In 2020, I wrote an article on Quant network claiming it was a scam. Then, a few days ago, I saw articles saying that Quant network is trying to build an Operating system for blockchain. It reminds me of Ripple of 2017–18, when it shills partnerships with banks and enterprises and tons of jargon that people didn’t understand.

But this time, I was shocked to see that Quant is already listed on the biggest exchanges and people have exposed this overmarketed project with no adoption, and its token QNT’s market cap is over $1.5bn dollar.

Therefore, I decided to write a more detailed article explaining how it works and why I still think it’s a highly over-valued project.

Note: These are my opinions as an individual and do not represent the view of any other entity.

What is Quant network?

Quant network says it’s trying to solve blockchain interoperability problems and a product called Overledger.

Overledger is an API gateway that provides a uniform way to interact with multiple blockchains.

How do Overledger works?

To explain how Overledger works, First, let me explain how people interact with the blockchain.

Let’s take an example of ethereum:

- Ethereum is a protocol,

- Ethereum clients are implementing protocol (For ex — Geth),

- When you run this implementation on a machine, that machine is called a blockchain node,

- Two or more nodes create a network. Ethereum has thousands of nodes.

How do people interact with a node?

When you run a node, you can interact with it using the command line as well as Ethereum clients have also exposed JSON RPC.

Now anyone can host nodes and give you access to Ethereum node, so you can read and write from the blockchain. Many companies like Quicknode, Infura, and Blockdaemon does it.

Additionally, anyone can create a library using this JSON RPC to simplify it. There are tons of them; the most popular is Web3 JS.

Most EVM chains like Ethereum, BSC, and Matic are compatible with Web3 js.

So What does Overledger do?

Overledger is an API gateway similar to Infura and Quicknode. However, rather than providing direct access to Blockchain Node APIs, they have built a middle layer, which tries to provide uniformity when working with multiple blockchains.

In other words, Overledger is a layer that provides you with one interface to talk to blockchain regardless of any blockchain.

Overledger SDK is a wrapper for Overledger APIs. As a developer, I know most of the time, the developer looks for some SDK for APIs, which abstracts many complexities when using any third-party APIs.

For example, if you want to interact with the Ethereum network, you will use web3.js as SDK with an API gateway like Quicknode or Infura.

Understand Overledger with an example.

Let’s say you use both Facebook and Twitter.

Now Let’s say I create a service using which you can update status on both Facebook and Twitter.

This is what Overledger is.

It sounds good, so what’s the problem?

Everything above sounds good, but why do I think Quant network $QNT doesn’t worth it?

Under Delivered

People have different visions, and I understand it. However, it doesn’t matter what your vision is. The only thing matters are your efforts and delivery.

Quant network finished its ICO in May 2018. So it’s been four years, and when I inspected the project, it delivered a very basic project.

Overledger APIs allow only a few options, like Create and sign a transaction, search addresses and transactions and subscribe to address changes.

This is a very basic type of functionality, you won’t be able to build a crypto wallet using it, and they are buzzing things like mDapps aka Multichain dapps.

Zero Adoption

I think no one uses them because let me show you what usage looks like.

