CakeDeFi is gaining popularity in the cryptocurrency space. It enables anybody to stake their cryptocurrency and begin generating passive income quickly. Today, the platform is most recognized for its easy-to-use design and transparency. Furthermore, CakeDeFi is an innovative concept for introducing cash flow to crypto assets. It aspires to be the portal through which millions of people may quickly and safely obtain a significant income on their investments. In this CakeDeFi review, we will learn everything about the platform and by the end of it would have a complete understanding of how to use CakeDeFi?

Table of Contents

Summary

- CakeDeFi is a platform that allows us to take control of our finances by generating cash flow and using the benefits of Decentralized Finance.

- Its objective is to make decentralized financial services and cryptocurrencies accessible and usable by everybody.

- It also intends to create cash flow.

- It is built on the DeFi Chain network, and the DFI is its native token. Cake Rewards are always paid out in DFI.

- CakeDeFi now supports the following currencies: BTC, BCH, DASH, DFI, DOGE, ETH, LTC, and USDT.

- It does not have a requirement for minimum deposit. This implies that we can begin earning rewards on our cryptocurrency, no matter how minor the amount is.

- All we have to do is transfer our crypto assets to Cake DeFi’s platform for their services.

History

2019

- June: Julian Hosp and U-Zyn Chua founded Cake DeFi in Singapore in June 2019.

How to use CakeDeFi?

In this article, we will understand how to use the CakeDeFi platform.

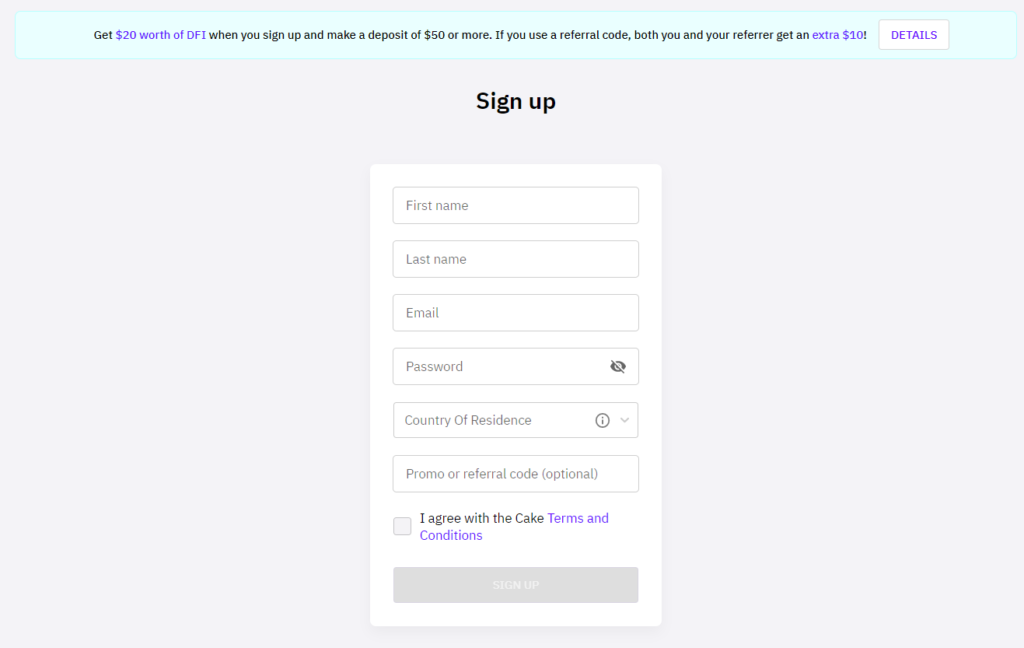

Step 1: Sign-Up

- The registration process is quick and straightforward.

- After submitting the necessary documents, you may usually begin investing within a few hours, or at most 1-2 days.

- Requirements: A valid ID is required, as well as recent selfies of oneself. The entire method is designed to meet KYC standards and to avoid money laundering.

