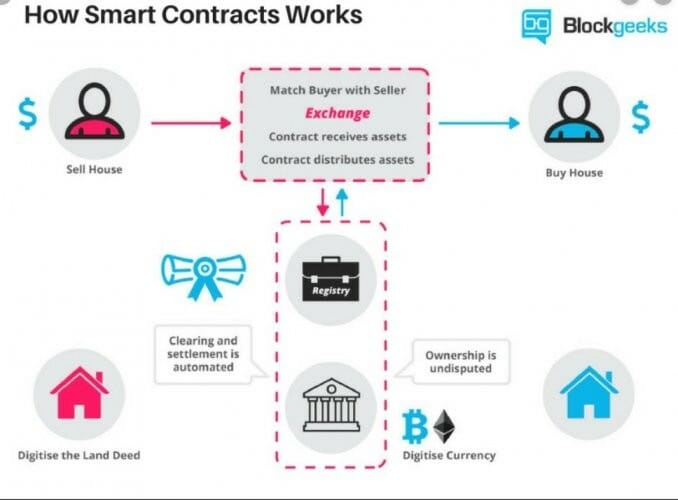

A “smart contract” or a dumb contract is a programme that runs on Ethereum’s blockchain. Ethereum accounts come in the form of smart contracts. This indicates that they have a balance and can send transactions across the network. However, they are not controlled by a user; instead, they are deployed to the network and run according to a set of instructions.

Smart contracts, like conventional contracts, can set rules and have them enforced automatically through programming.

Since the establishment of the Ethereum blockchain, smart contract adoption has risen dramatically. The complexity of smart contracts is increasing. They are in charge of digital asset ownership and business logic. Companies, investors, and end-users will have more confidence in executing decentralized finance (DeFi) transactions if more transparency occurs.

After Bitcoin, Ethereum has become the dominant venue for some of the most exciting cryptocurrency innovations. However, the network’s popularity – and the high fees associated with transacting on it – has prompted a slew of competitors to try to undercut Ethereum with lower fees, faster speed, and higher throughput.

Table of Contents

ETH’s Value is Driven by ‘Use Case’ Demand:

The value of Ethereum is determined by ‘use case’ demand: Ethereum’s market capitalization represents a share in a massive “user-owned” decentralized blockchain that serves as a clearing, storage, and security layer for the future Web3 protocols.

The demand for ETH is driven by its ‘use case’ value. If you want to mint and sell a lot of NFTs, you’ll need ETH, and if you want to use a lot of DeFi protocols, you’ll need ETH, which acts as collateral and as the “currency” that certifies blockchain transactions. In many ways, ETH begins to resemble a currency, but because ETH is essentially a stake in the Ethereum network, using it to authenticate blockchain transactions is more analogous to swapping network equity.

Given the importance of real-world applications in deciding a store of value, ether stands a reasonable possibility of displacing bitcoin as the most popular digital currency. Smart contracts are supported by the Ethereum ecosystem, allowing developers to construct new applications on the Ethereum platform. The Ethereum network is used to build the most decentralized finance (DeFi) applications, and most non-fungible tokens (NFTs) created today are purchased with ether. The fact that ether has more transactions than bitcoin demonstrates its supremacy. As the use of cryptocurrencies in DeFi and NFTs grows, ether will gain a first-mover advantage in applied crypto technology.

Ethereum may also be used to safely and privately store almost any information on a decentralized ledger. This data can also be tokenized and traded.

JPMorgan Report Claims Ethereum may Lose Defi Dominance due to Scaling Issues:

According to a JPMorgan analysis, Ethereum’s supremacy in the field of decentralized finance may continue to erode in the coming year. The report, published by Nikolaos Panigirtzoglou, managing director of global markets strategy at JPMorgan, claims that Ethereum’s dominance is in jeopardy due to scaling issues.

According to the note, scaling, which is required for the Ethereum network to sustain its supremacy, may happen too late.

Ethereum has focused on an L2 (Layer 2)-centric roadmap, which encourages the use of roll-ups and side chains as alternatives to the high fees and intense activity on its Layer 1 blockchain.

The Arrival of New Challengers:

Panigirtzoglou says that what’s more concerning is that Ethereum has lost some of its defi clout to other chains rather than its L2 scaling solutions. A collection of intelligent contracts-enabled cryptocurrencies and networks known as “Ethereum killers,” Solana, Avalanche, BSC, and Terra have gained market share and built a community around them.

After the merger, which will shift the proof-of-work (PoW) consensus to a more energy-friendly proof-of-stake (PoS) consensus, sharding the approach Ethereum will use to scale in its L1 blockchain, won’t arrive until next year.

The note ended with these words:

In other words, Ethereum is currently in an intense race to maintain its dominance in the application space, with the outcome of that race far from given, in our opinion.

Ethereum Could Retain its Position as the Most Powerful Smart-Contract Blockchain:

Analysts at Coinbase Institutional, which provides cryptocurrency analysis to large investors, believe Ethereum will be able to fend off the challengers. Other layer 1, or base layer, protocols may face competition from Ethereum’s layer 2, or companion system, which operates alongside the main blockchain to speed transactions cheaper. Upgrades to Ethereum itself, such as a complete transfer from the existing proof-of-work system to a proof-of-stake blockchain and the inclusion of sharding, may also help.

