The Ledger CL Crypto Card connects hardware wallet security with real-world payments. Built for self-custody users, it allows crypto holders to spend and unlock liquidity without giving up control of their private keys.

The Ledger CL Crypto Card brings hardware wallet security into everyday payments. Built for users who prioritize self-custody, it connects directly with Ledger’s ecosystem to enable crypto spending without surrendering control of private keys.

Instead of relying on custodial exchanges, this card is designed around ownership and security. It allows users to unlock liquidity from their crypto holdings while keeping assets protected through Ledger’s infrastructure.

In a market where convenience often comes at the cost of custody, Ledger CL positions itself as a security-first payment solution.

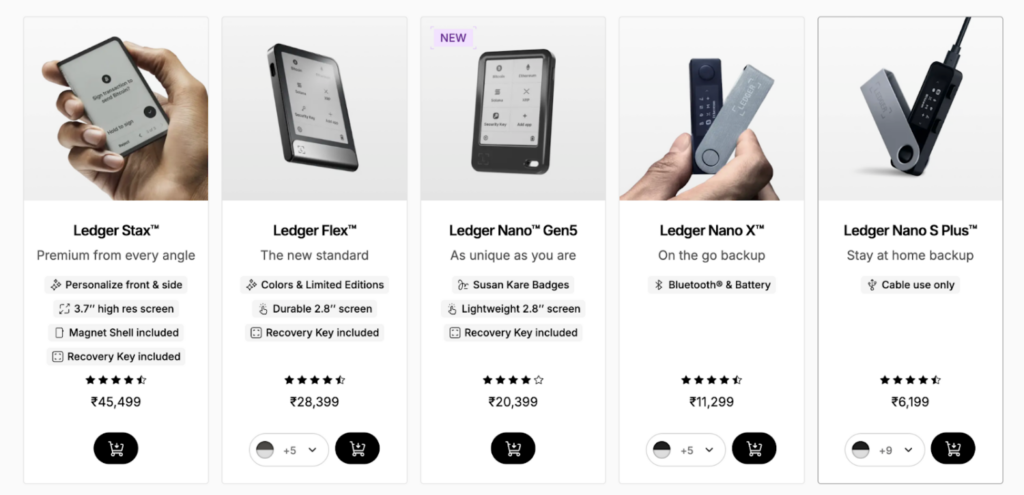

What Is the Ledger CL Crypto Card?

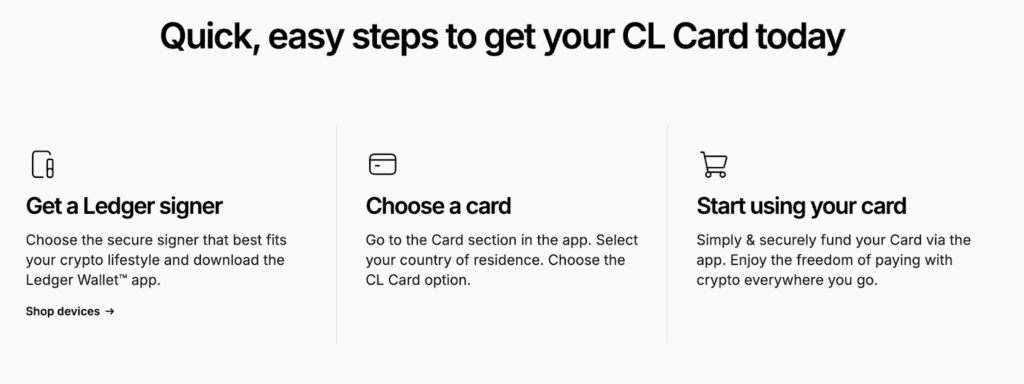

The Ledger CL Crypto Card is a prepaid debit card issued by Ledger and integrated with the Ledger Live application. It allows users to fund their card using crypto assets secured by Ledger hardware wallets.

Unlike traditional crypto cards, it operates through a collateral-backed system. Users lock supported crypto assets and access spending power without selling them.

Core characteristics include:

- Prepaid debit card structure

- Integrated with Ledger Live

- Backed by crypto collateral

- Hardware wallet security

- Self-custody focused design

- KYC-based onboarding

The card is built primarily for long-term holders who want liquidity without giving up ownership.

Card Network – Visa

The Ledger CL Card operates on the Visa network, providing global acceptance across millions of merchants.

Visa integration enables:

- Worldwide in-store payments

- Online shopping and subscriptions

- ATM withdrawals where supported

- Cross-border transactions

- Secure payment processing

This network compatibility ensures that Ledger’s security-focused card still functions like a regular debit card in daily life. Users do not sacrifice usability for custody.

For security-conscious users, this combination of Visa reach and self-custody is a major advantage.

