Key takeaways :

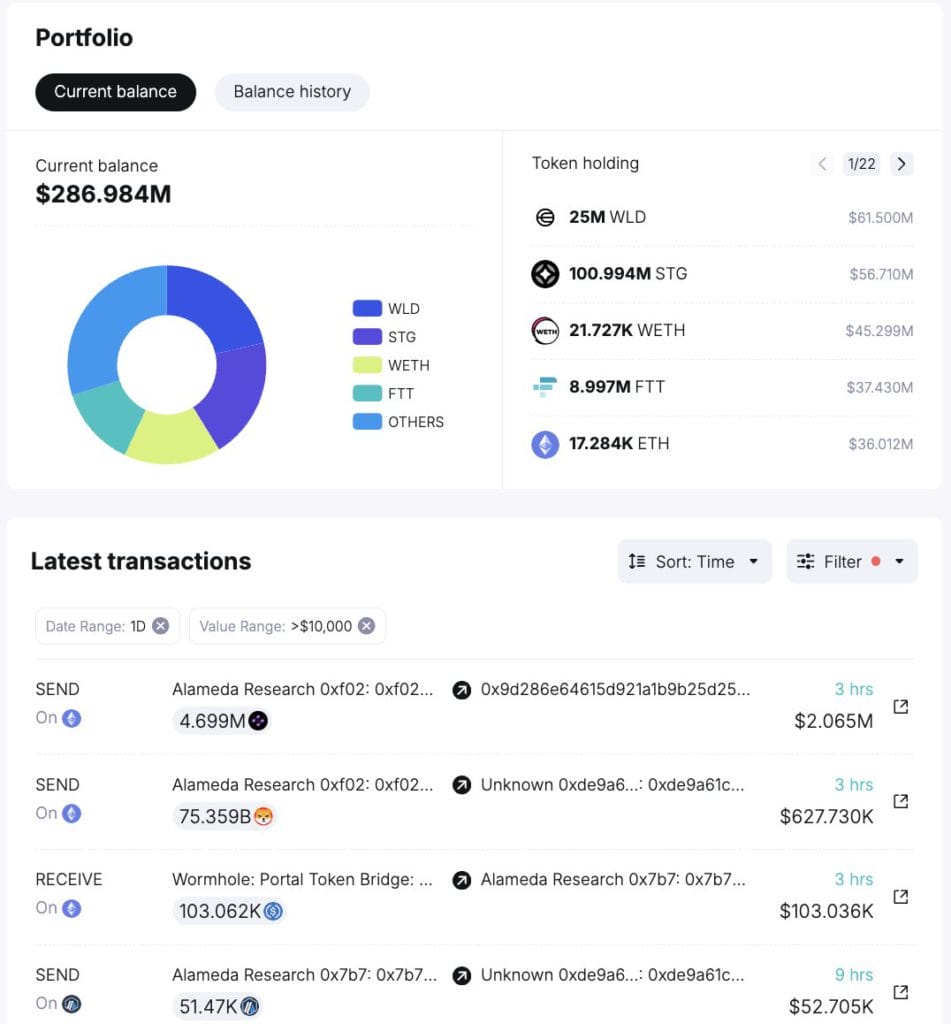

- FTX and Alameda Research executed a substantial transfer of $10.8 million in cryptocurrencies to three different crypto exchanges

- According to Spot On Chain, these transactions are part of a larger movement, with the defunct entities shifting a staggering $551 million.

In a recent turn of events, wallets associated with the defunct crypto trading firms FTX and Alameda Research have moved $10.8 million across major cryptocurrency exchanges. The funds, originating from addresses linked to collapsed FTX and Alameda entities, were distributed in eight different cryptocurrencies.

This intriguing transaction is part of a broader effort initiated in March 2023 to recover assets for investors.

The recent $10.8 million transaction involved a meticulous distribution across eight cryptocurrencies. Notably, $2.58 million in StepN GMT, $2.41 million in Uniswap UNI, $2.25 million in Synapse SYN, $1.64 million in Klaytn KLAY, $1.18 million in Fantom FTM, $644,000 in Shiba Inu SHIB, and smaller amounts in Arbitrum ARB and Optimism OP were moved.

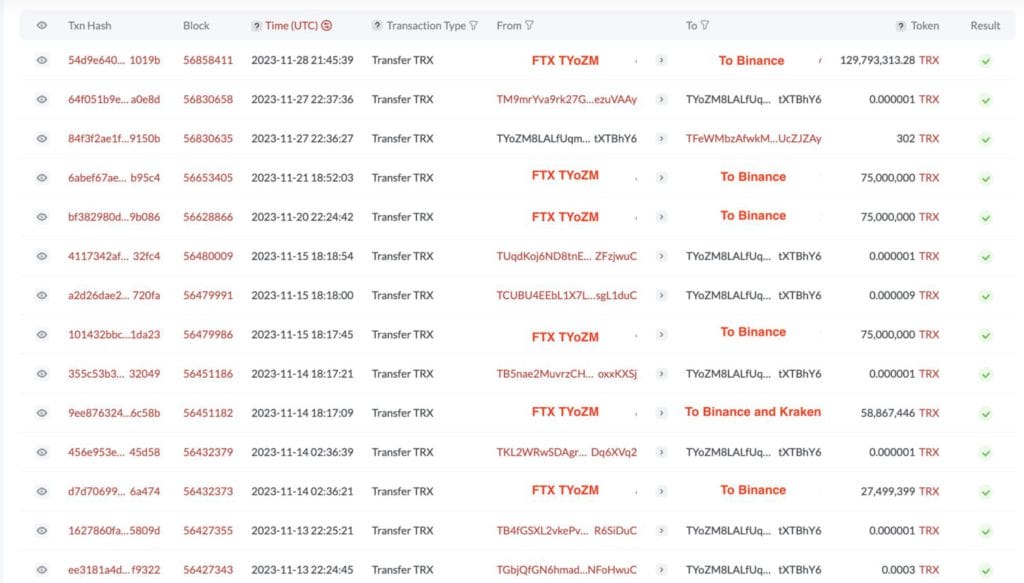

This isn’t the first instance of fund movement from FTX and Alameda wallets. In November 2023, a substantial $24 million in crypto assets were transferred to the Kraken and OKX crypto exchanges.

These funds found their way to accounts on popular exchanges such as Binance, Coinbase, and Wintermute.

The ongoing recovery process, initiated in March 2023, saw the movement of $145 million worth of stablecoins to various platforms, including Coinbase, Binance, and Kraken.

In September 2023, a U.S. court approved a plan to sell FTX’s digital assets to settle creditor claims. The resolution outlined a weekly limit of $100 million for token liquidation per position, extendable to $200 million with the approval of a special committee. However, challenges persist, with a recent lawsuit filed against ByBit, its investment arm Mirana, and several executives.

Led by FTX bankruptcy estate CEO John J. Ray III, the lawsuit seeks to retrieve an estimated $1 billion worth of funds and digital assets that ByBit allegedly removed just before FTX’s collapse.

The cryptocurrency landscape is witnessing intriguing developments as FTX and Alameda Research navigate recovery efforts amidst legal challenges.

The recent $10.8 million transaction raises questions about the fate of these assets and the complexities surrounding the broader cryptocurrency ecosystem. Investors and industry observers are closely monitoring these events as the saga unfolds.