A futures proprietary trading firm lets you trade futures markets using the firm’s capital under a rule set. In most modern programs you first trade a simulated evaluation, prove risk control, then get a funded account offer. The firm’s edge is structured risk limits and capital access, your edge is execution and consistency. Read on this 5 Best Futures Prop Firms on NinjaTrader to know about each firm in detail.

NinjaTrader is a futures-focused trading platform used for charting, order execution, analytics, and automation. It is widely used with common futures connections like Rithmic, CQG, and broker integrations, and it also has a dedicated “NinjaTrader Prop” ecosystem that partners with funded trading programs.

Table of Contents

5 Best Futures Prop Firms on NinjaTrader: Analytical comparison

| Firm | NinjaTrader availability | Typical connection you will see | NinjaTrader licensing nuance | Best-fit trading profile |

|---|---|---|---|---|

| Apex Trader Funding | NinjaTrader is included on plans and has official connection guides | Rithmic (common), also Tradovate options appear on plans | Often positioned as “included” with the plan | Plan shoppers who want many account-size options and familiar Rithmic workflow |

| Earn2Trade | NinjaTrader is explicitly supported and “recommended” for its programs | Rithmic workflow with setup guidance | Notes that NinjaTrader is free during their program path | Traders who want a structured evaluation track with standard Rithmic setup |

| Take Profit Trader | Dedicated guide for connecting NinjaTrader 8 | CQG-based setup guide for NinjaTrader | Requires the CQG connection steps they outline | Traders who want a simple “get connected and trade” path and are fine with CQG workflow |

| Elite Trader Funding | Dedicated NinjaTrader connection guide | Rithmic or Tradovate per their NinjaTrader guide | Standard “connect your account” guidance | Traders who want a straightforward NinjaTrader onboarding flow |

| Tradeify | Officially lists NinjaTrader as supported and appears in NinjaTrader Prop lineup | NinjaTrader (under Tradeify’s structure), plus Tradovate and TradingView via Tradovate | You trade under Tradeify’s company license, not your personal NinjaTrader license | Traders who specifically want to stay inside the NinjaTrader Prop ecosystem |

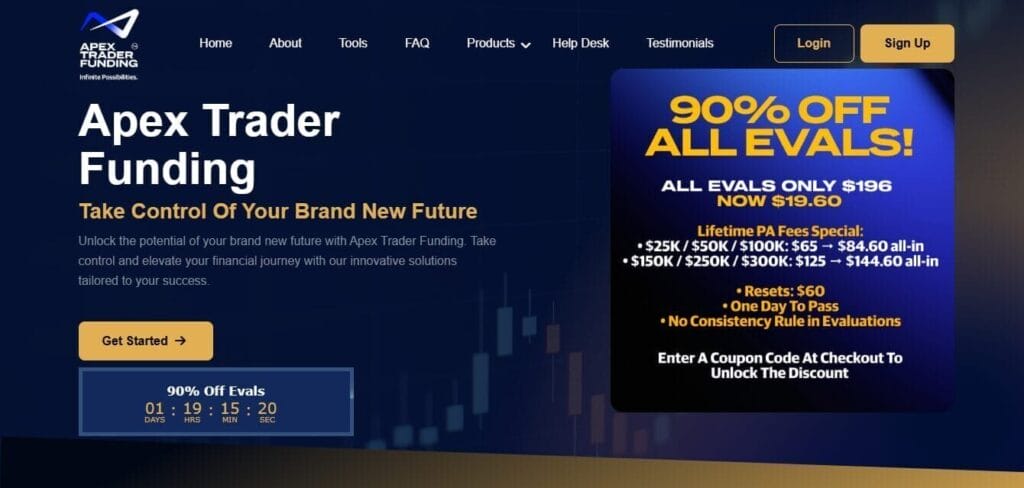

1. Apex Trader Funding- Simple one-step funding for futures traders

Apex Trader Funding operates within the growing proprietary trading ecosystem, positioning itself as a performance-based capital access platform for futures traders seeking scale without deploying substantial personal capital. Its core proposition centers on a single-step evaluation model, emphasizing risk discipline and consistency over multi-phase challenges, reflecting an industry shift toward simplified qualification frameworks designed to attract high-volume and retail-professional traders.

Apex is one of the most visible futures funding brands that actively markets NinjaTrader as part of its platform bundle, especially across its Rithmic plan lineup.

Apex Trader Funding Key features

- NinjaTrader access is positioned as included in many plan listings, so the “platform fee friction” is often reduced.

- Rithmic connection is well-trodden, and the setup flow is widely documented, which tends to reduce setup ambiguity for traders.

