Key Takeaways:

- UNCTAD cautioned that cryptocurrencies were a volatile financial asset that could have negative social effects.

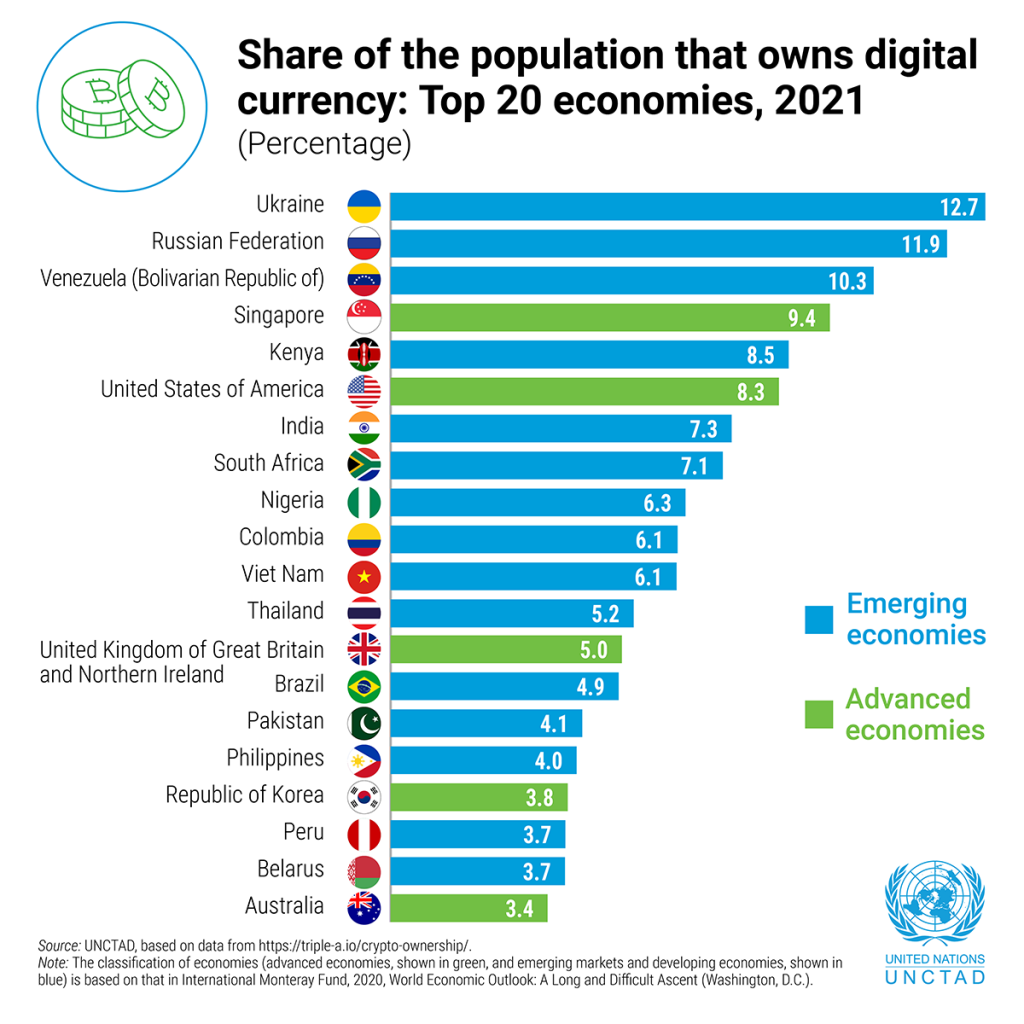

- The policy brief examines the factors that have contributed to the rapid adoption of cryptocurrencies in developing nations, including the ease of remittances and their use as a hedge against inflation and currency risks.

In three policy briefs released on Wednesday, the UN Conference on Trade and Development (UNCTAD) urged action to restrict cryptocurrencies in developing nations. While some people have benefited from these private digital currencies and help with remittances, they are volatile financial assets that can also have negative social effects.

The risks and costs associated with cryptocurrencies, including the dangers they pose to financial stability, the mobilization of domestic resources, and the security of monetary systems, are covered in depth in three policy briefs published by UNCTAD.

During the COVID-19 pandemic, cryptocurrency use multiplied globally, including in developing nations. According to UNCTAD, the ease of remittances and the use of cryptocurrencies as a hedge against currency and inflation risks are some factors driving their rapid uptake in developing countries.

Recent market shocks involving digital currencies indicate privacy risks associated with holding them. Still, the agency added that if the central bank intervenes to safeguard financial stability, the issue becomes a public one.

The policy briefs are:

1) The policy brief “All that glitters is not gold”: The high cost of leaving cryptocurrencies unregulated” examines the factors that have contributed to cryptocurrencies’ rapid uptake in developing nations, including the ease of sending money home and using them as a hedge against inflation and currency risks.

2) The policy brief “Public payment systems in the digital era”: Responding to the financial stability and security-related risks of cryptocurrencies” concentrates on the impact of cryptocurrencies on the safety and security of monetary systems as well as economic stability.

A national digital payment process that functions as a public good is said to be able to satisfy at least some of the motivations for cryptocurrency use and restrain the growth of cryptocurrencies in developing nations.

The monetary authorities may offer a central bank digital currency or, more likely, a quick retail payment system, relying on nationwide capabilities and needs. UNCTAD implores authorities to preserve the issuance and allocation of cash because doing otherwise highlights the digital divide in developing nations.

3) The policy brief “The cost of doing too little, too late”: How cryptocurrencies can subvert domestic economic growth in developing countries” examines how cryptocurrencies have emerged as a fresh avenue for undermining domestic resource mobilization in developing nations.

While cryptocurrencies can make remittances easier, they may also make it possible to evade taxes and avoid paying them through unauthorized transfers, much like a tax haven where ownership is difficult to trace.

UNCTAD encouraged authorities to take action to stop the spread of cryptocurrencies in developing nations and provided a list of recommendations, including limiting advertisements for high-risk financial products like cryptocurrencies.

The agency further stated that there is a need to regulate cryptocurrency exchanges, digital wallets, and decentralized finance and forbid regulated financial institutions from holding cryptocurrencies, including stablecoins, or providing clients with related products.

According to UNCTAD, capital controls need redesigned to account for cryptocurrencies’ decentralized, borderless, and pseudonymous characteristics.

Netizens think The UN is being dishonest by making this new move; users like @MattAhlborg are accusing the organization of having ulterior motives.

Undoubtedly, the community is displeased with yet another outside intervention, said @SurfingMacro This analysis is sorely lacking. Developing nations are becoming more accessible thanks to bitcoin.