Key Takeaways

- Vauld has assets worth $330 million and liabilities worth around $400 million.

- Filed for a six-month moratorium period for financial restructuring.

- Optimistic about the acquisition deal closing with Nexo

- If Nexo deal doesn’t go through, they have other ways to cover the cost.

Crypto market volatility is taking big names in the industry one by one. Leading crypto lender is the latest in the growing list of companies beaten by market conditions. On 5th July, Vauld suspended all withdrawals, trading, and deposits, essentially locking in retail investor capital. Ever since then, the company has been working towards financial restructuring to navigate its way out of bankruptcy.

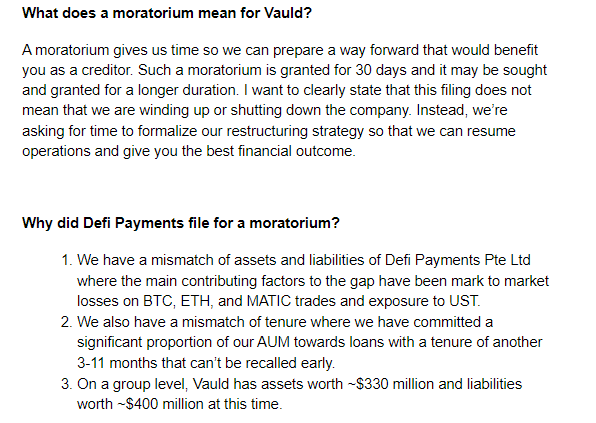

The battered crypto lender has now issued an email to its creditors disclosing an overall shortfall of around $70 million. According to the letter, Vauld currently has assets worth around $330 million and liabilities worth approximately $400 million. Vauld cited mark-to-market losses on Bitcoin, Ether, Polygon trades and exposure to the now collapsed algorithmic stablecoin terraUSD as reasons for the liquidity crisis.

In the email sent to retail investors. Vauld further acknowledged the mismatch of tenure where they have committed a significant proportion of their AUM (assets under management) towards loans with a tenure of another 3-11 months that can’t be recalled early.

Vauld added that it had filed for a six-month moratorium period to prepare for the intended restructuring of the company. The crypto lender’s Singapore entity Defi Payments Pte Ltd filed for a moratorium on July 8 in the Singapore Courts according to section 64 of the Insolvency, Restructuring and Dissolution Act 2018, as previously planned.

