Key Takeaways:

- According to co-founder Sandeep Nailwal, Polygon’s scalability, efficient processing times, and meager gas fees give a solution to Ethereum’s present network restrictions.

- Polygon represents the ecosystem, and MATIC represents the Native Token.

Polygon (MATIC), a layer-two network built on Ethereum (ETH) for scaling and application infrastructure development, has recently gained traction among blockchain supporters. The network’s momentum is strong, from its $1 billion investment in zero-knowledge technology to co-launching a $200 million Web 3.0 social media venture to integrating with Opera’s web browser to make its decentralized apps accessible to 80 million Android mobile users.

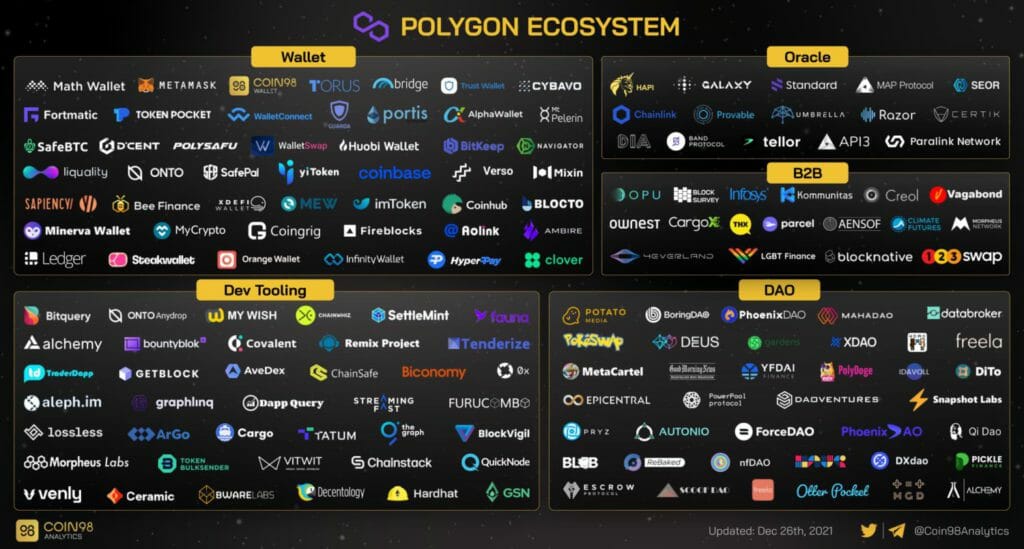

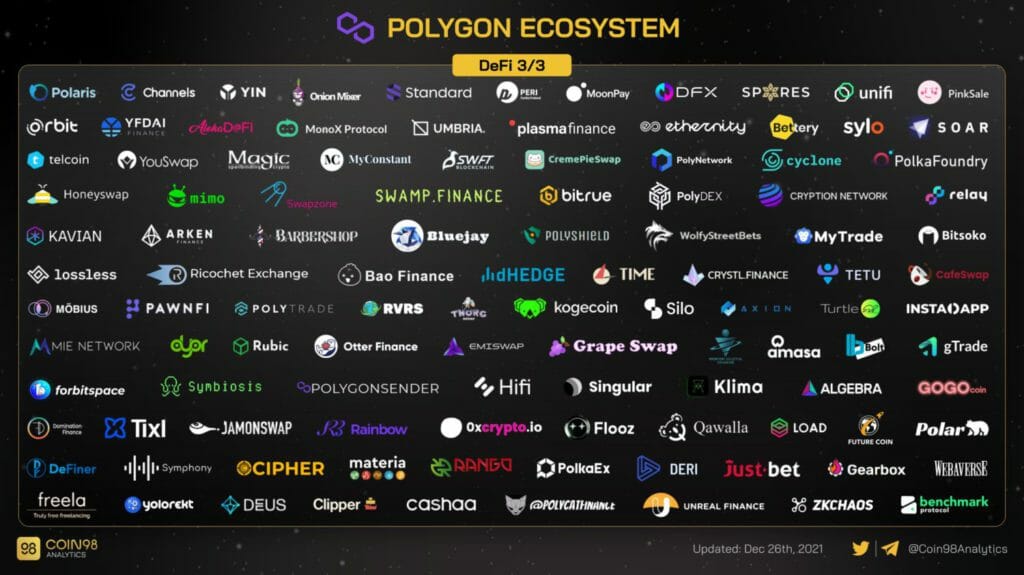

Polygon’s ecosystem is growing, as evidenced by an upsurge in protocol launches, cross-chain migrations, the launch of a Polygon-focused exchange-traded product (ETP), and increased user activity.

