Table of Contents

The Declining Trend In The NFT Industry

Even though the trend in the market has been completely bloody for a couple of weeks (or months that might turn into years). Nobody can wait for the next bull run to start BUIDLing again (not LUNA tho, though those guys are way too REKT now, or did they just keep all the BTC, who knows?).

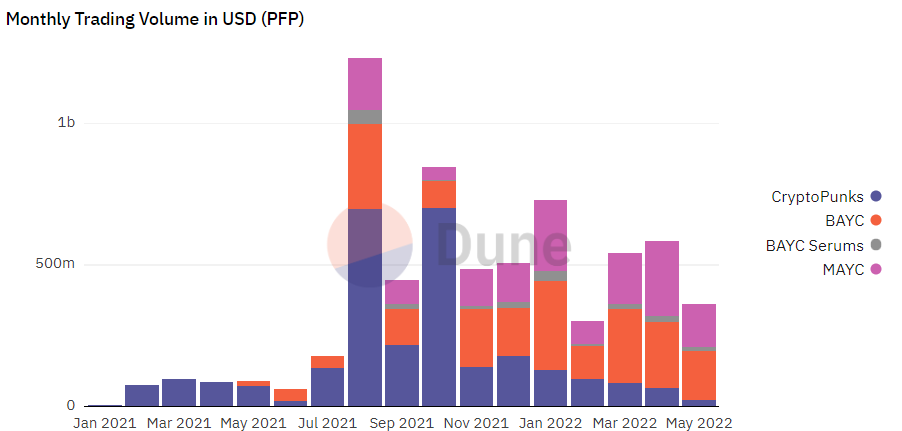

However, the NFT market has been losing its volume since last year, and this was pretty much evident depending on the craze we saw last year. Only the strong survive, rest, and just die out with time.

But this hasn’t stopped OpenSea from launching new products. More recently, the platform announced the launch of a new WEB 3 Marketplace called Seaport, a place meant for safer and smoother transactions of NFTs (though this might just be the start of things Seaport is capable of hosting!)

According to the monthly trading volume of PFPs, the decline hasn’t been too sudden, however, if the market does not get back up anytime sooner, I believe things might get worse for the NFT market, and the volume might keep declining until we hit the levels of July 2021.

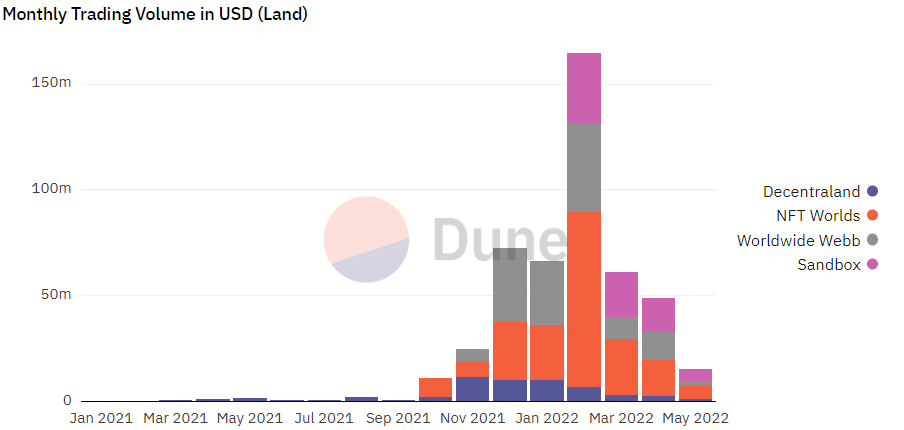

This delining trend is not just limited to the PFPs, the metaverse is affected adversely as well. With the declining market cap of metaverse projects such as Decentraland, Sandbox, etc. it is evident that their condition on holding their initial volume might have been difficult. Though, it is worth observing if Decentraland will be able to hold up to present levels, as the transaction volume keeps declining there is a chance it might not be able to survive this bear market.

