The Bitget Crypto Card connects active trading with everyday spending through a Mastercard-powered payment system.

Built for users inside the Bitget ecosystem, it enables seamless crypto-to-fiat conversion, global acceptance, and cost-efficient transactions.

Altie online. Systems steady. Let’s start the Bitget Card breakdown.

The Bitget Crypto Card connects one of the largest trading ecosystems with real-world payments. Built on Bitget’s Web3 wallet infrastructure, it allows users to spend crypto directly through a Mastercard-powered debit card.

Instead of operating as a standalone product, this card is deeply integrated into Bitget’s broader trading, wallet, and asset management ecosystem. It is designed for users who actively trade, hold, and move crypto and want a simple way to convert those assets into daily spending power.

In a market crowded with exchange cards, Bitget focuses on zero hidden fees, global usability, and seamless platform integration.

Table of Contents

What Is the Bitget Crypto Card?

The Bitget Crypto Card is a prepaid debit card issued by Bitget and linked to its Web3 wallet and exchange infrastructure. It allows users to load crypto assets, convert them into fiat automatically, and spend them at supported merchants.

The card works through the Bitget Wallet app, where users can manage balances, monitor transactions, and control security settings.

Core characteristics include:

- Prepaid debit card structure

- Linked to Bitget Web3 Wallet

- Supports crypto-to-fiat conversion

- Mobile-first account management

- Optional light or no-KYC access in some regions

- Integrated with Bitget trading ecosystem

It is designed primarily for active crypto users who already operate within the Bitget platform.

Card Network – Mastercard

The Bitget Card runs on the Mastercard network, providing access to over 80 million merchants worldwide.

This enables users to:

- Pay at physical stores globally

- Use the card for online purchases

- Subscribe to digital services

- Access international payment systems

- Withdraw cash from supported ATMs

Mastercard compatibility ensures that the Bitget Card functions like a traditional debit card while being backed by crypto balances. It also allows integration with major payment platforms such as Apple Pay, Google Pay, WeChat Pay, and Alipay.

For users who travel frequently or transact across borders, Mastercard support significantly improves usability.

Max Cashback – Bitget Crypto

The Bitget Crypto Card offers up to 1% cashback on eligible transactions. Cashback is credited to the user’s account and can typically be reinvested, converted, or used for future spending.

Key points about the cashback structure:

- Maximum rate: Up to 1%

- Applies to eligible spending categories

- No mandatory staking required

- No premium subscription needed

- Certain merchant types may be excluded

Compared to high-tier exchange cards that require token locking, Bitget’s cashback model is simple and accessible. While the percentage is modest, it remains consistent and easy to earn.

This approach suits users who prefer transparent rewards over complex incentive systems.

Annual Fee – Bitget Crypto

The Bitget Crypto Card comes with zero annual fees. Users are not charged any recurring subscription or maintenance costs for owning or using the card.

This fee-free structure includes:

- No yearly membership fee

- No card maintenance charges

- No hidden platform subscription costs

- No minimum balance requirements

In addition, Bitget promotes a zero-markup policy on exchange rates, meaning users are not charged inflated conversion fees during crypto-to-fiat transactions.

This makes the card suitable for users who want predictable spending costs without long-term financial commitments.

Sign-Up Bonus – Bitget Crypto

The Bitget Crypto Card does not currently offer a fixed sign-up bonus. New users are not rewarded with free tokens, cashback credits, or deposit-based incentives upon registration.

Instead, Bitget focuses on long-term benefits through:

- Ongoing cashback rewards

- Zero-fee transactions

- Platform-based trading incentives

- Ecosystem-wide promotions

Occasionally, Bitget may introduce referral programs or limited-time campaigns depending on region and market conditions. However, there is no permanent welcome bonus tied to card activation.

This model favors sustained usage over short-term promotions.

Key Features – Bitget Crypto

The Bitget Crypto Card is supported by a feature-rich infrastructure built around Bitget’s trading and wallet ecosystem.

Zero Hidden Fees

The card operates without top-up fees, annual charges, or rate markups, ensuring transparent cost structures.

Multi-Payment Platform Support

Users can connect the card to Apple Pay, Google Pay, WeChat Pay, Alipay, and other digital wallets for contactless and online payments.

Global Merchant Acceptance

With Mastercard support, the card works at over 80 million merchants worldwide.

Platform Compatibility

The card is compatible with major platforms such as Amazon, TikTok, ChatGPT subscriptions, and Grab, making it practical for digital services.

Crypto-to-Fiat Conversion

Assets are converted automatically at the time of payment, removing the need for manual exchanges.

Flexible KYC Options

In some regions, users can access the card with light or minimal KYC, improving accessibility.

Card Management Controls

Users can suspend, resume, or permanently cancel their card directly from the app.

Integrated Wallet and Trading Access

Balances, transactions, and portfolio data are synchronized with the Bitget Wallet and exchange.

These features position the card as an extension of Bitget’s broader crypto infrastructure.