- Apex plan pages surface rule primitives like profit goals and trailing thresholds, which matters because NinjaTrader users often build rule-aware automation and dashboards.

Also, you may read 10 Best Forex Prop Trading Firms

Strengths and considerations

| Strengths | Considerations |

|---|---|

| Strong “NinjaTrader is included” messaging, fewer surprises around platform access | Rules vary by plan type, so you must map your strategy to the specific plan parameters you buy |

| Clear Rithmic + NinjaTrader connection documentation reduces onboarding friction | If you rely on certain connection types, confirm the exact feed and account type you are purchasing |

| Many account-size options, helpful for scaling your “contract model” methodically | Always validate that your intended platform mode is supported for the specific account you are on |

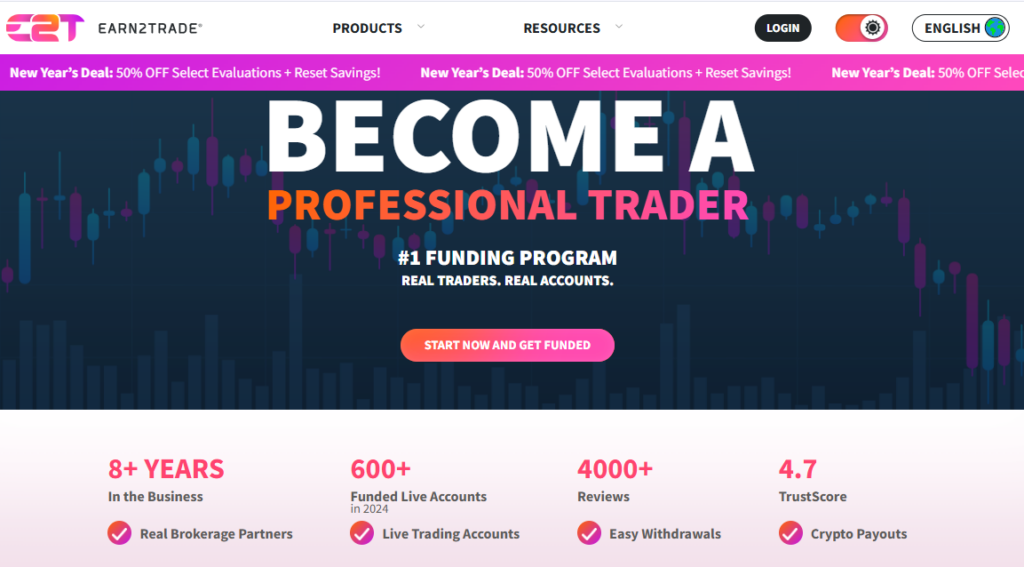

2. Earn2Trade

Earn2Trade is a U.S.-based futures trading education and evaluation firm that positions itself as a structured gateway for aspiring traders to transition from learning to professional funded trading. Through its core programs—the Trader Career Path and The Gauntlet Mini—Earn2Trade offers traders the opportunity to demonstrate their market skills on simulated accounts, meet defined profit and risk management targets, and, upon successful completion, receive a funding offer from proprietary trading partners to trade live capital and retain a majority share of profits.

Earn2Trade is evaluation-first and explicitly frames NinjaTrader as a supported and recommended platform for its funding pathways.

Earn2Trade Key features

- Earn2Trade clearly lists NinjaTrader as “recommended” and notes it is free during their program path, which is a material cost and setup advantage for new NinjaTrader users.

- They provide a Rithmic to NinjaTrader connection workflow, which matters because most “it does not connect” issues come from connection order and credential mismatch.

- Earn2Trade’s program framing emphasizes a career-style progression, which tends to appeal to traders who want a defined process rather than shopping dozens of rule variants.

Also, you may read 5 Best Prop Trading Firm Affiliate Programs Compared

Strengths and considerations

| Strengths | Considerations |

|---|---|

| NinjaTrader is explicitly supported and recommended, with clear guidance | Your trading workflow must align with their evaluation structure, not just the platform |

| “Free during the program” note can reduce upfront platform friction | You still need to execute cleanly within their rules and minimum requirements where applicable |

| Rithmic setup steps are documented, helping reduce onboarding errors | If you use advanced NinjaTrader automation, validate what is permitted and stable in your connection environment |

3. Take Profit Trader

Take Profit Trader positions itself as a proprietary futures trading funding firm designed to empower disciplined traders by providing access to funded accounts following a structured evaluation process. Traders select a futures account size and pursue a profit target under a defined set of risk rules; successful completion of this evaluation grants access to a PRO account where profits can be withdrawn from day one and shared under an 80/20 profit-split arrangement.

