Table of Contents

Bitcoin News: 11th October 2021

- Bitmain will no longer supply Bitcoin mining equipment to China.

- On October 13th, Revault will launch its Yield Maximizer Platform.

- El Salvador’s president plans to utilise bitcoin revenues to establish an animal hospital, according to a tweet.

- Sri Lanka establishes a committee to deploy cryptocurrency mining and blockchain technology.

- The opposition in South Korea is preparing to take on the country’s contentious crypto tax law.

- Senator Ted Cruz proposes that Texas employ Bitcoin mining to absorb unused natural gas.

- Miners of Ethereum (ETH) are hoarding over $2 billion in mining rewards.

- BSN, a Chinese blockchain enterprise, now has offices in Turkey and Uzbekistan.

Bitmain will no longer supply Bitcoin mining equipment to China

Following the country’s crypto prohibition, Bitmain, a Chinese cryptocurrency mining equipment company, will expand its operations outside of China. In order to comply with local legislation, Bitmain will be suspending delivery to mainland China locations, but foreign commerce will continue as usual, the company said in a blog post on Sunday.

“From October 11, 2021, Antminer will stop shipping to mainland China. For customers in mainland China who have purchased long-term products, our staff will contact them to provide alternative solutions.”

Bitmain’s company has began to suffer, as had many other crypto firms, as a result of new laws in China since 2017. In 2017, it had a roughly 50 percent domestic market share, and in the first half of 2018, it had a 40 percent market share.

Although Bitmain finally exited the domestic market as a result of the crackdown, the firm ascribed the decision to China’s carbon-neutral policy.

It also announced that the World Digital Mining Summit 2021 will be held in Dubai in 2021 to examine green energy mining prospects. It was stated, “This would not harm international business, but what about domestic business?” Users in China have been suffering for the past several months, and Bitmain has yet to announce its intentions for dealing with them.

However, Antminer crypto mining equipment will continue to be available to customers all across the world, including in Taiwan and Hong Kong.

Meanwhile, the void left as a result of this was apparently filled by an increase in at-home mining operations in China using graphics processing units [GPUs], but the Chinese authorities’ crackdown was intensifying, and no hidden operations could operate.

Nonetheless, the Bitcoin value had been affected by a gap in mining activities, which was now on the mend. Since late July, miners have relocated to more convenient sites throughout the world, and the hash rate has grown by 39%.

On October 13th, Revault will launch its Yield Maximizer Platform.

Revault customers will be able to quickly identify the top performing vaults for their assets and will benefit from an automated rebalancing function that adjusts their position whenever a new vault enters the lead, with the goal of becoming the Google search of Decentralized Finance (DeFi).

The project was created by Defi.org and its founding partners, Binance, Moonstake, and Orbs, to address two fundamental issues in DeFi: locating the best location to put your assets to work, and maintaining that position so that it is always at its best. Revault is able to provide real-time vault APY using its own vault indexer, eliminating the need to trust their supplied data.

Revault’s Initial Liquidity Offering (ILO) will take place on October 13th, 12:00 PM CET, and will raise up to $440K USD, which will be split amongst three launchpads: Lightning, Poolz, and DAOmaker’s Infinity Pad. As the name implies, 100% of the BNB raised in the ILO, as well as the Presale donations, will remain locked as liquidity on PancakeSwap in the form of $REVA tokens of identical value.

The project’s official Medium account has the entire $REVA tokenomics, DAO, and ILO information.

Revault will deploy its beta version of the platform on October 14th, allowing holders of its governance token ($REVA) to begin staking the tokens for staking incentives.

The Revault team has doxxed themselves, disclosing its vast blockchain experience with founding members of crypto businesses and veteran projects like Orbs, Bancor, Efficient Frontier, and others, after being in stealth mode for almost a year.

El Salvador’s president plans to utilise bitcoin revenues to establish an animal hospital

El Salvador’s president, Nayib Bukele, revealed in a series of tweets on Saturday that a portion of the country’s $4 million in bitcoin revenues will be used to create a modern-looking pet hospital.

The trust that El Salvador established to assist make Bitcoin legal tender currently has a surplus, according to Bukele, due to the cryptocurrency’s rising value. El Salvador’s legislature authorised the $150 million fund before Bitcoin became a legal tender on September 7, and the nation has also acquired 700 bitcoins in total. Bukele explained how the trust works and why it has a surplus in a series of tweets on Oct. 9. According to the president, the amount of money in this trust, known as FIDEBITCOIN, is set by law in dollars.

The balance sheet of the trust contains both cash and bitcoin. Chivo, the trust’s operating firm, must pay Bandesal, El Salvador’s development bank, that amount in dollars.

