Key Takeaways

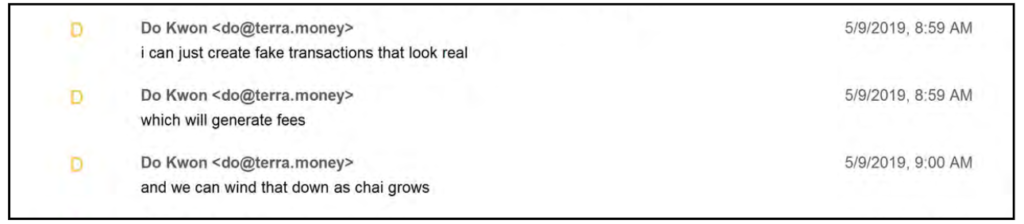

- In one leaked chat, Do Kwon outlined his intent to use Chai to create fake transactions on the Terra blockchain

- Kwon allegedly told his co-founder that he could create fake transactions to increase investor interest in his venture.

- Do Kwon’s leagl team has denied the SEC accusations.

In a startling revelation, Do Kwon, the founder of Terraform Labs, has admitted to fabricating trading volume in a text message exchange with Daniel Chin, the founder of payments app Chai, as revealed in court documents filed by the U.S. Securities and Exchange Commission (SEC) on September 22.

The text messages, a critical piece of evidence in the SEC’s case, show Do Kwon telling Chin, “I can just create fake transactions that look real…which will generate fees.” When Chin raises concerns about people discovering the deception, Do Kwon responds, “I won’t tell if you won’t.”

Chai had initially partnered with Terra to streamline payment processes. However, Terra experienced a dramatic collapse last year, leading to allegations of fraud by the SEC. The agency contends that the partnership did not live up to what had been marketed to users, as Terra failed to replace Chai’s payment systems with its own blockchain.

Notably, Daniel Shin, the founder of Chai, had also co-founded Terraform with Do Kwon in 2018. In 2019, Terra announced the partnership with Chai, with plans to rebuild the payments infrastructure on the blockchain and offer discounted transaction fees to merchants. The deal was anticipated to handle transactions worth millions, if not billions of dollars.

The SEC’s recent filing provides new insights into the intricate relationship between Terraform and Chai. It highlights an extensive private chat between Do Kwon and Daniel Shin during the early stages of their collaboration, where Kwon outlined his intent to use Chai to create fake transactions on the Terra blockchain. These fabricated transactions were designed to appear genuine, generating fees in the process.

Kwon’s legal team has however denied accepting the conversation as proof, arguing it’s irrelevant and taken out of context.

Terra, once a prominent player in the decentralized finance (DeFi) blockchain space, faced a significant downturn in May 2022, resulting in a bear market and multiple affiliated projects declaring bankruptcy. In the aftermath, Do Kwon faced a series of charges from both American and South Korean authorities. He was arrested in Montenegro earlier this year on charges of document forgery and remains in detention, contesting his extradition to the United States.

The SEC’s complaint against Do Kwon includes charges of conspiracy to defraud, commodities fraud, securities fraud, wire fraud, and conspiracy to engage in market manipulation. The filing alleged that Kwon made a number of “untrue and misleading statements of material fact” over the course of several years, Terra’s deceptive replication of Chai payments onto the Terraform blockchain, misleading users into believing that these transactions occurred on Terra’s blockchain when, in reality, they were conducted through conventional means is also another allegation raised by regulatory bodies.