Table of Contents

Bitcoin News: 11th November 2021

- FLOKI Token Loses The Bullish Craze, Is This A Good Time to Sell And Protect Your Profits? [LINK]

- Digital asset platform Bakkt reports $28.8 million net loss in Q3 [LINK]

- AMC Now Accepts Bitcoin, Ethereum, Two Other Cryptos, Dogecoin To Follow [LINK]

- Kazakhstan struggles to accommodate new Bitcoin miners amid energy crisis [LINK]

- Bitcoin (BTC) Long-Term Holder Distribution Begins, Watch Out for the Bears [LINK]

- Forte Raises $725 Million for Blockchain Gaming Plans [LINK]

- Shiba Inu ($SHIB) Coming to India’s First Crypto Unicorn With 3.5 Million Users [LINK]

- Here’s Why Dogecoin Withdrawals Are Frozen On Binance [LINK]

FLOKI Token Loses The Bullish Craze

The general trend of FLOKI/USD is bearish from a technical standpoint. Furthermore, the FLOKI token is struggling to find sufficient support from the 0.5 Fibonacci Level, which could lead to its demise.

The $0.0004 mark was the source of heavy selling pressure on the FLOKI token rally on November 4th, triggering a regression phase in its technical chart. The token price has dropped to the 0.5 Fibonacci retracement level, where it is attempting to find sufficient support.

The Relative Strength Index (56) on the other hand, has a persistent fall in its chart, showing that market sellers are becoming more powerful.

In this lower time frame chart, the FLOKI coin exhibited a head and shoulders pattern, presenting a great short opportunity for crypto traders. This pattern’s neckline is at $0.00022, and the price is now sitting just above that level.

Because both the MACD and the signal lines are constantly falling below the neutral zone, the MACD indicator indicates a bearish momentum for this coin.

The 50 and 20 EMAs are also showing bearish crossings on the 4-hour chart, although the 100 EMA may be able to keep the stock above its neckline. The price might fall to the $10700 or $0.00018000 support levels if it obtains enough bearish momentum.

Digital asset platform Bakkt reports $28.8 million net loss in Q3

Bakkt has released its first quarterly financial report as a publicly traded business, revealing a net loss of $28.8 million for the quarter ended September 30, 2021.

Bakkt’s revenue for the third quarter was $9.1 million, up from $6.6 million in the same period last year, according to the company’s financial report released on Friday. In addition, the company lost $24.1 million in profits before interest, taxes, depreciation, and amortisation (EBITDA), about double the figures reported in the third quarter of 2020.

The company’s considerable business expenses throughout the quarter undoubtedly contributed to the increase in Q3 loss year over year. According to the report, operating expenses totaled $39 million in the third quarter of 2020, accounting for more than 60% of total spending.

Bakkt has partnered with a number of organisations in the payments, fintech, and crypto industries, including Mastercard and Fiserv. These partnerships are said to be part of the company’s effort to transition from a solely institutional Bitcoin futures exchange to a more consumer-focused digital asset exchange.

In October, the Intercontinental Exchange-backed company started trading on the New York Stock Exchange. Following a merger with VPC Impact Acquisition Holdings, the company went public.

In a statement, Bakkt CEO Gavin Michael said, “As we move forward, we will utilise the revenues from our recent business combination to activate our alliances, further deploying our capabilities with consumers, businesses, and institutions.”

However, year-to-date, only 1.7 million transactional addresses were reported in Friday’s report. With only a quarter remaining in the year, this figure is much lower than the company’s previous prediction of 9 million customers by the end of 2021.

AMC Now Accepts Bitcoin, Ethereum, Two Other Cryptos, Dogecoin To Follow

AMC has become the first theatre chain to accept Bitcoin, Ethereum, and other cryptocurrencies as payment methods. After CEO Adam Aron originally declared the entertainment giant’s plans to accept crypto payments by the end of the year, it’s taken a long time for this to happen. According to the release, crypto payments for cinema tickets and concessions would be accepted online.

Everything appears to have gone according to plan on AMC’s end, since the cancellation three months ago said that the business will begin accepting cryptocurrency payments in the fourth quarter of the year. Aron turned to Twitter to share the joyful news that AMC has started accepting payments in four different cryptocurrencies. Bitcoin, Ethereum, Bitcoin Cash, and Litecoin were among them.

