With the recent release of its real Visa card, RedotPay, a well-known cryptocurrency payment network headquartered in Hong Kong, took a big step toward being globally accessible. This evaluation explores it’s cutting-edge payment solutions’ features, application procedures, security precautions, and limits.

Table of Contents

What is RedotPay?

Redotpay is a payment solutions provider renowned for its cutting-edge approach. The company provides a virtual card that can be used for online transactions. For a short period, the virtual card is free to obtain. Therefore, consumers should take advantage of this chance. it is also linked to SpectroCoin, a website that provides a free card that lets customers take full advantage of PayPal. It has been linked to several marketing campaigns, one of which allowed consumers to win $200 in a single day by registering through a specific link and placing an order for a card through the app. However, it is a relatively recent newcomer to the payment solutions industry.

RedotPay Features

- Redotpay provides a physical and virtual card for use with online transactions.

- Virtual assets, including Bitcoin, Ethereum, Tether, and USD Coin, are supported on the platform.

- The users can manage their virtual assets via an application on their mobile wallet.

- For a limited period, Redotpay is giving away a free virtual card.

- The app lets users use their physical card to withdraw cash from Global ATMs.

- Moreover, it requires a PIN code to be entered to access the platform and complete transactions.

- Users can take their virtual assets out of the site via its withdrawal options.

- Furthermore, it is an inventive and user-friendly payment solution for people who wish to handle their virtual assets and carry out online transactions thanks to these capabilities.

- RedotPay’s unique Buy Crypto Card eliminates the difficulty of purchasing bitcoins. Allowing users to purchase various digital assets instantly removes the necessity for complex external transactions.

- With support for various cryptocurrencies, including altcoins and Bitcoin, the app offers customers unparalleled flexibility and diversity.

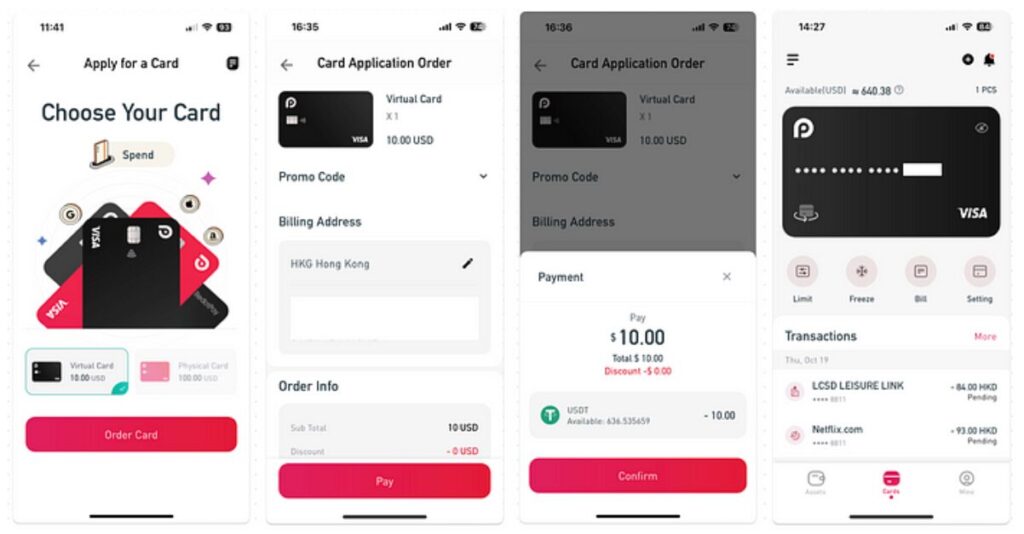

Application Process for Virtual RedotPay Card

- Verify your identity and deposit the corresponding digital assets.

- Go to the application page for the card, choose Virtual Card, and then click “Order Card.”

- Enter the billing address.

- Finalize the payment.

- The virtual card will be successfully activated after a brief wait.

