Table of Contents

Bitcoin News: 16th October 2021

- Tether and Bitfinex have been fined a total of $42.5 million by the CFTC. [LINK]

- NFT by Jimmy Choo is a new line of shoes designed by Jimmy Choo.

- New sanctions guidelines for crypto companies has been released by the US Treasury.

- The Shiba Inu ($SHIB) has been listed on India’s oldest cryptocurrency exchange, which has over four million users.

- Cryptocurrencies are impossible to ignore, according to Zimbabwe’s finance minister.

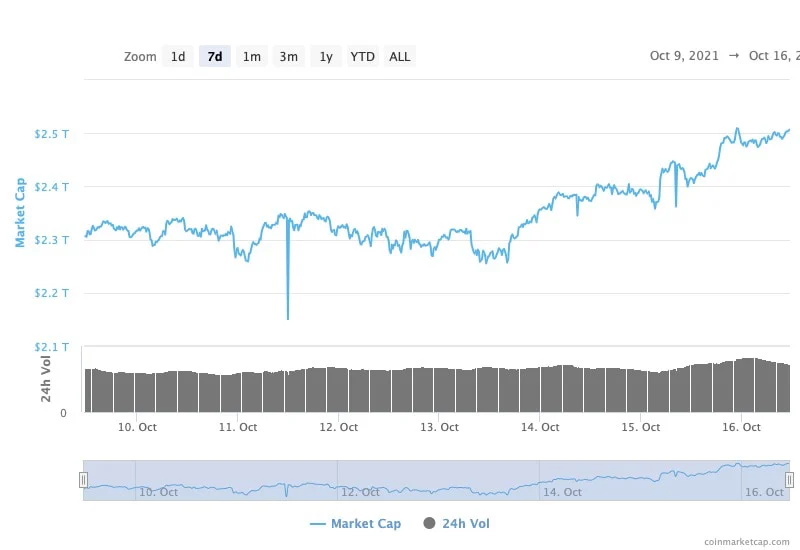

- The cryptocurrency market has surpassed $2.5 trillion as the SEC approves the first Bitcoin futures ETF.

- All Blockchain Games Are Banned From Steam. [LINK]

- Bakkt, a cryptocurrency financial service, will shortly be listed on the New York Stock Exchange.

Tether and Bitfinex have been fined a total of $42.5 million by the CFTC

Tether and Bitfinex were fined $41 million and $1.5 million, respectively, by the Commodity Futures Trading Commission (CFTC) on Oct. 15, citing breaches of the Commodity Exchange Act (CEA) and a previous CFTC ruling.

Tether, the company behind the namesake stablecoin, only had adequate cash assets to support the dollar-pegged currency for 27.6% of the time during the 26-month period under examination between 2016 and 2018, according to the regulator. Tether also broke the law by keeping a portion of its reserves in non-fiat financial instruments and mixing operating and reserve money, according to the agency.

Commissioner Dawn Stump, in a concurring statement, endorsed the move while also expressing worries that the settlement might “give consumers of stablecoins with a false feeling of confidence,” leading them to believe that the CFTC supervises and oversees stablecoin issuers.

Stump distanced the CFTC from regulating stablecoins and having “daily insight into the activities of those who issue” stablecoins, despite the fact that the CFTC used a broad definition of “commodity” in this instance.

Tether responded with a statement claiming that it “always kept enough reserves.” The company justified its choice to settle by stating that it was willing to “resolve” the issue.

Tether responded with a statement claiming that it “always kept enough reserves.” The business justified its settlement by stating that it wanted to “resolve this situation so that we can move forward and focus on the future.”

NFT by Jimmy Choo is a new line of shoes designed by Jimmy Choo.

Jimmy Choo, the luxury fashion accessories brand, is excited to announce its first foray into the digital art and gaming discourse by launching two NFT projects in collaboration with UCOLLEX.

Jimmy Choo will unveil a one-of-a-kind NFT for auction with 8,888 Mystery Boxes for purchase on the Binance NFT marketplace as the last layer of the partnership with New York artist Eric Haze. The NFTs continue the collaboration’s concept of collectability, which weaves together art, fashion, and street culture.

On October 20th, Binance NFT will have an animated artwork showcasing a digital rendition of the sneaker created for the JIMMY CHOO / ERIC HAZE CURATED BY POGGY collaboration up for auction. The NFT is a digitally-only shoe that rotates across a canvas of Haze’s trademark writing. The winner of the auction will not only receive the NFT, but also a limited-edition pair of hand-painted sneakers.

