GBTC is a type of financial instrument that allows investors to put money into trusts that hold huge amounts of Bitcoin. This means that as the price of BTC pumps or dips, the value of these trusts’ shares rises or falls roughly in lockstep.

Investing in BTC in this form has a number of benefits for investors, not least the fact that investments are regulated by the Securities and Exchange Commission.

By unlocking the GBTC holdings, there could be sell-offs or there could be eat-up of the sell-offs, in this article, I shall try to address them objectively.

Table of contents

What Is the Grayscale Bitcoin Trust?

The GBTC is an example of a new form of fund that is experimenting with Bitcoin’s value in new ways. The Bitcoin Investment Trust (BIT) was established in 2013 and has developed fast since then. The GBTC currently allows investors to obtain exposure to Bitcoin via a private trust that trades on the New York Stock Exchange (as “GBTC”).

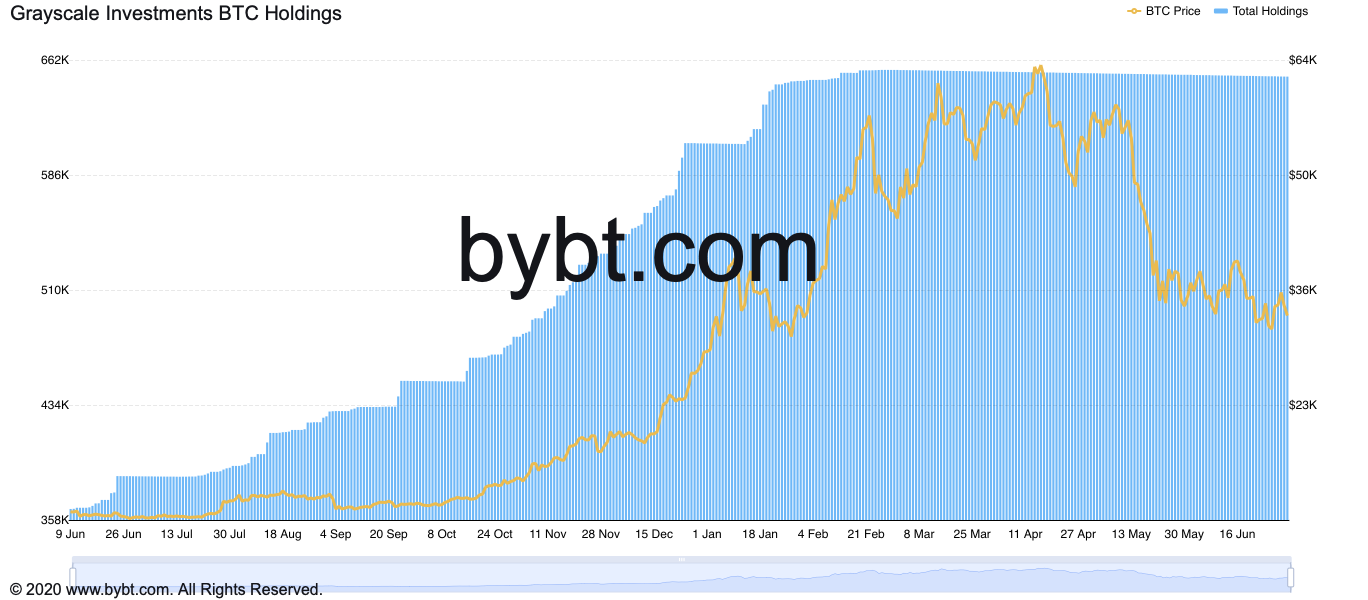

The GBTC currently possesses 654,885 Bitcoin as of April 2021. This accounts for around 46% of the 1.4 million Bitcoin now held by publicly traded firms. This also makes the GBTC the world’s largest Bitcoin fund.

How Does GBTC Work?

Grayscale raises funds from a group of affluent investors, which the company then utilizes to purchase Bitcoin. The fund is then listed on public stock exchanges, where anybody can purchase and sell shares.

