In recent times, the world has witnessed a surreal opposition of bitcoin from the international monetary fund. IMF has been targeting bitcoin as a cause of surging energy costs.

According to the IMF, surging energy costs have boosted inflation, especially in Europe, after fossil-fuel prices nearly doubled in the past year. Not long ago, it also urged El Salvador to drop bitcoin as its legal tender, citing risks to the nation’s financial stability and consumer protection.

Also, read IMF Recommends El Salvador not use Bitcoin as Legal Tender

Also, read El Salvador Discarded IMF’s Recommendation to Drop Bitcoin

And this is not the first time IMF has targeted bitcoin; there are numerous mentions in IMF blogs that deliver a sense of opposition against the cryptocurrency. But why is it so? Why would a global organization target something so valuable to ease international trade? That was too citing multiple reasons from time to time.

Yes, a straightforward answer to this was given by the Managing Director of IMF at a bank of England conference in 2017. According to her, citizens may one day prefer virtual currencies, since they potentially offer the same cost and convenience as cash—no settlement risks, no clearing delays, no central registration, no intermediary to check accounts and identities.

In the long run, the technology itself can replace federal monies conventional financial intermediation and even “puts a question mark on the fractional banking model we know today.”

The IMF has been the controller of international trade for a long time now, and bitcoin’s entry in the picture takes away their control. It’s cheaper and faster to transact and therefore highly adaptable for international trading purposes.

Not denying the fact that the crypto market is highly volatile and risky now, but as the MD quoted, the only substantial problems with existing cryptocurrency are fixable over time.

Why no bitcoin for IMF?

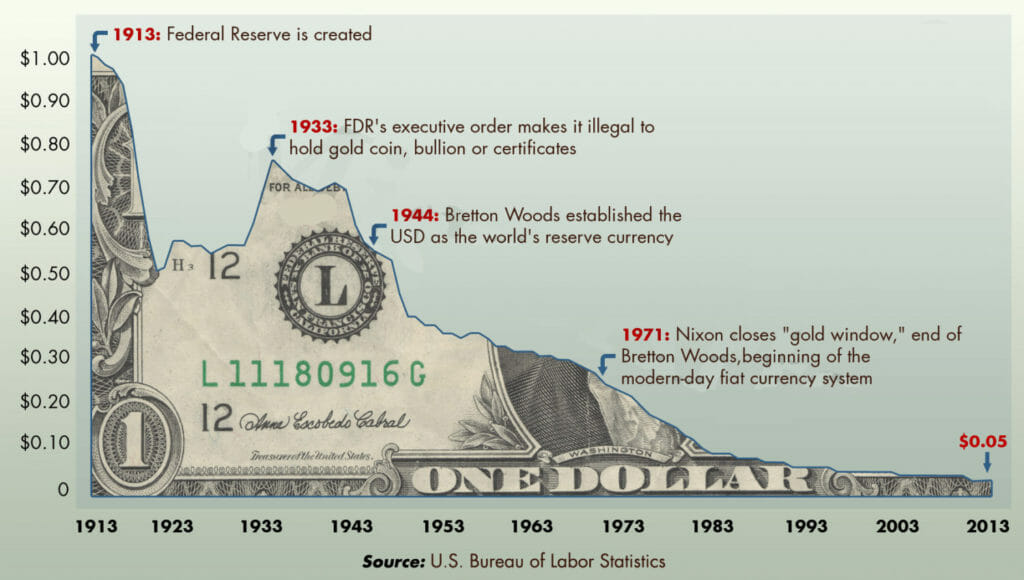

Prior to the global FIAT standard where every country had its own national currency the global trade and economy flourished during the Gold standard. The era when global trades happened in Gold, and hence value was eventually transferred from one continent to another. However, carrying gold was hard for people, and so banks and governments introduced gold-backed notes. Which worked fine for value transfer until governments started going off the gold standard.

This led to a hindrance in global trade as different governments can now print as much currency as they want to; which lead to fluctuating global conversion rates. Now, this is when the IMF was formed, the sole purpose of this organisation was to further simplify global trade.

With bitcoin, things for IMF could go sideways, since bitcoin’s value is determined in the open market, meaning anyone with internet can buy, sell, or trade bitcoin for digital or physical goods; IMFs role to provide a stable conversion rate of different currencies is no longer needed.

Bitcoin as an Inflation Hedge

While the IMF keeps asking for more regulatory norms for cryptocurrency, bitcoin speculations prove themselves as a powerful inflation hedge.

To be a little explanatory, an asset or investment that maintains or increases its value over time while protecting against price fluctuations is a hedge against inflation.

Inflation is defined as the loss of purchasing power of a currency over time, implying that the same unit of currency used to buy a basket of items today will buy fewer items in the future.

Investors have become more serious about finding hedges against inflation since the debunking of the myth that it is “transitory” in the US economy. Further, since the US inflation hit a 40 year high in 2021-22, things for normal citizens keeping their hard-earned cash in banks wouldn’t be the best idea.

Also, read Ignorance of the Rising Inflation

The Motley Fool reports: “Investors have been concerned about the rate of inflation recently, as the Fed has gone on a printing spree. As a result, there have been calls to halt the printing rate, but it has continued thus far, causing inflation rates to rise.”

Bitcoin is being hailed as a good hedge by a growing chorus of voices, including:

Jones, Paul Tudor. The billionaire investor believes cryptocurrency is a better inflation hedge than gold, describing Bitcoin as “a great way to protect wealth over time” and “a store of wealth like gold.”

Whatever side of the debate you support, one thing is sure: inflation in the United States and elsewhere assists in the growth of crypto investing. On the other hand, gold, which was once the preferred method of inflation hedging among investors, is no longer serving the purpose it once did.