Since 2009, Bitcoin’s meteoric climb has produced a surprising and diverse group of millionaires. These multi-millionaires made their fortunes by developing products to help Bitcoin’s still-developing ecosystem. Some have set up exchanges to trade cryptocurrencies and their derivatives, for example. Others have used it to construct million-dollar financial products and tokens. Their products and services have benefited from the rise in Bitcoin’s popularity and price.

According to a September 2021 study by Engine Insights, 59 percent of Gen Zs believe that investing in cryptocurrency is the best way to become a millionaire. Almost half of millennials (46%) agree with this statement.

Apps have transformed their cellphones into the modern-day digital equivalents of slot machines, allowing users to bet on hundreds of crypto coins without knowing anything about their intrinsic value beyond what others, notably high-profile social influencers, have to say about them.

When it comes to making investment decisions, 91 percent of Gen Z investors believe that social media is more trustworthy than friends, family, and traditional investing sites, according to a Motley Fool survey published in July 2021. The three most popular social media sites they used to decide whether, when, and how much to invest were YouTube, Reddit, and TikTok.

However, we think that’s not a very good way, since investing in crypto starts with a much heard term DYOR or Do Your Own Research and don’t get influenced by anyone.

Here are the world’s top five crypto Millionaires:

Sam Bankman-Fried

Fried’s climb to the title of crypto billionaire has been swift. In October 2021, Forbes projected the 29-year-old MIT graduate to be worth $26.5 billion. He launched FTX, one of the world’s most prominent crypto exchanges, in 2019.

FTX sets itself apart from the competition by delivering a variety of new items that are not available on other exchanges. Complex derivatives, digital tokens of physical shares, and pre-initial public offering (IPO) contracts are all part of the mix.

Tyler and Cameron Winklevoss

Tyler and Cameron Winklevoss invested their millions in cryptocurrency after winning a lawsuit against Facebook. Following the late-2017 increase in Bitcoin values, they became the first crypto billionaires. Forbes says that each of them is worth $5 billion. 78

While the Winklevoss twins are best known for their bitcoin investments, they are also entrepreneurs who founded the Gemini cryptocurrency exchange. After obtaining $400 million in November 2021, the exchange was valued at $7.1 billion.

Barry Silbert

Digital Currency Group’s chief executive officer (CEO) and founder, Barry Silbert (DCG). His net worth is $1.6 billion, according to Forbes.

The objective of the company is to hasten the growth of the global financial system. It accomplishes this by establishing and promoting Bitcoin and blockchain-based businesses. 12 Silbert’s influence has expanded across industries thanks to DCG.

Silbert’s company also controls Genesis, a digital currency market-making and trading organisation, as well as Grayscale, a digital currency investment firm. Silbert also founded Grayscale Bitcoin Trust (GBTC), an exchange-traded fund that tracks Bitcoin’s price.

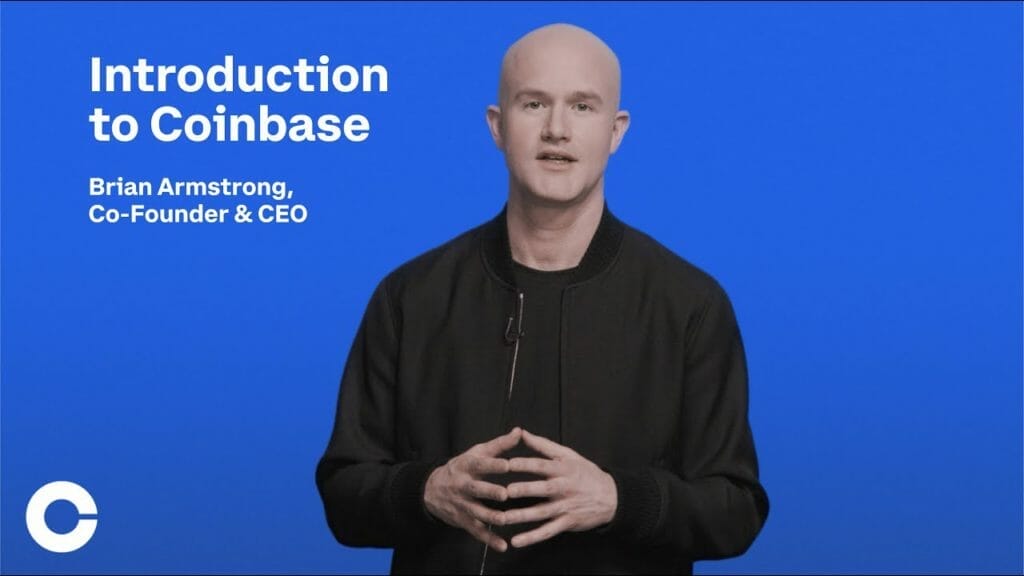

Brian Armstrong

Brian Armstrong is the creator of Coinbase, the largest cryptocurrency exchange in North America in terms of trading volume. After quitting his job as a software developer at Airbnb in 2012, he co-founded the exchange. Armstrong owns 19 percent of Coinbase and Forbes assessed his net worth to be $10.4 billion in January 2022.