Disadvantages of GBTC

There are a lot of drawbacks to investing in GBTC rather than purchasing Bitcoin directly. The first, and most obvious, is that because the trust’s shares trade at a premium, they have a high initial investment. This initial outlay is unlikely to be significant in a five-year commitment, but GBTC could face a lot more competition by then than it does now.

GBTC does not immediately track the price of Bitcoin, it can take some time for price variations in BTC to be reflected in the GBTC price.

One criterion that governs the interaction between investors and the trust is that they must keep their bitcoin in the trust for at least six months before the asset may be evaluated.

Core Rule

Investors must keep their bitcoin in the trust for at least six months before the asset may be evaluated.

This of course will now lead to the topic of Un-Locking.

Unlock — July 18th, 2021

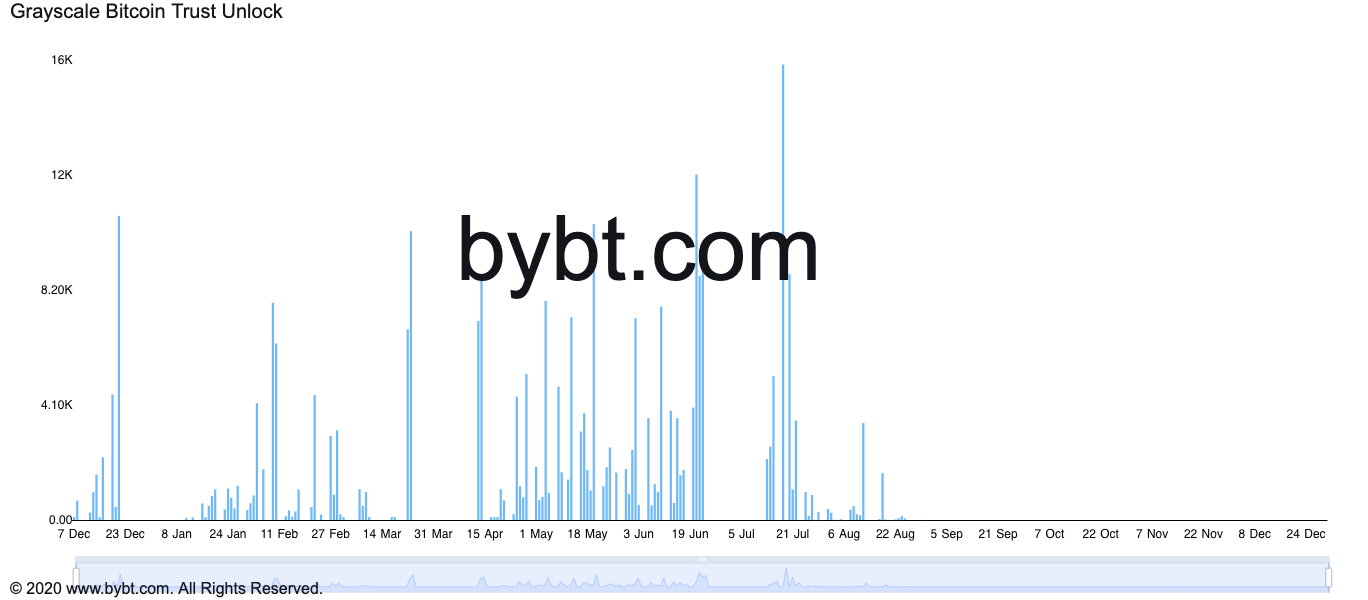

Around 16,000 BTC will be delivered by the trust, with a large amount going to investors on July 18th, 2021. The value of 16,000 BTC is roughly $550 million, and while it’s unclear whether investors will sell their holdings, the number of unlocked BTC will undoubtedly affect Bitcoin’s volatility.

Bitcoin and July

July has typically been a strong month for Bitcoin historically, and cryptocurrency aficionados will be hoping that history repeats itself following a poor performance in June. According to Bybt, the finest month in recent years was July 2020, as it represented the commencement of the bull market.

