Table of Contents

Bitcoin News: 06th October 2021

- The Decentralised Blogging platform Mirror goes live

- Gary Gensler comments, SEC won’t be banning crypto assets

- Colombia is on the path to use waterfalls to produce Bitcoin

- The United States Bank has partnered with NYDIG to provide bitcoin custody services.

- Qatar National Bank has joined RippleNet in order to increase remittances to Turkey.

- NFT inventor of ‘Evolved Apes’ allegedly flees with $2.7 million.

- AMC Theatres is the first to accept cryptocurrency for e-gift card transactions.

- Bitcoin has reverted to being a $1 trillion asset, as its price has soared to $55 K dollars.

The Decentralised Blogging platform Mirror goes live

Mirror released its first product, a decentralised publishing system, in December of last year. The platform also released economic blocks for crowdfunding, auctions, NFT editions, and splits, as well as a governance product, in the last year. Mirror has grown from a writing tool to a full-stack web3 creative suite for communities and decentralised autonomous organisations (DAOs).

The platform particularly believes that every creative effort should begin with a narrative now more than ever.

Further, the platform announced, “Today, we’re opening up decentralized publishing on Mirror to anybody with an Ethereum address. Anyone can connect their wallet and start writing.”

Mirror looks and feels a lot like the popular blogging site Medium, but it has a lot of crypto-native features and capabilities. It’s a decentralised protocol that allows users to log in and “sign” messages with an Ethereum wallet, as well as use Arweave, a blockchain-based storage technology, to “permanently” back up posts and increase their censorship resistance.

Mirror has been adding numerous crypto-centric economic components to enable monetization for users over the last few months, allowing them to sell NFT items, run auctions, and even launch crowdfunding campaigns.

Gary Gensler comments, SEC won’t be banning crypto assets

During a video chat with members of Congress today, Gensler claimed that the US Securities and Exchange Commission had no plans to ban Bitcoin.

His remarks came in reaction to Representative Ted Budd’s claim that China has been on a “warpath” against bitcoin since 2013. Budd brought up the country’s recent restriction on cryptocurrency transactions.

Quoting Gensler, “the U.S.’s approach is really quite different” from that of China. “It’s a matter of how we get [the cryptocurrency] field within the investor-consumer protection that we have.”

When pressed further, he said that banning cryptocurrency to make room for a government-backed digital currency would be a matter for Congress to decide. He went on to say that the SEC can only work with the authority that has been given to it.

Historically, the Securities and Exchange Commission (SEC) has regulated cryptocurrencies that can be categorised as securities, which includes most new tokens offered by corporations as part of an ICO or other offering. The Securities and Exchange Commission (SEC) considers these assets to be a danger to investors.

As a result, the SEC is uninterested in regulating long-established cryptocurrencies like Bitcoin that do not have an initial sale.

Colombia is on the path to use waterfalls to produce Bitcoin

Instead of producing cocaine, a high-profile Colombian politician has urged that the country looks to El Salvador for inspiration and mine Bitcoin using renewable energy.

A Marxist senator, Gustavo Petro, shared news about El Salvador President Nayib Bukele declaring that the government has begun mining Bitcoin using volcanic energy and added:

“What if the Pacific coast took advantage of the steep falls of the rivers of the western mountains to produce all the energy of the coast and replace cocaine with energy for cryptocurrencies?”

El Salvador’s President Bukele, who legalised Bitcoin legal tender last month, claims that the Central American country would mine Bitcoin using geothermal energy generated by its volcanoes.

Bitcoin mining is the process of verifying transactions on the blockchain with powerful computers in order to create digital asset. However, because it consumes a lot of energy, mining corporations are now exploring for alternative sources of energy to create the asset.

U.S. Bank partners with NYDIG

Crypto custody services are now available to U.S. Bank’s institutional clients in the United States and the Cayman Islands.

According to today’s news, private funds can now maintain their bitcoin with the bank. In the future, support for more coins will be added.

Though the bank is creating a network of providers, NYDIG is the first sub-custodian arrangement it has announced. According to the statement, NYDIG topped the list because of its experience managing compliance and regulatory norms in the field.

Gunjan Kedia, vice-chair, U.S. Bank Wealth Management and Investment Services, commented,

“Investor interest in cryptocurrency and demand from our fund services clients have grown strongly over the last few years. Our fund and institutional custody clients have accelerated their plans to offer cryptocurrency and, in response, we made it a priority to accelerate our ability to offer custody services.”

According to CNBC, the bank would provide private key storage for bitcoin, bitcoin cash, and litecoin as part of its custody products.

Following in the footsteps of a number of other banks, U.S. Bank has decided to take up crypto custody. State Street is launching a new crypto unit, and Bank of New York Mellon will begin offering custody services later this year.

QNB joins RippleNet to increase Remittances to Turkey

Ripple has been steadily increasing the number of financial partners it has throughout the world. Qatar National Bank has established a cooperation with the blockchain solutions firm (QNB). Through its on-demand liquidity (ODL) corridors, this cooperation will make cross-border payments easier.