Users of decentralized applications, or dapps, may stop hunting for faster and cheaper alternatives to Ethereum as the ecosystem’s scalability improves, according to a recent analysis by Coinbase Institutional.

Although Coinbase Institutional expects several chains to coexist in the crypto world in the short term, Ethereum may retain its throne.

According to the Coinbase Institutional study, “We do think that the culmination of [layer 2] scaling solutions combined with upgrades like the Beacon Chain merge and sharding could limit progress for alternative [layer 1s] in their current form.”

‘Flippening’ Done Differently: In 2022, Ethereum will Outperform Bitcoin in Terms of Transaction Fees:

Chris Burniske, a former Blockchain Products lead at Cathie Wood’s Ark Invest, provided a figure on Twitter illustrating ETH’s supremacy in terms of fee % share over time. When Burniske saw the graphic, he claimed he couldn’t believe it. “Bitcoin is currently at 1% of [Ethereum] in terms of the amount users pay to utilize the network,” according to the report.

The transaction charge for Ethereum has risen significantly. It was only $0.462 at the start of July 2020, whereas the average BTC transaction cost was $2.48 at the time.

As the popularity of non-fungible tokens, decentralized finance, and smart contracts grew, so did Ethereum costs.

According to Yan Pritzker, co-founder of the Swan Bitcoin app, high transaction costs on BTC and ETH constitute bullish and bearish circumstances for the respective coins.

The popular NFT and DeFi activity is based on Ethereum:

It’s worth noting that the more than $1 billion in Ethereum burned last month was entirely transactional gas fees, implying that there were a lot of transactions. Moreover, most such transactions took place on OpenSea, the leading NFT marketplace. In January, OpenSea achieved a new monthly revenue record of more than $5 billion in NFT transactions, most of which took place on the Ethereum network.

The OpenSea revenue record proves that Ethereum is the most popular platform for decentralized finance (DeFi) and non-fungible token (NFT) exchanges and transactions. On the Ethereum blockchain, DeFi currently has $100 billion in locked assets, with more streaming into this automated banking system.

Ethereum Assassins Aren’t as Lethal as Previously Feared

Cardano, Solana, EOS, and Polkadot are among the leading cryptos displacing ETH. Each of these undertakings, however, has its own set of problems. Cardano recently experienced update issues that stopped Coinbase trading and have yet to be resolved. The rising popularity of Solana has resulted in multiple network failures and a large number of furious users. Polkadot’s staking feature, which generates interest, is said to be hazardous, pricey, and deterring users. Meanwhile, competitors appear to have surpassed EOS.

While Ethereum is currently trading at a 46% discount to its all-time high, each of the projects above is performing significantly worse, according to CoinMarketCap, at the time of writing: Solana is down 62%, Cardano is down 65%, Polkadot is down 66%, and EOS is down 90% approx.

As a result, the danger to Ethereum’s smart contract dominance is currently substantially diffused.

Could Ethereum Reach $10,000 in 2022?

In recent months, there has been a lot of chatter and media coverage about several cryptocurrencies that have been labelled “Ethereum killers” by significant players in the crypto smart contract field.

Those “killers” are anticipated to jointly outperform ETH because they can process more transactions per second than the Ethereum network and at a lower processing price than the current average Ethereum transaction cost of around $30.

Ethereum’s transaction fees have dropped by 35% in the last two weeks as engineers continue to enhance the network under the ETH2.0 development plan. This proposal will increase the number of transactions per second to above 100,000, lowering transaction costs and reducing settlement time.

According to UltraSound.money, an Ethereum tracking website, a total of $1.079 billion in Ethereum (ETH) fees were burned in January, setting a new monthly record. A “fee burn” is an automated “self-destruct” mechanism that removes a set percentage of ETH from the circulating supply of currencies. These fees were previously used to compensate ETH miners for validating transactions on the Ethereum blockchain using the “proof-of-work” protocol.

Following the activation of EIP-1559, the fee burn began on August 5, 2021, as a critical first step toward upgrading the Ethereum network to a more efficient “proof-of-stake” consensus paradigm. Using fundamental supply and demand concepts, the burn function is an intentional effort to reduce Ethereum’s overall circulating quantity to make the token more valuable.

Ethereum Survival Depends on Proof-of-Stake Transition:

Buterin posted a “roadmap diagram for where Ethereum protocol development is at and what’s coming in what coming in what order” on Twitter on December 1.

One of the significant points of contention was the timing of the Ethereum 2.0 integration. That is when the crypto will go from a proof-of-work (i.e. crypto mining) to a proof-of-stake method for transaction validation.

Buterin stated that he believes the update is around halfway complete in answer to a question. He also stated that the process would be 60% complete once the merging with Ethereum 2.0 is completed.

He did not provide a particular timeframe for the merger with Ethereum 2.0 to convert to proof-of-stake, though.

The main problems with Ethereum are the high transaction costs and the considerable time it takes to process transactions.

This has to deal with the blockchain network’s scalability. Buterin uses terms like “sharding,” “roll-ups,” and “chain” to describe this. This is a more challenging challenge to solve than both the merger issue and the transfer to proof-of-stake.

Meanwhile, the proprietors of Ethereum’s promotion organization and its miners continue to make a lot of money. Owners of ETH and most other transactions on the site are responsible for this cost. As a result, many other Ethereum rival cryptocurrencies will have plenty of opportunities to grow their market share.