When purchasing GBTC, there is a six-month lockup period. This means that investors will be unable to sell their shares in the market for the next six months. Furthermore, the trust only trades its shares, not its bitcoins. However, there is still some ambiguity regarding how it works, as some assume the trust would sell billions of BTC, putting upward pressure on the price.

Opinions of Prominent ones

According to Bybt.com data, if investors who bought GBTC at the start of the year decided to sell today, they would do so at a loss, as the GBTC premium has been negative since late February. However, this discount has been dropping gradually, reaching 10% on Friday, down from 21% in May.

“I suspect the future of GBTC will see the premium/discount trade within a much tighter range than we have seen in the past. Naturally, during periods of high demand, modest premiums will return, and during the occasional bitcoin death spiral, we will see a discount,”

Charlie Morris, Founder and Chief Investment Officer of crypto-asset data provider ByteTree Asset Management

He also wrote recently, adding that

“the bottom line is that the GBTC risk to the bitcoin ecosystem is now behind us.”

Charlie Morris, ByteTree Asset Management

Is the price of Bitcoin linked to Grayscale unlock dates?

Investors bought GBTC shares at a 40% premium in December 2020, insight shared by JPMorgan lead strategist Nikolaos Panigirtzoglou. Grayscale Bitcoin Trust received $2 billion in inflows in December, followed by $1.7 billion in January.

By the end of July, nearly 140,000 Bitcoin worth of shares will be unlocked. Between mid-April and mid-June, about 139,000 Bitcoins were released, a period that also coincided with spot BTC/USD’s crash from around $65,000 to as low as $28,800.

Nikolaos Panigirtzoglou, as reported by Bloomberg at the end of June, Upon the expiration of the lockup period, Grayscale’s trust shares may be sold. “could be an additional headwind” for the price of BTC. Bitcoin’s fair value is in a range of USD 23,000 to USD 35,000 in the medium term they said.

But , Grayscale Investments stopped selling GBTC shares after February 2021

Willy Woo

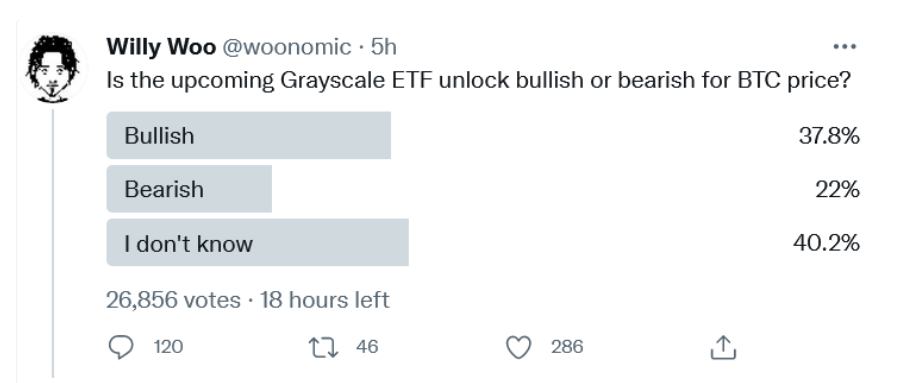

Willy Woo, a Bitcoin analyst, believes there are two effects on the market.

Conclusion

The findings suggest that there happened to be a decent sell-off during the recent unlock during the 60k price range. Will that happen again at 35k? I don’t think so, considering the amount of premium paid upfront, and also the bitcoin is now down by 40 % from the all-time high. The holders are growing at a fast phase.

Looking at these, there could be price impact, which of course a temporary demand and supply imbalances.

However, keep an eye on the market.

Stay Bullish !!

PS: This is neither a Paid Article nor Financial Advice. What has been documented are the findings from my own research out of passion in this space which is Crypto.

Sources

- Grayscale ‘Unlockings’ Poses Downside Risk to Bitcoin Price, JPMorgan Says

- GBTC Soars as Shareholders HODL

Also Read