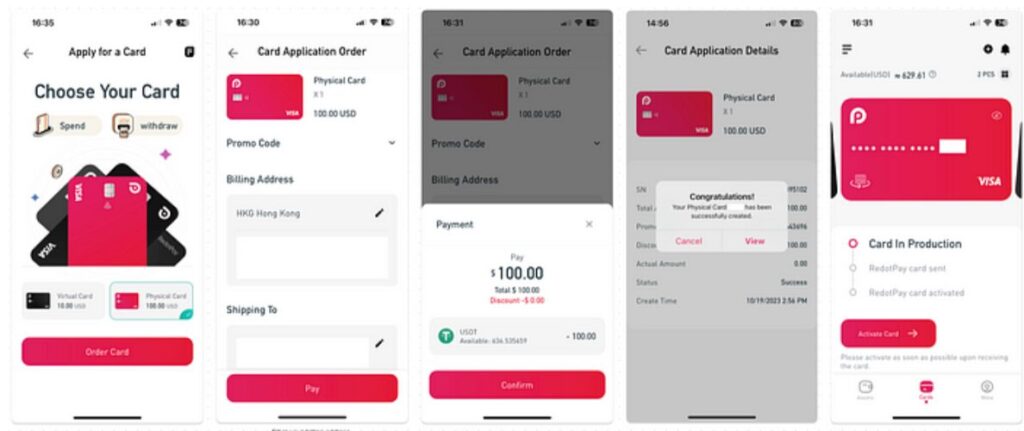

Application for the Physical Card

- Verify your identity in total and deposit the corresponding digital assets.

- Go to the application page for the card, choose “Physical Card,” and then click “Order Card.”

- Complete the shipment and billing addresses and sign personally.

- Finalize the payment.

- Get notified when your application is successful, then wait for the cards to be made and shipped.

- After receiving it, activate the card by following the guidelines.

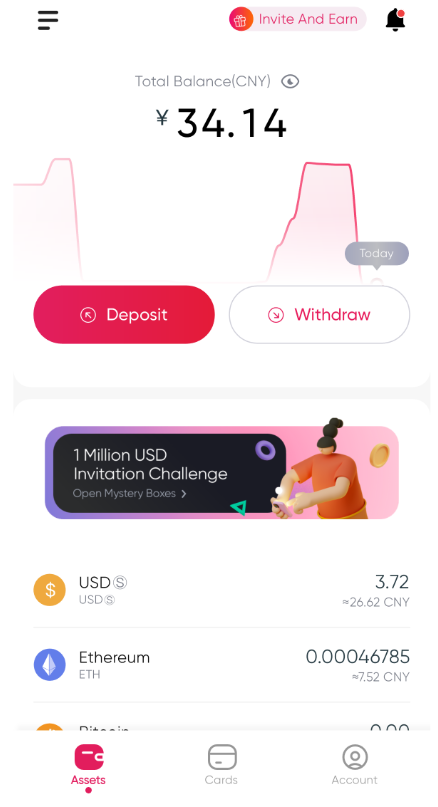

Deposit and withdrawal of Cryptocurrency assets

Deposit

- RedotPay allows for instant deposit and withdrawal of major cryptocurrencies, providing users with the flexibility to manage their digital assets efficiently and in real-time.

- The platform ensures that users are not burdened by prior conversion or excessive fees when depositing their cryptocurrencies, making the process cost-effective and convenient.

- To facilitate secure and streamlined transactions, RedotPay assigns a unique blockchain address to each user, adding an extra layer of safety to the deposit and withdrawal process.

Withdrawal

- RedotPay offers a physical Visa card that enables global cash withdrawals, allowing users to access their funds from ATMs worldwide.

- Users can benefit from fee-free withdrawals, ensuring they can access their funds without incurring additional costs.

- The platform provides multi-scenario coverage for international shopping, studying abroad, global ATM withdrawals, and more, providing for user needs and preferences.

