In the fast-paced realm of decentralised finance (DeFi), where memecoins surge and vanish in moments, innovative tools like BloomBot are revolutionising trading for retail investors. Launched in early 2025 amid Solana’s memecoin boom, BloomBot is a Telegram-based, non-custodial bot designed for seamless buying, selling, and managing tokens across chains like Solana and Base. With features such as ultra-fast token sniping, copy trading, AFK automation, and limit orders, it empowers degens and yield farmers to capitalise on volatile markets efficiently. As Solana DEX volume hits billions daily, BloomBot’s updates in 2025 introduce rewards systems and cross-chain support, democratising high-speed trading. This review examines its origins, capabilities, setup, pricing, pros, cons, security, and competitive edge, determining whether it’s the ultimate DeFi companion.

Table of Contents

What is BloomBot?

BloomBot emerged in early 2025, capitalising on Solana’s explosive growth in memecoin trading and DeFi activity. Developed by a team focused on accessibility and speed, its core purpose is to provide an “unfair advantage” to traders by simplifying complex DeFi operations through a Telegram interface. Primarily optimised for Solana’s high-speed, low-fee ecosystem, it extends to other chains like Base, allowing users to trade memecoins, altcoins, and yield opportunities without clunky wallets or exchanges. Targeting degens chasing quick gains on tokens like $BONK or $POPCAT, as well as intermediate traders managing portfolios, BloomBot emphasises non-custodial control, where users retain full wallet sovereignty via integrations like Phantom or Solflare. By mid-2025, it had facilitated over 3 billion in trading volume, underscoring its role in democratizing DeFi amid Solana’s dominance in high-performance trading. In a fragmented Web3 space plagued by MEV exploits and latency, BloomBot acts as a streamlined gateway, blending automation with user-friendly tools to enhance efficiency and profitability.

Deep Dive into Key Features: Powering Smarter Trades

BloomBot’s arsenal of features caters to diverse trading styles, from aggressive sniping to passive automation.

Token Sniping and Degen Mode

At the forefront is token sniping, enabling real-time detection and instant purchases of new launches on platforms like Pump.fun. Users input contract addresses for automated buys, customizable with slippage up to 50% and priority fees via Jito for MEV protection. Degen Mode amplifies this for high-risk plays, allowing aggressive settings like minimal liquidity checks and rapid executions, ideal for memecoin pumps where seconds matter. Reports indicate snipes under 2-3 seconds on Solana’s sub-second blocks, outpacing manual trades.