The exchange went public in April 2021, and as of the closing of trading on January 3, 2022, it had a total market capitalization of $65.961 billion.

18 Coinbase was founded by Armstrong because he wanted the world to have a “global, open financial financial system that encouraged innovation and freedom,” according to Armstrong.

Michael Saylor

Michael Saylor, CEO of software firm MicroStrategy Inc. (MSTR), stated his company began buying bitcoin in August 2020, with a $250 million purchase. The company stated at the time that it was purchasing bitcoin to make better use of funds on its balance sheet.

Saylor has become a vocal proponent of Bitcoin over time, appearing on TV shows and at cryptocurrency conferences to promote its merits and applications.

21 MicroStrategy has raised its Bitcoin holdings to $3.5 billion by December 2021, jumping in to buy the cryptocurrency during price troughs.

How can you become a Bitcoin Millionaire?

With the passage of time and the expansion of money-making chances, many people are attempting to make a large sum of money with Bitcoin.

On the Blockchain, more than 20 million Bitcoins can exist, each of which can be partitioned into smaller pieces. The smallest unit of Bitcoin is known as a Satoshi, and it is worth 0.00000001.

You have a fantastic possibility to greatly grow your money if you have complete knowledge and a deep comprehension of investing or trading in cryptocurrency. Many people are interested in investing in the world of Bitcoins nowadays for the following reasons:

- Future Possibilities

- Profits Could Be Accelerated Significantly

- User Control

- International Payments with Low Transaction Fees

- There are no banking costs.

- Places emphasis on peer-to-peer

There are two basic ways to make a million dollars with bitcoins: mining and trading.

Most top Bitcoin millionaires, on the other hand, have made their fortunes by developing products and services that help to expand the cryptocurrency’s ecosystem.

The Legend of Machines

It’s one of the most effective ways to make a lot of money using Bitcoin. Solving cryptographic riddles and contributing new blocks to the Bitcoin Blockchain network can earn you a lot of money. There are two forms of mining:

Individual Mining, this sort of mining is carried out by a single person. Bitcoin is one of the most difficult cryptocurrencies to mine because of its mainstream success. Bitcoin’s supply is limited in comparison to its demand.

Most people choose cloud mining because it does not have any recurring expenses or escalating electricity expenditures. The contract simply requires a one-time payment. It also does not necessitate the purchase of any software or hardware.

The Legend of Charts

Proficient traders, for the most part, analyse trading charts, research the market, assess external factors, and are willing to take risks.

When the price of their current trade rises, these traders close the position to profit. The best aspect is that you can trade Bitcoin at your leisure 24 hours a day, seven days a week.

There are four trading techniques to consider while investing:

Day Trading is when a trader buys and sells a position in a single trading day. The main advantage of day trading is that you don’t have to pay overnight funding fees on your position.

Bitcoin Hedging, this is a risk-mitigation approach in which you take an opposite position that you have already purchased.

Trend trading, for example, if the trend is bullish, you will choose to invest for the long term, however if the trend is bearish, you will prefer to invest for the short term.

The Legend of HODLer

HODL (Buy and Hold) is a technique that involves purchasing Bitcoins and holding them until the price rises. If you choose to HODL, you must be prepared to make long-term investments and have a lot of patience.

Bitcoin and other digital assets are being used by an expanding number of businesses and investors around the world for a variety of investment, operational, and transactional objectives. There are unknown dangers, as with any frontier, but there are also great incentives.

Bitcoin was, and continues to be, a high-risk asset class. The lack of regulatory safeguards and the volatility of cryptocurrency prices have attracted both criminals and investors.

Regulatory scrutiny and regional security turmoil has wiped out about 30,000 Bitcoin billionaires in the last three months, as the unpredictable cryptocurrency has plummeted from $69,000 in November to around $36,000 (as of Thursday).

According to data obtained by financial news portal Finbold, the number of Bitcoin addresses holding over $1 million decreased by 28,186, or 24.26 percent, between October and January.

The Legend of Pen

You think you don’t have enough capital to get into any of these fields? Well, you can start writing. The one thing I’ve learnt over time is, everyone is a writer. You think you can’t writer, well even I thought that, and guess what, you’re reading an article I wrote. You can start by writing anything, maybe read a few books around bitcoin or money, try reading the emails of Satoshi, or the Bitcoin Standard by Dr. Safedean. Many people out their produce content you can start by reading some of our own.