- Follow the steps till they are done.

- Sign-Up Bonus: When we open a Cake DeFi account and make our first deposit of $50 or more, we will receive a $20 DFI bonus. This bonus will be kept in the Freezer for 180 days and automatically gives staking returns.

Step 2: Depositing Cryptocurrency

Before we can invest in Cake DeFi, we must first put cryptocurrency into our crypto wallet. This is done by;

- Buying cryptocurrencies using Fiat Money:

- Money can be deposited via a Visa credit card, a SEPA bank transfer, the iDEAL payment service, or Sofort.

- Processing costs apply to Visa and Sofort.

- In the top right corner, click on the profile, then on credits.

- All cryptocurrencies that can be purchased with fiat money have a Buy button.

- When we click on buy, we will be given numerous choices for payment in fiat currency.

- Swapping:

- Here, we swap one crypto for another here.

- To see the balance overview, go to our profile in the upper right corner and choose Balance.

- Coins that offer the option of Swap in their row can be obtained by swapping other coins.

- By Clicking Swap opens the dialog for swapping cryptocurrencies.

- On the left, enter the number of coins we need to buy.

- The matching counter value will be calculated automatically on the right side.

- When the procedure is finished, click Next and Buy.

- Transferring from Blockchain to Wallet:

- Different blockchains will be used depending on the currency we want to deposit.

- Select the Deposit for the currency we wish to deposit in the balance overview.

- Our wallet address will be presented via QR code.

- We can also copy the address from below the QR code.

- When transferring cryptocurrency from another platform to CakeDeFi, we use this address as the destination address.

Now we can use the CakeDeFi platform.

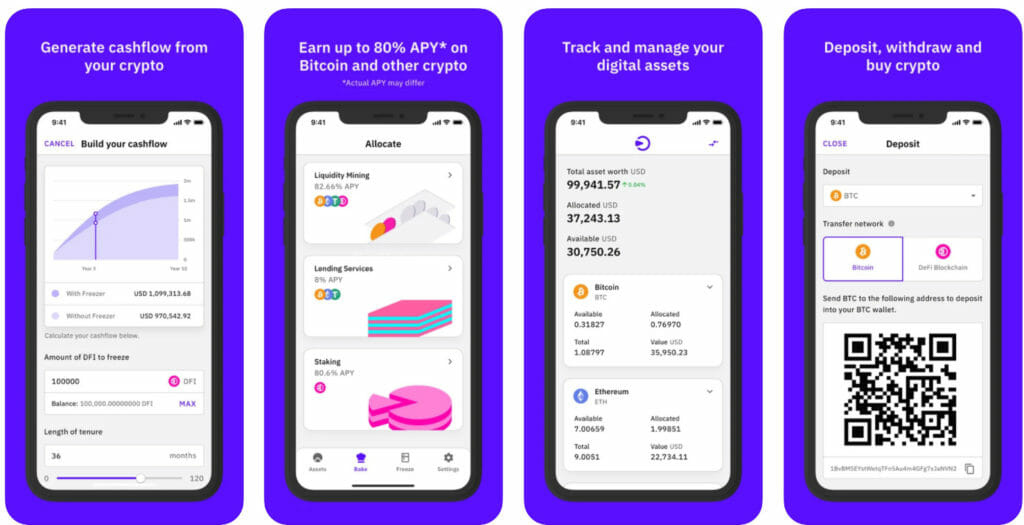

Working of CakeDeFi

Cake DeFi offers several services to assist us in earning interest on our cryptocurrency. Liquidity Mining, Staking, Freezer, and Lending are some examples. All of these services will assist us in making our cryptocurrency work harder for us and growing our cryptocurrency portfolio.