Copy Trading and Automation

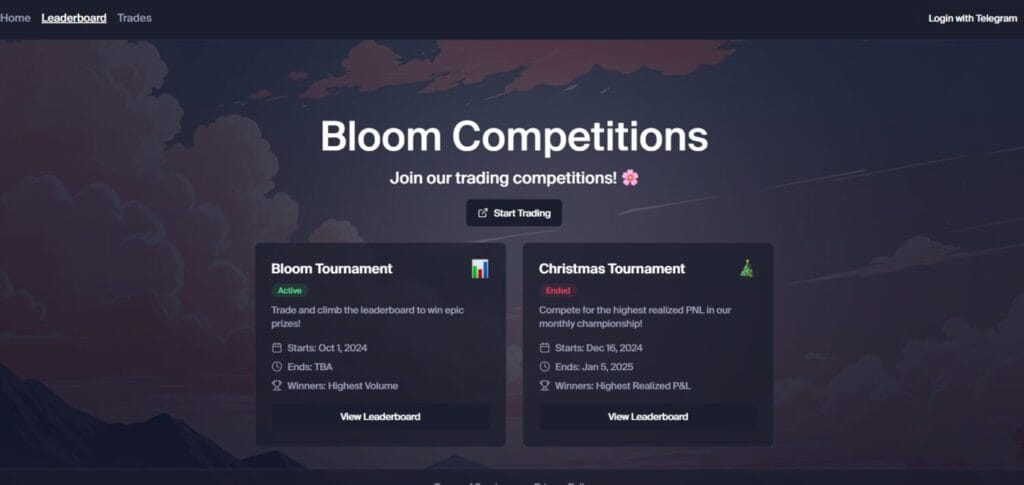

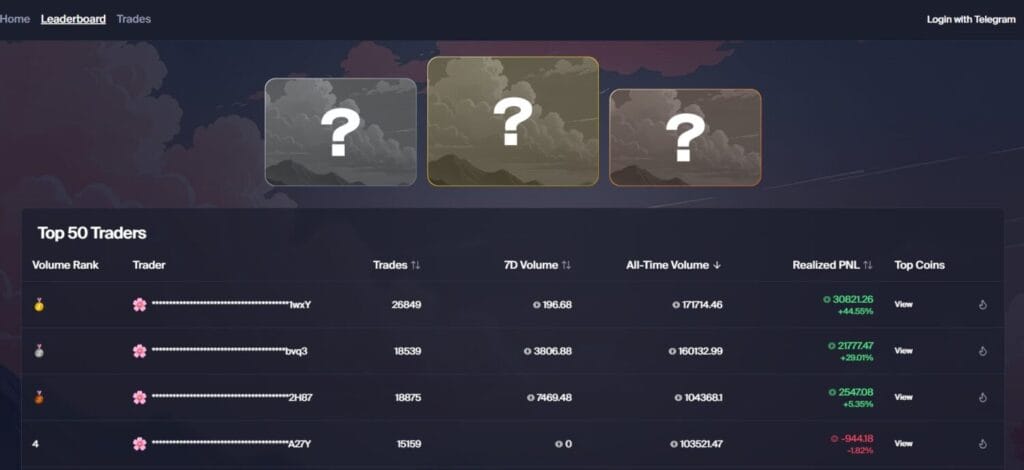

Copy trading lets users mirror successful wallets from leaderboards, displaying anonymised PNL histories for informed choices. AFK mode automates 24/7 strategies, including DCA, trailing stops, and auto-sells based on profit targets or market caps. Limit orders and multi-position management streamline operations, while cross-chain bridging (e.g., SOL to Base) facilitates seamless transfers.

Portfolio Tools and Analytics

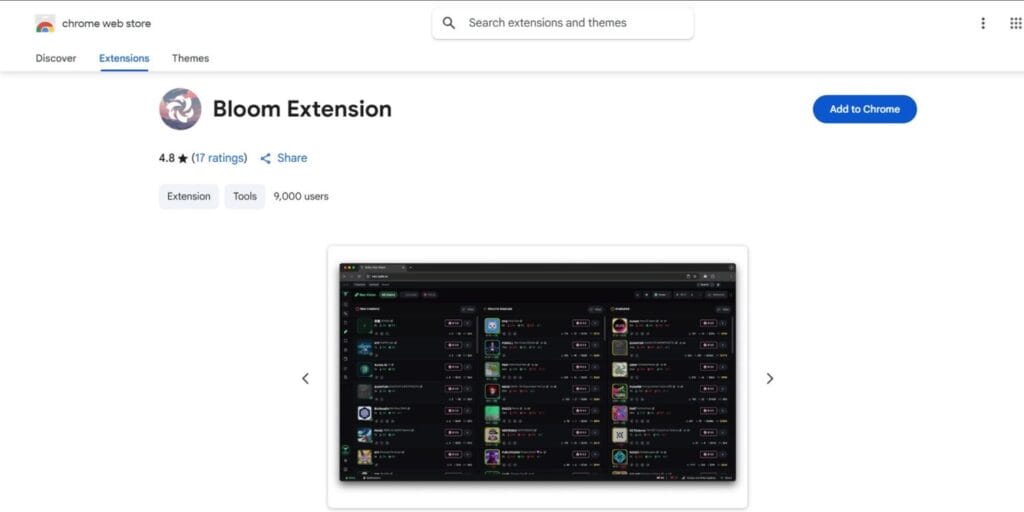

Portfolio management includes real-time trackers, P&L dashboards, and past trade analysis. Integrations with Dexscreener and BullX provide on-chart insights, and multi-DEX routing aggregates liquidity from Jupiter, Raydium, or Meteora to minimise fees and slippage. A Chrome extension enhances desktop usability with advanced charting. Growth levels reward active users with XP points, unlocking lower fees and perks. Compared to earlier bots, BloomBot’s optimisations reduce latency to under a second, making it versatile beyond memecoins for yield farming with auto-compounding and rug checks.