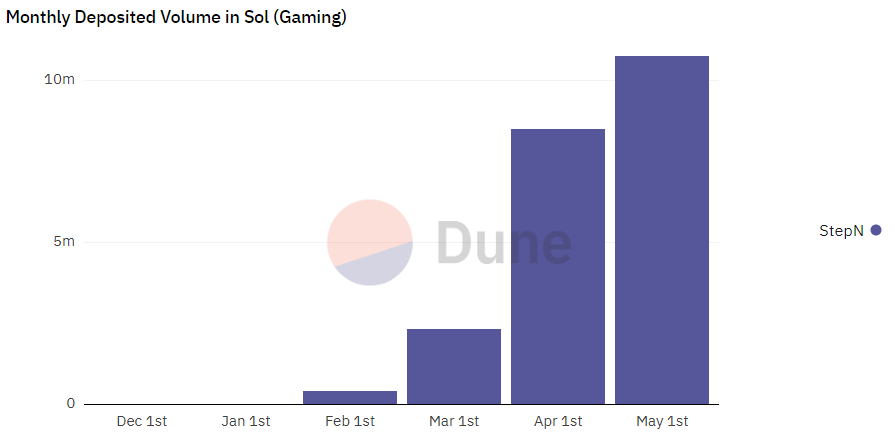

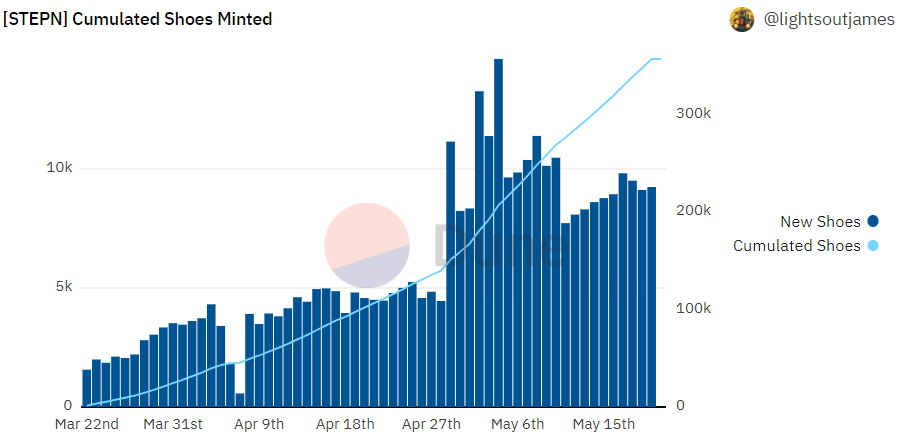

Amid this downfall, there is a project that has been seeing stagnant growth, StepN. A WEB 3 lifestyle app that allows you to earn crypto by simply Walking, Running, or Jogging outdoors. Here’s the data of monthly deposits in StepN, imagine the rinse in these numbers during the last 3 months.

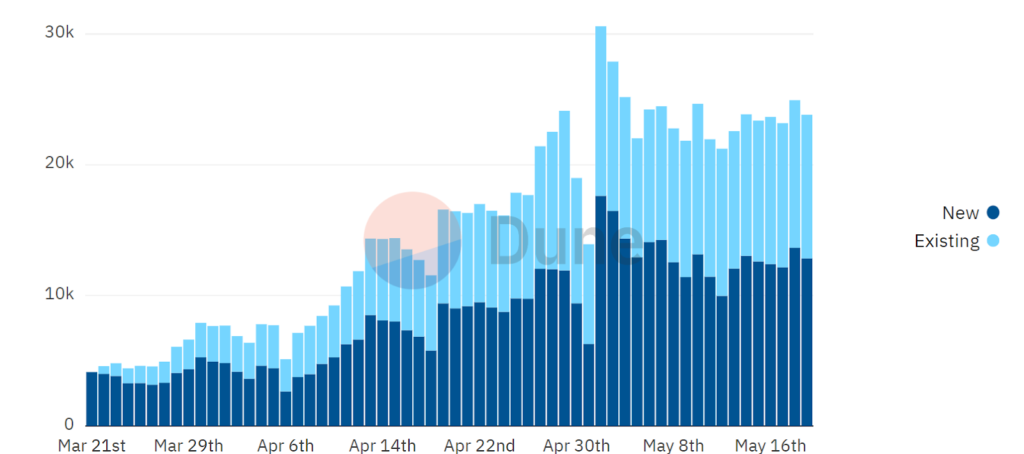

User Acquisition of StepN has been on the right track, hence answering the exponential growth in the trading volume. The platform is seeing almost as many new users every day as there are existing users.

The cumulative shoe mints have been on the constant growth as well, hence the interest of the crypto community.

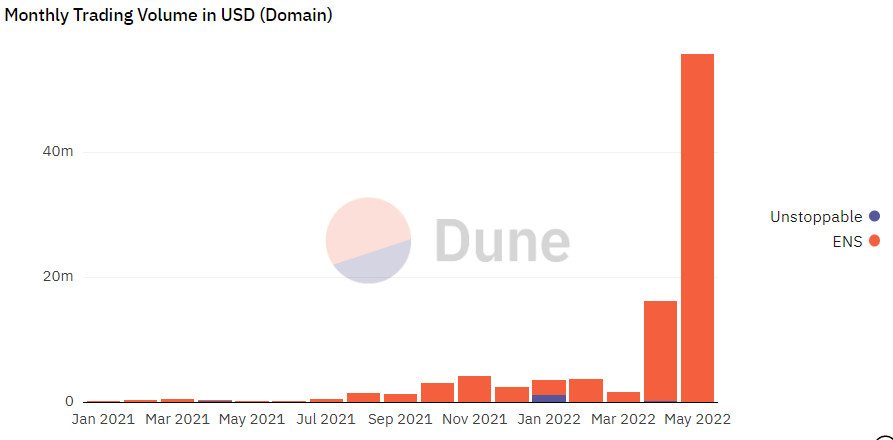

.eth addresses sound so cool, but they do come at a cost. Even though things have been bad for the overall macro dynamics of the market, there has been a steady (or a very sudden growth in the ENS trading volume). Here’s the chart of the monthly trading volume of Unstoppable (almost ded) vs ENS:

This Week In The Markets

$BTC-USDT ANALYSIS

- BTC rejected from the potential reversal zone of bearish gartley pattern and currently retesting the 38.20% fib retracement level.

