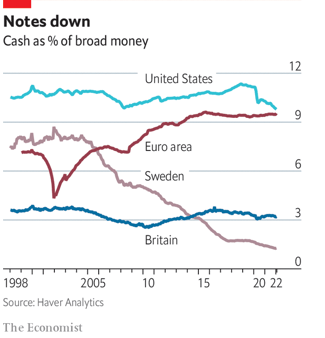

Physical currency has lost favour in recent years. The majority of money is digital and created by regulated commercial banks. Customers’ e-wallets are being fought over by a cast of digital-money want tobes. And central banks want to continue in the money game by creating their own digital currencies.

Everyone can benefit from a central-bank digital currency (cbdc). The public might either open accounts with the central bank or keep money from the central bank in privately issued wallets. According to the Atlantic Council, a Washington, DC-based think organisation, 89 countries accounting for 90% of global GDP are considering a cbdc. The Bahamas sand dollar, the East Caribbean dCash, and Nigeria’s e-naira are all now in use. China’s e-CNY digital currency pilot has grown to over 260 million wallets.

The European Central Bank (ECB) has stated that a “digital euro” might be introduced within four years and would “promote financial inclusion” at a time when the “vast drop” in the number of bank branches may be impacting vulnerable clients.

On Monday, Fabio Panetta, a member of the European Central Bank’s executive board, spoke at the National College of Ireland in Dublin about ideas for a digital euro.

Panetta also addressed recent cryptocurrency market turbulence, which saw the TerraUSD (UST) depeg from the US dollar and the price of numerous major coins, including Bitcoin (BTC), fall. Stablecoins, like Tether (USDT), were not “risk-free,” as per the ECB official, and were still “susceptible to runs,” much like investing in cryptocurrencies.

“Recent events in the crypto-asset market demonstrate that believing private instruments may operate as money when they cannot be turned at par into public money at all times is a delusion,” Panetta added. “Despite promises that cryptos are a trustworthy kind of “money free of government control,” they are far too dangerous to be used as a reliable payment method. They act more like speculative assets, raising a slew of legislation and financial stability problems.

The synergy of public and private money, which has traditionally been a core of our economic model, is being put to the test by digital technologies, shifting payment patterns, and the struggle for payments hegemony. From the start, this initiative was conceived as a joint European undertaking, with cooperation being critical to the development and eventual success of a digital euro.

The ECB initiated a two-year research in October 2021 to look into the feasibility of deploying a digital euro.

“We could decide to start a realisation phase at the end of 2023 to build and test the right technical solutions and business arrangements required to supply a digital euro,” Dr. Panetta added.

He continued, “This phase might take three years.”

The European Central Bank will guarantee that cash is available. However, if the trend holds, they may find themselves in a future where cash loses its central function and capacity to serve as a successful anchor as consumers shift to digital payment methods.

For two reasons, the ECB cannot permit public money to become neglected.

- 1)First, key parts of the payments market, such as card payments and e-commerce, have become dominated by a few multinational players. The expansion of big techs, who can offer payment services by leveraging their massive consumer base and dominant position in adjacent markets, could amplify this trend.

- 2) The smooth operation of digital payments will ultimately rely on the anchoring role of public money.

“By increasing Europe’s strategic autonomy and threatening monetary sovereignty if central bank money is no longer at the centre of the payment system,” he stated, “it could enhance threats to Europe’s strategic autonomy and endanger monetary sovereignty.”

“Our ability to convert private money – such as monies stored in bank accounts or digital wallets – into public money, which is the safest form of money accessible, hinges on our ability to convert, at par, private money into public money, which is the safest form of money available.”

“Confidence that €1 is €1”

A Significant Change towards Digital Euro:

According to the ECB, digital money produced by a central bank would act as an instrument to support the current digital payment changes.

“This transformation is particularly obvious here in Ireland, where the financial environment is undergoing dramatic change, with some major incumbent banks retreating and fintechs rapidly infiltrating the payments business,” said Dr. Panetta.

He characterised the growing popularity of non-cash payments and the development of crypto assets as evidence of a growing need for immediacy and digitisation. “Others will meet this demand if the official sector – central banks and supervised intermediaries – does not,” he warned.

“As a result, countries all over the world are looking into issuing a central bank digital money.”

“Digital money issued by the central bank would allow anyone to make digital payments using public money.” It would be a safe, dependable method of payment that was created with the public good in mind.

Prof Lane stated that money supply is “naturally a governmental monopoly” that the European political system is unlikely to relinquish, even while technology companies advance with rapid advances in payments technology that may render official currency obsolete.

Simultaneously, he argued, banks that help the economy by transforming depositors’ savings into loans should not be displaced. Consumers may perceive a central bank emoney wallet as a safer savings option than traditional banks.

CBDCs are gaining popularity and as a result, the political process for reaching an agreement on them is critical.

“The coexistence of public and private money can be a win-win situation in the digital age, perhaps even more so.”

Also Read: ECB Updates Digital Euro Privacy Options