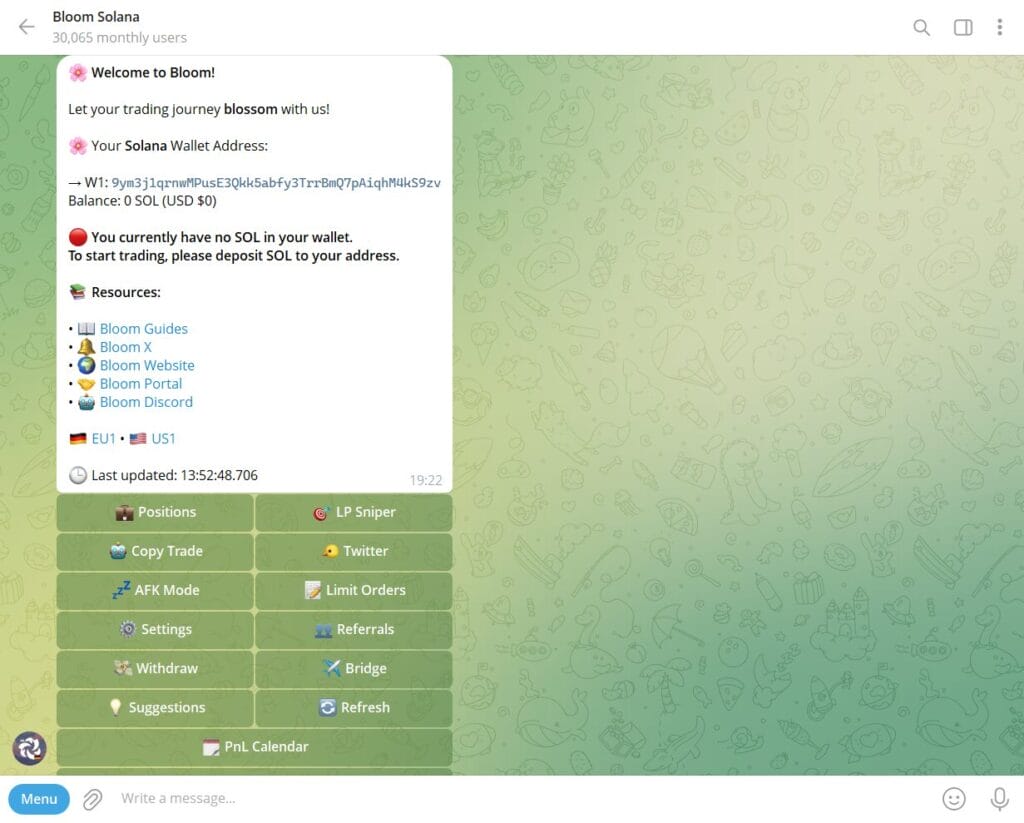

Getting Started: A Step-by-Step User Guide

Onboarding is designed for simplicity in Web3. Begin by accessing the bot via Telegram at @BloomSolana_bot, using a referral for bonuses like fee reductions. Connect a non-custodial wallet like Phantom—securely save your private key, no KYC required. Fund with SOL or other tokens, then customise settings: adjust slippage, enable MEV protection, and set alerts for launches. Test with small trades (e.g., 0.1 SOL) using commands like /buy or /snipe. Install the Chrome extension for enhanced features. Pro tips: Verify official links to avoid scams, and practice on devnet. Here’s a setup checklist:

| Step | Action | Time Estimate |

|---|---|---|

| 1 | Join Telegram Bot & Link Wallet | 2 mins |

| 2 | Fund Wallet & Customize Settings | 3 mins |

| 3 | Install Chrome Extension | 1 min |

| 4 | Test First Trade & Activate Alerts | 5 mins |

This accessibility suits intermediates, but newcomers should research DeFi fundamentals.

Pricing Model: Transparent and Trade-Based

BloomBot employs a performance-based model with a 1% fee on buys and sells, reducible to 0.9% via referrals—competitive against Maestro’s 1.2% or Trojan’s 0.9%. No subscriptions; fees fund development and servers, with no charges on failed transactions due to revert protection. Referrals offer up to 25% commission on invitees’ fees, promoting community growth. Growth levels further lower costs for high-volume users. In Solana’s low-gas environment (~$0.01 per tx), this scales well, though frequent snipers should monitor cumulative expenses. The value shines in profitable trades, where speed often recoups fees.

Pros and Cons of BloomBot

Pros

- Ultra-Fast Trade Execution: Enables quick sniping of new tokens on Solana, reducing latency to under a second for instant buys and sells during memecoin launches.

- Diverse Feature Set: Includes token sniping, copy trading, AFK automation, limit orders, and Degen Mode, catering to various trading styles from high-risk plays to passive strategies.

- User-Friendly Telegram Interface: Simplifies DeFi trading with intuitive commands and mobile accessibility, allowing trades anywhere without complex setups.

- Chrome Extension Enhancement: Boosts efficiency with quick-action buttons and desktop integration, streamlining workflows for more advanced users.

- Competitive Fees with Rewards: Around 0.9-1% per trade, reducible via referrals, with no subscriptions and potential for passive income through community growth.

Cons

- Reliability Issues: Spotty trade execution, with reports of failed buys/sells, stuck orders, and errors leading to potential losses.

- Security and Scam Concerns: Scam allegations, transparency issues, and risks from wallet permissions, including potential for fake bots or vulnerabilities.

