Key Takeaways

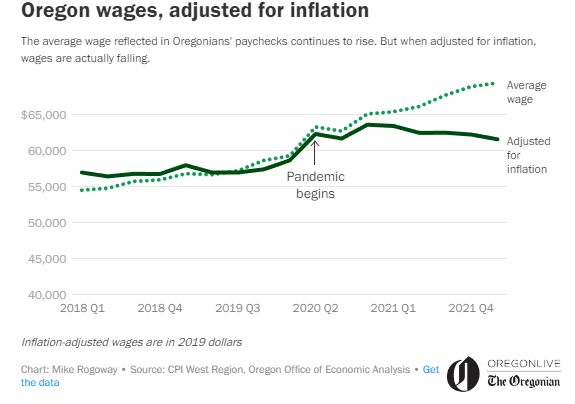

- As per Josh Lehner of the Oregon Office of Economic Analysis, the ordinary Oregonian’s purchasing power is lower today than it was a year ago.

- Oregonians’ “real” salaries have declined by 3% in the last year when adjusted for inflation. As a result, he claims that rising costs are forcing 4 out of 5 workers to lose ground.

- Rising prices are reducing consumer spending and threatening to send the economy back into recession.

Wage levels in Oregon begin to escalate, but inflation is soaring even faster to catch up bursting the bubble of economic prosperity.

“The purchasing power of the average Oregonian is lower today than it was a year ago.” “Our standard of living is declining,” Josh Lehner, director of the Oregon Office of Economic Analysis, told lawmakers Wednesday during the state’s quarterly revenue forecast.

As per federal and state data, average wages in Oregon have increased by 17% since the start of the pandemic. However, price increases have eaten up the majority of those gains, and inflation has risen so quickly in the last year that most workers are effectively receiving pay cuts.

As per a Deloitte fact sheet, wage increases across industries differed in a very narrow band prior to the pandemic. Despite these large wage increases, inflation is rising (7.5 percent year over year in January 2022). Only three service-related industries—accommodation, food and beverage establishments, and couriers and messengers—have seen real wages rise faster than overall consumer prices.

“Inflation disproportionately affects our low-income neighbours and those on fixed income,” Lehner said. “They live from paycheck to paycheck.” They spend every single dollar they make, and sometimes even more.”

When adjusted for inflation, Oregonians’ “real” wages have fallen by 3% in the last year, according to Lehner. He claims that rising prices are causing 4 out of every 5 workers to lose ground.

A recent survey validates that Oregonians, like the rest of the country, are struggling to meet their expenses in the new inflationary era. As shown in the QuoteWizard study, which measures the impact of inflation in each state, the rest of the country appears to be doing worse. According to QuoteWizard, 40% of Oregon residents surveyed are experiencing “slight to moderate” difficulty paying for household expenses. Another 7% report having a “very difficult time” doing so.

The report comes as overall inflation has increased by 7.5 percent since last year.

@Dennis Porter expresses his concern about the burning issue in a tweet, quoting an Oregon state economist who contends that despite a 17 percent increase in wages, Oregonians have lost 3 percent of their purchasing power.

“This means that inflation is at 20%. Insane.”

However, some netizens remain sceptical of wage push inflation, according to @eriikjones. For example, a $50k salary with a 17% wage increase would result in $58.5k. A 3% decrease in purchasing power equals a previous salary of $56.7k… a genuine difference of 13.4% The user believes that this is a real wage increase rather than inflation.

To understand what is going on, consider this: a person used to be able to buy 100 items with a $100 check. They are now paid $117 but can only purchase 97 items. Commodities used to cost one dollar per item. It is now $117 for 97 items, representing a 20.62% inflation.

Dutch Bros, for instance, alerted earlier this month that rising gas prices are leaving its consumers with less “discretionary income”, causing them to visit the drive-thru business less frequently. The announcement sent the stock of the Oregon company plunging.

The stock was trading at $21.87, its lowest level since going public in September at $23 a share. Last November, the stock hit an all-time high of $81 per share.

Dutch Bros officials claimed just three months ago that they were substantially shielded from inflation and had only hiked prices by 2.9 percent since the outbreak began.

With the Federal Reserve boosting interest rates to manage inflation by cooling the economy and thus raising the cost of borrowing money, such as for a home mortgage or paying off a credit card balance — Lehner believes the worst of the price hikes may be behind us.