OctoBot is an open-source AI trading bot optimized for Bitcoin markets. It allows users to automate their trading techniques without requiring continuous manual intervention. In this article, we will explore Octobot Cloud Review.

Table of Contents

What is Octobot Cloud?

OctoBot, founded in 2018, is noted for its transparency and configurable features in cryptocurrency trading. It also provides free, open-source strategies. As an open-source initiative, it offers free access to a variety of trading techniques, giving users greater power and freedom.

OctoBot’s cloud platform streamlines setup, making it accessible even to amateurs and free of charge. Moreover, OctoBot keeps track of each strategy’s performance, assisting users in making educated judgments.

Octobot cloud Review: Features

- OctoBot offers multiple built-in methods that can be used as is or as inspiration. Of course, you can make your own from scratch. OctoBot is open-source, so you can even look at the code to see how it works.

- Customize your trading strategy using Octobot’s AI and technical indicators, such as RSI, MACD, Moving Averages, ADX, or other TA. Integrate ChatGPT or a custom artificial intelligence forecast into your approach.

- Make use of optimized Dollar Cost Averaging techniques. Automate your entry and exits with as many orders as you like, optimize each, and Profit from long or short-term DCA.

- Furthermore, Octobot provides Profit from sideways markets by using fine-tuned grid trading tactics and advanced customization for every trading pair and exchange.

- Automate your TradingView strategies or indicator signals on any exchange to create or cancel orders as soon as your TradingView indicator or strategy gives an alert.

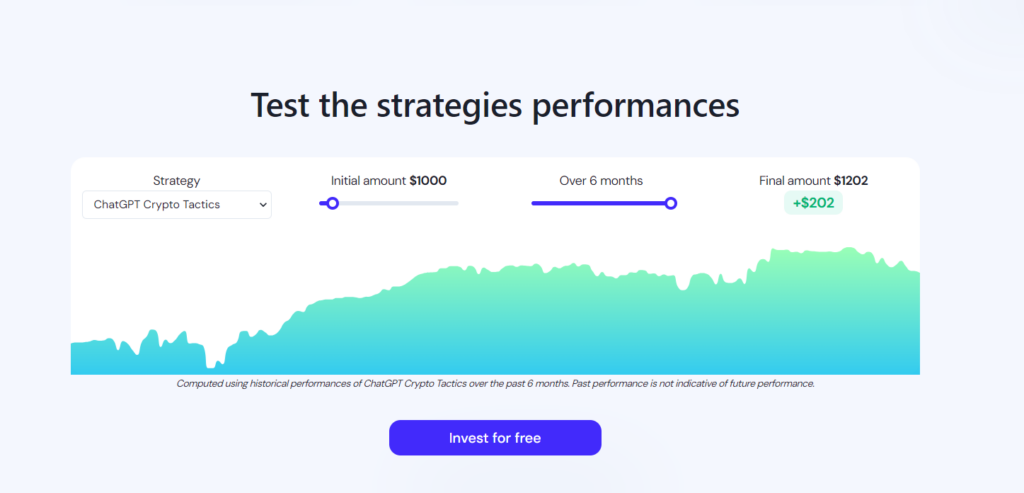

- Each strategy’s prior success is assessed regularly using historical data and OctoBot’s backtesting engine, ensuring that the shown numbers are accurate for strategy-based programs.

- Profits depend on various factors, including market conditions; thus, strategies can sometimes become unprofitable. If a technique does not generate profits for a specific period, you will be notified before employing it.

- OctoBot may be run in simulation mode. In this mode, OctoBot simulates deals using the same procedure as in the real trading mode.

- You can also check their Blog section to keep yourself updated and educated about Octobot.

Octobot cloud Review: Tools

- Three tools are offered by this platform that include :

- OctoBot ChatGPT trading is an AI-powered approach that employs OpenAI ChatGPT to evaluate cryptocurrency market patterns and provide trade signals.

- Triangular arbitrage on cryptocurrency exchanges is a tactic for profiting from price disparities between three cryptocurrencies by making fast trades.

- Scalping is a rapid trading practice that involves making a large number of small transactions to profit from minor price swings. This tool makes frequent, modest profits.

Octobot cloud Review: Supported Exchanges

The following are the officially Supported Crypto Exchanges that includes

- Binance

- OKX

- Kucoin

- Coinbase

- Binance.us

- Bybit

- Crypto.com

- HTX

- Bitget

- BingX

- MEXC

- CoinEx

- HollaEx

- Phemex

- GateIO

- Ascendex

- Okcoin

Octobot cloud Review: Mobile Application

- The software allows you to follow your OctoBot, whether self-hosted or cloud-hosted, directly from your mobile device.