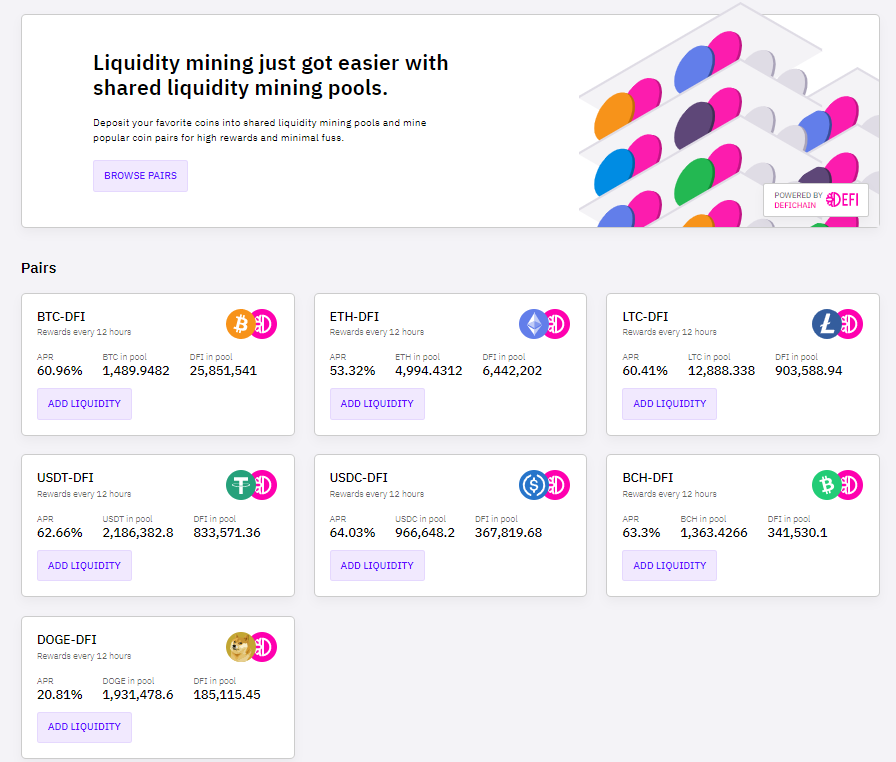

Liquidity Mining

Introduction

- Liquidity Mining lets us mine rewards by depositing a token pair into a liquidity mining pool.

- The act of supplying liquidity to decentralized exchanges using cryptocurrency is known as liquidity mining.

- DEXs aims to reward customers who bring capital to their platform as the primary function of an exchange is liquid.

- Cake now supports the following cryptocurrency pairs for liquidity mining: BTC-DFI, ETH-DFI, USDT-DFI, LTC-DFI, BCH-DFI, DOGE-DFI, and USDC-DFI.

Procedure

- Select Liquidity Mining under Products on the Cake website.

- We now have to choose a market from various marketplaces.

- After deciding the market, click on Add Liquidity.

- Enter the amount. The quantity for the counter pair is automatically changed so that they are in proportion.

- Once decided the amount, click the Deposit button and Confirm the deposit.