The balance sheet of the trust contains both cash and bitcoin. Chivo, the trust’s operating firm, must pay Bandesal, El Salvador’s development bank, that amount in dollars. Salvadorans use Chivo, a commission-free wallet software, to transfer remittances and make digital payments to companies in both dollars and bitcoin.

The trust currently has a $4 million excess, according to Bukele.

Chivo can get rid of those millions without hurting the trust’s overall balance, which retains the same amount of bitcoin even if the value of the US dollar falls.

“By the way, we’re not selling any BTC, [we are] using the USD part of the trust, since the BTC part is now worth more than when the trust was established,”

Bukele responded with a tweet in English. He also stated that the pet hospital’s worth “would most likely rise in comparison to USD.”

Sri Lanka establishes a committee to deploy cryptocurrency mining

After forming a committee to investigate and deploy blockchain and crypto mining technologies, Sri Lanka has joined the global crypto adoption campaign.

Sri Lanka’s director general of government information, Mohan Samaranayake, published a letter on Oct. 8 indicating that the authorities had accepted a recent proposal aimed at attracting investments in the country’s blockchain and cryptocurrency projects.

The Sri Lankan government, according to Samaranayake, has highlighted the necessity to build “an integrated system of digital banking, blockchain, and cryptocurrency mining technologies” in order to keep up with global partners and international markets. He continued, “

“This committee will be mandated to study the regulations and initiatives of other countries such as Dubai, Malaysia, Philippines, EU and Singapore, etc., and propose a suitable framework for Sri Lanka.”

Namal Rajapaksa, the minister of project coordinating and monitoring, proposed that the committee transmit its conclusions on crypto and blockchain to the Cabinet of Acts, Rules, and Regulations.

Two of the committee’s eight members, Sandun Hapugoda of Mastercard and Sujeewa Mudalige of PricewaterhouseCoopers (PwC), represent worldwide fintech heavyweights. Traditional finance members include Rajeeva Bandaranaike, CEO of the Colombo Stock Exchange, and Dharmasri Kumarathunge, director of the Central Bank of Sri Lanka.

The President’s Council, Sri Lanka Computer Emergency Readiness Team (SLCERT), Department Of Government Information, Information and Communication Technology Agency (ICTA), and the President’s Council are among the remaining four members.

The committee will also examine laws and regulations enacted by other countries to create rules against anti-money laundering (AML), terror funding, and criminal activities, in support of this endeavour.

The opposition in South Korea is preparing to take on the country’s contentious crypto tax law.

Opposition legislators are asking for a one-year delay in the law’s implementation as well as a reduction in the tax burden on cryptocurrency dealers.

South Korea’s opposition People Power Party lawmakers have prepared a new challenge to the proposed crypto tax bill.

According to The Korea Herald, opposition legislators are pushing for a one-year delay in the country’s implementation of crypto taxes.

In 2022, South Korea’s crypto tax policy, which will impose a 20% charge on cryptocurrency earnings above 2.5 million Korean won ($2,100), will take effect.

Aside from the one-year delay, MPs are also pressing for a multi-tiered tax on cryptocurrency, similar to the Financial Investment Income Tax system slated to take effect in 2023.

Instead of the government’s 20 percent flat rate on earnings above $2,100, the legislators propose a 20 percent flat rate on gains between 50 million and 300 million won ($42,000 to $251,000) and a 25 percent flat tax on profits over 300 million won.

Representative Cho Myoung-hee, speaking on the need to reduce the burden on crypto investors, suggested that a tax system for cryptocurrencies should be aligned with the country’s financial investment income tax.

However, an agreement reached between legislators and the country’s finance minister is said to have put an end to any attempts to postpone the crypto tax law’s implementation.

Senator Ted Cruz proposes that Texas employ Bitcoin mining to absorb unused natural gas

Senator Ted Cruz of the United States argues that instead of flaring natural gas, the US should use it to mine Bitcoin.

Senator Ted Cruz stated at the Texas Blockchain Summit on Oct. 8 that Bitcoin mining may be used to monetize energy produced by oil and gas production rather of burning it, claiming that there is a “enormous opportunity for Bitcoin to capture that gas instead of squandering it.”

Cruz said that half of the natural gas flared in the country is now being burnt in West Texas, according to a copy of the lecture posted on social media by Coin Metrics creator Nic Carter.

He went on to say, “It’s being squandered because there is no transmission infrastructure to deliver that natural gas where it might be used the way natural gas would normally be used.”

Use that power to mine Bitcoin. Part of the beauty of that is the instant you’re doing it you’re helping the environment enormously because rather than flaring the natural gas you’re putting it to productive use.”

Cruz stressed Bitcoin mining’s ability to respond instinctively to variable energy supplies, claiming that electricity could be restored to the grid instantly in the case of a power outage or shortage.

