Key Takeaways

- The Federal Reserve has issued its annual survey on Americans’ financial lives, which suggests that they are more likely to use cryptocurrency as an investment tool than as a payment method.

- Low-income people were also shown to be more likely to use cryptocurrency for transactions.

- Almost six out of ten people who utilise cryptocurrencies for transactions make less than $50,000, with only 24% making more than $100,000.

- Crypto investors were “disproportionately high-income, almost always had a normal banking link, and typically had other retirement assets,” according to the report.

The Federal Reserve has released its annual study on Americans’ financial life, and it shows that they are more likely to utilize cryptocurrency as an investing tool than as a means of payment. The Federal Reserve System is the United States’ central bank. It contributes to the efficient operation of the US economy and, more broadly, the public good.

The report, Economic Well-Being of US Households in 2021, is based on the Federal Reserve Board’s ninth annual Survey of Household Economics and Decisionmaking, which was distributed in October and November of 2021. The subsequent study included data on cryptocurrency use for the first time.

In 2021, 12 percent of adults held or employed cryptocurrency, as per the research. Crypto is favored as an investment tool over a transactional one, according to the report, with only 2% of individuals using it for purchases and 1% for sending money to friends and relatives.

According to the survey, American consumers are uninterested in cryptocurrency as money. They’re largely investors rather than traders, with only 3% claiming to have paid in or sent cryptocurrencies in the preceding year. On the other side, 11% had put money into bitcoin.

In 46% of cases, pure-play investors made $100,000 or more.

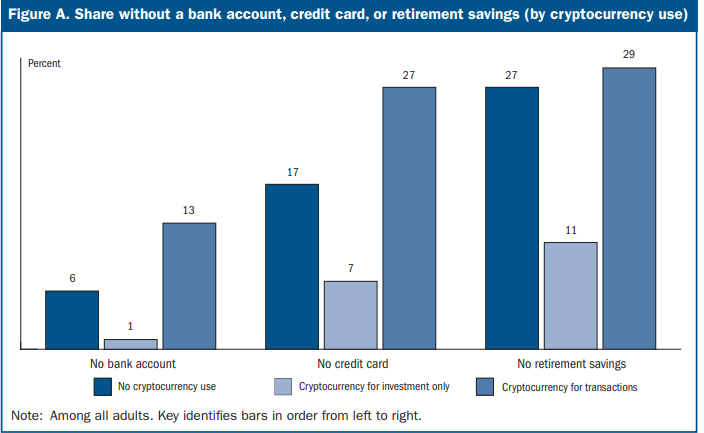

It was also discovered that low-income consumers were more inclined to use cryptocurrency for transactions. Thirteen percent of people who utilised cryptocurrency for these transactions did not have a typical bank account, and 27% did not have a credit card. Nearly six out of ten persons who use cryptocurrency for transactions earn less than $50,000, while only 24% earn more than $100,000.

According to the survey, people who used crypto for investing purposes were “disproportionately high-income, almost always had a traditional banking link, and occasionally had alternative retirement financial savings.” Indeed, 46 percent had a salary of $100,000 or more, while 29 percent earned less than $50,000. A checking account was held by nearly everyone (99 percent).

Those who used cryptocurrencies for transactions, on the other hand, had very different financial profiles. Almost six out of ten persons who used bitcoins for transactions earned less than $50,000.

Only 24% of transactional users reported an annual salary of more than $100,000. Users of transactional crypto were also less likely to have a bank account. Thirteen percent of adults who used cryptocurrencies for transactions did not have a bank account, compared to six percent of adults who did. Likewise, 27 percent of transactional bitcoin users did not have a credit card, which was higher than the 17 percent of non-users.

Unbanked People Benefit From Cryptocurrency:

According to the survey, 6% of Americans are unbanked, with black (13%) and Hispanic (11%) people having fewer bank accounts than the total adult population.

Cryptocurrencies, proponents argue, offer a relatively simple method for marginalised and unbanked groups to get access to sophisticated payment systems. The Fed research may support that concept even in countries with developed banking sectors, such as the United States.

The price of Bitcoin rose from $3,000 to $69,000 during a bull run in 2020 and 2021, creating worldwide interest in cryptocurrencies.

The study was carried out before the Omicron variant increase in 2021. If the study had been conducted later, the Fed understood that this and other changes in the economic landscape could have influenced the results.

Nonetheless, the report stated that self-reported financial well-being had reached its highest point since the survey began in 2013.

Despite its extreme volatility, cryptocurrency can help investors grow wealth, particularly if they invest in digital coins over time.

It’s a portfolio strategy that’s gained favor and is getting closer to stock trading as a source of wealth for Americans. As per a survey by NORC at the University of Chicago, 13% of Americans had purchased or exchanged cryptocurrencies in the past year. The study discovered that 24 percent of people traded equities within the same time period.

Fed’s recent study can be seen as indicator of crypto being widely embraced and seeping in the institutional economic systems.