Take Profit Trader supports NinjaTrader via a CQG-based connection process and provides a dedicated step-by-step guide for NinjaTrader 8.

Take Profit Trader Key features

- Their documentation focuses on operational clarity, including where to find your CQG account details and the exact sequence to connect NinjaTrader.

- CQG-based access can be attractive if you prefer a path that is not Rithmic-centric, but you should be comfortable following their specific credential flow.

- For NinjaTrader users, the real value is fewer “mystery steps” during setup, which reduces downtime during evaluation periods.

Also, you may read 10 Best Stock Trading Prop Firms

Strengths and considerations

| Strengths | Considerations |

|---|---|

| Dedicated NinjaTrader 8 connection guide with clear steps | You must follow their CQG credential flow exactly, or you waste trading days |

| CQG pathway can suit traders who want alternatives to Rithmic workflows | Confirm that your intended NinjaTrader install and login path matches what they describe |

| Strong operational “how-to” style documentation reduces setup ambiguity | If you use multiple machines or VPS setups, keep connection consistency tight |

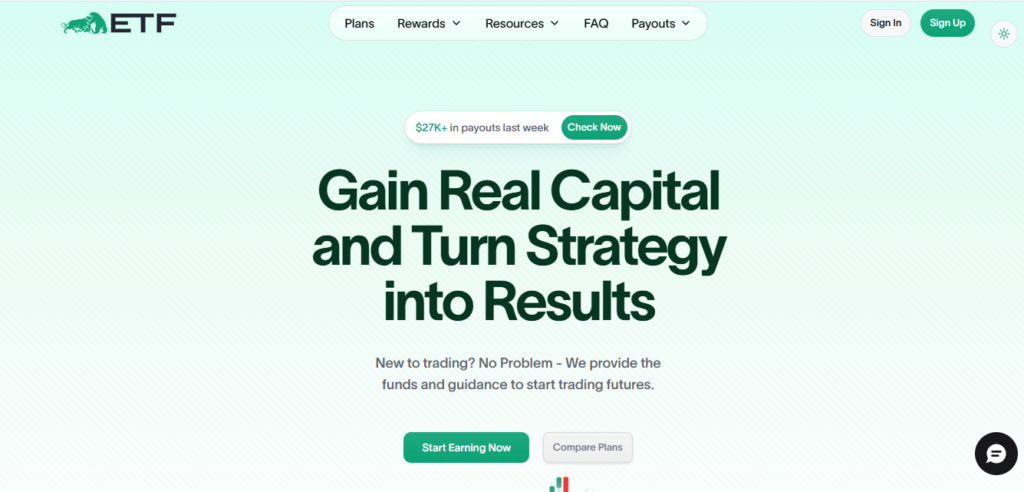

4. Elite Trader Funding

Elite Trader Funding (ETF) is a proprietary futures trading firm that offers traders a structured pathway to access real trading capital by demonstrating proficiency in risk management, consistency, and profitability within a simulated evaluation environment. The core proposition of ETF is to enable traders—from beginners to seasoned practitioners—to “gain real capital and turn strategy into results” without initially risking their own funds, positioning the platform as both an educational and professional funding solution.

Elite Trader Funding offers a direct NinjaTrader connection guide and explicitly frames the setup around connecting either a Rithmic or Tradovate account in NinjaTrader.

Elite Trader Funding Key features

- Their guide makes it explicit that NinjaTrader can be used with Rithmic or Tradovate account contexts, which helps traders who switch between common futures infrastructures.

- The onboarding is presented as a straightforward connection process, which is what most NinjaTrader users want: install, authenticate, trade.

Also, you may read 10 Prop Trading Firms Australia

Strengths and considerations

| Strengths | Considerations |

|---|---|

| Clear NinjaTrader connection guide, designed for quick onboarding | Always verify whether your specific account is Rithmic or Tradovate and set up accordingly |

| Supports common connection contexts mentioned in the guide | If you maintain multiple funded accounts, keep credential management clean to avoid misrouting trades |

| Simple “get connected” framing fits NinjaTrader traders who value speed | Platform access is only one variable, rules and risk model still decide fit |

5. Tradeify– A next-generation prop firm

Tradeify Partners positions itself as a futures trading prop firm designed for traders who value fast access to capital, structured performance incentives, and clear payout pathways. Its model eliminates traditional lengthy evaluation phases with instant or rapid funding options, making it attractive to active traders who prioritize speed and early market participation.