- OctoBot Android App is recently launched by this platform that provides quick access to your OctoBot trading bots.

- It lets you connect with your OctoBot cloud account and monitor your trading bots from your Android device.

- You can download their app for Android devices from Google Play. However, an app for iOS devices has yet to be created.

Octobot cloud Review: Customer Support

- With OctoBot, you can control your trading bots remotely via Telegram. This versatile support option allows you to monitor your robot’s performance, portfolio, and profits and even initiate an emergency sale, providing security and support.

- You can follow them on their various Social media profiles, including YouTube, Twitter, and Instagram.

- In addition, you can email your queries to them by clicking on the ‘Contact us’ option, which allows you to send mail directly.

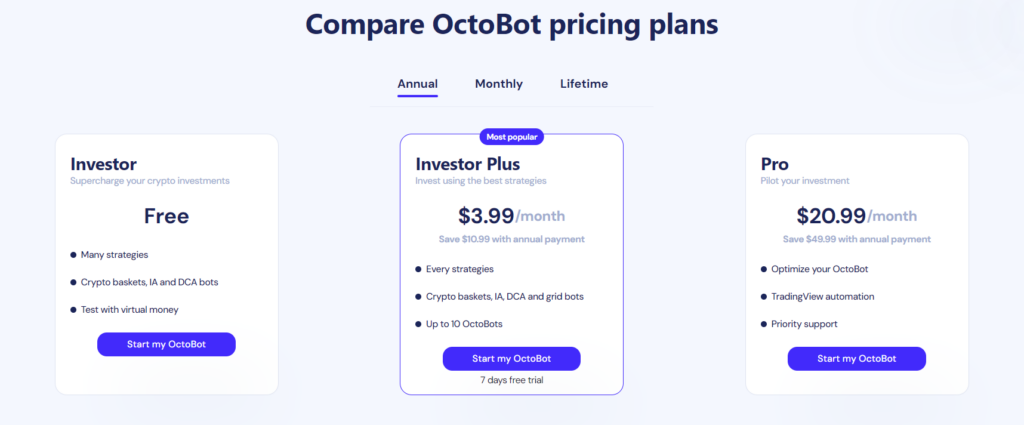

Octobot cloud Review: Pricing

Octobot cloud Review: Security

When using the OctoBot cloud, the following security precautions are applied:

- Your exchange API keys are stored in a secure, encrypted vault. This implies that even in the unlikely case that exchange API keys leaked from OctoBot servers, they would be unreadable.

- OctoBot API keys with withdrawal rights cannot be used. OctoBot cloud does not keep exchange API keys with withdrawal rights (where technically possible). This implies that OctoBot or its firm cannot technically withdraw funds from your exchange account.

- OctoBot depends on automated strategies rather than human efforts. This means that each method is consistent and predictable. You do not have to trust a human to carry out the approach correctly.

Conclusion

Octobot can trade spot and futures markets across various exchanges, allowing customers to diversify their trading tactics. Its backtesting feature allows traders to assess the efficiency of their strategies using past data, ensuring they are well-informed prior to live trading. This makes it an excellent alternative for traders with and without experience.

How to Select a Crypto Trading Bot?

Here are some key factors to consider when selecting a crypto trading bot that coincides with your trading objectives and experience.

- Ease of use: To ensure easy operation, choose a bot that fits your level of technical expertise.

- Strategy variety: The bot should provide various techniques consistent with your trading goals and style.

- Cost consideration: Compare the bot’s price to your budget and the possible profits it can provide.

Is automatic trading profitable?

Profitability in automatic trading is not guaranteed.

Before deploying a bot in live trading, it is critical to backtest its strategy using historical data and simulate trading in a risk-free environment (paper trading).

Analyzing historical performance: While past performance does not guarantee future success, it provides useful information about how a bot may perform in different market situations.

How do cryptocurrency trading bots work?

Understanding how crypto trading bots operate is critical for any cryptocurrency trader.

Technical Indicators: These bots frequently employ a variety of technical indicators, including moving averages, the Relative Strength Index, and others, to inform their trading decisions.

Crypto Predictions: Advanced bots, such as OctoBot GPT, may use machine learning algorithms to forecast future price movements based on historical data analysis.

Crypto Signals: These bots use signals from sites like TradingView to conduct trades based on market movements and expert views.