Key Takeaways:

- Spot cryptocurrency trading edged lower to $1.39 trillion in July, a 1.3% monthly decline.

- In July, the derivatives trading volume of major exchanges fell 5.2% MoM.

- Binance’s trading volumes surged 76% in July.

Cryptocurrencies haven’t had an impressive run in recent months. Digital assets, especially crypto, have lost $2 trillion in value since the height of a massive rally in 2021. The unexpected Terra/LUNA crash only exacerbated the weakening position of crypto in the digital asset world.

In July, the derivatives trading volume of significant exchanges fell 5.2% MoM. As per a WuBlockchain analysis, the largest decreases were Deribit -28%, Crypto.com -25%, and FTX -11%.

The Spot trading volume of big exchanges also witnessed a 1.7% MoM fall in the past month. While LBank and Hubi witnessed a 51% and 31% fall in trading volume, the world’s largest exchange, Binance’s trading volumes surged by 76%. OKX +30% and Bitmart +18% also notably increased spot trading volume in July.

According to CryptoCompare, spot cryptocurrency trading edged lower to $1.39 trillion in July, a 1.3% monthly decline. Reportedly, exchange website traffic also declined 10% MoM in July. While MEXC gained a 27% spike in traffic, Bitget and Bitmart surged 14% and 15%, respectively. Sam-Bankman Fried’s FTX website traffic declined by a staggering 33%, Huobi’s declined by 21%, and OKX by 20%.

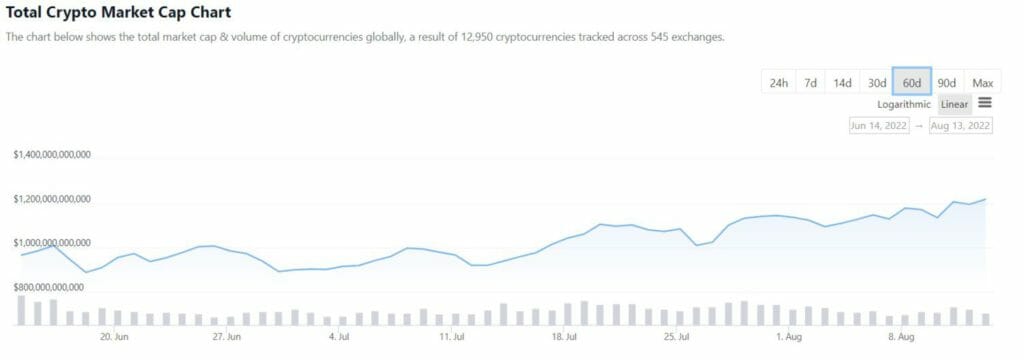

Cryptocurrency trading volumes have been plummeting to new lows ever since the beginning of this year. The crypto market plunged in May and June as worries about high inflation and Federal Reserve interest rate hikes pushed investors to abandon risky assets.

Following the collapse of Terra/LUNA, several leading cryptocurrency lenders froze customer withdrawals, while others laid off staff to cut costs. Crypto prices recovered partly in July, with bitcoin gaining 17% this month. BinanceUSD – a stablecoin issued by crypto exchange Binance – became more prominent in July, with spot volumes for bitcoin-to-BinanceUSD trades overtaking bitcoin-to-dollar for the first time.

Binance still owns the top spot among exchanges, with 54% of the market share, while Atom Asset Exchange is now the second largest, with volume rising 26.5% in the past month.