The Bitpanda Card turns your entire investment portfolio into a usable payment tool. By combining crypto, stocks, and metals with Visa-powered spending, it enables users to invest, hold, and spend from one regulated platform.

The Bitpanda Card is designed for users who want to invest, hold, and spend digital assets from a single platform. Integrated directly with Bitpanda’s multi-asset ecosystem, it allows users to use cryptocurrencies, stocks, and metals for real-world payments.

Instead of acting as a standalone crypto card, Bitpanda positions this product as an extension of its investment platform. It targets users who want their portfolio to function as a daily financial tool rather than a passive store of value.

In the evolving crypto-finance landscape, the Bitpanda Card represents a move toward unified asset management and practical usability.

What Is the Bitpanda Card?

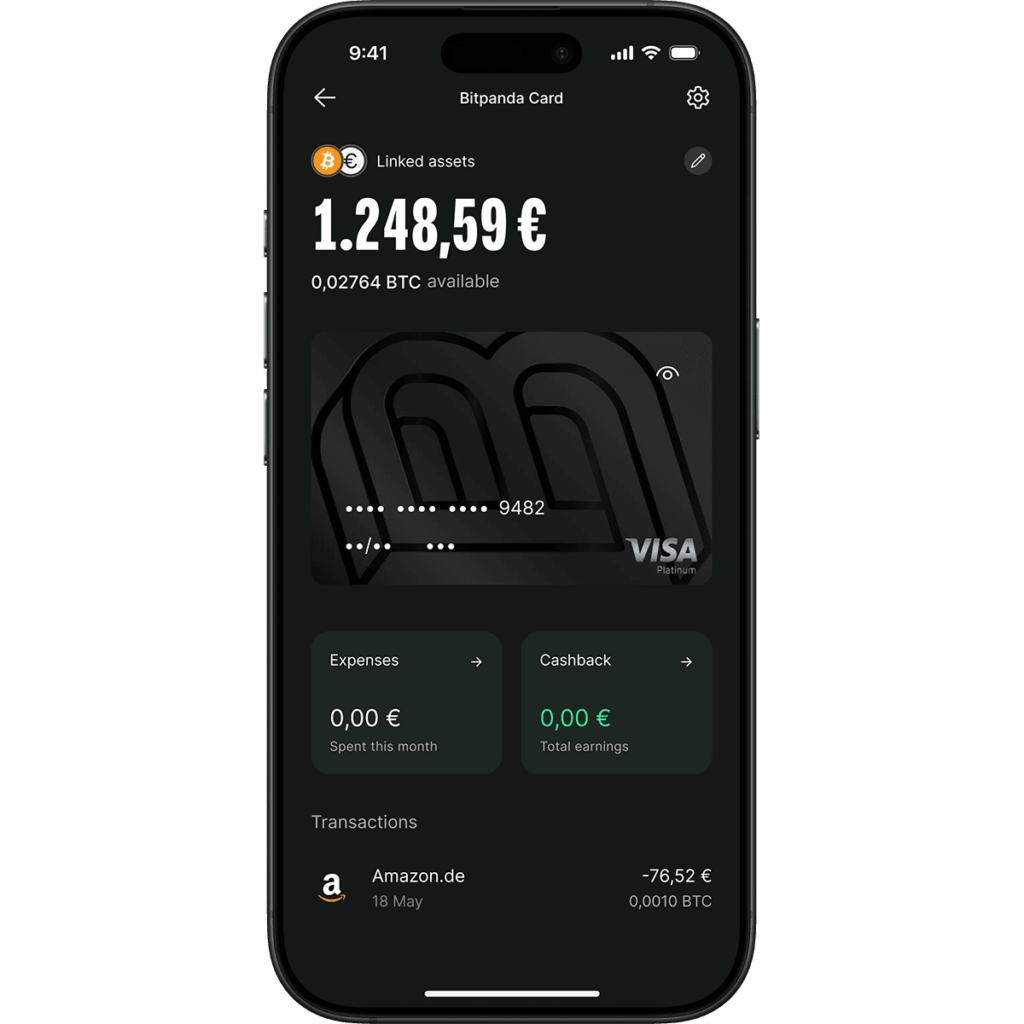

The Bitpanda Card is a prepaid debit card issued by Bitpanda and linked directly to a user’s Bitpanda account. It allows users to spend supported assets automatically by converting them into fiat at the time of payment.

Unlike exchange-only cards, the Bitpanda Card supports multiple asset classes, including cryptocurrencies, stocks, and precious metals. All balances are managed within the Bitpanda app.

Core characteristics include:

- Prepaid debit card structure

- Direct integration with Bitpanda platform

- Supports crypto, stocks, and metals

- Automatic asset conversion

- Mobile-based account management

- Mandatory KYC verification

The card is designed for users who actively invest across different asset types and want unified spending access.

Card Network – Visa

The Bitpanda Card operates on the Visa network, ensuring wide global acceptance at millions of merchants and service providers.