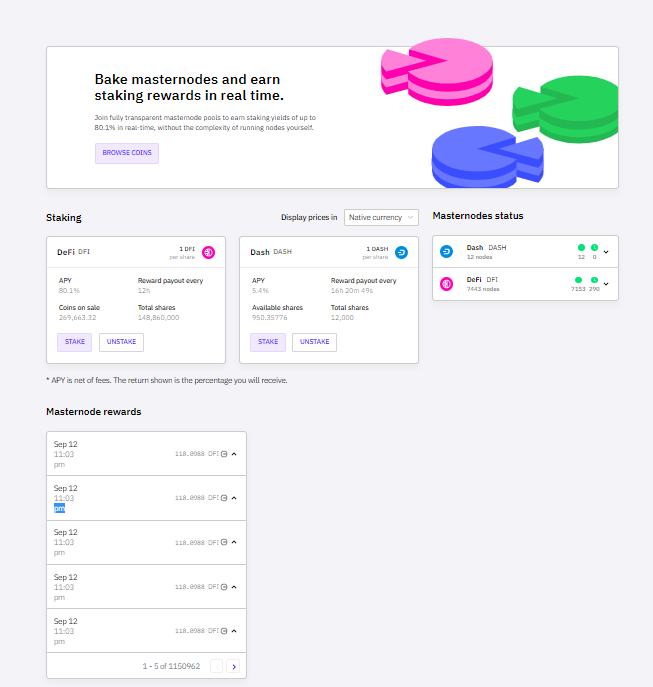

CakeDeFi Review: Staking

Introduction

- Staking includes depositing money or tokens into nodes that verify transactions for cryptocurrencies that use Proof of Stake consensus processes.

- Stakers are compensated with staking incentives for performing this service.

- With our coins, when we join in a masternode pool for which staking is available.

- As a return for contributing our coins to the Masternode pool, we will receive a part of the Staking Rewards.

- After subtracting a processing charge, which CakeDeFi will keep directly, our rewards will be paid out to us twice daily as interest.

- Dash and DeFiChain are the currencies that are currently supported for staking.

Procedure

- There are two methods to participate in the staking:

Method 1

- Here, we swap our Bitcoin or Ethereum for the coin of our choice.

- We can exchange Bitcoin/Ethereum for a Staking Coin.

- In the upper right corner of our profile, click balance.

- Click the Stake button next to the coin of your choice.

Method 2

- Here, our Staking Coin is sent to Cake.

- In the top right corner of our profile, click Credit.

- Click on DEPOSIT next to our selected coin.

- We can now transfer our coin to this address.

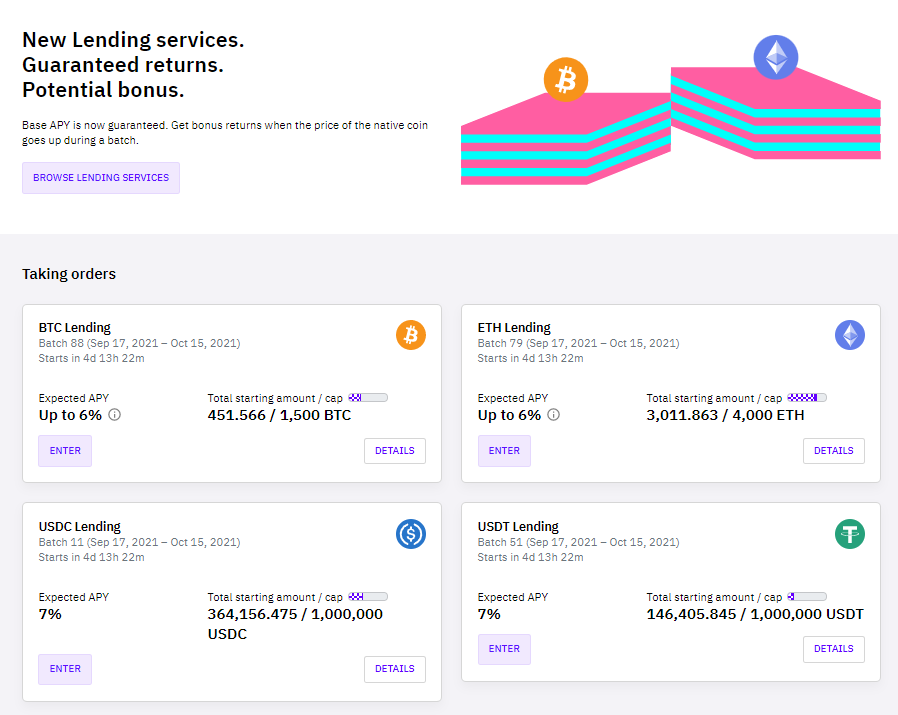

CakeDeFi Review: Lending

Introduction

- Lending enables us to lend our cryptocurrency to others in exchange for a fixed interest rate.