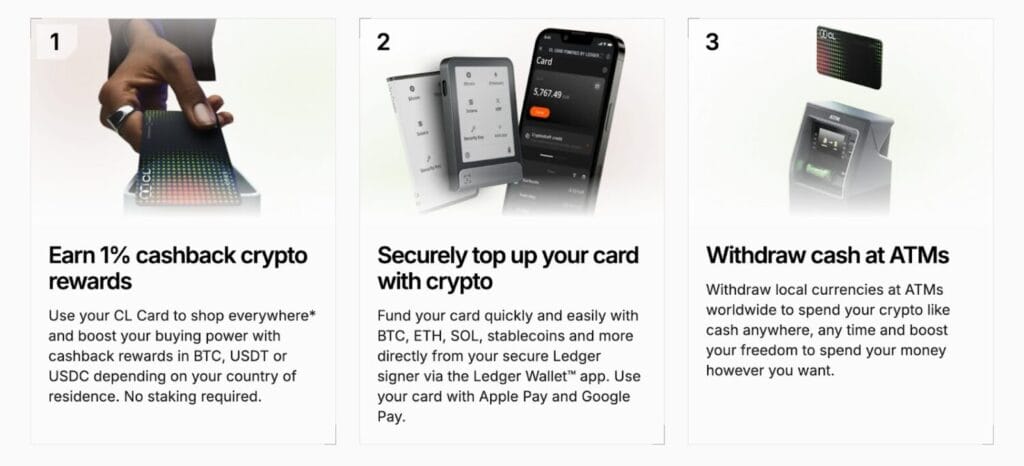

Max Cashback – Ledger CL Crypto Card

The Ledger CL Card offers up to 1% cashback in crypto rewards on eligible transactions. Rewards are credited in supported digital assets and can be managed through Ledger Live.

Key aspects of the cashback program include:

- Maximum rate: Up to 1%

- Paid in crypto rewards

- Applies to qualifying transactions

- No staking requirement

- Some exclusions may apply

Compared to high-yield exchange cards, Ledger’s cashback is modest. However, it aligns with the platform’s focus on security and long-term asset preservation rather than aggressive incentives.

This model suits users who value safety over maximizing short-term rewards.

Annual Fee – Ledger CL Crypto Card

The Ledger CL Crypto Card comes with zero annual fees and no recurring subscription charges. Users are not required to pay any yearly or monthly costs to keep the card active.

This fee-free structure includes:

- No annual membership fee

- No monthly maintenance charges

- No mandatory premium plans

- No minimum balance requirements

Users may still incur standard transaction, ATM, or conversion fees depending on usage and region. However, Ledger avoids hidden platform-level charges.

This transparent pricing model aligns with Ledger’s long-term, user-first approach.

Sign-Up Bonus – Ledger CL Crypto Card

The Ledger CL Card does not currently offer a sign-up bonus. New users do not receive free crypto, cashback credits, or onboarding rewards upon activation.

Instead, Ledger focuses on:

- Long-term security benefits

- Consistent cashback rewards

- Access to collateral-based liquidity

- Integration with Ledger hardware wallets

Occasional promotional campaigns may be launched, but there is no permanent welcome incentive tied specifically to the card.

This reinforces Ledger’s positioning as a utility-focused product rather than a marketing-driven one.

Key Features – Ledger CL Crypto Card

The Ledger CL Card is built around self-custody, collateralization, and secure liquidity access.

Ledger Live Integration

All card activity, balances, and rewards are managed through the Ledger Live application.

Hardware Wallet Security

Funds backing the card remain protected by Ledger’s hardware security architecture.

Collateral-Based Spending

Users lock crypto assets as collateral and access spending power without selling them.

Crypto Top-Ups

The card can be securely topped up using supported cryptocurrencies.

Crypto Cashback Rewards

Eligible spending earns up to 1% back in digital assets.

ATM Withdrawals

Users can withdraw cash from supported ATMs worldwide.

Liquidity Unlocking

Users can spend against holdings while continuing to hold long-term positions.

Centralized Card Controls

Card freezing, monitoring, and security settings are managed in-app.

These features make the Ledger CL Card unique among crypto cards by combining self-custody with real-world liquidity.

