Key Takeaways

- Fir Tree seeks details to probe potential mismanagement and conflicts of interest at Grayscale’s $10.7 billion Bitcoin fund.

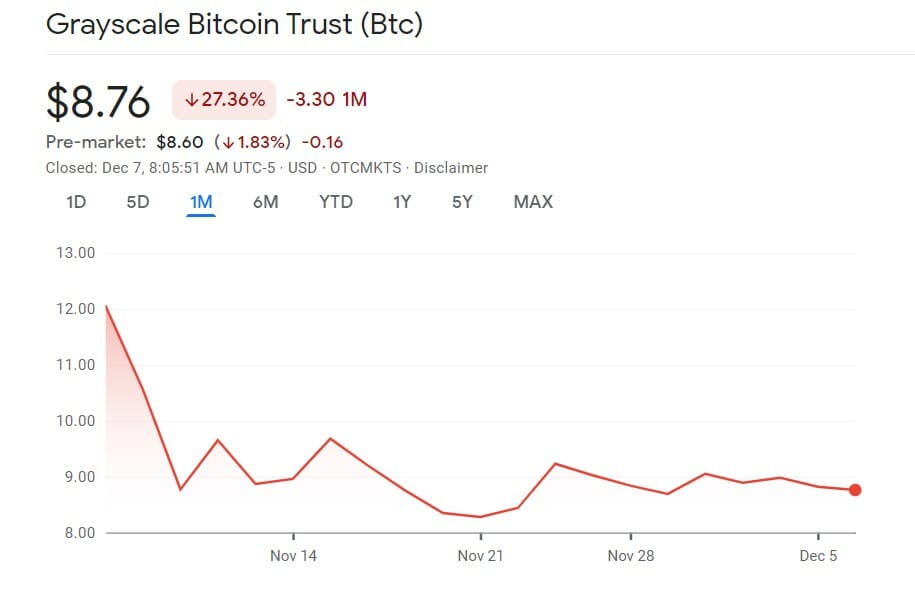

- GBTC is plunging to new lows with each passing day as Bitcoin’s price collapses

- Fir Tree wants Grayscale to resume redemptions and also cut fees from the current 2%

Crypto Hedge Fund Fir Tree Capital Management has filed a lawsuit against crypto investment firm Grayscale Investments to get details to probe potential mismanagement and conflicts of interest at its $10.7 billion Bitcoin fund.

The latest development comes amid GBTC-Grayscale Bitcoin Trust selling at close to a record 43% discount and is down around 75% this year amidst bitcoin’s sharp collapse owing to unfavorable crypto market conditions.

Reportedly, Fir Tree wants to use the details to pressure Grayscale to resume redemptions, which are not immediately available to investors, and also to cut fees from the current 2%. This is in reference to GBTC charging a 2% management annual fee.

First Tree alleges that there exists no legal reason to stop GBTC investors from converting their positions into fiat as long as the trust abides by securities laws. The crypto hedge fund further, in its lawsuit, claims that approximately 850,000 retail investors had been “harmed by Grayscale’s shareholder-unfriendly actions.”

Fir Tree also seeks to stop Grayscale from converting GBTC into a spot BTC exchange-traded fund. “That strategy will likely cost years of litigation, millions of dollars in legal fees, countless hours of lost management time, and goodwill with regulators,” Fir Tree stated. “All the while, Grayscale will continue to collect fees from the trust’s dwindling assets.”

For several months, Grayscale Investments have been seeking SEC‘s permission to convert GBTC into a spot Bitcoin ETF. After multiple rejections, frustrated Grayscale last month appealed the SEC’s move to deny converting the firm’s bitcoin trust to a spot ETF.

Grayscale argues that the SEC had previously approved several bitcoin futures ETFs but continues to reject proposed ETFs that would hold bitcoin directly — a move the asset manager says would give investors relatively risk-free exposure, considering buyers would not have to custody the underlying digital assets outright.

In response to Fir Tree’s move to stop Grayscale from going ahead with its move pf converting its BTIC Trust to a spot ETF, Grayscale spokesperson said, “We remain 100% committed to converting GBTC to an ETF, as we strongly believe this is the best long-term product structure for GBTC and its shareholders”.