- All we need to do is send our coins to Cake and deposit them into Lending.

- Here, we lock our crypto for four weeks at a time.

- We earn interest throughout this period.

- The platform provides an annual percentage yield of up to 10.5 percent for Ethereum and 11.5 percent for Bitcoin.

- Every week, CakeDeFi offers a loan batch for each currency.

- Each batch lasts four weeks, and our cryptocurrency will be locked up during that time.

- Currently, we can only lend out four currencies: BTC, ETH,

USDT, and USDC.

Procedure

- Select Lending under Products on the Cake website, which is then followed by the proper batch that corresponds to the coin we wish to lend.

- Now, we will click on join, a dialog will appear in which we can choose how much of our bitcoin we want to lend.

- Choose how much cryptocurrency we want to lend.

- In the following dialog, notice the selection option for the automatic reinvestment setting.

- The last step will provide us with a summary of our settings and conditions.

- Check the box to confirm our acceptance of the conditions, then click Join one more time.

- The Procedure is completed.

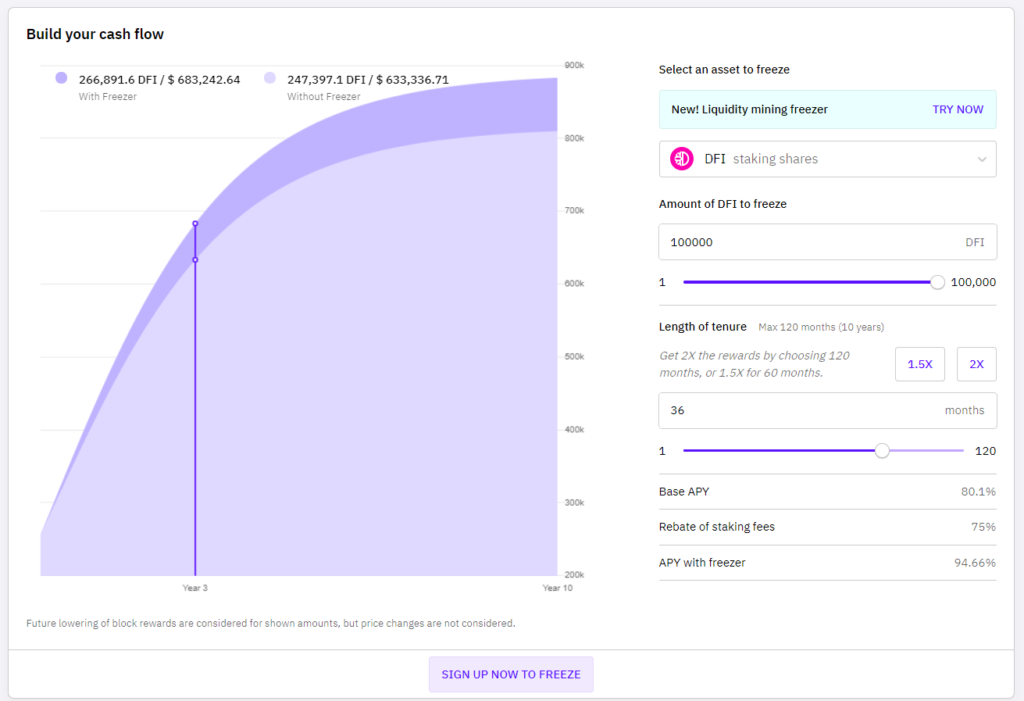

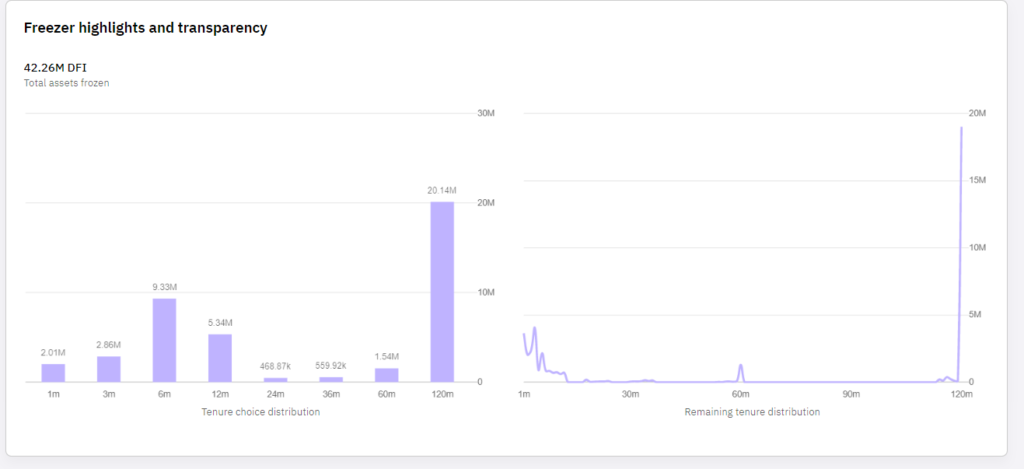

CakeDeFi Review: Freezer

Introduction

- Freezer helps in freezing our DFI for a certain period.

- Cake keeps a tiny percentage of our staking Coins Rewards as a service charge for processing and providing the Masternodes.

- The longer we keep our DFI in Freezer, the more money we save.

- Advantage: We can avoid fees and increase our interest and cash flow depending on the duration of our Freezer.

- Disadvantage: Our DFI has been locked for a certain period and cannot be withdrawn or exchanged under any circumstances.

- APY for staking DFI in the Freezer is dynamic.

Procedure

- On the Freezer page, we can experiment with different DFI levels and periods.

- A button labeled Stake DFI is located at the bottom.

- Further to the right, there is a Freeze now button.

- A list of currently active freezers can be seen further down on the freezer page.

- We can run many freezers simultaneously with varying quantities and durations.

Security offered by CakeDeFi

- Cake DeFi strives for complete transparency in all transactions on their platform.

