Key Takeaways

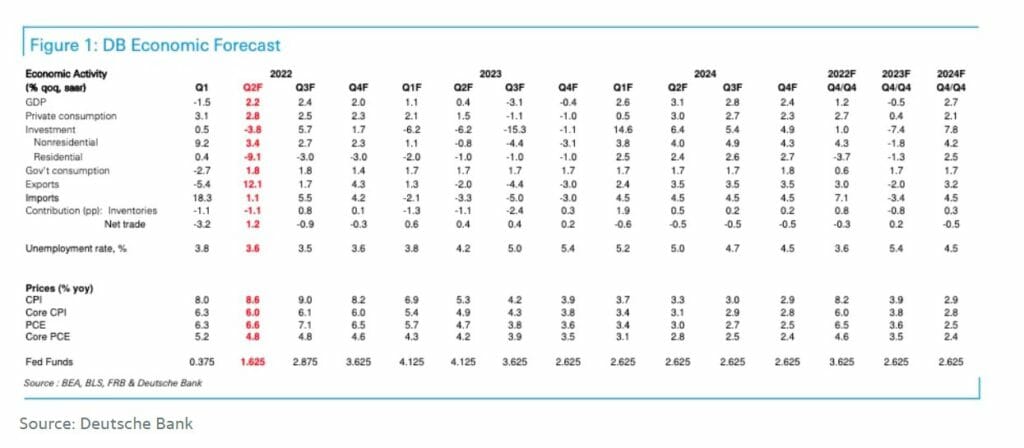

- Deutsche Bank projects a 3.1% contraction of the GDP in the third quarter of next year.

- Federal Reserve recently raised interest rates by 75 basis points to a target range of 1.5% to 1.75%.

Leading Financial Institution Deutsche Bank is now hinting at an upcoming recession in late 2023. The bank updated its forecast, stating that it now expects an “earlier and somewhat more severe recession.” Deutsche Bank projects a 3.1% contraction of the GDP in the third quarter of next year.

Deutsche Bank Chief U.S. economist Matt Luzzetti wrote in a note to clients stated that more than two months ago, the bank forecasted that the U.S. economy would tip into a recession by end-2023. He adds that since then, the Fed has undertaken a more aggressive hiking path, financial conditions have tightened sharply, and economic data are beginning to show clear signs of slowing.

Luzzetti sees U.S. GDP growth coming in at “sub-1%” in the first half of 2023, followed by a -3.1% contraction in the third quarter of 2023 — one quarter earlier than Luzzetti previously estimated. In the fourth quarter of 2023, the economist expects growth to contract by another -0.4%. He further believes the Consumer Price Index (CPI) will peak at 9% in the third quarter of 2022. CPI was up 8.6% year-over-year as of May — the most since 1981.

Apart from Deutsche bank, several other institutions have also hinted at a severe recession. Recently the chief economist at Moody’s Analytics warned the risks of a recession were “uncomfortably high” and “rising”. In April this year, Goldman Sachs economists also projected a 35% chance of a recession in the following 24 months but implied the risk was rising following the Fed’s recent rate hike. Despite these predictions, U.S. President Joe Biden insists that a recession was not “inevitable,” adding that the U.S. is in a “stronger position” than any other nation to fight inflation.

Deutsche Bank’s latest projections come days after the Federal Reserve raised interest rates by 75 basis points to a target range of 1.5% to 1.75%. This was the steepest rate hike enacted by the regulator in 28 years as it is trying to tackle inflation.

The Federal Reserve’s rate hike was triggered by the Labor Department’s May Report, which revealed that annual inflation in the U.S. surged to 8.6% in May—the largest 12-month increase in consumer prices the country has witnessed in over 40 years. With the inflation rates spiking worldwide, the fear of recession is likely to loom around much longer.