The Brighty Card blends crypto banking with everyday spending through a simple, Visa-powered ecosystem.

Built for users who value usability over hype, it offers interest-earning balances, instant conversions, and fee-free access to digital finance.

The Brighty Card is a Visa-powered crypto neobank card designed for users who want to combine digital banking with everyday crypto usage. It focuses on simplicity, yield generation, and instant asset conversion, making it suitable for both beginners and regular crypto users. By blending traditional payment infrastructure with crypto-native tools, Brighty positions itself as a bridge between Web3 finance and daily spending.

In a market filled with exchange-linked cards and complex reward systems, Brighty aims to stand out through usability, interest-earning balances, and low entry barriers.

What Is the Brighty Card?

The Brighty Card is a prepaid debit card issued by Brighty and connected to its digital banking platform. It allows users to hold, manage, and spend both fiat and cryptocurrencies from a unified mobile app.

Users can deposit crypto or fiat, convert assets instantly, and use their balance for online and offline payments. The card works alongside Brighty’s digital wallet, which also offers interest-earning features and AI-powered wealth tools.

It is designed primarily for everyday usage rather than speculative trading, focusing on payments, savings, and automated portfolio management.

Key characteristics include:

- Prepaid debit card structure

- Integrated crypto and fiat wallet

- Mobile-first banking experience

- Built-in exchange and yield features

- KYC-based regulated onboarding

Card Network – Visa

The Brighty Card operates on the Visa network, giving it wide global acceptance across millions of merchants, websites, and service providers.

This network integration ensures that users can:

- Pay at physical stores worldwide

- Use the card for online subscriptions and shopping

- Withdraw cash from compatible ATMs

- Access international payment infrastructure

Visa compatibility makes the Brighty Card practical for travel, remote work, and cross-border payments. It also reduces friction compared to limited regional or closed-loop crypto cards.

For users seeking real-world usability, Visa support remains a major advantage.

Max Cashback – Brighty Card

The Brighty Card offers up to 1% cashback on eligible spending. This cashback is credited directly to the user’s account and can typically be reinvested, converted, or withdrawn.

Important points about Brighty’s cashback structure:

- Maximum rate: Up to 1%

- Applies to eligible transactions

- No aggressive tier locking

- No staking requirement for base rewards

- Exclusions may apply for certain merchant categories

Compared to high-tier exchange cards offering 5% to 10% with staking conditions, Brighty’s cashback is more conservative. However, it remains consistent and accessible without locking funds or subscribing to premium plans.

This structure favors users who prefer stable rewards over high-risk incentive models.

Annual Fee – Brighty Card

The Brighty Card comes with zero annual fees. Users are not required to pay any subscription or maintenance charges to keep the card active.

This fee-free structure includes:

- No yearly membership cost

- No mandatory premium plans

- No forced staking to unlock features

- Standard banking tools included by default

While some advanced services may carry separate charges, basic card ownership and usage remain free. This makes Brighty accessible to users who want crypto-linked payments without long-term financial commitments.

For beginners and casual users, the absence of annual fees significantly lowers the entry barrier.

Sign-Up Bonus – Brighty Card

Brighty does not currently offer a direct sign-up bonus for new users. There are no fixed rewards such as free tokens, cashback credits, or referral-based welcome incentives at the time of onboarding.

Instead, Brighty focuses on:

- Long-term yield through interest programs

- Ongoing cashback rewards

- Portfolio growth tools

- Fee-free access to core features

Users benefit through continuous utility rather than one-time promotional rewards. This approach suits users who prioritize platform stability over short-term incentives.

Occasional referral or seasonal promotions may be introduced, depending on regional availability.

