Derivatives/ On-Chain Analytics Update

From a price structure standpoint, Bitcoin bounced off the macro support level we talked about last week of $40K. Open interest is still high and in the area of which we have seen major squeezes/flushes take place.

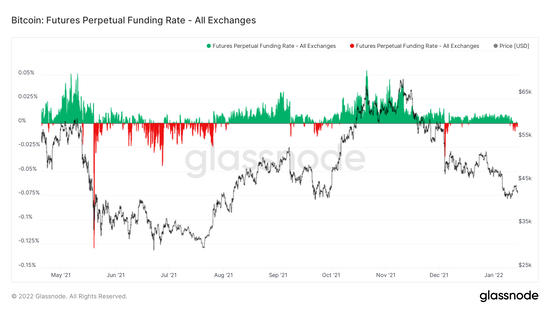

This is the longest the ratio has sustained these elevated levels. A lot of leverage is still built up and Bitcoin is still far from out of the woods volatility-wise. As a way to gauge some of the aggression of this open interest, we look at funding.

We have finally seen some negative funding, showing that either spot is leading perps or perps are fading spots. Upon some further digging, it appears Coinbase has been bidding aggressively (shown by cumulative volume delta).

Coinbase has a large weight to the weighed spot index that’s used for funding payments on all major perpetual exchanges.

In this case, it appears to be more so that spot is leading perps than perps fading spot. Still a good sign and glad to see a little regime of negative funding get carved out here.

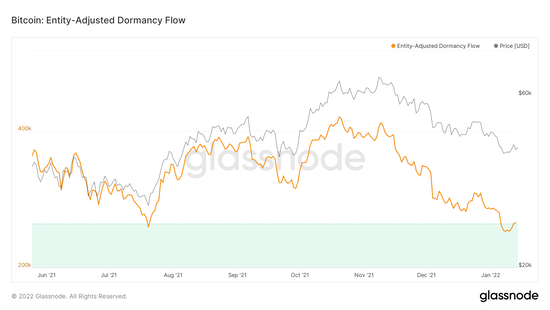

Dormancy flow has entered the buy zone for the sixth time in Bitcoin’s history. Zooming out we look at dormancy flow as a macro/high time frame chart.

At a high-level dormancy, flow compares the amount of coin destruction to Bitcoin’s market cap.

What is destruction? Think of it this way: A coin is moved to a wallet and sits there for 10 days. It has now accumulated 10 coin days. Once it is moved out of that wallet, there are now 10 coin days destroyed. Dormancy takes coin destruction and adjusts it for volume because by definition coin days destroyed will be higher in times of high volume.

With that in mind, from the first principles, this is essentially telling us that smarter money has slowed the spending of their coins.

This offers a great zone to average in buys, but not necessarily a “pico bottom”. For momentum-oriented market participants, it’s not a bad idea to wait for the metric to exit the buy zone. Interestingly enough, it seems to be exiting the buy zone as of yesterday. (NFA)

Bitcoin’s hash rate has reached new all-time highs

This is remarkable given how fast it has recovered since the China mining ban. This speaks to the resiliency of the Bitcoin network, as all of this computing power was relocated around the world and back online within months; in a completely uncoordinated decentralized way.

This also has eliminated one of the biggest criticisms of BTC, the claim that the majority of Bitcoin’s mining power was coming from China.

Next, we look at the portion of supply held by retail.

One of the biggest criticisms of Bitcoin is that supply is held by a small portion of market participants. Here I have taken all entities with less than 10 BTC (roughly $425,000) and compared them to the overall Bitcoin circulating supply.

Over time where does this trend: Up and to the right.

The rate of this increases in a bull market, but even in a bear market, we see this trend upwards steadily.

This doesn’t even take into account the fact that most “whales” are actually exchanges/custodians that are holding BTC for hundreds of thousands if not millions of individuals.

Making this argument against Bitcoin is analogous to saying that USD supply distribution is unfair because the banks hold a large portion of the circulating supply of dollars.

Anyone who just looks at the amount of BTC held by the largest Bitcoin addresses is making an intellectually lazy argument against Bitcoin. Not saying the supply distribution is perfect (Bitcoin is still just 12 years old), but is heading in the right direction.

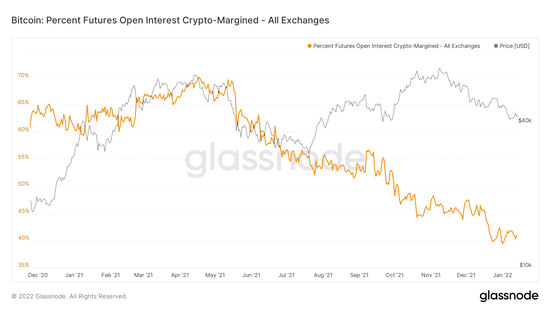

Last we take a look at another macro trend in the Bitcoin market: the decreased percentage of futures open interest collateralized with coin/crypto versus stable coins. Since the May long liquidation event, we’ve seen traders more akin to using stable coins as margin for their futures contracts. This impacts the overall risk structure of the market.

More use of crypto margin means a higher potential convexity (or risk) to the downside. This is because when using crypto as collateral if you’re long and the trade starts to go against you not only is your PnL on the trade decreasing but so is the value of the collateral you have posted for that contract.

This makes you more susceptible to getting liquidated or stopped out of the trade.

Nothing in this article is financial advice, and you should only invest in the market you believe is suitable for your portfolio.