Tradeify explicitly lists NinjaTrader as a supported platform and is also listed among prop firms offering NinjaTrader Prop, which strengthens ecosystem fit for dedicated NinjaTrader users.

Tradeify Key features

- Tradeify supports NinjaTrader, Tradovate, and TradingView via Tradovate, which is useful if you want flexibility while still centering your workflow in NinjaTrader.

- Important nuance: on Tradeify accounts, you trade under Tradeify’s company license in NinjaTrader, not your personal NinjaTrader license. This can be a plus (simpler licensing) or a constraint (less control), depending on your setup.

- Their site messaging highlights mechanics like payout cadence options and end-of-day drawdown framing, which many futures traders care about when building a routine around risk limits.

Also, you may read 6 Best Prop Trading Firms for Long-Term Careers: Compared

Strengths and considerations

| Strengths | Considerations |

|---|---|

| Official supported-platform listing includes NinjaTrader | You must use Tradeify’s company license for NinjaTrader on their accounts |

| Strong alignment with the NinjaTrader Prop ecosystem | If you depend on specific personal-license features, confirm what is available under their license model |

| Multi-platform flexibility around Tradovate and TradingView options | Always map the firm’s drawdown style to your strategy’s volatility profile |

5 Best Futures Prop Firms on NinjaTrader: Final verdict

| Firm | NinjaTrader support | Best suited for whom |

|---|---|---|

| Apex Trader Funding | NinjaTrader supported (commonly via Rithmic), plus Tradovate and other options listed by Apex | Full-time traders who want frequent payout cycles and plan to scale across multiple accounts, and whose edge produces steady daily output that stays compliant with trailing drawdown and consistency rules |

| Earn2Trade | NinjaTrader is recommended for Gauntlet Mini and Trader Career Path | Traders who want a structured, rule-driven progression (minimum trading days, defined risk rules), and prefer a training-style ladder that rewards process and consistency |

| Take Profit Trader | NinjaTrader supported (via CQG/Tradovate setup options in their platform guides) | Traders who want simple withdrawal logic centered on a buffer, and prefer fewer “profit distribution” constraints, with a focus on getting to withdrawals quickly once the cushion is built |

| Elite Trader Funding | NinjaTrader supported (official platform list and connection guides) | Traders with smooth, repeatable equity curves who can satisfy active-day and best-day style constraints, and want rules that strongly discourage “one big day” pass-and-cash behavior |

| Tradeify | NinjaTrader supported (officially allowed; typically under Tradeify’s company license) | Traders who prefer end-of-day drawdown, want no consistency requirement once funded, and like daily or 5-day payout positioning with a straightforward platform stack (NinjaTrader, Tradovate, TradingView via Tradovate) |

- Best for classic Rithmic + NinjaTrader familiarity: Apex (lots of plan options, strong connection documentation).

- Best for structured, program-style progression with NinjaTrader clearly endorsed: Earn2Trade.

- Best for traders who are comfortable with a CQG path and want explicit NT8 steps: Take Profit Trader.

- Best for simple “connect and go” NinjaTrader onboarding with common account contexts: Elite Trader Funding.

- Best if you want to live inside the NinjaTrader Prop ecosystem and accept firm-license constraints: Tradeify.

Also, you may read E8 Markets vs Funded Trading Plus vs DNA Funded vs PipFarm

Conclusion

For full-time traders who prefer NinjaTrader, these five firms split into distinct operating models: Apex Trader Funding positions itself around frequent payout cycles and includes NinjaTrader in its supported platform stack, which fits traders optimizing for regular cashflow. Take Profit Trader supports NinjaTrader connectivity through its broker and data-provider setup and centers withdrawals on a defined “buffer zone,” making it a better match for traders who can build cushion quickly and then withdraw consistently.

Elite Trader Funding is designed to enforce profit distribution discipline through its payout-eligibility rules, which favors traders with smoother, repeatable daily output.. Earn2Trade recommends NinjaTrader for its evaluation programs, while Tradeify lists NinjaTrader as an allowed platform and pairs it with end-of-day risk logic and payout schedules that appeal to traders who want a clearer, routine withdrawal rhythm.

Frequently Asked Questions

Do all NinjaTrader prop firms use Rithmic?

No. Many are Rithmic-based, but some provide CQG-based connection paths for NinjaTrader.

Can I use my personal NinjaTrader license with every prop firm?

Not always. Some firms require trading under the firm’s company license for NinjaTrader accounts.

What is the biggest NinjaTrader setup mistake with prop accounts?

Skipping the exact connection sequence and credentials expected by the firm’s guide (Rithmic or CQG flows). It usually results in login failures or no market data.