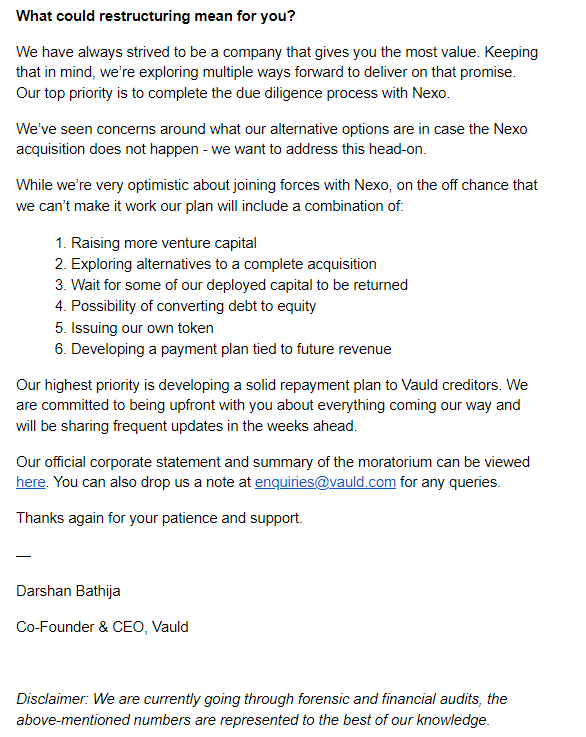

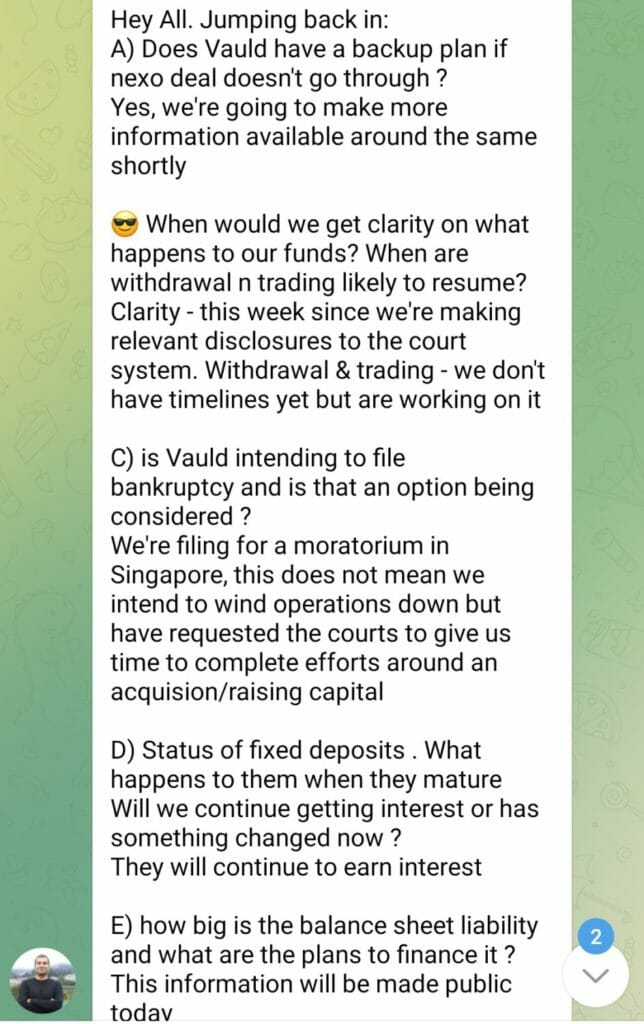

Vauld said that the moratorium is usually granted for 30 days, adding that the firm may seek a longer duration. According to the CEO Darshan Bathija, Vauld is not winding up operations but requesting courts to give them more time to complete efforts surrounding the acquisition and raising capital.

Soon after Vaould suspended all operations, the firm announced that they have signed an indicative term sheet with London-based Nexo to acquire up to 100% of Vauld. Reportedly term sheet grants Nexo a 60-day exclusive exploratory period in order to conduct due diligence. Antoni Trenchev, the co-founder of Nexo had then stated that the firm may either restructure Vauld or refinance the platform depending on the outcome of its due diligence.

In the recent letter to creditors, Darshan commenting on the possible deal with Nexo noted they are exploring potential restructuring options, mainly acquisition. “The Vauld Group continues to have discussions with Nexo Inc whilst Nexo Inc carries out its due diligence, and also explores potential restructuring options that would best protect the interests of the Vauld Group’s stakeholders,” the email sent to creditors reads.

Creditors however, remain skeptical about the chances of the deal closing with Nexo. Vauld in its letter, stated that they are optimistic about the deal closing but also added that if the deal doesn’t go through, they have other ways to cover the cost.

Vauld suggests raising more venture capital, exploring alternatives to a complete acquisition, waiting for deployed capital to be returned as possible steps to recover from the liquidity crisis. In the letter, the crypto lender further mentions the possibility of converting debt to equity, issuing their own token as well as developing a payment plan tied to future revenue as options to fall back on if the Nexo deal doesn’t work out.

Despite being on the brink of bankruptcy, Vauld CEO Darshan in a telegram Q&A reassured creditors that they would continue earning interests on their fixed deposits.

Vauld is backed by high-profile investors, such as Peter Thiel’s Valar Ventures and Coinbase Ventures. Weeks before suspending operation, the company cut 30% of its workforce to save costs. The coming weeks will tell if Vauld will be another Voyager Digital succumbing to market conditions or whether it will restructure and save itself from getting liquidated.