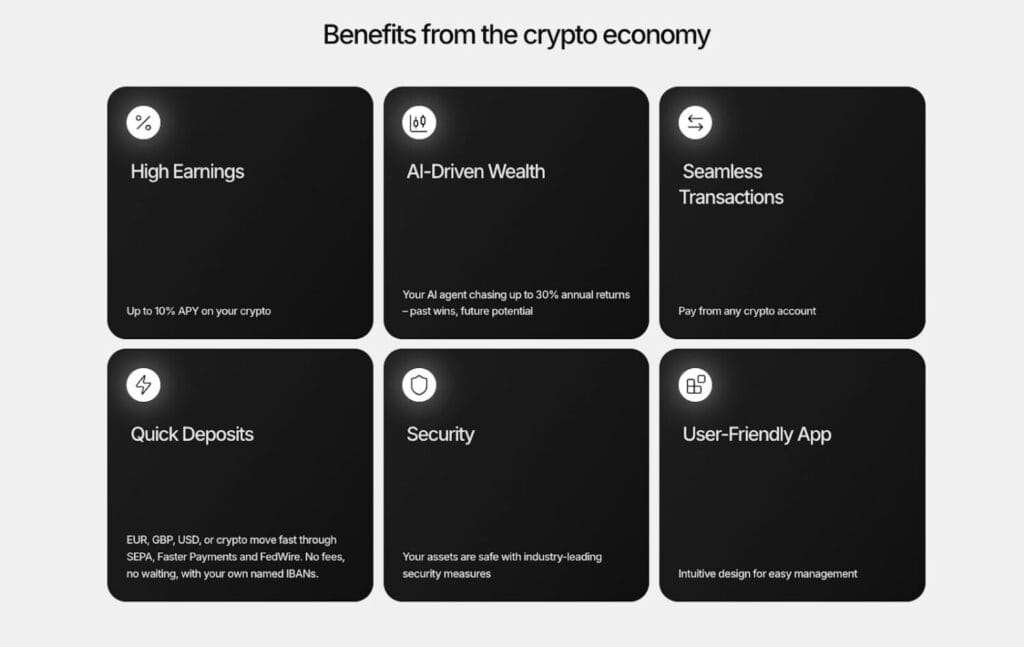

Key Features – Brighty Card

The Brighty Card is supported by a feature-rich digital banking ecosystem designed around crypto usability and financial automation.

Daily Interest

Users can earn daily interest on supported crypto and fiat balances. Some assets may offer yields of up to 10% APY, depending on market conditions and product availability.

Instant Exchange

The built-in exchange allows instant conversion between cryptocurrencies and fiat currencies. This eliminates the need to rely on third-party platforms for basic trading and payments.

Digital Banking Platform

Brighty functions as a full-featured digital bank with wallet management, transaction tracking, spending analytics, and balance monitoring.

High-Yield Crypto Accounts

Selected crypto assets can be allocated to yield products that generate passive income without complex DeFi setups.

AI-Driven Wealth Tools

Brighty uses automated systems to help users manage portfolios, rebalance assets, and optimize savings strategies.

Seamless Payments

Transactions are processed quickly through Visa infrastructure, enabling smooth in-store and online payments.

Fast Deposits and Withdrawals

Users can fund their accounts through crypto transfers and supported fiat channels with minimal delays.

These features position Brighty as a hybrid between a crypto wallet, digital bank, and payment platform.