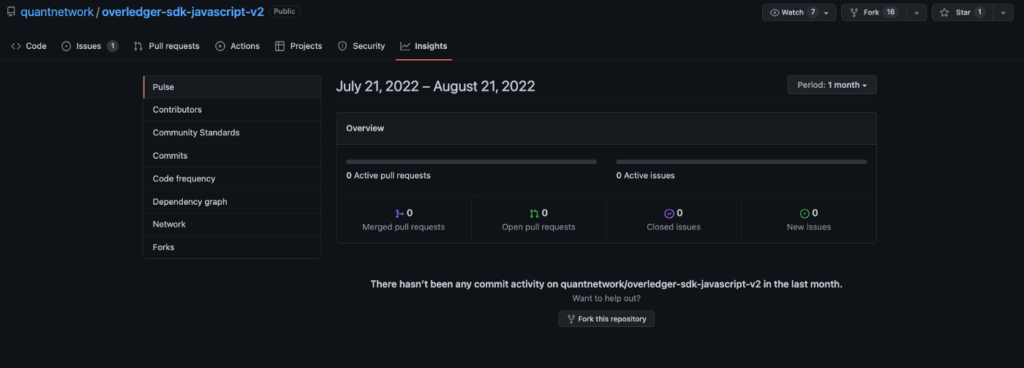

Below is Github of Overledger SDK; you see 0 everywhere. No pull requests, no issues, very small number of forks.

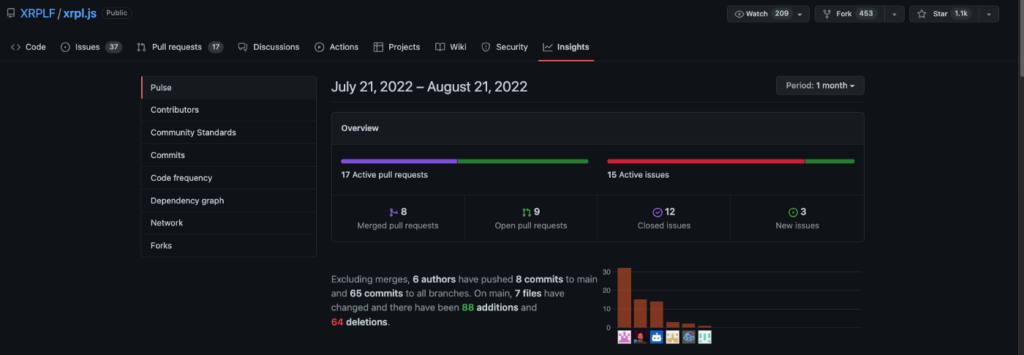

Now below is Github of xrpl.js, which has a very small adoption even though they are 10 times more active than Overledger.

However, I don’t have a very positive view of Ripple’s valuation and its token.

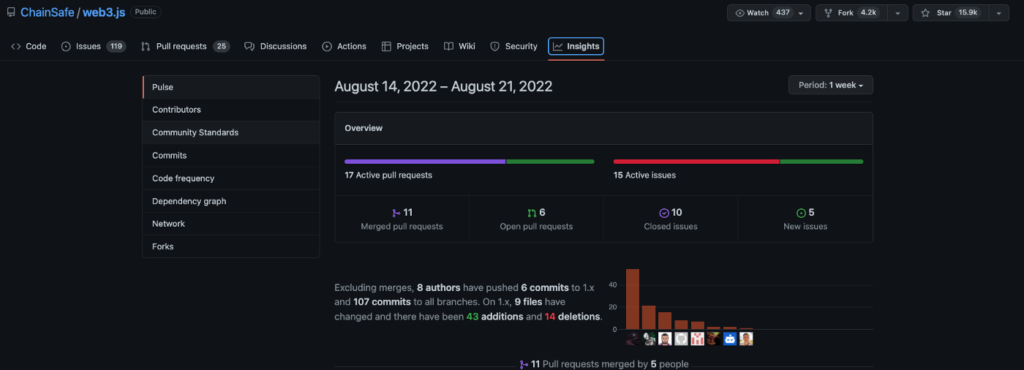

This Github of Web3.js, now you see an active project; people are raising issues, forking to test and implement different features, and merging new code.

So if people were using Overledger, their only SDK would have been more active.

Because people use Ethereum and EVM chains, web3.js is an active project.

I don’t think anyone is using Overledger because if people had used it, there would have been more activity on their SDK.

