Key Takeaways:

- Crypto funds witnessed inflows totaling $81 million last week, marking the fifth consecutive week of inflows totaling $0.53 billion.

- BTC ended the month at $23,300 – 16.8% higher than the June closing price.

- July was BTC’s best-performing month since October 2021.

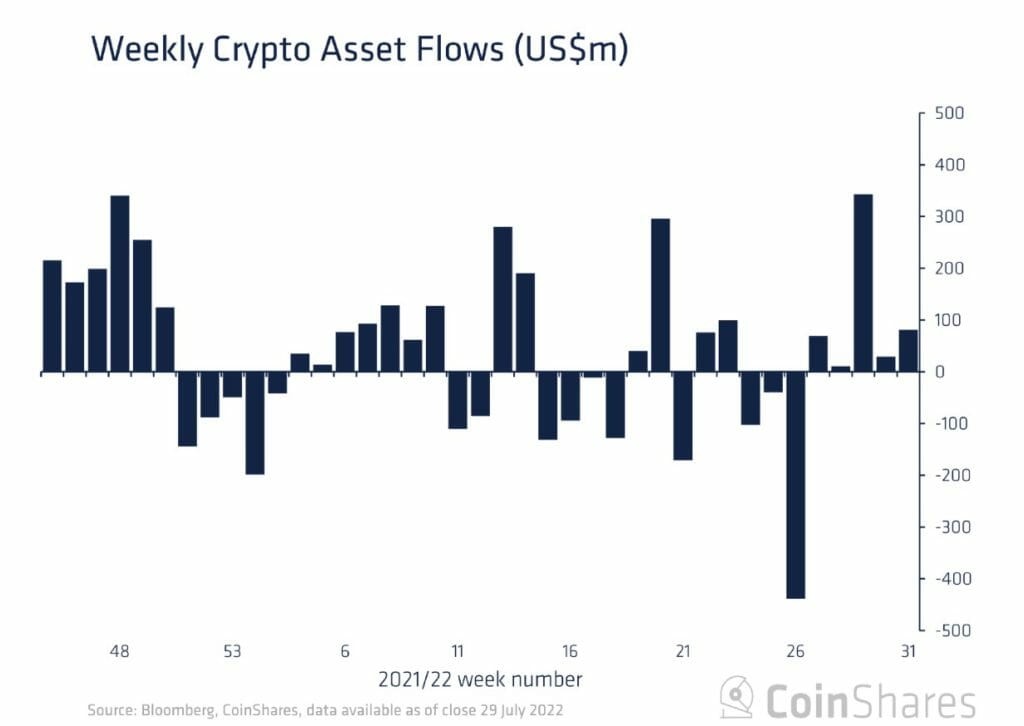

European cryptocurrency investment firm CoinShares put out a report detailing the Digital Asset Fund Inflows in the past month. As per the report, July witnessed the strongest set of monthly inflows this year, totaling US$474m, almost correcting all of the June outflows, totaling US$481m. This performance was despite July being an extremely volatile month with the U.S. logging concerningly high CPI numbers and the Federal Reserve increasing the interest rates again.

The report states that crypto funds witnessed inflows totaling $81 million last week, signifying the fifth consecutive week of inflows totaling $0.53 billion, or 1.6% of total assets under management (AUM). Most inflows were from North America, with inflows from the U.S. and Canada totaling $15m and $67 million, respectively.

The report touching upon individual crypto fund providers’ performance states that Grayscale bagged first place with a total AUM of $21.46 billion, followed by CoinShares at $2.11 billion and 21Shares with an AUM of $1.15 billion.

Despite choppy market conditions, Bitcoin had an impressive run in the past month. Bitcoin inflows totaled $85 million last week, while short-bitcoin saw outflows totaling around $2.6 million. This was the first week of outflows after the recent bear market saw a five-week run of inflows.

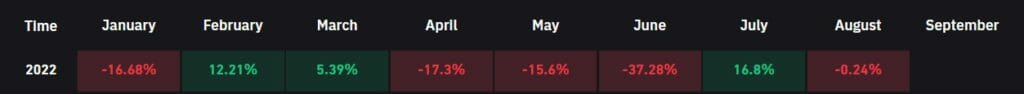

BTC ended the month at $23,300 – 16.8% higher than the June closing price, making it the token’s best-performing month since October. This surge is notable since June was one of BTC’s worst months ever since its introduction. In June, Bitcoin dumped from $30,000 to a multi-year low of $17,500 and closed with a 37% decrease.

Ethereum, another popular cryptocurrency, also rose around 50% in July. Despite the surge in prices of digital assets, trading activity in the past month was not impressive. July last week’s trading volumes totaled $1.3 billion compared to this year’s weekly average of $2.4 billion.

Analytics platform Dune’s data shows that about 1.61 million Ethereum NFTs were sold in July on OpenSea compared to 1.54 million for all of June. As per data reports, the number of unique traders also increased from nearly 393,000 in June to over 400,000 in July. Despite good numbers on NFT Marketplaces, since the value measured in U.S. dollars has fallen, the Dune report shows that the Ethereum NFT volume in July was $495 million compared to $695 million across June.

Overall the crypto economy and digital asset industry had a satisfactory run this past month. However, this should not be taken as a sign of relief for crypto investors since the shadow of an impending recession and the Fed rate hikes are looming right above the crypto market.