Bitcoin is trading around $90,945, reflecting a modest rebound after a volatile month in November.

For on-demand analysis of any cryptocurrency, join our Telegram channel.

Bitcoin Next Target

- Price: $90,945

- Circulating Supply: 19.9 million BTC (fixed total supply: 21 million)

- Market Cap: $1.81 trillion

- 24-Hour Trading Volume: $700bn

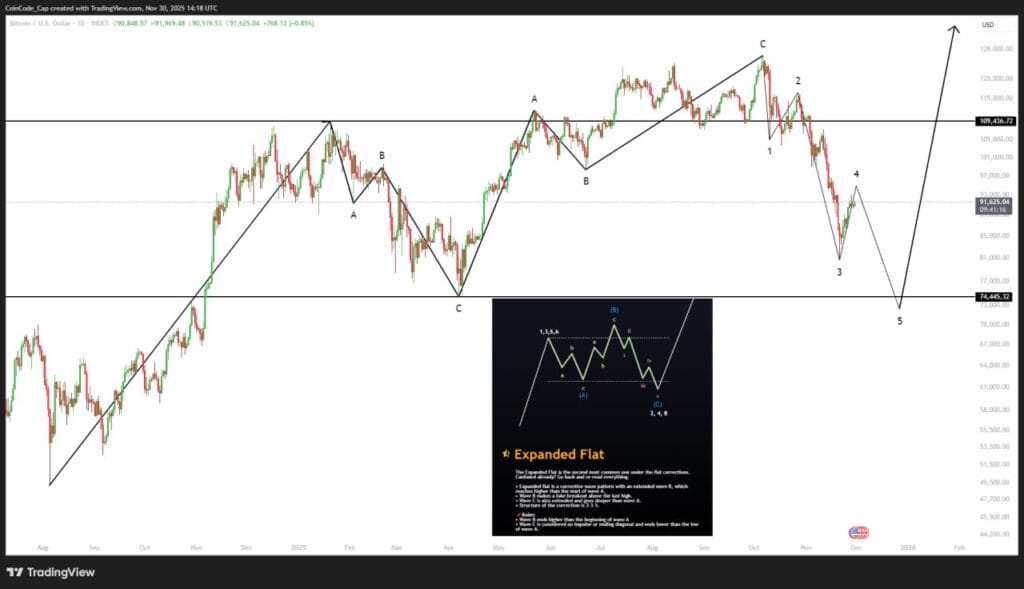

It looks like an expanded flat correction pattern.

Key Indicators & Market Signals

- Recent rebound from lows near $85,000 suggests buyers are stepping back in after the steep November drop.

- Immediate resistance lies around $95,000–$98,000 — clearing this could set up a retest of $100,000+.

- Support is forming in the $88,000–$90,000 range; a clean break below this may lead to further downside toward $85,000–$82,000.

- On-chain data shows buying pressure returning (e.g. exchange inflows slowing, institutional interest picking up), which adds to medium-term stability.

Latest Sentiment & Context

- Bitcoin’s recent rebound (~ 12% over the past week) comes as macroeconomic signals — especially in the U.S. — show signs of caution, which may support risk-on assets in coming weeks.

- Analysts now watch for a successful move over $95,000 to trigger a more sustained rally potentially toward $100,000+.

- That said, uncertainty remains: November has been one of the weakest months this year for BTC, and volatility is likely to remain elevated until macro conditions stabilize.

Summary

- Short-Term: BTC is in a rebound/consolidation phase, with key levels between $88,000 and $95,000.

- Bullish Scenario: A clean breakout above $95,000 — particularly with strong volume — could lead BTC toward $100,000–$105,000 in the coming weeks.

- Bearish Risk: If price fails to hold current support and dips below $88,000, BTC could revisit $82,000–$85,000.

Bitcoin remains the leading cryptocurrency by adoption, liquidity, and institutional interest. While near-term swings may be sharp, many view the current price zone as a potential accumulation or stabilization area ahead of the next major move.

For on-demand analysis of any cryptocurrency, join our Telegram channel.