Key Takeaways

- Fed raised the interest rate by another 75 basis points on Wednesday.

- Bitcoin price went up around 9% from 24 hours before the announcement.

- Ethereum’s price increased by 15.64% following the rate hike.

- ETC up 32%, and STETH increased by 15%.

In its continuing effort to tackle the surging US inflation, the Federal Reserve on Wednesday decided to raise the interest rate by another 75 basis points. This was the second straight 75 basis point increase and marked the fourth rate hike in 2022. How much has this decision affected the crypto market and the prices of the tokens?

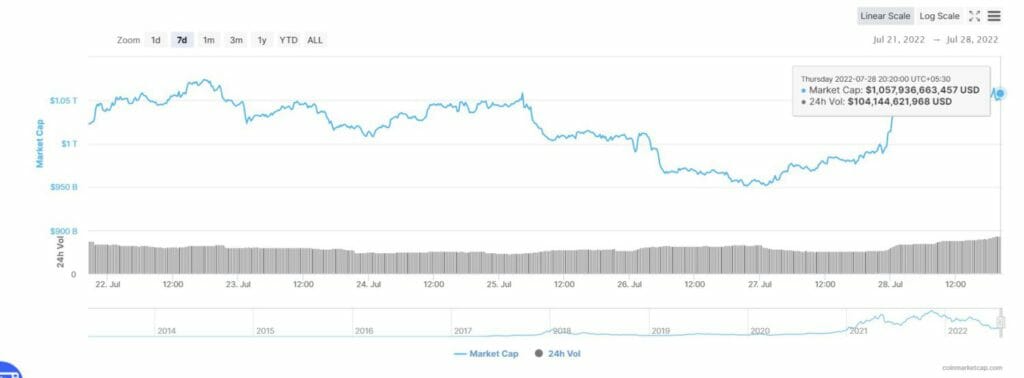

Following Fed’s announcement, Bitcoin traded at $23,168.88 at around 3 a.m. ET on Thursday morning, up around 9% from 24 hours prior, while Ethereum’s price increased by 15.64%. Bitcoin’s price surge becomes notable when one takes into account the fact the BTC has dropped by 7% in the week leading up to Wednesday’s Fed event. Nasdaq also jumped over 4% on Wednesday in its biggest daily percentage gain since April 2020.

According to Coingecko, after the Fed announced a 75bps rate hike, the Ethereum merge concept remained the main target of speculation, with LDO up 36% in 24 hours, ETC up 32%, and STETH increased by 15%. The 12-hour liquidation amount was $264 million.

Aggressive rate hikes are never good for stocks or crypto prices in general. Despite this general notion, BTC and ETH prices have surged following the rate hike. In simple terms, markets rallied because Chair Jerome Powell only hiked 75bps instead of 100 while hinting at the possibility that they might reduce the rate of future hikes.

Market participants who were actually quite fearful of the 100 bps and sighed with relief when the raise aligned with the consensus, which explains the rally. Investors anticipated another relatively large increase after the latest US CPI index showed inflation jumped 9.1% in June from a year earlier, faster than in May and crushing hopes that prices had already peaked.

The July rate hike brings the main policy rate to a range of 2.25-2.5%. That is roughly the level that is considered neutral, where interest rates neither stimulate nor restrict economic activity. Powell also tried to back away from the more explicit forward guidance investors were expecting.

“We are now at levels broadly in line with our estimates of neutral interest rates, and after front-loading our hiking cycle until now, we will be much more data dependent going forward”, Powell said on Wednesday.

He further emphasized the Fed’s commitment to restoring price stability and said failing isn’t an option, adding that economic uncertainty remains unusually high. Another 0.75-point hike could be necessary in September, he said,

As the Federal Reserve has reached its neutral rate, any hikes will likely put Fed in the actively restrictive territory. This is indicative that Fed isn’t on autopilot, and if the Fed isn’t gonna force tighter financial conditions on autopilot anymore, real yields will actually start declining again.

The decline in the price of real yield will eventually lead to outperforming of risk-driven digital assets like crypto. Since the marginal return for owning cash USDs becomes less attractive the incentive to grab hold of riskier assets like Nasdaq, and BTC becomes higher.

This explains the rallying of riskier assets like ETH and BTC following the rate hike. During the announcement, Powell had tried to walk a fine line between acknowledging a weakening economy and unacceptably high inflation. The Fed Chair also didn’t say anything to endorse the idea that rate cuts would come so soon. Powell’s comments on slowing growth were viewed as a positive sign by the market as fewer rate increases and quicker cuts.

Economists, however, believe Powell’s comment that a slowdown in hikes would be appropriate at some point shouldn’t be read as dovish. “We continue to expect core inflation to push the Fed to hike more aggressively than they or markets anticipate with a 75 bps hike in September, policy rates reaching 4% by year-end and probably rising further in early 2023,” said economists Andrew Hollenhorst and Veronica Clark. Analysts have also advised investors not to bet that bitcoin and other riskier digital assets will continue to increase because another rate hike could bring down valuations.