Initially, Bitcoin was the only cryptocurrency accepted by the theatre chain, but owing to popular demand, the theatre chain added more choices. One of the arguments was that bitcoin had large transaction fees and would not be the best choice for minor transactions. Soon after the bitcoin announcement, CEO Adam Aron announced the addition of Ethereum, Bitcoin Cash, and Litecoin to the platform.

Other additions came later, after Aron conducted a Twitter vote. He asked the community in a poll if they wanted the popular meme coin Dogecoin to be accepted, and the majority said yes. As a result, AMC has implemented Dogecoin payments for gift cards and expects to implement Dogecoin payments for movie tickets and snacks in the near future.

Aron stated in the announcement tweet that Dogecoin payouts will be forthcoming. There was no specific timetable mentioned, but with four cryptocurrencies now in use, rumours suggest it won’t be long before it happens. Aron, on the other hand, had mentioned nothing about Shiba Inu, its newest crypto addition.

On Twitter, the CEO conducted another vote, this time for Dogecoin’s rival Shiba Inu. The majority had voted to include the meme coin as a payment mechanism once more, and Aron had affirmed in an earnings call that Shiba Inu payments would be implemented in the future. The SHIB community has questioned about when they would be able to pay with their coins, but there has been no response from AMC on the subject.

Along with cryptocurrency payments, Google Pay, Apple Pay, and PayPal were all introduced.

Kazakhstan struggles to accommodate new Bitcoin miners amid energy crisis

Kazakhstan, the second most popular location for Bitcoin mining, is facing an impending energy crisis as displaced Bitcoin miners seek refuge in the city to take advantage of its inexpensive electricity.

Following China’s strong crackdown on Bitcoin-related transactions, exiled Chinese miners sought asylum in Kazakhstan, where they could mine Bitcoin without the interference of the Chinese authorities. Kazakhstan has become a popular alternative for Bitcoin miners due to its inexpensive electricity supply; however, a recent development has prompted the country to question its newly gained title.

However, Kazakhstan is currently facing an energy crisis as a result of increased Bitcoin mining activity, which has forced miners to make excessive use of the city’s cheapest electric supply, which is rapidly decreasing.

The country has among of the lowest electricity prices in the world, with rates that are about half of those in the United States. Kazakhstan is an attractive region to mine Bitcoin because of the lower prices and rates.

However, due to the unexpected inflow of Chinese miners, the country is facing an impending energy crisis because it relies largely on coal to generate electricity, and the overuse of natural resources is rapidly depleting the country’s coal supplies.

Furthermore, on Tuesday, the National Association of Blockchain and Data Centers asked for a solution that includes pursuing grey miners and pushing them to follow crypto rules and legitimately mine bitcoin.

“While many illicit miners have set up operations in recent months,” said organization president Alan Dorjiyev in a statement, “many Bitcoin mining enterprises have been functioning in the country for many years, fully complying with all regulations, paying their taxes, and providing local jobs.”

He went on to say that the organization is working closely with both the Ministry of Energy and the Ministry of Digital Development to “establish a fair and transparent market where those who follow the rules may thrive while those who don’t will be put out of business.”

Bitcoin (BTC) Long-Term Holder Distribution Begins

Bitcoin (BTC), the world’s largest cryptocurrency, has been trading sideways since hitting an all-time high of $69,000 earlier this week. Bitcoin is currently trading 1.75 percent lower at $63,823 with a market capitalization of $1.203 trillion as of press time.

