The Wayex Card is built for users who want to spend crypto globally without friction. Powered by Visa, it combines instant crypto-to-fiat conversion with multi-currency accounts, making cross-border payments simple and reliable.

The Wayex Card is designed as a cross-border crypto spending solution that connects digital assets with everyday payments. Built on Visa infrastructure, it allows users to convert crypto into fiat instantly and spend globally without relying on traditional banks.

Wayex focuses on simplicity, fast transactions, and international usability. Instead of positioning itself as a trading-focused card, it targets users who want practical crypto access for daily life, travel, and remote income management.

In an increasingly borderless digital economy, Wayex aims to function as a global crypto bank account with payment capabilities.

What Is the Wayex Card?

The Wayex Card is a prepaid debit card issued by Wayex and linked to its digital wallet platform. It allows users to store cryptocurrencies, convert them into fiat currencies, and spend through a Visa-powered payment system.

The card is managed through the Wayex mobile app, where users can monitor balances, track transactions, and control security settings.

Core characteristics include:

- Prepaid debit card structure

- Integrated crypto and fiat wallet

- Automatic crypto-to-fiat conversion

- Mobile-first management system

- KYC-based onboarding

- Support for global USD and EUR accounts

Wayex positions the card as a financial bridge between crypto holdings and traditional spending.

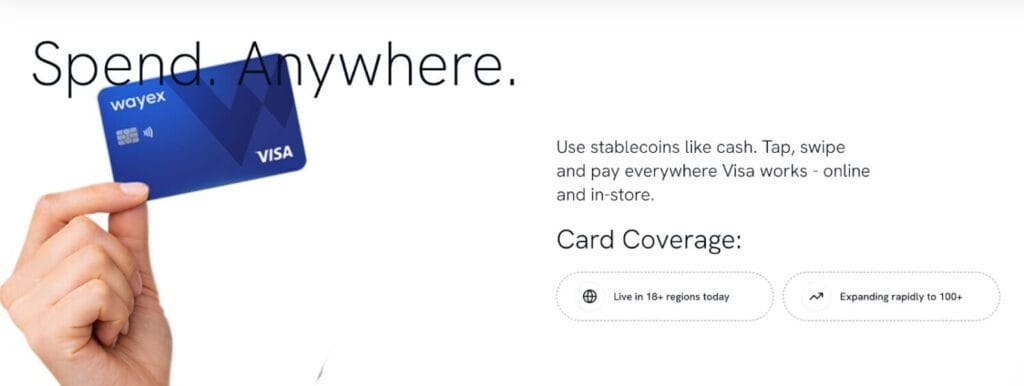

Card Network – Visa

The Wayex Card operates on the Visa network, providing access to millions of merchants worldwide. This ensures that users can use the card in most countries for both physical and online transactions.

Visa support enables:

- Global in-store payments

- Online shopping and subscriptions

- International merchant acceptance

- ATM withdrawals where supported

- Compatibility with major payment systems

For users who travel frequently or operate across borders, Visa integration makes Wayex a practical payment tool rather than a limited regional product.

Max Cashback – Wayex Card

The Wayex Card offers up to 1% cashback on eligible transactions. Cashback is credited to the user’s account and can be reused for spending, converted, or reinvested.

Key points about Wayex’s cashback structure:

- Maximum rate: Up to 1%

- Applies to qualifying purchases

- No mandatory staking required

- No premium subscription needed

- Certain merchant categories may be excluded

Compared to high-reward exchange cards, Wayex’s cashback model is modest but stable. It focuses on consistency and accessibility rather than aggressive incentive schemes.

This approach suits users who prioritize usability over reward maximization.

Annual Fee – Wayex Card

The Wayex Card comes with zero annual fees. Users are not required to pay any subscription or maintenance charges to keep the card active.

This fee-free structure includes:

- No yearly membership cost

- No card maintenance fees

- No mandatory premium plans

- No minimum balance requirements

Users only incur standard transaction or conversion fees where applicable. This makes Wayex suitable for users who want predictable costs without long-term commitments.

Sign-Up Bonus – Wayex Card

The Wayex Card does not currently offer a fixed sign-up bonus. New users are not rewarded with free tokens, cashback credits, or deposit-based incentives upon registration.

Instead, Wayex emphasizes long-term value through:

- Interest-earning products

- Consistent cashback rewards

- Fee-free card access

- Future yield and swap features

Occasional promotional campaigns may be introduced, but there is no permanent welcome bonus tied to card activation.

This approach supports sustainable platform growth rather than short-term user acquisition.

