In March start, the value of Bitcoin declined due to adverse reports from the U.S. markets. Last month saw a fourth consecutive dismal performance from the nation’s manufacturing industry and a decline in consumer confidence. As a result, Bitcoin recovered some of the losses it had incurred over the previous days. Prices dropped to a two-week low on Friday, but sentiment improved. Ethereum followed suit and was back in positive numbers by the start of the weekend.

Bitcoin

The crypto markets experienced a decline yesterday, linked to the release of the Institute for Supply Management’s (ISM) manufacturing index report. The figure of 47.7, which was lower than the 50.00 threshold that would indicate growth, caused BTC to drop to a low of $21.9K but recovered quickly afterward, peaking at $22K. This was likely due to an increase in the number of long trades on the asset.

On Friday, a selloff in Bitcoin (BTC) occurred when traders raised worries about Silver gate, a bank that supports crypto transactions. This drove away bullish positions from the futures market and set off a decline in BTC. As a result, during the Asian trading hours, Bitcoin futures holders experienced a significant surge in liquidations of their long or bullish positions. This amounted to over $62 million, an unusually large amount since August. Additionally, there were also liquidations worth around $500,000 for short positions.

In the 1D timeframe, the $BTC/USDT BTC price action will pump a little to fill the imbalanced area and continue making lower lows and lower highs. So it’s important to identify the trend and be friend with it. Nothing to worry about when CCC is with you. Already informed you about that move, so you can save yourself and take short positions accordingly.

Ethereum

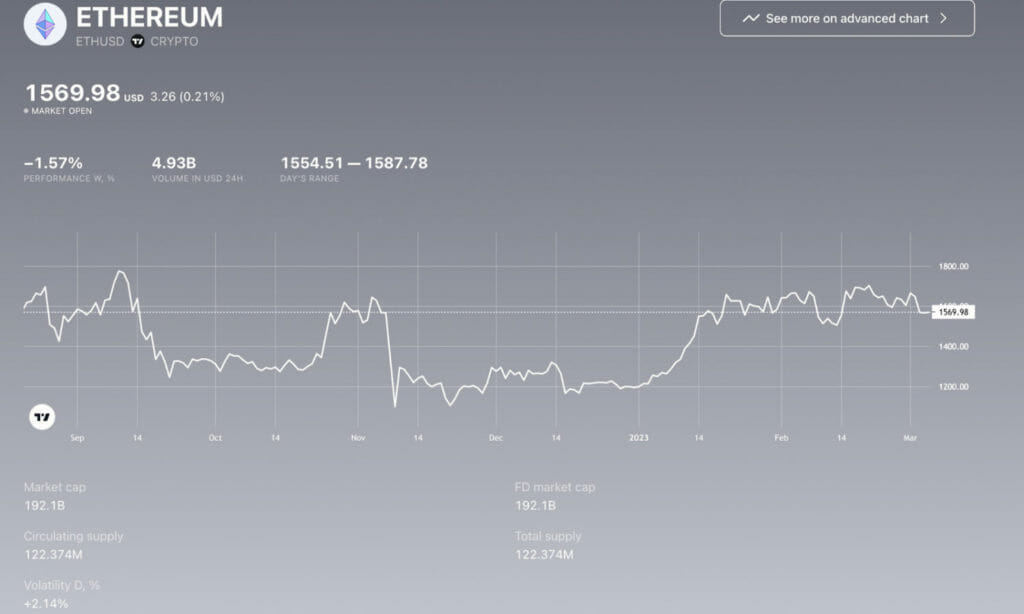

People investing in ETH are currently deciding whether the dip in its market value implies a good opportunity to buy or indicates that it may be going further down soon. Ethereum has not been displaying much volatility like Bitcoin and is moving in a narrow range instead. However, the cryptocurrency recently fell below its supporting level of $1,600 and held steady at $1,550.

ETH prices could drop and reach the support zone of $1500, the last stand before it drags down to $1360. If it tests this support zone, a rebound may be expected that could propel its value back up.

In the 12H timeframe, the price action of $ETH/USDT is rejected from the horizontal resistance zone. Currently, the price is bouncing from the horizontal support zone. If it breaks the key level of the horizontal ray, then it can go upward. On the other hand, if it breakdown the support zone, we will see a further downward movement of $ETH.

For any time, on-demand analysis, any other coin can join our Telegram channel.