El Salvador recently announced plans for a state-backed Bitcoin mining facility powered by renewables, echoing Cruz’s belief that Bitcoin mining might be an effective way to collect renewable energy.

Miners of Ethereum (ETH) are hoarding over $2 billion in mining rewards.

According to Santiment, a behaviour analysis tool, Ethereum (ETH) miner balances continue to rise, reaching a 50-month high.

According to the supplier of on-chain and social metrics monitoring, the quantity of Ethereum owned by miners has hit its highest level since July 2016.

The analytical tool said that the current total balance of Ethereum is 532,750, but that the value of these currencies is rapidly nearing $2 billion.

The price of Ethereum has risen 10.32 percent in the last seven days, recently reaching the $3,600 milestone.

The unwillingness to sell mining rewards reveals a strong HODL attitude among Ethereum miners, who presently hold 0.45 percent of the cryptocurrency’s entire circulating supply of 117,7 million coins.

According to recent statistics, Ethereum miners aren’t the only ones who expect the price to rise further.

Despite high gas prices and increased competition, the network settled $6.2 trillion in the previous year, a 350 percent rise, according to crypto analytics firm Messari.

Meanwhile, according to a recent CoinShares poll, fund managers continue to increase their Ethereum holdings, citing the “most compelling” growth forecast.

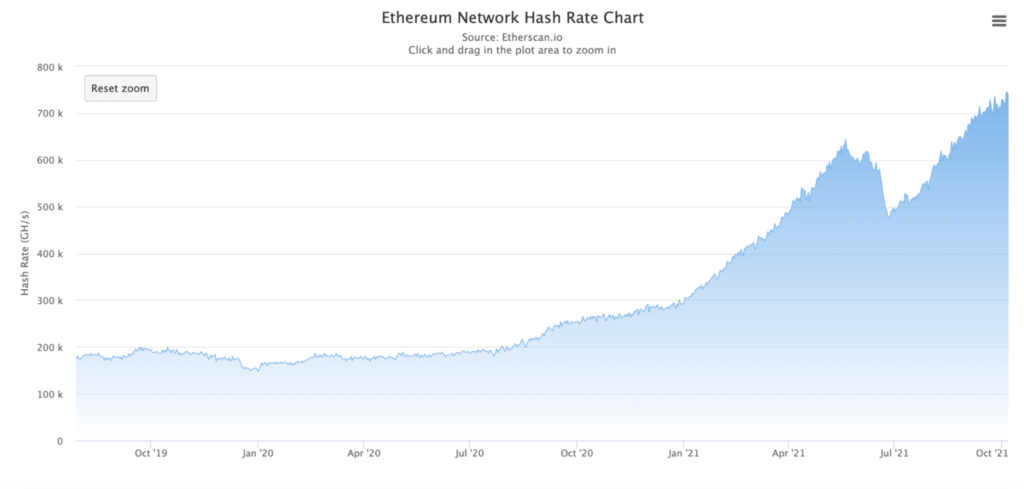

Following the miner migration in China, the Ethereum hash rate, a measure of computing power per second that reflects the network’s vitality and security, plummeted to 477 terahashes per second (TH/s) in late June.

According to Etherscan data, it has fully rebounded in recent months and is already up 150 percent since the beginning of the year.

Despite the closure of large China-based Ethereum mining pools SparkPool and BeePool in recent weeks, the hash rate has remained stable, reaching an all-time high of 745 TH/s on Tuesday.

BSN, a Chinese blockchain enterprise, now has offices in Turkey and Uzbekistan.

The Blockchain-based Service Network (BSN), a Chinese government-backed blockchain project, continues to expand its worldwide reach by launching two new portals in Turkey and Uzbekistan.

In late December 2021, Red Date Technology, the project’s architect, will launch two international BSN portals in Turkey and Uzbekistan in collaboration with Turkish consultancy company Turkish Chinese Business Matching Center (TUCEM).

TUSEM was founded in 2006 and has since grown into a major commercial cooperation hub between Turkey and China. The business will be the only operator of two new BSN websites in Turkey and Uzbekistan that will provide blockchain-as-a-service (BaaS).

The new portals will allow Turkish and Uzbek blockchain developers to create BaaS apps utilising the global BSN portal, which supports major blockchains such as the Ethereum network, Algorand, Polkadot, Tezos, ConsenSys Quorum, Corda, and others. The effort seeks to address significant problems in blockchain application development, as well as allow blockchain interoperability and reduce development costs. On September 1, BSN launched a Hong Kong and Macau site, assisting in the creation of over 30 new blockchain projects. In November, BSN aims to launch an international BSN site in South Korea.

Follow us on Social Media:

Join Our Telegram Channel for more such Technical analysis and Telegram group for free crypto signals.

Medium | YouTube | Twitter | Instagram | Reddit | Facebook | LinkedIn

Read Yesterday’s news here.