Key Takeaways

- Coinbase CEO says he has a lot of sympathy for everyone involved in the current situation with FTX.

- Tether’s CTO also stated that the firm has no exposure to either FTX or Alameda.

Leading crypto exchange Coinbase has denied exposure to FTX or Alameda following reports of the near-collapse of Sam Bankman-Fried’s FTX. Coinbase CEO Brian Armstrong took to Twitter to clarify user concerns adding that he has a lot of sympathy for everyone involved in the current situation with FTX.

“Coinbase doesn’t have any material exposure to FTX or FTT (and no exposure to Alameda),” his tweet reads. He further criticized that liquidity crisis due to risky business practices such as the misuse of customer funds and conflicts of interest.

“I think it’s important to reinforce what differentiates Coinbase in a moment like this “, the CEO said. “This event appears to be the result of risky business practices, including conflicts of interest between deeply intertwined entities and misuse of customer funds.”

He added that Coinbase doesn’t do anything with customer funds unless directed by the customer and that users can withdraw their funds anytime. Apart from Coinbase, stablecoin issuer Tether’s chief technology officer Paolo Ardoino also stated that the firm has no exposure to either FTX or Alameda.

Circle CEO Jeremy Allaire also denied having exposure to FTX and Alameda. Allaire stated that while both FTX and Alameda have been customers of Circle, the stablecoin issuer has not made loans or received FTX tokens.

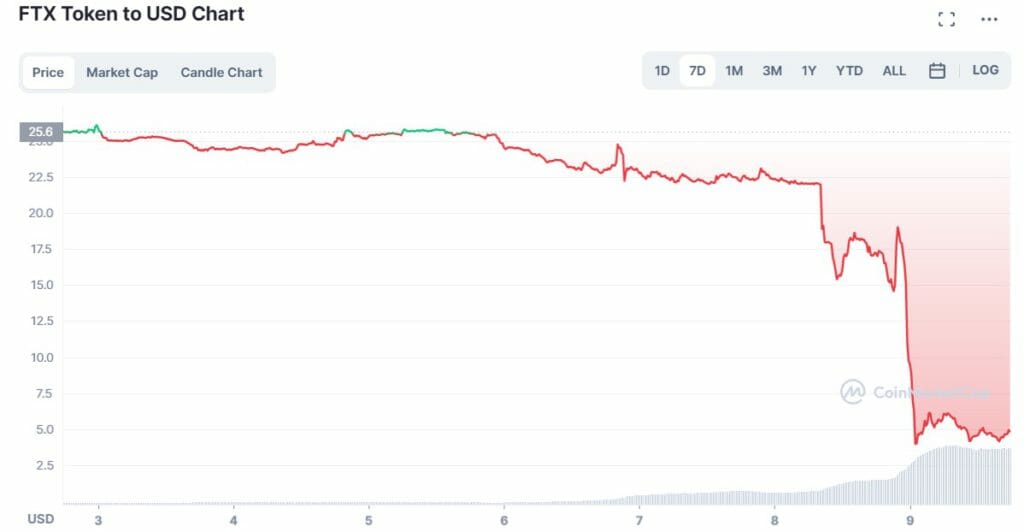

FTX’s liquidity concerns accelerated over the weekend when Binance said it intended to offload its holdings of FTX’s token, FTT, triggering concerns over the exchange’s financial stability and sending the token plunging in price. At the time of writing, FTT’s price is $4.73 USD and is down 75% from $22.09 in the last 24 hours.

There were also increasing FTX user complaints surrounding sluggish withdrawals. Binance has now agreed to buy rival FTX, making it one of the most prominent bailouts in the crypto industry FTX’s Bankman-Fried and Binance’s CZ have both said that a full due diligence process would be underway in the next couple of days.

FTX was valued at $32 billion early this year, with renowned industry names, including BlackRock, Canada’s Ontario Teachers’ Pension Plan, and SoftBank backing the company.