The Binance NFT marketplace will host the auction bidding. The Jimmy Choo Foundation will contribute all proceeds from the auction to Women for Women International, which helps women survivors of conflict rebuild their lives.

A single Jimmy Choo / Eric Haze LOVE 100 Glitter, 445 super-rare cards, 3,109 rare cards, and 5,333 neutral cards will be split into four categories of rarity. Buyers will make purchases without knowing which card they would get beforehand. The Binance NFT Mystery Boxes will go on sale on October 20th for 30 BUSD. Users who purchase the SSR or SR from the Jimmy Choo Mystery Box will be eligible to get an extremely rare, never-before-seen Jimmy Choo NFT design, which will be released at a later date.

The NFT’s debut is the culmination of multi-layered cooperation that saw three creative geniuses, three global capitals, and three unique points of view come together to create one memorable alliance. The JIMMY CHOO / ERIC HAZE CURATED BY POGGY collaboration brings together Eric Haze, a New York-based artist and designer, Poggy, a Japanese fashion legend and guest style curator, and Sandra Choi, the brand’s London-based Creative Director.

New sanctions guidelines for crypto companies released by the US Treasury

The United States’ sanctions watchdog is focusing its attention on the cryptocurrency business.

The Treasury’s Office of Foreign Asset Control (OFAC) published a new pamphlet on October 15 that includes crypto-specific information on circumventing US sanctions.

The guidance’s actual contents aren’t particularly innovative, but they do push the concept that virtual currency operators should be held to the same standards as traditional financial institutions when it comes to avoiding sanctions violations.

The instructions state:

“Technology firms, exchangers, administrators, miners, and wallet providers, as well as more traditional financial institutions that may have exposure to virtual currencies or their service providers,” according to OFAC, must create risk-assessment processes.

The fact that OFAC emphasises the geolocation of IP addresses and, especially, analytical techniques available to identify the use of a VPN as part of its expectations is perhaps most intriguing. Geofencing by crypto exchanges and operators is becoming more common, however, using a VPN may get around virtually all of these trade obstacles. Increased OFAC inspection of VPNs might have a significant impact on people’s access levels.

Increased OFAC inspection of VPNs might have a significant impact on persons in the United States’ access to platforms that they are legally prohibited from accessing.

OFAC has gotten increasingly active in the crypto business since initially targeting bitcoin wallet addresses in 2020. It issued its first-ever penalties on a crypto exchange, a Russia-based OTC desk named Suex, at the end of September.

The Shiba Inu ($SHIB) has been listed on India’s oldest cryptocurrency exchange

After “inspiring millions of people across the world to finance and fund a coin with a doggo’s picture on it,” the meme-inspired cryptocurrency Shiba Inu (SHIB) has been launched on India’s oldest cryptocurrency trading platform Zebpay.

SHIB is known as the “Dogecoin Killer” and is listed on its own decentralised exchange, ShibaSwap, as well as having two additional coins named “BONE” and “LEASH,” according to Zebpay.

The coin was established by a pseudonymous person known only as “Ryoshi” and has 50% of its total quantity locked on the decentralised exchange Uniswap. The remaining coins were given to Vitalik Buterin to be “burned,” according to the project’s website.

The initiative transferred the leftover tokens to Vitalik Buterin to be “burned,” but Buterin then contributed 50 trillion SHIB to India’s Covid Crypto Relief Fund, which was worth $1 billion at the time.

Only 2% of Buterin’s $1 billion contributions have been paid out as of August, according to CryptoGlobe. Over time, prominent cryptocurrency exchanges like Coinbase and Binance have listed the coin. Zebpay is India’s first and largest cryptocurrency trading platform, with over four million members.

Over 700,000 individuals own $SHIB on the blockchain, but it’s unknown how many people own the tokens via cryptocurrency exchanges and other custodial services.

Cryptocurrencies are impossible to ignore, according to Zimbabwe’s finance minister.

In 2021, the cryptocurrency industry became mainstream, drawing not just institutional investors and millionaires, but also governments. First, El Salvador made history by declaring Bitcoin legal tender, setting off a chain reaction that saw countries like Paraguay, Argentina, and Panama consider legalising cryptocurrency usage in their financial systems.

Now Zimbabwe may join the expanding league, as the country’s Finance Minister has stated that cryptocurrencies cannot be ignored at this time. Mthuli Ncube, the finance minister, stated that approximately 30% of the country’s young are involved in crypto-assets and that it is hard to avoid them.