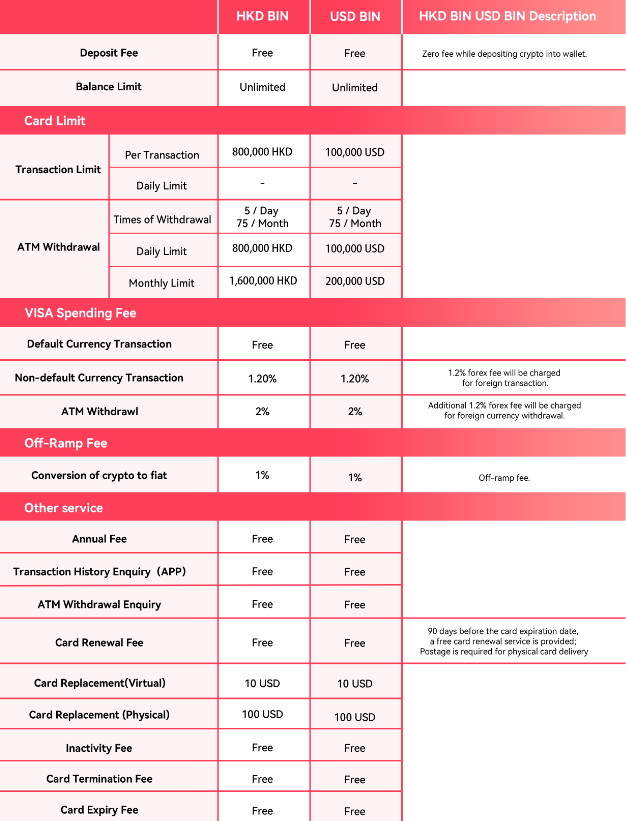

Fees

Customer Support

RedotPay recognizes the significance of promptly and effectively addressing user concerns and offering 24/7 customer support. This commitment to round-the-clock assistance contributes to the platform’s reputation for excellent customer service, ensuring that users are well-informed and supported.

Security

- RedotPay uses Sumsub’s services for KYC procedures, essential for confirming customers’ identities and backgrounds.

- RedotPay and Beosin collaborate to deploy transaction monitoring (KYT) with tools like EagleEye and Trace, which provide continuous monitoring and strengthen the security of users’ digital assets.

- RedotPay gives every user a distinct blockchain address, isolating the card from the user’s assets to improve security. This protection ensures that problems like RedotPay card freeze don’t affect users’ assets and wallets.

- To ensure that users are registered as the owners of their digital assets and that ownership rights are guaranteed even in the event of corporate bankruptcy,

- RedotPay goes above and beyond to safeguard users’ assets by entrusting them to a licensed trust or corporate service provider (TCSP).

- Redotpay has a clear fee structure, informing users of any associated costs, and offers a crypto credit card, allowing users to gain fiat credit limits, eliminating additional deposit fees and holding periods typically seen in traditional crypto cards.

Mobile App

- The RedotPay app offers a seamless experience for users. It allows for the online application and real-time approval of the RedotPay card, which can withdraw local fiat from ATMs and spend crypto-like fiat worldwide.

- The app also supports Binance Pay deposit and has received positive feedback for its convenience and user-friendliness.

- The mobile app is available for download for both iOS and Android devices from the Apple Play Store and Google Play Store.

Conclusion

In conclusion, RedotPay’s physical card introduction represents a big step in the right direction for the general public’s adoption of cryptocurrencies in everyday transactions. It’s smooth integration with the established financial system is opening the door for the peaceful coexistence of cryptocurrency and fiat money in the future.

How long does the withdrawal review procedure take?

Working hours: 9:00 to 18:00 (UTC+8), Monday through Friday; approximately one hour.

Holidays, non-working hours, and inclement weather: around 24 hours.

Which virtual cards are compatible with the RedotPay virtual card?

Currently, They accept PayPal, Apple Pay, Google Pay, Alipay, Grab, Uber, Line, Trip, and AirBnB.

Is there an age limit to apply for the card?

Please be informed that you can only apply for RedotPay credit card if you meet the legal adult age requirements in your area of residence.