According to the bank’s release

“According to the agreement both parties signed, QNB will first pilot Ripple’s global financial network technology, RippleNet, with QNB Finansbank in Turkey as part of a group rollout, with ambitions to extend to additional important remittance corridors in the future,”

Over the years, remittances to Turkey have remained high. In the year 2020, it received over $1 billion in remittances from across the world. This prompted Qatar to begin this collaboration by resolving remittances to Turkey before expanding to other RippleNet nations. This is a Fintech effort, according to Heba Al Tamim, QNB’s General Manager of Group Retail Banking, to expand the product offers for its clients. Particularly given the recent increase in worldwide demand for cryptocurrencies.

Ripple’s services have seen an increase in popularity as Qatar National Bank expands its remittance business to additional countries. Despite the fact that it is now being sued in the United States.

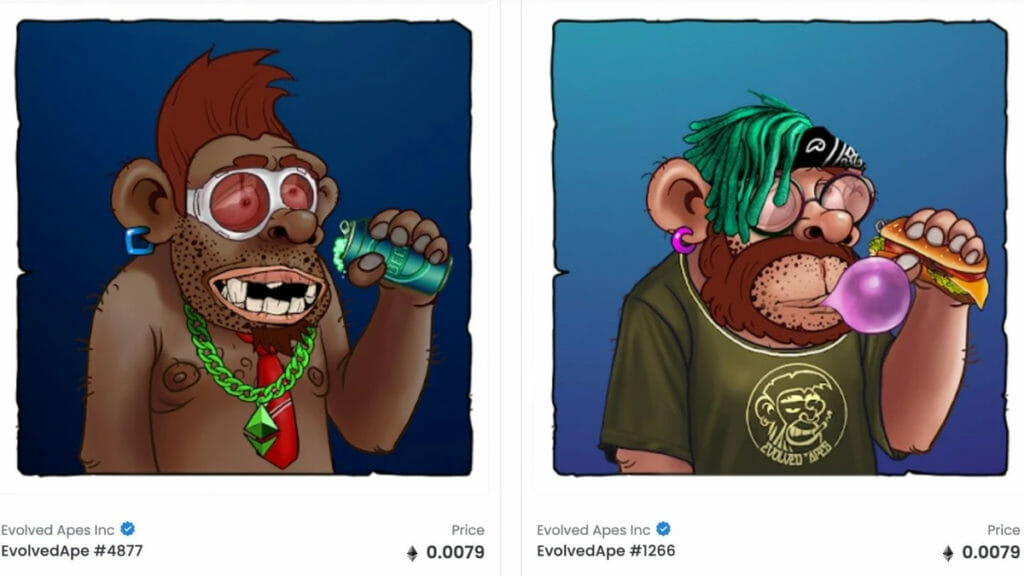

EVOLVED APES’ Inventors Flee with $2.7M

Coming up next, The developer, who goes by the pseudonym “Evil Ape,” is accused of stealing 798 Ether (ETH) worth more than $2.7 million from the project’s funds. The allegedly stolen cash included both the proceeds from the original minting procedure and the ETH exchanged during the secondary sale of NFTs on the OpenSea marketplace.

Evil Ape reportedly shut down the “Evolved Apes” Twitter account and website in addition to allegedly syphoning off all of the project’s funds. Evil Ape and the project’s designers had promised to launch a blockchain combat game before fleeing with the $2.7 million, a promise shared by other avatar-style NFT developers. Under the banner of “Fight Back Apes,” a group of community members have banded together to continue the project’s development.

To avoid a repetition of the Evil Ape disaster, the organisations behind the new faction claim they want to build a more community-centric operational model for the project, including a multisig wallet.

AMC theatres to accept Cryptocurrencies

By 2022, the big American theatre chain hopes to allow consumers to purchase movie tickets using cryptocurrency. AMC Theatres, the world’s largest movie theatre chain, is getting closer to its aim of taking cryptocurrency payments by the end of the year, with crypto purchases for electronic gift cards now available.

CEO Adam Aron said on Tuesday that AMC consumers may now purchase digital gift cards using cryptocurrencies such as Bitcoin (BTC) directly through the AMC website, mobile app, and cinemas.

The new payment option was enabled by BitPay, a prominent crypto payments processor, and allows users to buy e-cards worth up to $200, according to Aron.

Among the digital assets approved for AMC e-card purchases, the CEO singled out Dogecoin (DOGE). Aron suggested in September that towards the end of 2021, AMC will accept DOGE as a cryptocurrency for ticket purchases.

Aron had organised a Twitter poll of 140,000 people, asking if AMC should accept DOGE as a form of payment for tickets. “You’ve made it obvious that you believe AMC should take Dogecoin. We’ll have to find out how to accomplish it now. “Watch this space,” Aron remarked at the time.

Major Cineplex Group, Thailand’s largest movie theatre operator, launched a payment trial earlier this year that allowed consumers to purchase tickets using cryptocurrency.

BTC price Soared to $55 K

Bitcoin (BTC) soared even higher on Oct. 6, with its spot price surging to more over $55,000, its highest level since May 12.

However, futures markets moved in lockstep with intense volatility, despite multiple calls for $57,000 to be hit in the short term.

During the rapid breakout, CME Group Bitcoin futures, which were earlier trading $400 above the spot price, were overrun.

As a result, BTC/USD completely erased the effects of China’s mining restriction in May and re-established itself as a trillion-dollar asset class.

Follow us on Social Media:

Join Our Telegram Channel for more such Technical analysis and Telegram group for free crypto signals.

Medium | YouTube | Twitter | Instagram | Reddit | Facebook | LinkedIn

Read Yesterday’s news here.