Key Features – Wayex Card

The Wayex Card is supported by a growing digital banking ecosystem focused on global crypto usability.

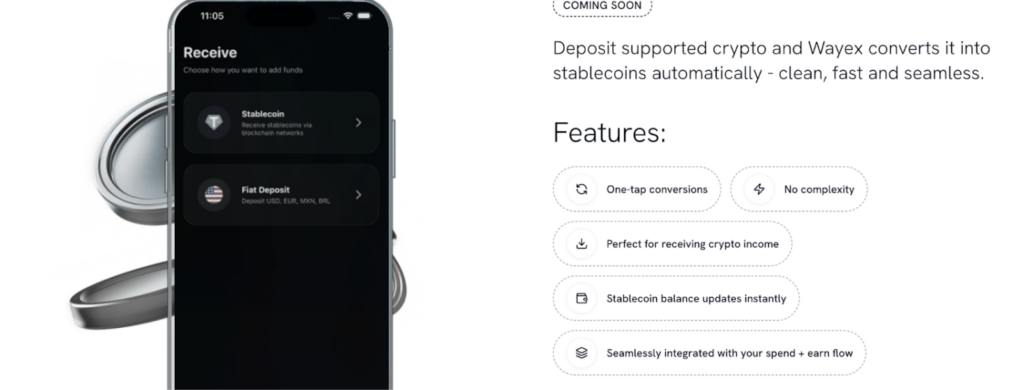

Crypto-to-Fiat Conversion

Users can convert crypto into fiat instantly at the time of payment, eliminating manual exchanges.

Instant Transactions

Payments are processed quickly through Visa infrastructure, ensuring smooth in-store and online purchases.

User-Friendly Interface

The Wayex app is designed for simplicity, allowing easy balance management and transaction tracking.

Automatic Yield Programs

Wayex plans to introduce automated yield products offering up to 5% daily returns and up to 20% fixed-term returns. These features are marked as coming soon.

Instant Swaps

Future updates aim to enable direct crypto-to-crypto swaps within the app, improving liquidity management.

Global USD and EUR Accounts

Users can maintain multi-currency accounts for international transfers and spending.

Centralized Card Controls

Users can freeze, manage, and monitor their card directly from the app.

Regulatory Onboarding

KYC verification ensures compliance and improves account security.

These features position Wayex as a hybrid between a crypto wallet and an international digital bank.

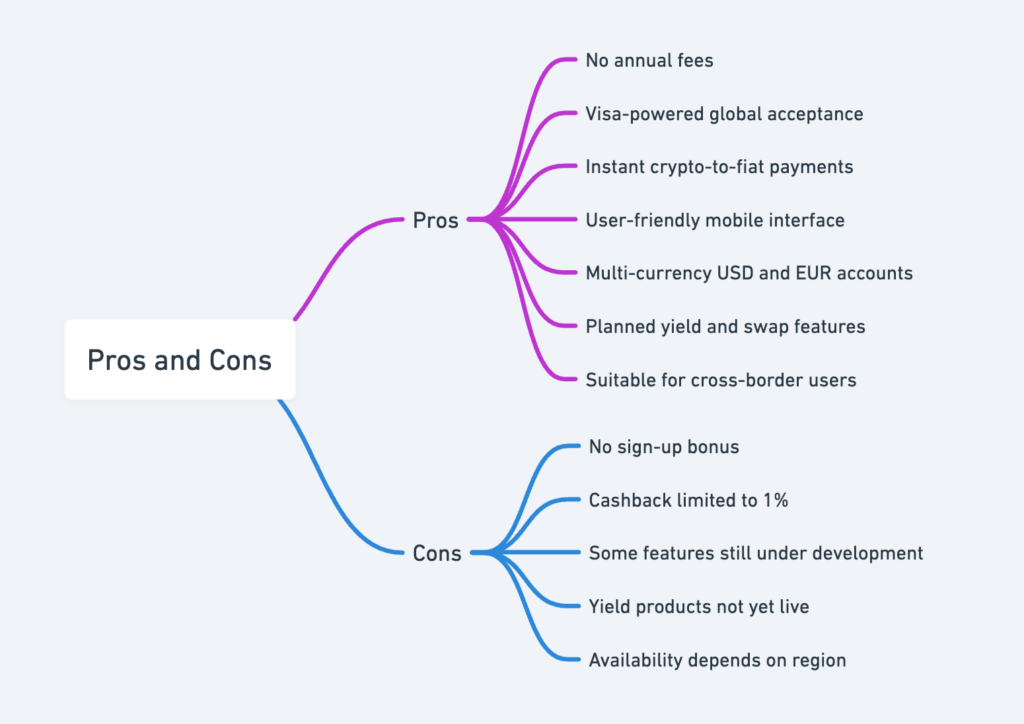

Pros and Cons – Wayex Card

Pros

- No annual fees

- Visa-powered global acceptance

- Instant crypto-to-fiat payments

- User-friendly mobile interface

- Multi-currency USD and EUR accounts

- Planned yield and swap features

- Suitable for cross-border users

Cons

- No sign-up bonus

- Cashback limited to 1%

- Some features still under development

- Yield products not yet live

- Availability depends on region

Wayex prioritizes long-term platform development over aggressive short-term incentives.

