Key Takeaways:

- The technology supporting a digital euro will be put to the test by the European Central Bank to see how well it works with commercially produced user interfaces.

- The largest e-commerce corporation in the world by market value, Amazon, is among the groups.

The European Central Bank (ECB) has chosen five companies to participate in a “prototyping exercise” as part of its two-year inquiry phase into a digital euro, a central bank digital currency (CBDC) that may be used as a cash substitute.

The chosen businesses will each concentrate on one particular use case of a digital euro along with the ECB team:

- peer-to-peer online payments – CaixaBank;

- peer-to-peer offline payments – Worldline;

- point of sale payments initiated by the payer – EPI;

- point of sale payments initiated by the payee – Nexi;

- e-commerce payments – Amazon.

The ECB issued a request for partners in April and received up to 54 answers from banks and technology enterprises. The ECB said that its five partners were chosen based on their “specific strengths.“

The purpose of this prototyping exercise is to evaluate how effectively the technology supporting a digital euro works with commercial prototypes.

The five firms’ front-end prototypes will be used to start simulated transactions, which will then be processed by the Eurosystem’s interface and back-end infrastructure. The prototypes won’t be used again in the project’s later stages for the digital euro.

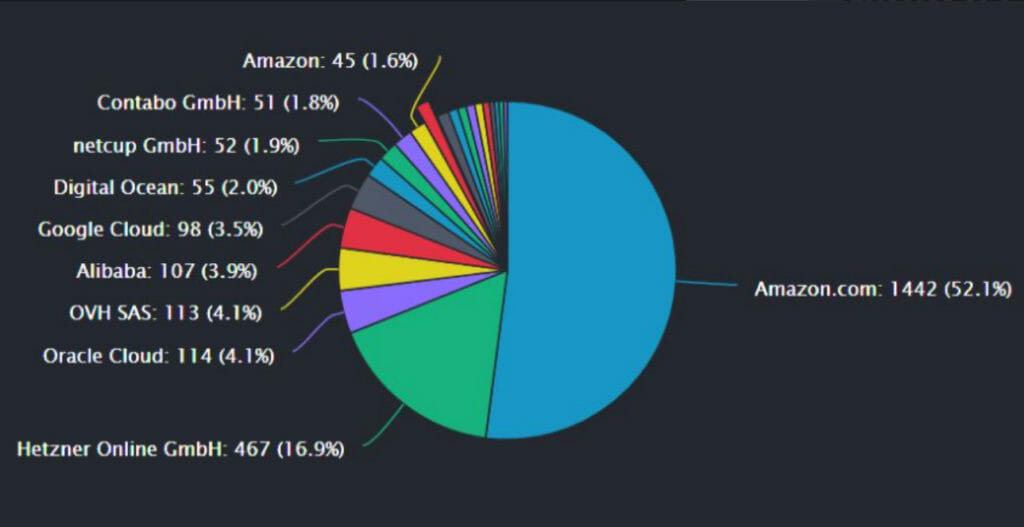

Amazon itself hasn’t entered the cryptocurrency market directly. However, the tech company offers the sector extensive infrastructure services. According to a Messari analysis, over 50% of Ethereum nodes and over 3% of Solana nodes respectively are hosted on Amazon’s cloud infrastructure.

“We look forward to delivering the best of Nexi’s acknowledged know-how in the digital payments in general and in merchant solutions in the specific scope, to drive innovation in the European payment environment,” said Nexi Group Chief Strategy and Transformation Officer Roberto Catanzaro in a release.

In a statement, Worldline stated that it supports the “shared objective of the ECB and its partners and aspires to be an active participant in the growth of the payment sector by contributing to strategic and possibly transformative projects like the digital euro.“

According to an announcement from CaixaBank, the company “will be building a mobile application that simulates the processes people will need to take to transfer digital euros to their accounts and/or send digital euros to other people.”

The prototype is anticipated to be finished in Q1 2023, the same quarter that the central bank will also release its results. The action is being taken while the ECB continues its two-year examination analyzing whether a digital euro should be produced as a replacement for cash.

The businesses were selected from a group of 54 front-end service providers. They were chosen in response to the April 2022 request for interest expressions in participating in the prototype exercise.

All 54 businesses meet a lot of the “fundamental capabilities” listed in the call, but only the top five suppliers met the “particular capabilities” needed for the given use case.