Cryptocurrency markets are very susceptible to manipulation through crypto pumps or manipulating market prices. One such manipulation technique is called the Pump and Dump Schemes. Here, a relatively unknown cryptocurrency or the one with a low market cap is bought by someone to show an artificial increase in demand which leads to a price rise. This price rise is exploited to sell the same cryptocurrency at higher prices. The scammers offload their coins, and genuine buyers lose money as the artificial demand fades away.

Join our signals channel on Telegram and get accurate market analysis

Table of Contents

What is a High-Volume Pump?

A high volume pumping generally corresponds to a situation where prices rise with high volume. It is a situation where many people are buying cryptocurrencies. Volume here refers to the number of transactions in a particular period. The price rise associated with the High Volume Pumping is genuine mainly because if a lot of investors decided to buy a significant chunk of crypto supply, then they are unlikely to dump it all at once.

What is a Low-Volume Pump?

A low volume pump is a situation where prices rise with low volume. Very small numbers of buyers create all the demand. This is usually employed by traders/ whales, who buy a significant portion of a crypto asset to create artificial demand and scarcity.

Pump and Dump Crypto (Crypto Price Manipulation):

The schemes are usually targeted at novice traders and investors with high expectations. As a result, the coins/tokens involved in these scams rise very quickly and then fade away. Sometimes, a pullback rally is seen where few traders/investors buy in the hope of selling at high prices. A trader typically buys the coins at the lowest price and sells them at the peak of demand.

Also read, Is Polka Metaverse Scam?

Comparison: High Volume vs Low Volume Pumping

- Number of Transactions

Since many traders are in high-volume price-rise, the subsequent number of transactions is also high. On the other hand, low volume price rise or pumping has minimal transactions.

- Demand for Coin/Token

The demand for cryptocurrency in high-volume trades is high. This demand starts slowly and keeps increasing. There are fluctuations in price, but no significant change occurs. In the low volume price rise, the demand picks up abruptly and tapers off as soon as the person starts selling the coins at higher prices.

- Intention

The intention behind a high volume price rise is to create a business on a genuine basis. Mostly it starts slowly, and as marketing picks up, so does the demand. This happened in the case of bitcoin. However, a low volume price rise might or might not have a clear intention.

- Liquidity

Cryptocurrencies in a high volume price rise do have high liquidity. This is due to the public demand, which stays for a more extended period. On the contrary, low volume price rise suffer a liquidity crisis when the demand fades away.

Also read, Top 3 Metaverse Tokens to Keep an Eye on

What is a Pump and Dump Scheme?

A pump and dump scheme is where artificial demand is created to inflate the prices and then offloaded (sold in huge numbers), resulting in a price crash. This is the complete opposite to High Volume Pumping in which the demand sustains. A Low Volume Pumping Scheme is probably the easiest way to exploit Demand and Supply economics. Both excess supply and demand are a result of high public exuberance.

Also Read: Crypto Price and Fake Trading Volume

Let’s have a look at the steps and how those steps work in the world of cryptocurrencies:

- At first, a coin is created which is worth nothing. The coin is so cheap that the creator or another person(scammer) buys them in huge quantities. This is the PUMP PHASE. Here the scammer pumps money into the cryptocurrency.

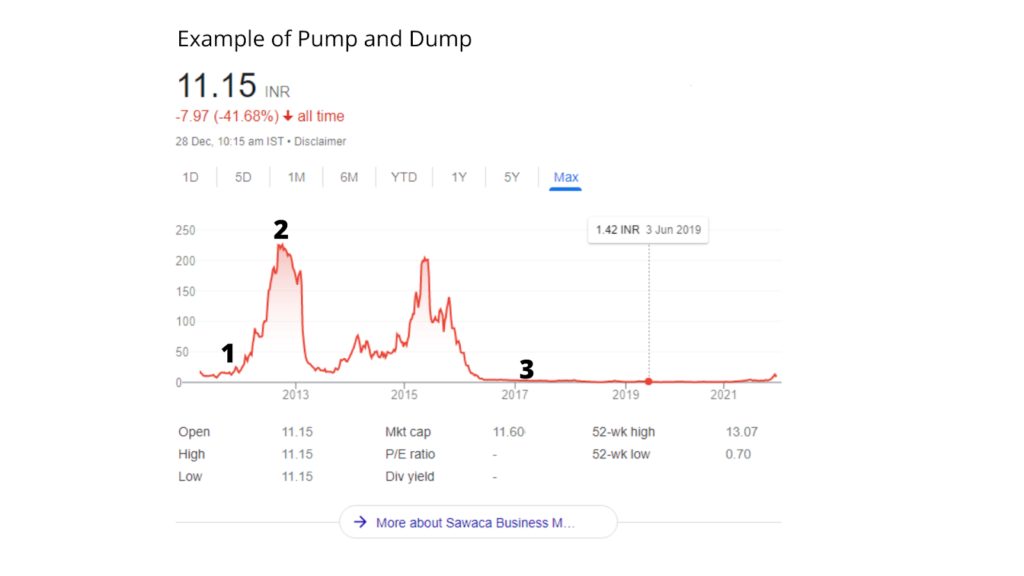

- This creates an artificial demand (point 1 in the graph), and according to the demand and supply theory, the prices rise (point 2).

- When the buyer(scammer) sees the prices are rising, he sells his coins or tokens, which he bought at a very cheap price (the DUMP PHASE).

- Since it is not a genuine demand where prices are dictated by a whole lot of buyers and sellers, the demand eventually fades away.

- This faded demand makes the prices fall, and other genuine buyers sell those coins in panic, creating a further decline in prices (point3).

- Sometimes, the second wave of buying is seen, which is called SHORT COVERING/PULLBACK RALLY. Here, those genuine buyers who have sold off in a panic buy, a ping that prices will eventually recover.

How do Low Volume Pumping Scams operate?

Such schemes take advantage of people’s overexcitement of cryptocurrencies. When a cryptocurrency has risen more than people’s expectations, many people try to find another opportunity instead of buying it at inflated prices. The illusion of buying cheap has been one of the most known tools of scammers.

Also Read: Ploutoz Finance Exploited using a Price Oracle Manipulation Hack

How to spot a Low Volume Pump scam?

A pump has dump scheme has the following traits:

- Relatively unknown cryptocurrency or business.

- Quick price rise.

- A minimal number of people are creating all the demand.

- The number of transactions seems to reduce with time consistently.

- The coin is listed on an open exchange while not in any verified exchanges.

Conclusion

High-volume and low-volume pumps create a price rise in cryptocurrency trading. To avoid any pump and dump scheme, the price rise is to be examined based on business presence, the number of trades, liquidity, the pattern of price rise, etc. High-volume price rises are primarily genuine and can increase your wealth. But, at the same time, low volume price rises can lead to loss of your funds.

Is it possible that a high volume price rise might turn out to be a scam?

It is significantly less likely that this might happen. Still, when buying in any trend or price rise, be aware of other factors such as the number of transactions, steep price rise, and the sustained demand is present.

Can a low-volume price rise turn out to be genuine?

A low volume price rise can be genuine if the price rise is also low. This might occur in the very initial stages of any cryptocurrency. You need to wait sometime to see where the demand goes.

How are pump and dump schemes get listed?

They get listed on open cryptocurrency platforms where anyone can list their cryptocurrency coins/tokens.

Also read,