Traffic Analysis

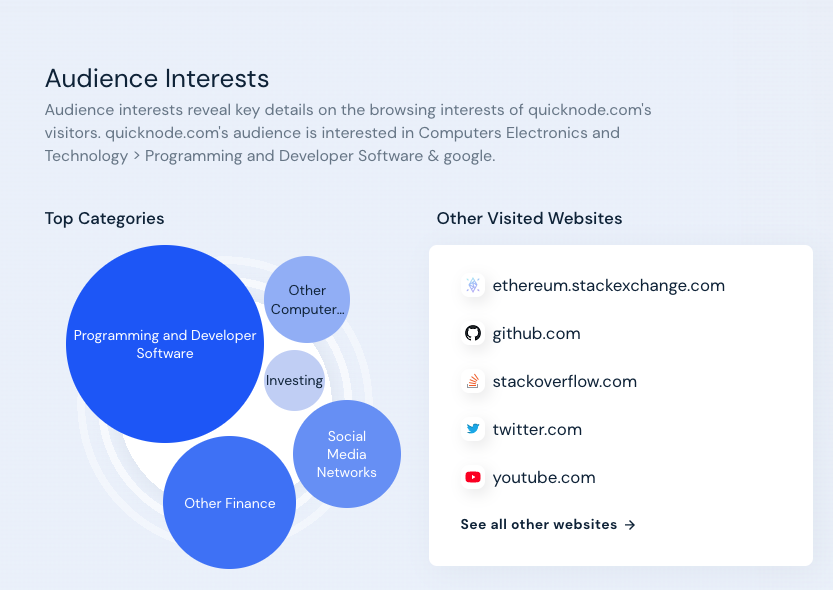

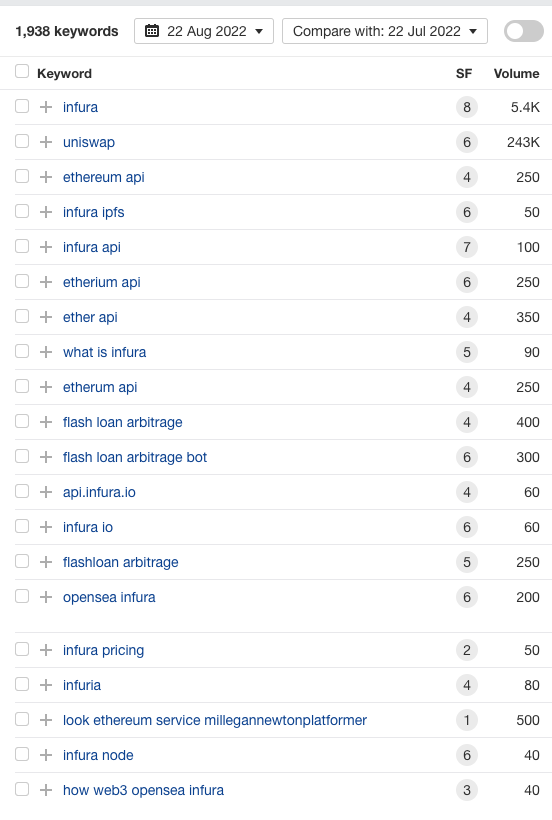

I compared their traffic on Similarweb against Infura and Quicknode. Look at the interests of people visiting their website and what sites they visit.

For Infura and Quicknode, it shows that people visiting them are interested in “Programming and Developer Software,” but Quant network nothing.