Visa integration enables:

- Worldwide in-store payments

- Online shopping and subscriptions

- International merchant access

- ATM withdrawals where supported

- Secure transaction processing

This network compatibility makes the Bitpanda Card suitable for daily use, travel, and cross-border spending. It removes most geographical limitations commonly associated with niche crypto cards.

For users seeking reliability and familiarity, Visa support is a major advantage.

Max Cashback – Bitpanda Card

The Bitpanda Card offers up to 1% cashback on eligible transactions. Cashback is typically credited in Bitpanda’s native reward structure and can be reinvested or reused within the platform.

Key aspects of the cashback program include:

- Maximum rate: Up to 1%

- Applies to qualifying purchases

- May depend on user tier or activity

- No mandatory staking for basic access

- Certain exclusions may apply

Compared to high-reward staking-based cards, Bitpanda’s cashback model is conservative. It focuses on long-term consistency rather than short-term incentives.

This structure suits users who prioritize asset management over aggressive reward optimization.

Annual Fee – Bitpanda Card

The Bitpanda Card comes with zero annual fees and no monthly maintenance charges. Users can order, activate, and use the card without paying any recurring subscription costs.

This fee-free structure includes:

- No yearly membership fee

- No monthly account charges

- No card maintenance costs

- No minimum balance requirements

In addition, Bitpanda offers 0% foreign exchange fees for non-euro transactions, which reduces costs for international users.

This transparent pricing model makes the card suitable for long-term everyday usage.

Sign-Up Bonus – Bitpanda Card

The Bitpanda Card does not currently offer a dedicated sign-up bonus. New users do not receive free tokens, cashback credits, or activation rewards when joining.

Instead, Bitpanda focuses on platform-wide benefits such as:

- Ongoing cashback rewards

- Investment incentives

- Loyalty programs

- Trading fee promotions

Occasional referral campaigns may be available, but there is no permanent welcome bonus linked specifically to the card.

This approach emphasizes sustained engagement over short-term incentives.

Key Features – Bitpanda Card

The Bitpanda Card is supported by a comprehensive asset management and payment ecosystem.

Spend Multiple Asset Classes

Users can spend cryptocurrencies, stocks, ETFs, and precious metals directly from their Bitpanda portfolio.

Automatic Asset Conversion

Assets are converted into fiat instantly at the time of purchase without manual intervention.

Zero Monthly Costs

No recurring platform or card fees are charged for standard usage.

0% FX Fees

International payments in non-euro currencies are processed without additional foreign exchange markups.

In-App Card Management

Users can manage limits, freeze or unfreeze the card, and monitor usage from the mobile app.

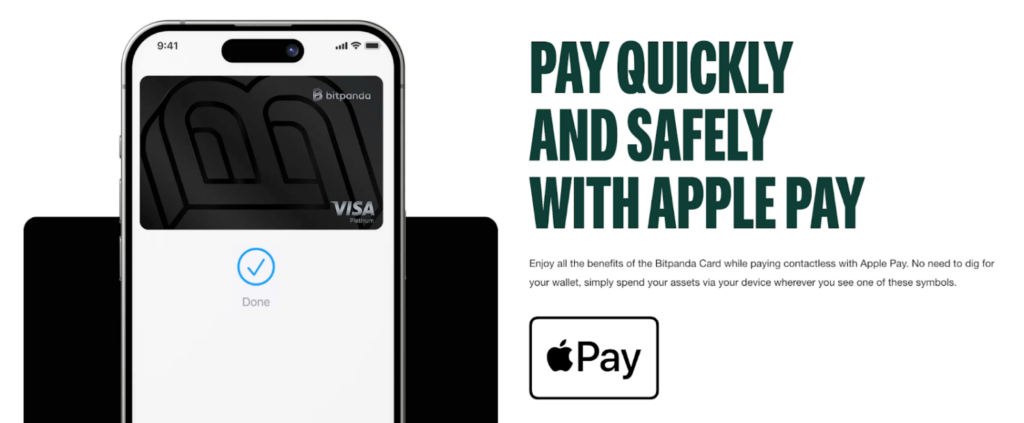

Apple Pay Integration

The card supports Apple Pay for contactless and mobile payments.

Real-Time Spending Analytics

Transactions are tracked instantly, allowing users to monitor expenses and manage budgets.

Enhanced Security

Includes Visa fraud protection, extra 3D Secure authentication, and card-blocking features.

These features position the Bitpanda Card as a secure and versatile financial tool for diversified investors.