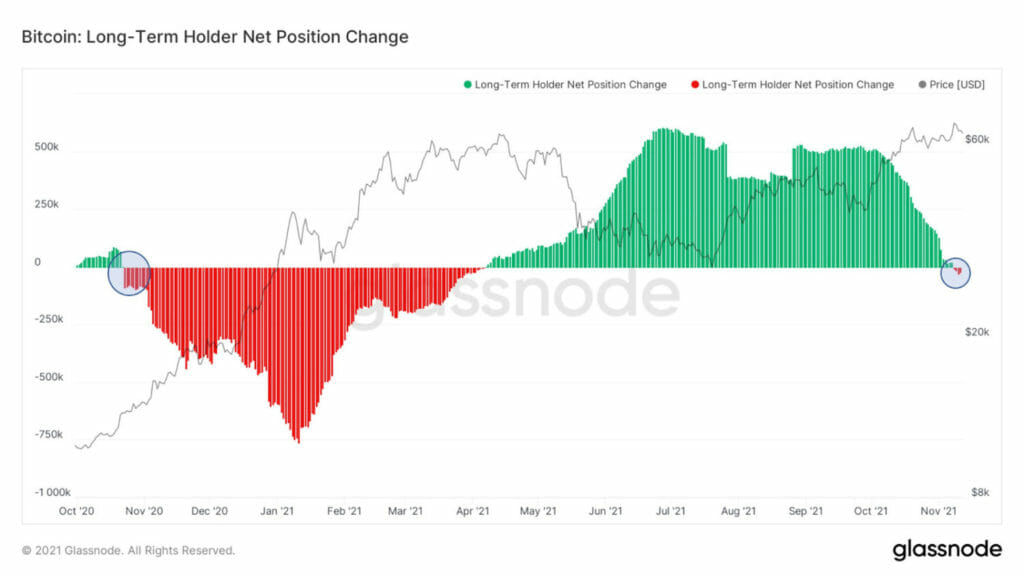

Long-term BTC holders have begun profit-booking and distributing their coins for the first time in six months, according to some on-chain measurements. Will Clemente, a well-known crypto expert, describes the graph of Long-Term Holder Distribution:

“Long-term investors buy BTC at a low price and sell at a high price. The first red prints on LTH net position change in over 6 months have now arrived, indicating that bull market distribution has begun.”

The Bitcoin financing rate for long futures positions, on the other hand, has slowed across the board. This could be a sign of a future downturn in the bullish trend. Short-term holders decided to profit-book on Friday, sending the BTC price to a low of $62,300, according to another prominent journalist Colin Wu.

The Securities and Exchange Commission (SEC) of the United States rejected VanEck’s spot Bitcoin exchange-traded fund (ETF) on Friday, November 12. This ETF aims to track the spot BTC price fluctuation.

The denial is based on the possibility of market manipulation in Bitcoin. The Cboe BZX Exchange first filed the application for the VanEck spot Bitcoin ETF in March. The Securities and Exchange Commission of the United States (SEC) has stated that VanEck has not done enough to reassure investors that it can avoid fraudulent trading.

The Bitcoin price has risen by 5% since the beginning of November and is up by nearly 10% on the monthly charts. While the charts suggest that long-term investors are profiting at this price, PlanB, the inventor of the stock-to-flow strategy, believes that the BTC price will reach $98K by the end of November.

Forte Raises $725 Million for Blockchain Gaming Plans

Forte, a supplier of blockchain gaming solutions, revealed today that it has raised $725 million in its most recent fundraising round.

Forte revealed that its most recent fundraiser helped the company earn more than $900 million for 2021. Though it did not disclose its current valuation, the company previously raised $185 million and was valued at $1 billion in a Series A fundraising round, according to the statement.

Sea Capital and Kora Management, two well-known venture capital firms, lead the current Series B fundraising round.

Big Bets, Overwolf, Playstudios, Warner Music Group, zVentures, Griffin Gaming Partners, Andreessen Horowitz (a16z), and Tiger Global are among the other contributors.

Cosmos, Polygon Studios, Solana Ventures, and Animoca Brands—the business behind the famous Ethereum game The Sandbox—were among the companies and projects that contributed to the investment round.

Forte enables game developers to include blockchain features like non-fungible tokens (NFTs) and cryptocurrency transactions, as well as compliance elements like anti-money laundering (AML) and IP protection, into their businesses. It also supports interoperability and multiple chains.

Josh Williams, Forte’s co-founder and CEO, stated that the gaming industry is “at the vanguard of a new technology wave, and blockchain gaming will be even bigger than all the shifts we’ve seen before,” adding that Forte seeks to serve both large and small producers.

The company has teamed up with 40 game developers, who have a combined 15 million gamers. Kongregate, a renowned web game site created in 2006, and Gallium Studios, an independent studio founded by Will Wright of SimCity fame, are two of Forte’s most notable partners.

Today’s announcement follows a flurry of other gaming-related announcements. Steam has reportedly disavowed cryptocurrencies and NFTs, while Discord, a popular gaming chat site, has received anger from gamers about prospective crypto integration.

GameStop and Ubisoft appear to be working on crypto plans as well, though their efforts have sparked far less outrage.

