After a rocky start to the year, Bitcoin is back above $40,000. According to data, the largest cryptocurrency by market cap has increased by 9% in the last 24 hours, trading for $40,400.

In 2022, the asset got off to a bad start, plummeting to levels not seen in six months. Despite being down over 40% from its all-time high of $69,044.77 reached in November, the coin appears to be making a slow recovery. Further, this might be the largest single-day return we might’ve seen in the last 4 months, or since when bitcoin made an all-time high in November.

Further, this sudden move of Bitcoin leads to liquidations worth $50 Million.

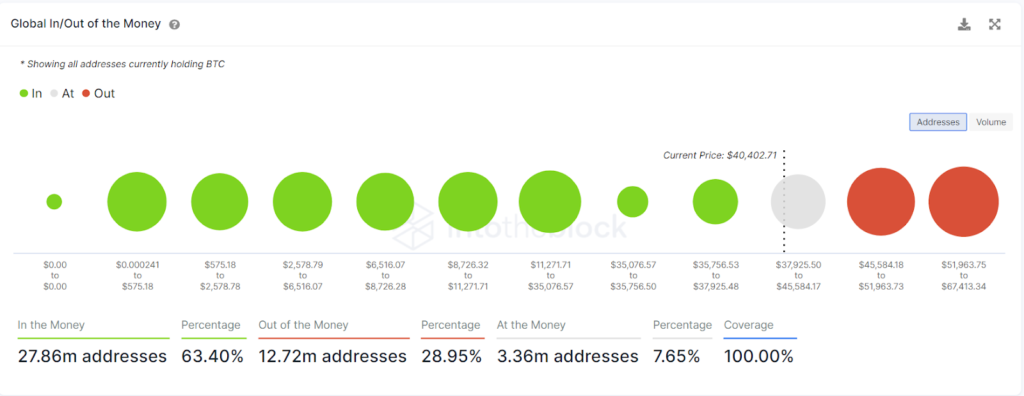

Moreover, the on-chain metrics have been showing a decent bullish sentiment as well. The Global In/Out of money indicator by IntoTheBlock suggests that bitcoin’s price has moved in a comparatively safer zone as more addresses are in profit and will not be acting as good support. Yesterday, bitcoin did touch the $35000-$36000 which was sort of a low volume and week support area. Moreover, the important part to look here would that if bitcoin is able to reach the $45,000 levels as that would act as better support for it to slingshot to the ~$50,000.

Moreover, looking at the derivatives data, this rally is accompanied by the highest number of open positions in the perpetual swaps. Meaning traders are continuously going long in this run and the supply of good money backing the upside move might not be as significant as we might need it for holding the achieved prices.

Ethereum, the second-largest cryptocurrency by market capitalization, is also up significantly: it was trading above $2,900 at the time of writing, an increase of 11% in just 24 hours.

It’s also down 41% from its all-time high of $4,878.26 reached three months ago. With the recovery, altcoins are also rising (as they usually do). At the time of writing, Solana, an Ethereum competitor and the seventh-largest digital asset by market cap, was trading for $110, up from $10 last year. That’s an increase of 11% in just 24 hours. It has also increased by 22% in the last week.

The so-called meme-coin market is also doing well: Dogecoin, a cryptocurrency that was created as a joke, is up 4% in 24 hours and currently trades for $0.14. Another asset based on the same doge-inspired meme, Shiba Inu, was trading for $0.00002198, a 6 per cent increase.

Because of macroeconomic factors, both Bitcoin and Ethereum were thought to have lost value in January: The Federal Reserve in the United States predicted that inflation would rise, prompting investors to sell risky assets like equities—as well as their cryptocurrency holdings. The crypto market, on the other hand, has been steadily rising since then.

Further, our market analysts provided a possibility of this move earlier just before this rally. Here’s the message that we put up for members in our premium telegram channel.

“It is rejecting from the marked trendline resistance and also from horizontal resistance. If we see a breakout with a good volume then this is a sign of bullish momentum back in the market. While seeing the decrease of volume and other resistance factors we also have a high chance of one more leg down before an upward move.”

Nothing in this article is financial advice, and you should only invest in the market you believe is suitable for your portfolio.