- On their YouTube Channel, they post quarterly reports.

- Furthermore, their masternode pools’ blockchain addresses are public. This enables anyone to keep track of all CakeDeFi transactions.

- CakeDeFi ensures the safety of our assets by being completely transparent about all transactions on their network.

- CakeDeFi keeps the majority of our funds in an offline cold storage facility.

- If hackers get access to Cake DeFi, they can only take funds from the hot wallet, which comprises just a tiny portion of CakeDeFi’s assets.

CakeDeFi Review: Application

We can use CakeDeFi on multiple platforms. Here is the link CakeDeFi’s Desktop Platform, Apple Store and Google Play Store.

Uniqueness of CakeDeFi

In this section, we will understand what makes CakeDeFi different from others.

Problems in Traditional Approach

- Because cryptocurrencies are very volatile, it frequently necessitates regular monitoring of the asset’s price movement and technical analysis charting on various time frames, which is done to predict where the market may be headed.

- Many inexperienced cryptocurrency traders don’t understand how the momentum of altcoins differs in connection to bitcoin.

Solutions in This Approach

- Cake is intended for users who do not want to deal with the inconvenience and risk of cryptocurrency trading.

- Users who prefer to devote their attention and time to other things will be relieved to learn that Cake provides an easy way to multiply one’s crypto holdings.

- CakeDeFi makes this possible by allowing customers to effortlessly roll over their principal and interest from one batch to the next with the flip of a switch.

- Cake sends out weekly and monthly reward aggregate emails with complete data about all staking revenues and balances to keep users aware of their earnings progress.

CeDeFi

Introduction

- Cake aspires to push the industry’s transparency to new heights.

- Cake bridges the gap between CeFi and DeFi by providing the best of both worlds: a CeDeFi solution.

- One in which consumers may be entirely certain that their assets are in good hands and without the necessity for the extensive technical expertise necessary in many recent DeFi transactions.