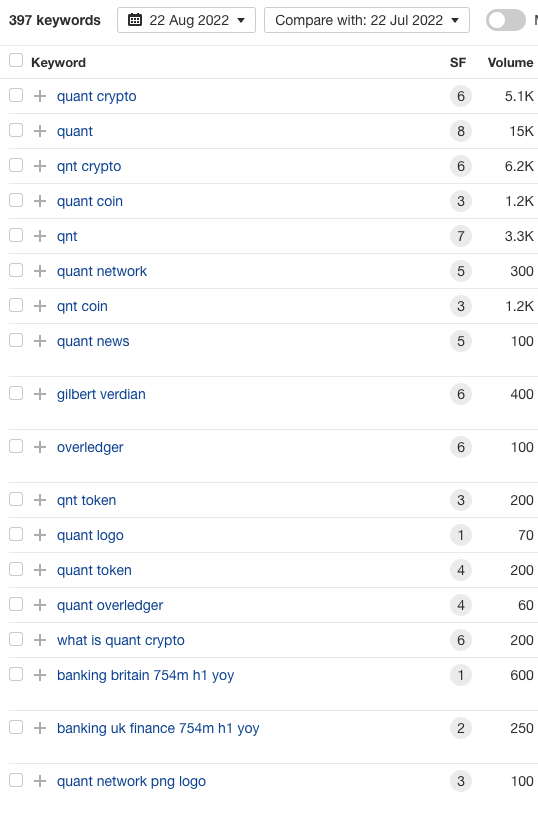

I also analyzed the organic keywords for Quant network vs. Infura; the results speak for themselves.

Quant Network Tokenomics

Quant network token QNT is used to buy licenses of its products. If there is no adoption, why their token marketcap is more than $1.5 billion?

Additionally, I never understood these utility tokens. Why do you want to get paid in your own token when you can get paid in USD?

Why do you need a token for a centralized company?

Overledger is similar to Quicknode, which works fine without a token. They prove their metal by building a product that works and get used.

Additionally, there is a whole controversy about their token supply. However, I checked it, and things looked good on that end.

Partnerships

Quant network has a Partners page on their website; let’s dig that too.

Oracle Partnership

Quant network announced the Oracle partnership in June 2020.

A video is linked to an article on the Oracle website that talks about the Overledger partnership.

At the end of the video, Overledger’s Luke talks about transferring tokens from Oracle to the Ethereum network using Overledger.

However, it’s entirely optional to use Overledger to perform this because Oracle has its REST APIs and Overledger’s public SDK does not support it. Also, I couldn’t find anything related to Oracle in Overledger’s APIs.

Sia (Nexi Group) Partnership

This partnership was announced annouced in June 2020, and nothing has happened since then. Even Siachain studio doesn’t mention Overledger in its brochure. Sia is a payment giant that is now part of the Nexi group.

I have also looked into other partnerships and didn’t find anything serious.

Competition

Quant Network pitched that it’s building an Operating system for Blockchain. It talks about solving blockchain interoperability by providing a layer that abstracts away the complexity of working with node APIs.

Its Overledger is the product that sits in the middle and tries to give you a uniform way to interact with blockchains.

But what is Quant Network’s business model? How will it earn money? How will it generate demand for its token?

As I explained above, it’s at an API gateway, similar to Infura, Quicknode, Blockdeamon, etc. And they generate fees in QNT tokens when people use their API gateway.

Now, if you look at one of the segment leaders in this sector Blockdaemon, they were valued at $3.25 billion this year. They have thousands of customers and generate millions of dollars per month.

At the time of writing this article, Quant network is valued around $1.5 billion; even in this bear market, Do you know why?

Exchanges are the biggest Culprits.

Quant network token $QNT is listed on many big exchanges such as Coinbase, Binance, Gemini, Kraken, etc. They exposed you with these assets with no utility, no existing revenue, nothing. These exchanges are the biggest culprit, and regulators will probably question them someday. But who knows?

Conclusion

In conclusion, Quant network raised money in 2018, and it’s been four years, and it’s delivered only a basic product and no sign of any adoption.

I always say, in crypto, “If your marketing is good, your price is good,” because projects throw a lot of jargon, which is difficult to understand.

Additionally, people perceive “Crypto” as a “Get rich quick scheme.” Instead, as a technology solution like any other such as Robotics or AI.

People who look at the Jam bottle’s price and expiry five times before buying now buy crypto because they saw it trending on Insta.

And about Quant network, it’s not alone in crypto. There are at least 90% of projects in crypto with similar fundamentals, with basic products and no revenue. As I said, “If your marketing is good, your price is good.”

About Author: Gaurav runs Coinmonks and heads Growth for a blockchain data company with many Enterprise customers.