Matic was developed in 2017 by three Indian programmers inspired by Joseph Poon’s Plasma research. The team launched its Mainnet in June 2020, with the goal of Matic being primarily a one-dimensional solution to scale Ethereum’s limited transaction throughput at the time.

For processing transactions, Ethereum uses an auction-based system, which means that customers that pay greater gas fees will have their transactions settled with a higher priority. As a result, transaction activity will rise during these times due to a gas fee bidding war due to the network’s limited bandwidth and restricted block space.

According to co-founder Sandeep Nailwal, Polygon’s scalability, efficient processing times, and low gas fees give a solution to Ethereum’s present network restrictions.

When asked, “What are some popular decentralized apps built on the Polygon blockchain?” he replied, “What are some popular decentralized apps developed on the Polygon blockchain?”

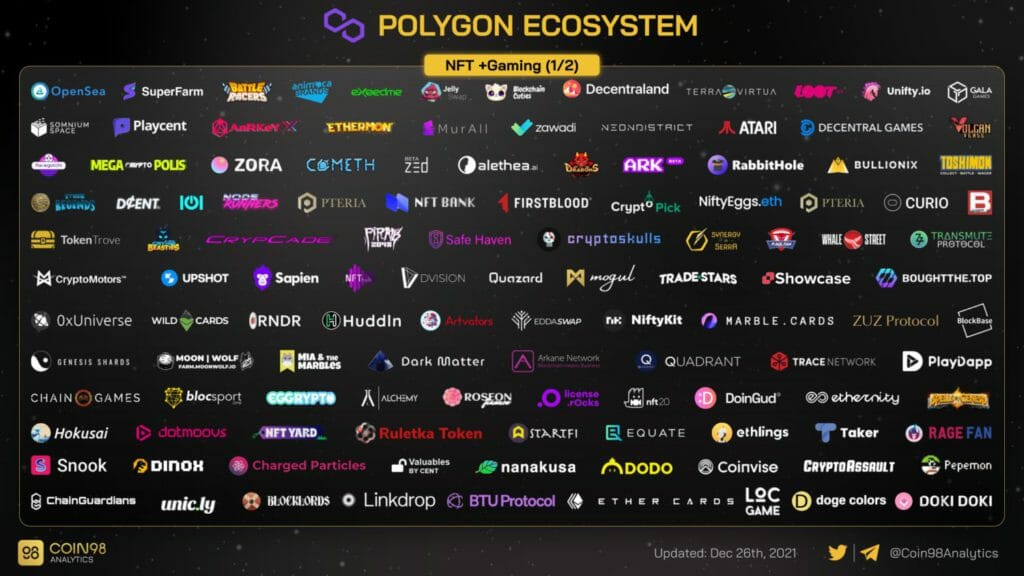

Polygon is now used by all Ethereum decentralized finance applications, according to Nailwal. Uniswap was the only one left. A week ago, the community also announced that they would be starting on Polygon soon. Uniswap, Aave, Decentraland, and other prominent DApps come to mind. The TVL across the bridges, I believe, is in the $5 billion to $6 billion range.