- CeDeFi, or centralized decentralized finance, is the ideal combination of centralized and decentralized finance, combining the greatest features of both systems.

- Corporations can use CeDeFi to explore novel and modern financial solutions while adhering to traditional financial regulatory norms.

- CeDeFi enables us to experiment with DeFi products like decentralized exchanges, liquidity aggregators, yield farming tools, lending protocols, and many more for cheap transaction fees.

- Cake also releases quarterly transparency reports so that the public may have a thorough knowledge of how the company is functioning and what each department has been working on for the quarter.

What are the Upgrades of CakeDeFi?

LAPIS

- It is a new update to their lending system which was announced on August 2020.

- The platform acquired strategic partnerships with Signum Capital and Sparrow as part of its goal.

- The update specifically secures: 5% on BTC + 4% on DFI and 4% on ETH + 4% on DFI.

- Developers opted to augment the guarantor’s fee with DFI tokens to ensure that the average profit margins for ETH and BTC are maintained.

- If the price of our locked-up cryptocurrency rises by more than 20% during our holding period, Cake will pay us a bonus.

- This raises the maximum earning potential for BTC to 11.5 percent APY and for ETH to 10.5 percent APY.

Liquidity Mining Freezer

- Liquidity Mining Freezer was announced on August 19, 2021.

- We can now not only earn better returns on our Staking coins but can also earn incredible returns on all of our supported Liquidity Mining currencies on the site.

- Liquidity mining pairs will get a 12.75 percent extra in rewards if we keep them for ten years.

- Now, bakers can customize their preferred lock-away duration, which may range from one month to up to ten years, and is adjustable with a few clicks.

Is CakeDeFi Legal?

- It is based in Singapore, where the rule of law and regulatory enforcement are usually considered among the best in the world.

- It is also completely compliant with the Monetary Association of Singapore‘s strict regulatory standards, as well as a member of the Association of Crypto-Currency Enterprises and Start-ups Singapore and the Singapore Fintech Association.

CakeDeFi Review: Conclusion

CakeDeFi is constantly pushing the boundaries of what is possible in the market. It’s inspiring to see a development team that is so committed to transparency. As the benefits of their platform become more widely understood, we can expect to hear more from this team. Cake DeFi will continue to be the creative doorway bringing masses into the crypto sector, with its mission spelled out and a highly qualified team to back it up.

Alternatives of CakeDeFi

BlockFi

- BlockFi is a cryptocurrency-focused banking platform.

- We can earn interest, spend our Bitcoin, and buy or trade cryptocurrencies by putting it into BlockFi, and also, there are no hidden costs or minimum balances.

Nexo

- Nexo is a blockchain-based lending platform that provides instant cryptocurrency-backed loans to its users.

- Users provide collateral in the form of an accepted token, such as Bitcoin, etc., to obtain a loan in the form of a fiat currency or stablecoin.

DeFiChain

- DeFiChain is a decentralized blockchain platform devoted to providing quick, intelligent, and transparent, decentralized financial services to everyone.

- Julian Hosp and U-Zyn Chua also lead this foundation.

Frequently Asked Questions

How is our Data handled?

Their Headquarters are located in Singapore and follow the Personal Data Protection Act. They gather only needed personal information to deliver their services. They have a legal responsibility to do so under Singapore’s payment services rules, which compel us to verify our identification and follow AML regulations.

What is DFI?

It is the native token of the DeFi Blockchain, i.e. DeFiChain. This is created by the DeFiChain Foundation to enable DeFi services on the Bitcoin blockchain.

What is the purpose of DFI?

It can be used to do transactions on the platform. We will use DFI to execute DeFi Services like initiating a loan contract, DEX trading etc.

How are our assets protected?

It adheres to strict asset segregation, which means that user assets are kept separate from operational accounts. The platform guarantees that it cannot and will not misappropriate any user assets for its use.

Also, read