The finance minister has hinted at future concessions on the crypto market to boost its usage, according to a Herald article. Ncube insisted on treating cryptocurrency as a type of investment rather than a currency. He clarified,

“But our view is that we do not want it to be a currency. Want this to be an investment class. So through the Victoria Falls Stock Exchange platform, we will try to create crypto-based products there, which are ring-fenced within the offshore zone.”

Ncube suggested during his conversation in Dubai that the Zimbabwean government had already begun the process of regulating cryptocurrency. The administration has begun a sandbox initiative, he stated.

The digital assets market, which was formerly regarded as an internet bubble, is now constructing a new world financial order, as evidenced by the rising interest of financially distressed countries in crypto.

Crypto market has surpassed $2.5 trillion

Following the introduction of the Bitcoin futures exchange-traded fund (ETF) by the US Securities and Exchange Commission (SEC) on Friday, October 15, Bitcoin (BTC) exceeded $60,000 for the first time since April, causing a price rise across the whole cryptocurrency market.

The action was sparked by reports that surfaced prior to the SEC’s original statement that the first Bitcoin ETF would be approved early next week.

Interestingly, the crypto market value was $2,194 trillion on April 14, 2021, when BTC achieved its all-time high, but it is currently $2,505 trillion, with many experts still forecasting that Bitcoin will reach a new all-time high.

The worldwide cryptocurrency market was trading in the green on Saturday morning; at the time of writing, the market’s overall worth was up 4.14 per cent from the previous day, making it more valuable than Apple Inc., the world’s most valuable corporation (NASDAQ: AAPL).

In addition, the crypto market’s overall volume increased by 0.72 per cent in the past 24 hours to $116.23 billion. At the same time, DeFi’s 24-hour volume is $14.97 billion, accounting for 12.88 per cent of the total crypto market volume, while other stable currencies’ combined volume is $91.19 billion, accounting for 78.46 per cent.

All Blockchain Games Are Banned From Steam

Blockchain gaming is the way of the future, but the move represents a step back for the whole gaming industry.

Valve revised the Steam Rules and Guidelines for onboarding new games, making it clear that no blockchain-based games are permitted. The regulation change made it clear that all cryptocurrencies and non-fungible tokens (NFTs) will be barred from the marketplace.

@SpacePirate io, a creator of the game Age of Rust, was the first to notice the new thirteenth line to the Steam Rules. Steam, being a prominent PC game marketplace, is frequently used as a testing ground for new ideas. According to SpacePirate, the decision is a huge setback for the Age of Rust and blockchain games in general.

Valve allegedly does not want goods with real-world value on its platform, thereby putting a stop to any blockchain efforts. The gaming business is known for its obstinacy, and we may be witnessing the start of yet another split. The role of gaming and e-sports may alter drastically as the world of blockchain games expands.

Steam should begin to warm as the obscurity surrounding blockchain regulation fades. If the market fails to bear its weight, other platforms and marketplaces may emerge to fill the void.

Bakkt will shortly be listed on the New York Stock Exchange

Bakkt Holdings, Intercontinental Exchange’s (ICE) digital asset management arm, has announced that it would begin trading on the New York Stock Exchange on October 18.

A merger with VPC Impact Acquisition Holdings, a Chicago-based special purpose acquisition firm, resulted in the Bakkt ticker’s public listing. According to an official announcement, the merger was approved by roughly 85.1 per cent of shareholders during a shareholders meeting:

“Upon closing, the combined company’s Class A common stock and warrants are expected to begin trading on the New York Stock Exchange (“NYSE”) under the ticker symbols “BKKT” and “BKKT WS” respectively”

Additionally, the business combination netted Bakkt about $448 million in gross revenues, which will be used to expand the company’s capabilities and relationships.

Bakkt, a cryptocurrency exchange, established a collaboration with Google last week to enable the purchase of products and services using Bitcoin (BTC) and other cryptocurrencies through the Google Pay network. The cooperation “is a tribute to Bakkt’s strong position in the digital asset marketplace, to allow customers to enjoy their digital assets in a real-time, safe, and dependable manner,” according to Bakkt CEO Gavin Michael.

Bakkt introduced a payments app in March that allows customers to make cryptocurrency purchases; before, the exchange only provided BTC futures contracts to accredited investors.

As a result of a new measure requiring a safe harbour for some token projects, mainstream crypto adoption in the United States is seeing greater backing from politicians.

The bill was based on an earlier proposal from SEC commissioner Hester Peirce, who stated that “safe harbour might be the most significant move for the US bitcoin sector to date.”

Read Yesterday’s news here.