- Learning Curve for Features: Advanced tools like automation and copy trading may require time to master, not always beginner-friendly.

- Telegram Dependency: Relies on Telegram’s platform, which can lead to UI glitches, spammy interfaces, or a lack of a standalone app.

- Chain Uptime and Inherent Risks: Performance tied to Solana’s network outages; high volatility in memecoin trading can amplify losses despite features.

Users on X and Reddit praise “insanely fast fills” and PNL boosts, with one noting “3B volume is no joke.” Community highlights its Solana optimisations and copy trading for learning. Real insights from 2025 show mixed views: Degens love it for memecoins, but some question hype for beginners.

Security Considerations and Risk Management in DeFi

BloomBot prioritises security with non-custodial wallets, verified smart contracts, and user-controlled funds. Features like anti-MEV (via Jito), withdrawal limits, and liquidity scanners flag rugs. It supports hardware wallets and Telegram 2FA. However, DeFi risks persist: volatility, contract bugs, and scams—2025 alerts noted fake bots draining wallets. Always verify @BloomSolana_bot and avoid unsolicited DMs. Best practices: Diversify, use small positions, set low slippage (1-5%), and monitor X for updates. BloomBot mitigates but doesn’t eliminate threats, emphasising user responsibility.

BloomBot vs. the Competition

In 2025’s bot landscape, BloomBot holds strong. Here’s a comparison:

| Bot | Speed (Solana) | Chains | Fees | Unique Edge |

|---|---|---|---|---|

| BloomBot | Ultra-Fast | Sol/Base | 0.9-1% | Degen Mode + Rewards |

| Trojan | Fast | Sol | 0.9% | High Volume Reliability |

| Maestro | Medium | Multi | 1.2% | Deep Analytics |

| Rekt Bot | Fast | Sol | 1% | Meme-Focused Alerts |

BloomBot excels in speed and accessibility, ideal for memecoin hunters, while Maestro suits multi-chain pros.

Conclusion

BloomBot emerges as a powerhouse in 2025’s DeFi landscape, blending speed, accessibility, and multi-chain versatility to transform trading for all levels of users. Its non-custodial design, robust features like Degen Mode sniping and AFK strategies, and competitive 0.9-1% fees (with referral reductions) make it a standout amid rivals like Maestro and Trojan. While risks like chain downtime and scams persist, its audited security and community praise for fast executions highlight its reliability. Looking ahead, expansions like the Chrome extension promise even greater utility amid evolving regulations. For those chasing memecoin pumps or optimised yields, BloomBot delivers an edge—DYOR, start small via Telegram, and unlock your trading potential. It might just be the bloom your portfolio needs.

Frequently Asked Questions (FAQs)

What is BloomBot, and who is it for?

BloomBot is a Telegram-based, non-custodial trading bot launched in early 2025, optimized for high-speed DeFi trades on Solana and Base chains. It offers features like token sniping, copy trading, and AFK automation, making it ideal for degens hunting memecoin pumps (e.g., $BONK) and intermediate traders managing portfolios. It’s designed for users seeking an “unfair advantage” in volatile markets without needing complex setups.

How do I get started with BloomBot?

Getting started is simple: Join the official Telegram bot at @BloomSolana_bot (use a referral for bonuses), connect a non-custodial wallet like Phantom, fund it with SOL, and customize settings like slippage. Test with small trades using /buy or /snipe commands. Install the Chrome extension for desktop enhancements. The whole process takes under 10 minutes—no KYC required.

What are BloomBot’s fees and pricing structure?

BloomBot uses a transparent, trade-based model with ~1% fees on buys and sells (reducible to 0.9% via referrals), with no subscriptions or charges on failed transactions thanks to revert protection. Referrals earn up to 25% commissions, and growth levels unlock lower rates for active users. In Solana’s low-gas environment, costs are minimal, often recouped by faster executions.

Is BloomBot secure, and how does it handle risks?

Yes, BloomBot is non-custodial, meaning you control your funds via verified wallets with support for hardware options and Telegram 2FA. It includes MEV protection via Jito, liquidity rug checks, and audited contracts. However, DeFi risks like volatility and scams persist—always verify official links to avoid fakes, diversify trades, and start small.

How does BloomBot compare to competitors like Trojan or Maestro?

BloomBot stands out for ultra-fast Solana sniping and Degen Mode, with competitive 0.9-1% fees and rewards, edging Trojan in multi-chain support (Sol/Base). It lacks Maestro’s deep analytics but excels in accessibility for memecoin hunters. If speed and mobile trading are priorities, BloomBot wins; for advanced multi-chain pros, consider Maestro.