The short-term target of this pattern is $28,350. BTC is showing weak bearish signs but we have to observe some price action here to know its next direction.

- $BTC: Inverse head and shoulder, the breakout will confirm our move

- If breakout didn’t happen, then this is my plan B. Take entry at the marked zone if it came there

- $BTC: It might take a reversal from here

- $BTC: If the upper one breaks down then this is our next paly

- $BTC: When the whole market is bearish and in indecision, don’t know where the market is heading. CCC precisely gave you the direction and levels, and you can see how they are working as always we do.

People like BTC when it is making ATH or in bullish trend and when it is down they don’t like and the best play is to buy things in recession and CCC knows the exact game and levels to play.

Cheers brothers and enjoy with CCC accuracy ????

- $BTC/USDT: This could be the next possible move as it is in the formation of a bullish butterfly pattern. We have to wait for its completion to confirm our upward move from the marked point.

$Crypto Total Market Cap Analysis:

- It is currently holding above it’s important support level, which bulls have to defend. A successful breakdown would be a bearish sign for the market, while fake outs or liquidity grab wicks can be a possible scenario here.

- This the level of CCC, when everyone was bullish in the market we gave you the direction and it exactly played out as we predicted as always.

Join premium and don’t miss any opportunity.Cheers ????

- GMT bounced from the first potential reversal zone of bullish shark pattern.

- $AXS retesting after breaking down symmetrical triangle

- $BTC: What pinpoint accuracy by CCC as always. Cheers

- $BTC: Now this is the next possible move

- $BTC making symmetrical triangle, have to wait for breakout or breakdown, The marked direction is the most possible plan for BTC.

Plan B = we will decide upon breakout or breakdown.

- $ICPUSDT: On 4 hour time frame the price action of ICPUSDT formed out an symmetrical Triangle where the price action is currently testing out the resistance trendline might need to wait for the breakout before any further movements

- BTC These are the possible scenarios, we have to wait for the development of some price action.

The Happenings

- Louisiana Bill to Allow Banks to Have Custody of Bitcoin and Digital Assets. Link.

- SEC Nigeria Releases New Rules for Custody and Issuance of Digital Assets. Link.

- Terraform Labs Pays Over 100 Billion Won for The Luna Fiasco. Link.

- The Global Regulatory Community to Create a Joint Body to Coordinate Crypto Rules. Link.

- South Korean Authorities Take Actions After the Luna Incident. Link.

- Wells Fargo Advisors Fined $7 Million by U.S. SEC for Anti-Money Laundering Violations. Link.

- Terra Removes UST mention from Official Publicly Released Document. Link.

- Crypto Poses a Threat to India’s Financial Stability. Link.

- U.S. House Introduces Bill to Allow Bitcoin in 401(k)s. Link.

- The US Court of Appeals Orders The SEC to Have Jury Trials in Enforcement Actions. Link.

- Grayscale Investments announces First European ETF. Link.

- Do Kwon Shares Revival Plans for the Terra Ecosystem. Link.

The Charts and Dips

- Best Paid And FREE Crypto Trading Bots In 2022. Link.

- Crypto Gambling Coins to Look Out for This Week. Link.

- Top 5 Crypto to Buy the Dip: BTC, ETH, AAVE, SOL, MATIC. Link.

- KCS Price Analysis May 2022. Link.

- AMP Price Analysis May 2022. Link.

- Crypto to look out for this week BTC, ETH, MANA, ZEC, QNT. Link.

Stolen/Rugged/Scammed/Hacked

- X2Y2 Phishing Scam, Around $200K Stolen. Link.

- EtherScan Ads Phishing Scam. Link.

- Luna DAO Rug Pulled, Around $566K Stolen. Link.

- HoneySwap FrontEnd Hacked, Around $20K Stolen. Link.

- SpiritSwap Hacked, Around $18K Lost. Link.

- QuickSwap Domain Hacked, But Funds Safe. Link.

- SeaHorseArmy NFT Discord Hacked. Link.

- 3Landers NFT Phishing Scam. Link.

- SudoSwap Phishing Scam. Link.

- Is Stocklandche a Scam Project? Link.

- Is NMSL NFT a Scam Project? Link.