Shiba Inu ($SHIB) Coming to India’s First Crypto Unicorn With 3.5 Million Users

Shiba Inu ($SHIB), a popular meme-inspired cryptocurrency, has been listed on Indian cryptocurrency trading platform CoinDCX’s retail-friendly platform. SHIB was previously exclusively available in trade-only mode on the professional-oriented CoinDCX Pro platform.

The listing took place on Friday, November 12th, according to a tweet from CoinDCX. CoinDCX is aiming to sign up 50 million users in India, with over 3.5 million currently registered.

After obtaining $90 million in a funding round sponsored by B Capital, a venture capital fund founded by Facebook co-founder Eduardo Saverin, CoinDCX became India’s first unicorn cryptocurrency startup, with a valuation of over $1 billion.

Last month, India’s oldest cryptocurrency trading site Zebpay featured SHIB, stating it “motivated millions of people around the world to finance and fund a coin with a doggo’s picture on it,” according to CryptoGlobe.

This year, the price of Shiba Inu soared due to a retail trade craze centred on meme coins. With 2.8 million average monthly searches, SHIB is the third most Googled cryptocurrency so far this year. It momentarily eclipsed Ethereum, the second-largest cryptoasset by market capitalization, in terms of trading volume.

Despite its recent price fall, Johnny Lyu, the CEO of famous cryptocurrency trading platform KuCoin, has stated that the meme-inspired cryptocurrency is worth holding over the long run.

Retail investors, according to Lyu, are “extremely passionate about such tokens and are determined to drive values higher.” Despite Shiba Inu’s recent drop, Lyu stated that he intends to hold the cryptocurrency, as well as bitcoin and DOGE, for the long term. According to him, BTC might operate as an inflation hedge, whereas meme tokens symbolise the strength of their communities.

Notably. According to Delphi Digital, a digital asset research organisation, dog coins, or cryptocurrencies based on the popular Shiba Inu meme, have traditionally been “a pretty solid indication of an overheated market.”

Here’s Why Dogecoin Withdrawals Are Frozen On Binance

Withdrawals of Dogecoin have been halted on Binance, the world’s largest cryptocurrency exchange. The exchange’s motives have been questioned as a result of the freeze. However, it appears that the decision was made out of necessity.

It’s not the first time that Dogecoin investors have had issues storing their coins on exchanges and trading sites. At the height of the Doge rally, a similar situation arose with Robinhood, but it was quickly remedied.

This time, though, it is Binance users who are facing issues with their Dogecoin holdings. While users wait for withdrawals to be authorised, here are the reasons Binance decided to put the freeze in place in the first place.

On Thursday, Binance announced the withdrawal freeze in a blog post. It blamed the problem on problems with the Doge network following an upgrade. However, the glitches have had a negative impact on the crypto exchange’s users. Aside from being unable to withdraw Dogecoin from the platform, some users appear to have been notified of a “Doge debt.”

One person took to Reddit to detail the issues they were having with Binance. Apparently, Dogecoin withdrawals to various other wallets were initiated on their accounts, but the transactions were not completed by them.

Binance appears to have resent Doge transactions that had become stuck due to insufficient network fees in the past, and is now asking users to refund the Dogecoin to the exchange. The only issue currently is that the users have no Doge in their accounts to return.

The freeze, along with the “Doge debt,” is causing problems for users, who have been told that until they return the Doge, their accounts would be frozen indefinitely. How, on the other hand, do you refund coins that you don’t have?

Although it appears that this has only lately been a problem for crypto exchange consumers, it appears that it has been a problem for some time. The Dogecoin developers’ Twitter account took to the site to clarify their side of the storey, claiming that the issue may have happened because Binance did not follow their instructions.

According to the evidence, the problem began a year ago when Binance contacted the developers about blocked transactions on their end. Binance had been informed by the developers that the transactions were likely stopped due to insufficient fees and that the crypto exchange should issue -zapwallettxes when resending these transactions.

They never heard back from Binance about whether or not the advice was followed.

Now, a year later, the Doge network’s most recent upgrade has been successfully deployed, lowering the transaction’s minimum charge. Because the min fee was low enough, these erroneous transactions were relayed successfully after Binance switched to the current version.

The developers then offered a remedy to other providers who may be experiencing the same issue; Dogecoin withdrawals on Binance are still stuck. The exchange, on the other hand, is working with the Doge developers to remedy the problem as soon as feasible.

Read Yesterday’s News Here.