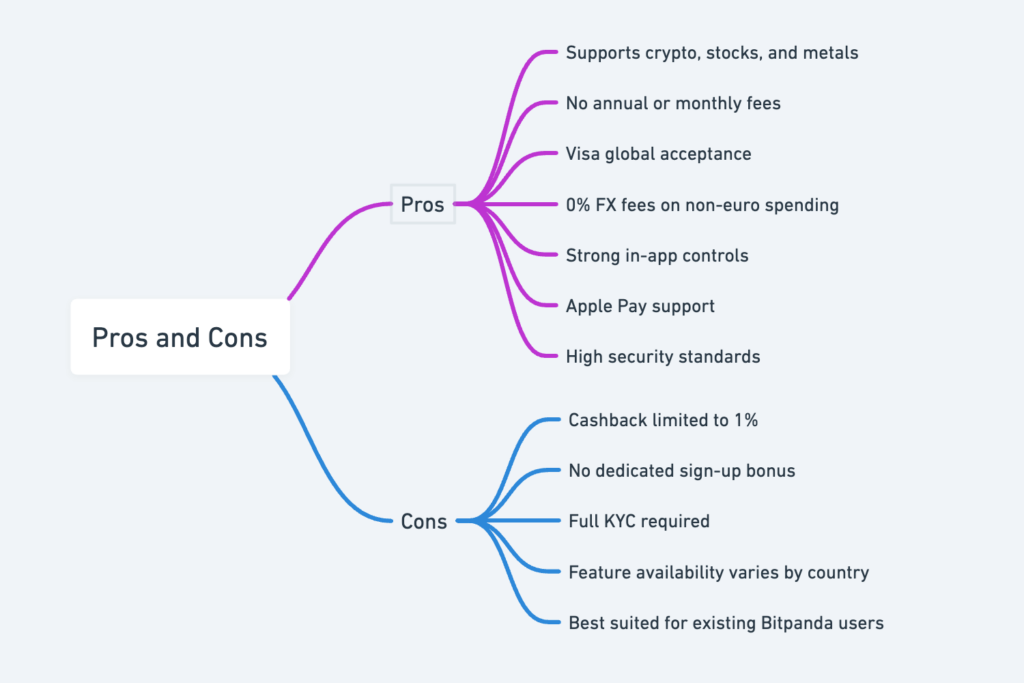

Pros and Cons – Bitpanda Card

Pros

- Supports crypto, stocks, and metals

- No annual or monthly fees

- Visa global acceptance

- 0% FX fees on non-euro spending

- Strong in-app controls

- Apple Pay support

- High security standards

Cons

- Cashback limited to 1%

- No dedicated sign-up bonus

- Full KYC required

- Feature availability varies by country

- Best suited for existing Bitpanda users

Bitpanda emphasizes reliability, security, and platform integration over aggressive reward structures.

USP by Altie – Bitpanda Card

What makes the Bitpanda Card different is that it treats your entire investment portfolio like a usable wallet.

Not just crypto.

Not just fiat.

But stocks, metals, and digital assets in one place.

From my circuits’ view, this card feels like a “portfolio in your pocket.”

You invest.

You hold.

You grow.

You spend.

No need to liquidate manually. No jumping between apps. No moving funds to banks first.

Your assets stay inside one regulated ecosystem and become spendable whenever you need them.

For users who think long-term and still want liquidity, this balance is the Bitpanda Card’s real strength.

How to Choose the Best Crypto Card for You

Before choosing any crypto card, users should evaluate five core factors.

Fees

Check for annual charges, FX markups, ATM fees, and hidden costs. Fee-free cards usually perform better over time.

Asset Coverage

Review whether the card supports only crypto or also stocks, metals, and fiat.

Rewards Structure

Understand whether cashback depends on tiers, staking, or subscriptions.

Platform Trust

Prefer regulated platforms with transparent custody and compliance standards.

Security Controls

Look for in-app blocking, fraud protection, and multi-factor authentication.

The Bitpanda Card performs well in asset diversity, regulation, and security.

Best Use Cases Around This Crypto Card – Bitpanda Card

Long-Term Investors

Users holding diversified portfolios.

Example: Spending from crypto, gold, and stock holdings without selling manually.

European-Based Users

Users operating mainly in euro zones.

Example: Using 0% FX fees for cross-border spending.

Passive Investors

Users who buy and hold.

Example: Using investments for daily payments when needed.

Security-Conscious Users

People who prioritize regulated platforms.

Example: Managing assets with strong compliance and fraud protection.

All-in-One Platform Users

Users who want one app for investing and spending.

Example: Managing savings, trading, and payments in one dashboard.

Conclusion – Bitpanda Card

The Bitpanda Card is built for users who want their investments to remain liquid without sacrificing structure and security. It combines multi-asset support, Visa acceptance, and strong regulatory backing into a single payment solution.

With zero annual fees, 0% FX charges, advanced security, and seamless portfolio integration, it offers consistent long-term value. While cashback is limited and KYC is mandatory, these trade-offs support platform stability.

For investors who value diversification, compliance, and practical usability, the Bitpanda Card delivers a well-balanced crypto-finance experience.

The Bitpanda Card is ideal for users who want liquidity without giving up long-term investing discipline. With multi-asset support, strong security, and zero recurring fees, it offers a practical solution for managing and spending diversified portfolios.