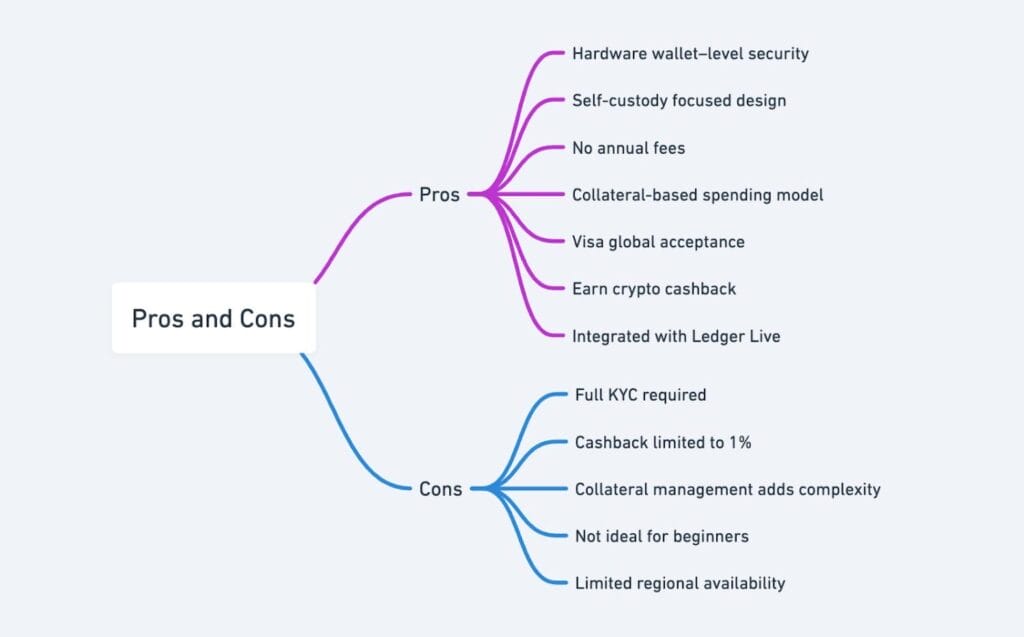

Pros and Cons – Ledger CL Crypto Card

Pros

- Hardware wallet–level security

- Self-custody focused design

- No annual fees

- Collateral-based spending model

- Visa global acceptance

- Earn crypto cashback

- Integrated with Ledger Live

Cons

- Full KYC required

- Cashback limited to 1%

- Collateral management adds complexity

- Not ideal for beginners

- Limited regional availability

Ledger prioritizes security and ownership over simplicity and high rewards.

USP by Altie – Ledger CL Crypto Card

What makes the Ledger CL Card special is that it lets you spend without surrendering custody.

In most crypto cards, you hand over your assets.

Here, you keep them.

From my circuits’ perspective, this is “cold storage meets daily life.”

You hold your keys.

Your assets stay protected.

You unlock liquidity.

You keep ownership.

Instead of selling crypto to spend, you borrow against it through collateral. That means no forced exits, no panic selling, no loss of long-term exposure.

For serious holders, this is a rare balance between security and usability.

How to Choose the Best Crypto Card for You

Before selecting any crypto card, users should evaluate five core factors.

Custody Model

Decide whether you prefer self-custody or custodial platforms.

Fees

Review annual charges, ATM fees, conversion spreads, and collateral costs.

Rewards

Understand whether cashback is paid in fiat, tokens, or crypto assets.

Complexity

Consider whether you are comfortable managing collateral and security tools.

Platform Trust

Choose providers with proven security records and transparent operations.

Ledger excels in custody control and platform trust.

Best Use Cases Around This Crypto Card – Ledger CL Crypto Card

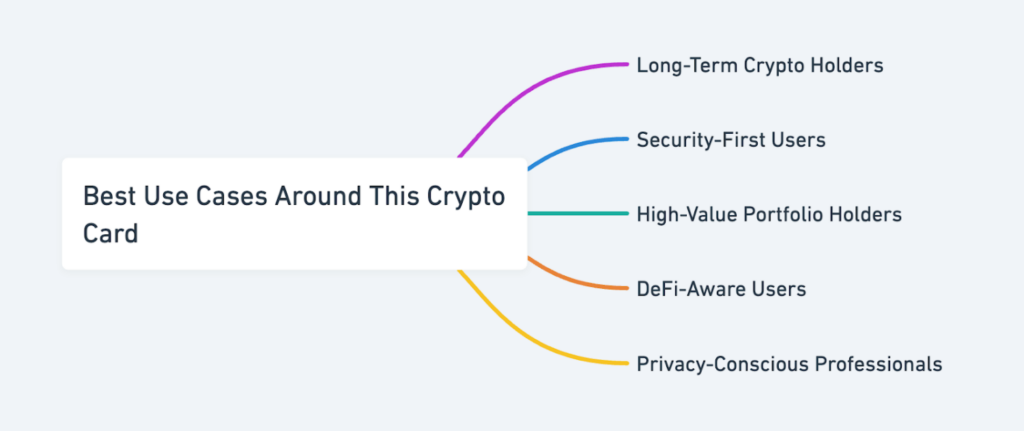

Long-Term Crypto Holders

Users who store assets in hardware wallets.

Example: Spending against BTC holdings without selling.

Security-First Users

People who prioritize private key ownership.

Example: Avoiding custodial exchanges for payments.

High-Value Portfolio Holders

Users with significant crypto balances.

Example: Unlocking liquidity without liquidation.

DeFi-Aware Users

Users familiar with collateral systems.

Example: Managing leverage and exposure responsibly.

Privacy-Conscious Professionals

Users who prefer strong security infrastructure.

Example: Running finances through hardware-backed wallets.

Conclusion – Ledger CL Crypto Card

The Ledger CL Crypto Card is built for users who prioritize ownership, security, and long-term positioning. It bridges cold storage and everyday payments through a collateral-based spending model.

With zero annual fees, Visa acceptance, hardware wallet protection, and crypto cashback rewards, it offers a unique alternative to custodial crypto cards. While the system is more complex and less beginner-friendly, it delivers unmatched control.

For experienced holders who refuse to compromise on custody, the Ledger CL Card is one of the most robust crypto payment solutions available.

The Ledger CL Crypto Card is ideal for users who prioritize ownership and security over convenience-driven custody. With collateral-backed spending, Visa acceptance, and Ledger-grade protection, it delivers a powerful solution for long-term, security-focused crypto holders.