The overweighing factor for the crypto market and all risk-on assets is the fear of monetary tightening and the effect that it will have on markets. This is the trade-off of Bitcoin becoming an institutionalized asset – we will see it have a stronger correlation to macro and traditional markets.

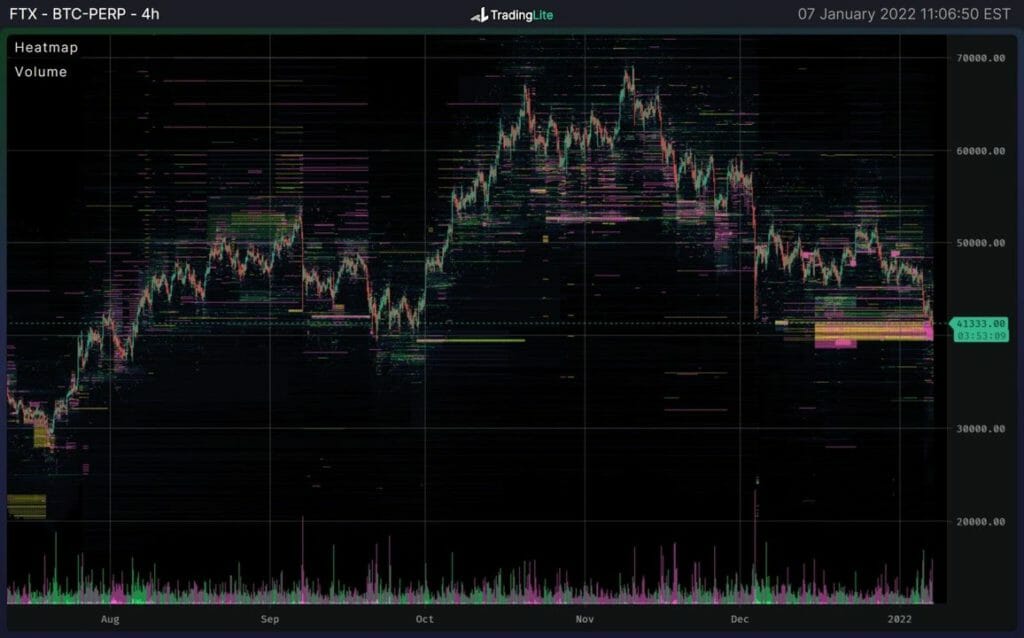

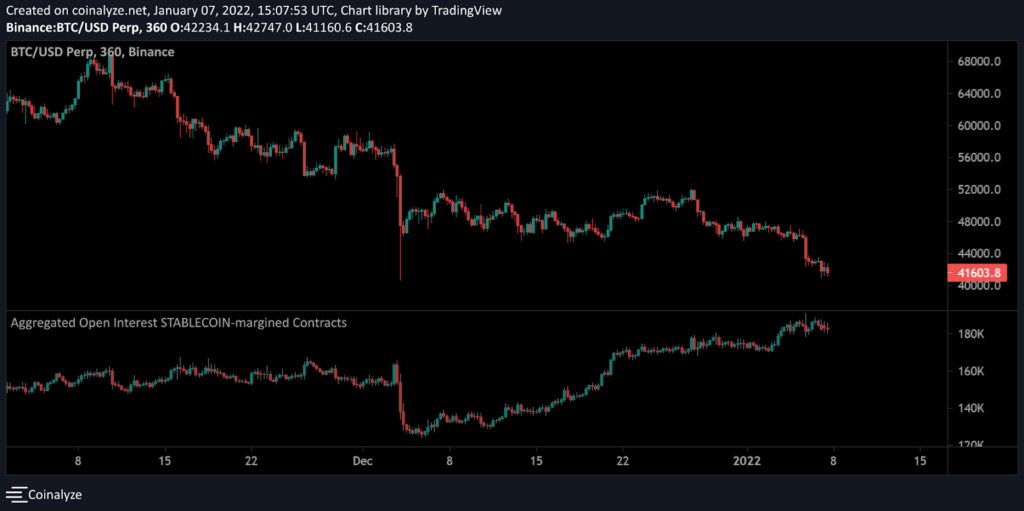

Bitcoin has been in a tight range between $52,000 and $45,000 for the last month. There has been a build-up of open interest during that period, specifically stablecoin margined open interest.

In the perpetual futures market, rather than trading the underlying asset, you are trading contracts or essentially bets on the Bitcoin price. The reason people use these contracts is because of the massive amount of liquidity they offer (the most liquid Bitcoin product) and the ability to access cheap leverage.

Open interest tells you the number of contracts that are currently open and have been opened.

Table of Contents

Can you show short open interest versus long open interest?

The answer is no.

Why?

There is a long and a short on both sides of every contract.

Open interest does not tell you about the positioning of market participants but instead shows you the amount of “pressure” through the leverage position that is built up. In that sense, I often look at open interest build-up as a proxy for when to expect significant volatility in the BTC market.

This, paired with the fact that implied volatility (the volatility that is priced into the Bitcoin options market) was at the lowest since the summer, made me feel that volatility was inbound.

So we talked about the fact that open interest is built up, but remember, this only tells us how many contracts are open, not about positioning.

To understand positioning, we need to understand the risk structure of both sides of the open contracts. We talked about the ideal case for bulls was to see a re-accumulation period showing adverse to mixed funding, similar to summer.

Funding hasn’t offered a clear signal to positioning over the last month. Aside from a few dips negative, it has overall just been muted. Not aggressively positive, not overly negative, just flat.

We are at massive macro support, the invalidation for the idea is so explicit, and this is the last level that makes sense from a risk-reward standpoint.

Futures Open Interest Leverage Ratio

Perpetual futures open interest relative to market cap shows us the importance of derivatives on the current market structure.

Since July, we are now at the highest this metric has been, showing a massive amount of “pressure” built up through leveraged futures contracts.

Volatility is not over.

Stablecoin margined open interest on Binance is explicitly still near the highest it’s ever been. After this recent price action that wiped out a few hundred million dollars in open interest, there is still a long way to go.

Supply Shock Ratios

When open interest is built up, derivatives data matters most, especially for this letter with a word limit. On-chain supply dynamics still look healthy. This, however, doesn’t take into account the demand side of the equation.

On-Chain Cost Basis

For more conservative HTF traders, this one chart from an on-chain perspective, which they may find interesting, is the short-term holder cost basis.

Either buy support with explicit invalidation below or buy the reclaim of prior resistance flipping to support.

Think this price band offers a solid level to do that for those interested in the latter.

Network Difficulty

People have cited Bitcoin’s hash rate reaching a new all-time high. However, network difficulty, the actual metric that determines miner profitability, has yet to hit a new all-time high.

The current network difficulty is at 24.27 T. The all-time difficulty high set in May of 2021 was 25.05 T. This indicates that difficulty will need to increase roughly 3.2% to surpass the previous all-time high.

Because blocks are, on average, only coming in a few seconds faster than the 10 minutes expected block time, it is unlikely that we will see difficulty adjust to a new all-time high in the next couple of days.

This can partially be attributed to the internet blackouts and nationwide protests in Kazakhstan. Many may be surprised to hear this, but as of August 2021, Kazakhstan accounted for 21.2% of the total Bitcoin hash rate.

This was an attractive location to set up mining farms due to cheap, abundant coal power, and it was a popular location for Chinese miners to escape after the mining ban.