Polygon Ecosystem Expansion

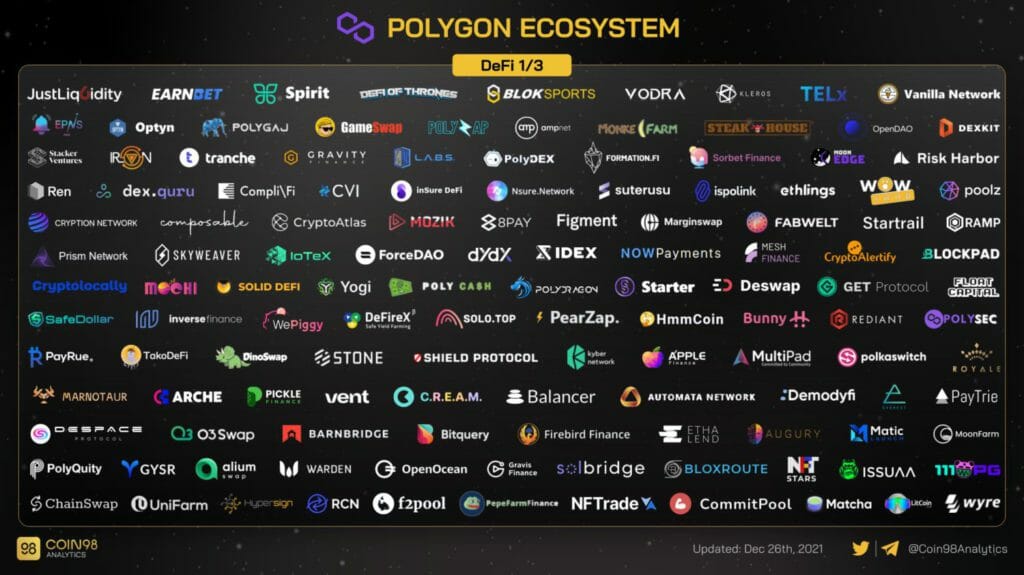

The addition of more protocols to the Polygon network through project launches and cross-chain migrations has been one of the greatest drivers of MATIC pricing and on-chain activity.

The IDEX decentralized exchange recently announced the launch of version 3 of their exchange on the Polygon network, making it the first hybrid liquidity DEX.

ApeSwap announced in a statement that the team is introducing new projects cross-chain with Polygon’s official endorsement. ApeSwap announced the news on their Twitter and Medium accounts earlier this week.

With this narrative in mind (Pure ETH Scaling Solution), investing in Polygon is effectively investing in Ethereum. As a result, the utility of the ecosystem will expand, as will the price of ether, as long as Ethereum’s ecosystem continues to grow and its tools incentivize devs (developers) to continue to create more and more dapps.

NFT projects, including the OpenBiSea NFT marketplace and gaming/DeFi platforms like Rainmaker Games, Harvest Finance, and Jarvis Network, have all launched on the Polygon network.

The Uniswap community is now voting on whether or not to add Polygon support to Uniswap v3. The process has moved into Phase 2 after a majority yes vote in Phase 1 on November 25.

Polygon has evolved into an ecosystem of scaling solutions made by developers, for developers, or a B2B model. Developers can use Polygon to establish pre-configured blockchain networks with features tailored to their specific requirements. These may be customized further with more modules, allowing developers to build sovereign blockchains with more particular capabilities.

Increased interest from institutional investors is another reason for Polygon’s strong price action. Polygon has had many exchange-traded products (ETPs) recently, including the Osprey Polygon Trust in September and the 21Shares Polygon ETP in November.

Polygon is another on the list of assets Grayscale Investments is looking into as a prospective Trust candidate.

Wintermute, a digital asset market maker focused on assisting in jumpstarting the creation of decentralized apps on the blockchain, has also contributed $20 million to the network.

As indicated by the increase in wallet addresses holding a balance, the steady increase of users on the network is the third cause for MATIC’s optimistic price behavior.

The data for total money earned from fees on the network, which has been steadily increasing over the second half of 2021, also shows increased activity.

Some of the largest major stock enterprises deployed on Polygon, which has collected one of the largest developer ecosystems, include Aave, Sushi Swap, and Curve Finance (even when compared to some layer one blockchains).

An investment will signal a change in investors’ perceptions of Polygon, which has previously failed to secure funding from India’s most prestigious venture capital companies. (It’s also worth remembering that most VCs in India were not actively watching the web3 area until a few quarters ago.) According to two people familiar with the situation, Polygon has seen at least one instance where some of its early investors have sought their money back during market periods.