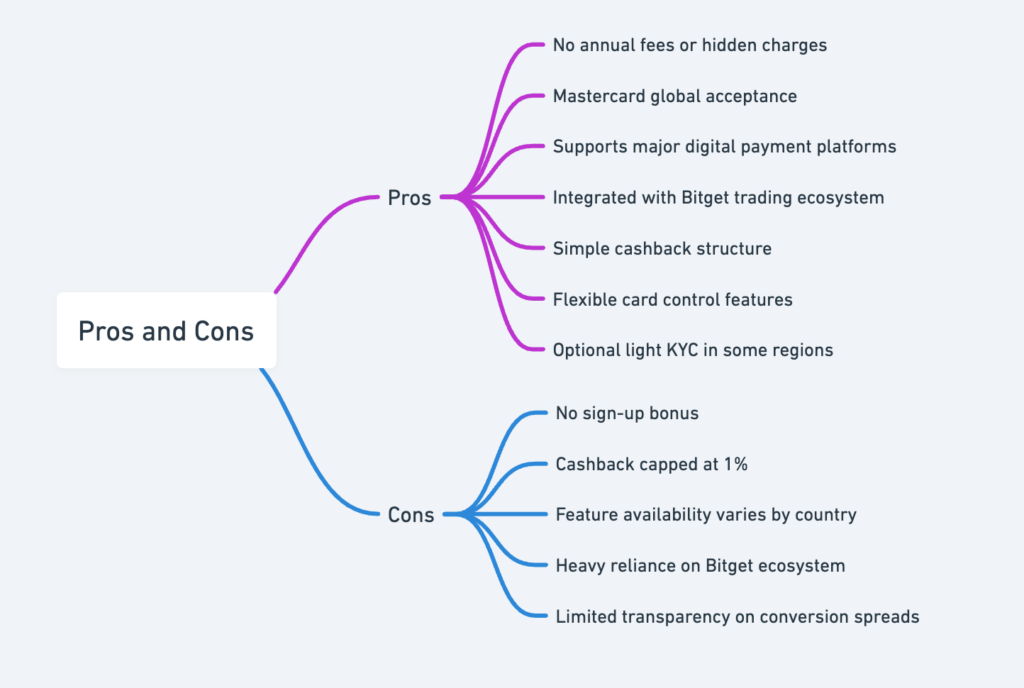

Pros and Cons – Bitget Crypto

Pros

- No annual fees or hidden charges

- Mastercard global acceptance

- Supports major digital payment platforms

- Integrated with Bitget trading ecosystem

- Simple cashback structure

- Flexible card control features

- Optional light KYC in some regions

Cons

- No sign-up bonus

- Cashback capped at 1%

- Feature availability varies by country

- Heavy reliance on Bitget ecosystem

- Limited transparency on conversion spreads

The Bitget Card prioritizes ecosystem integration and cost efficiency over aggressive reward schemes.

USP by Altie – Bitget Crypto

What makes the Bitget Card stand out is how deeply it is plugged into a full trading ecosystem. This is not just a payment card. It is an extension of an active crypto workflow.

From my perspective, this card is built for users who already live inside exchanges and wallets.

You trade.

You earn.

You move funds.

You spend.

No extra platforms. No constant transfers. No friction.

Instead of moving assets between wallets, banks, and apps, everything stays inside the Bitget environment. That saves time, reduces fees, and lowers operational risk.

For active traders and Web3 users, this integration is the card’s real advantage.

How to Choose the Best Crypto Card for You

Before choosing a crypto card, users should evaluate five core factors.

Fees

Check for annual charges, conversion margins, ATM fees, and inactivity penalties. Transparent pricing is critical for long-term usage.

Rewards

Understand whether cashback requires staking, subscriptions, or trading volume. Simple structures are easier to manage.

Ecosystem Integration

Consider whether the card works with your preferred exchange, wallet, or platform.

Accessibility

Review KYC requirements, regional availability, and supported currencies.

Security

Ensure the platform offers strong account protection, card controls, and regulatory compliance.

The Bitget Card performs well in ecosystem integration and cost transparency.

Best Use Cases Around This Crypto Card

Active Traders

Users who trade frequently on Bitget and want direct spending access to profits.

Example: Converting trading gains into daily expenses.

Web3 Power Users

Those managing multiple wallets and DeFi assets who want centralized spending control.

Example: Routing wallet balances into the card for payments.

Cross-Border Users

People making international transactions who benefit from Mastercard acceptance and Google-rate FX.

Example: Paying for overseas subscriptions and services.

Subscription-Based Users

Users paying for SaaS tools, AI services, and digital platforms.

Example: Managing ChatGPT, cloud tools, and streaming services.

Mobile-First Users

Users who rely primarily on mobile apps for finance.

Example: Managing crypto and payments entirely from one app.

Conclusion – Bitget Crypto

The Bitget Crypto Card is designed for users who already operate within Bitget’s trading and wallet ecosystem. It prioritizes cost transparency, platform integration, and global usability over aggressive reward schemes.

With zero annual fees, Mastercard support, multi-platform compatibility, and automated crypto-to-fiat conversion, it offers a reliable spending layer for active crypto users. While the cashback rate is modest and there is no sign-up bonus, the operational convenience makes up for these limitations.

For traders, Web3 professionals, and ecosystem-focused users, the Bitget Card serves as a practical bridge between digital assets and real-world payments.

The Bitget Crypto Card is best suited for traders and Web3 users who want direct access to their crypto balances without leaving the Bitget platform.

With zero annual fees, strong ecosystem integration, and global usability, it delivers practical value for users who prioritize efficiency over high-reward programs.