Key Takeaways:

- Men- the most dominant gender group (63%) among young investors

- 76% of crypto investors have less than one year of experience in crypto

- 3.6 Million adults in Saudi are “crypto-curious.”

Nearly 14% (or 3 Million) of the adult population in Saudi Arabia aged 18 to 60, are either crypto investors or have traded crypto over the last six months, the latest study by the cryptocurrency exchange Kucoin revealed. The study further added that around 17% (Approximately 3.6 Million) of the country’s adults are “crypto-curious and are likely to invest in cryptocurrencies over the coming six months.”

According to the study’s findings, 76% of crypto investors have less than one year of experience in crypto investment. Of that, 49% of investors started trading cryptocurrencies in the past six months. 51% of total crypto investors invested because they believe it is the future of finance, while 44% believe that cryptocurrencies can bring them higher returns in the long run compared to other types of financial investment.

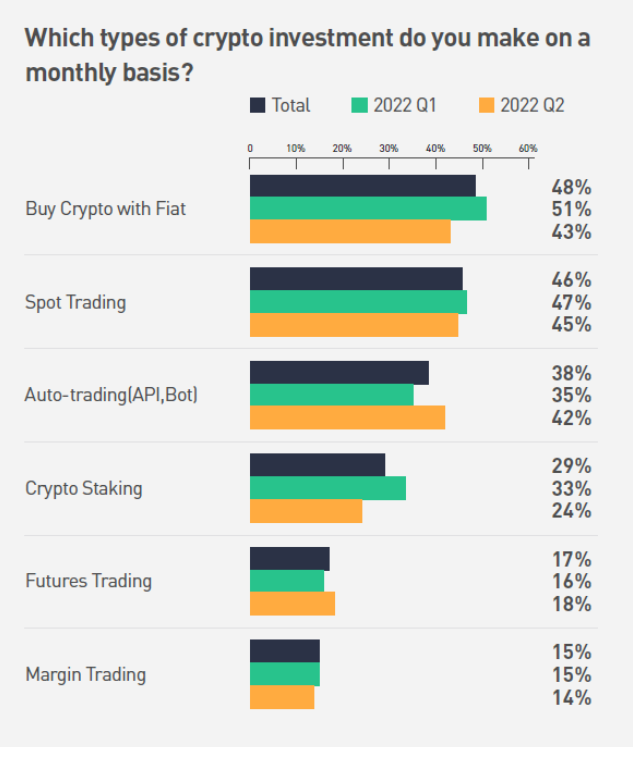

According to the study, nearly half of crypto investors buy digital currencies using fiat and engage in spot trading every month, which involves buying, trading, and selling on the current market value as the only form of crypto trading that is considered halal by some scholars in the Arab world. Since Staking, futures trading, and margin trading involve gambling they are less popular in Saudi Arabia

While men were found to be the most dominant gender group (63%), young investors aged 30 and below are now thought to account for at least a third of the total. The study titled ‘Into The Cryptoverse’ further observed that women are more focused on the realistic benefits of crypto. According to the report, 48% of female crypto investors are motivated by crypto’s profitability in the long run, and 42% of females invest in crypto to gain passive income.

The high penetration of crypto in Saudi Arabia presents a higher chance of other Middle Eastern countries also adopting crypto into their economy. Leading publicly traded oil company Saudi Aramco’s investment of $5 million in blockchain-based oil trading firm Vakt likely triggered the surge in crypto adoption in the Arab Country. It was also reported that Saudi Aramco would begin Bitcoin (BTC) mining operations.

In 2018, the Saudi government placed an outright ban on banks processing any transactions involving cryptocurrencies. The Saudi Government has repeatedly maintained that those who trade in crypto are doing so illegally and enjoy no financial protection and risk the loss of their assets. Despite the ban, the latest study findings are an indication that the youth of Saudi Arabia does not fear engaging in crypto-trading.

In 2019, the Saudi Arabian Monetary Authority (SAMA) joined hands with United Arab Emirates Central Bank (UAECB) to announce a digital currency called Aber. Recently SAMA tapped blockchain technology to execute money transfers and deposits.