USP by Altie – Wayex Card

What makes the Wayex Card stand out is its focus on global usability rather than trading hype. This card is built for movement. Across countries, currencies, and platforms.

From my perspective, Wayex feels like a portable crypto bank account.

You hold crypto.

It converts instantly.

You spend anywhere.

No friction.

There is no need to constantly move funds between exchanges and banks. Your wallet, conversion engine, and payment card stay in one place.

For users who live, work, and earn across borders, this simplicity is its real advantage.

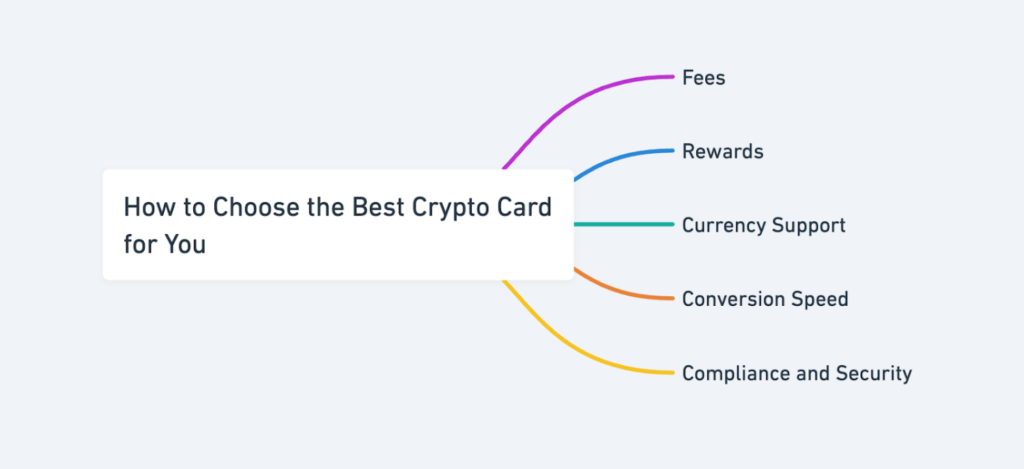

How to Choose the Best Crypto Card for You

Before selecting a crypto card, users should evaluate five core factors.

Fees

Check for annual charges, conversion margins, ATM fees, and hidden costs.

Rewards

Understand whether cashback requires staking, subscriptions, or minimum balances.

Currency Support

Review supported fiat and crypto currencies, especially if you transact internationally.

Conversion Speed

Ensure that crypto-to-fiat conversion happens instantly at payment time.

Compliance and Security

Look for proper KYC, regulatory standards, and in-app security controls.

Wayex performs well in conversion speed, global usability, and cost transparency.

Best Use Cases Around This Crypto Card – Wayex Card

Digital Nomads

Users who live and work across countries.

Example: Paying rent, transport, and subscriptions while holding crypto.

Remote Workers

Freelancers earning in crypto.

Example: Receiving USDT and converting it for daily expenses.

International Students

Users studying abroad.

Example: Managing living expenses through USD and EUR accounts.

Cross-Border Entrepreneurs

Business owners operating globally.

Example: Handling supplier payments and SaaS subscriptions.

Crypto Holders Seeking Simplicity

Users who want spending access without managing multiple platforms.

Example: Using one app for storage, conversion, and payments.

Conclusion – Wayex Card

The Wayex Card is built for users who prioritize global mobility and practical crypto usage. It focuses on instant conversion, Visa acceptance, and multi-currency account support rather than aggressive reward schemes.

With zero annual fees, stable cashback, and a user-friendly interface, it offers a reliable solution for cross-border spending. While some advanced features are still under development, the core payment infrastructure is already strong.

For digital nomads, remote professionals, and internationally active users, Wayex provides a balanced and future-ready crypto payment platform.

The Wayex Card stands out as a practical solution for international crypto users who value speed, simplicity, and accessibility. With zero annual fees, global acceptance, and strong conversion features, it fits naturally into modern, borderless financial lifestyles.