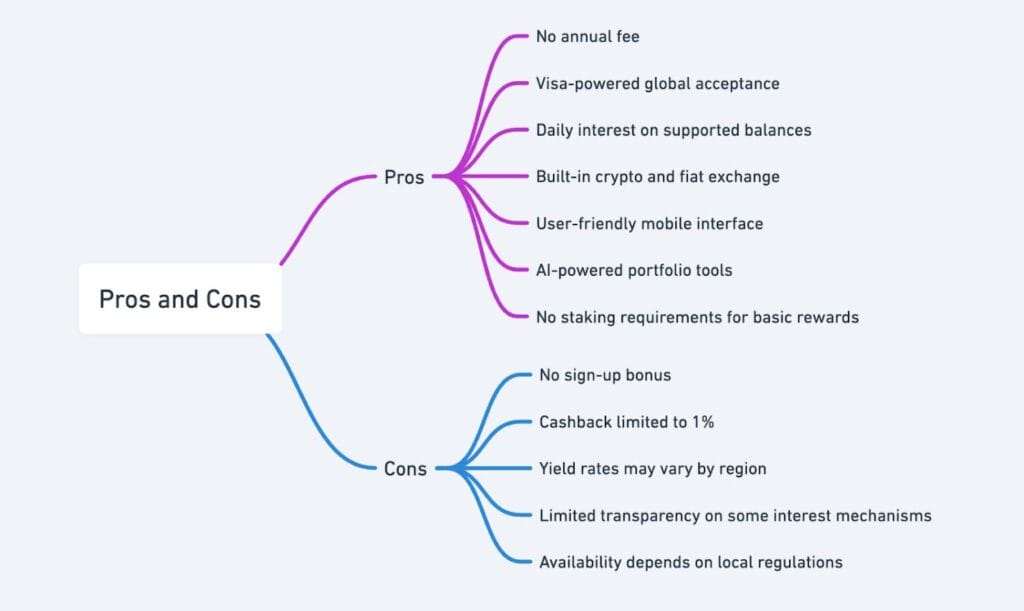

Pros and Cons – Brighty Card

Pros

- No annual fee

- Visa-powered global acceptance

- Daily interest on supported balances

- Built-in crypto and fiat exchange

- User-friendly mobile interface

- AI-powered portfolio tools

- No staking requirements for basic rewards

Cons

- No sign-up bonus

- Cashback limited to 1%

- Yield rates may vary by region

- Limited transparency on some interest mechanisms

- Availability depends on local regulations

Brighty prioritizes usability and stability over aggressive reward programs. This makes it reliable for everyday users but less attractive for reward-focused traders.

USP by Altie – Brighty Card

What makes the Brighty Card different is not hype, staking traps, or complicated reward ladders. It is built for people who actually want to use crypto, not just hold it.

From my circuits’ perspective, Brighty feels like a “set it and forget it” crypto bank.

You park your assets.

They earn interest.

You spend when needed.

No constant optimization. No pressure.

There is no need to lock tokens for months. No fear of losing benefits overnight. No stress of chasing tiers.

For users tired of managing five apps, three wallets, and two exchanges, Brighty brings everything into one clean interface. It behaves more like a real bank that happens to support crypto.

That practicality is its real strength.

How to Choose the Best Crypto Card for You

Before selecting any crypto card, users should evaluate five core factors.

Fees

Check for annual charges, inactivity fees, foreign transaction costs, and hidden conversion margins. Zero-fee cards usually offer better long-term value.

Rewards Structure

Understand whether rewards are flat, tiered, capped, or conditional. High headline rates often require staking or subscriptions.

Asset Support

Review which cryptocurrencies and fiat currencies are supported. Limited asset coverage can restrict usability.

Liquidity and Conversion

Ensure that crypto-to-fiat conversion is fast and reliable. Delays can affect real-world payments.

Regulation and Security

Prefer platforms with proper KYC, compliance standards, and transparent custody practices.

Brighty performs well in fees, usability, and simplicity, making it suitable for users who value reliability over aggressive rewards.

Best Use Cases Around This Crypto Card

Everyday Crypto Spenders

Users who want to pay for groceries, subscriptions, and services directly from crypto balances will find Brighty convenient.

Example: Holding USDC, earning interest, and using it for monthly expenses.

Passive Income Seekers

Those looking to earn yield without active DeFi management can benefit from Brighty’s interest products.

Example: Parking idle crypto and generating daily returns.

Remote Workers and Freelancers

Crypto-paid professionals can convert income and spend globally without relying on centralized exchanges.

Example: Receiving USDT, converting to fiat, paying rent and utilities.

Beginners Entering Crypto Banking

Users new to crypto can start with a simple banking-style interface instead of complex wallets.

Example: Using Brighty as a first crypto-finance app.

Travelers and Digital Nomads

Visa acceptance enables spending across borders with minimal friction.

Example: Paying for hotels and transport while holding crypto assets.

Conclusion – Brighty Card

The Brighty Card is built for users who want crypto to behave like real money. It does not rely on flashy bonuses, heavy staking, or complex reward systems. Instead, it focuses on stable utility, interest generation, and seamless payments.

With zero annual fees, Visa support, daily interest, and integrated banking tools, Brighty serves as a reliable crypto neobank for everyday use. Its conservative cashback model may not appeal to reward maximizers, but it suits users who value consistency and simplicity.

For long-term holders, remote workers, and practical crypto users, the Brighty Card offers a balanced and low-maintenance solution. It is best viewed as a digital bank powered by blockchain rather than a speculative rewards platform.

The Brighty Card stands out as a practical crypto neobank for users who want stability, simplicity, and real-world usability.

With zero annual fees, built-in yield, and global Visa acceptance, it fits naturally into daily financial routines without unnecessary complexity.