Imagine Bitcoin as a digital version of money. Just like you have physical cash or coins in your wallet, Bitcoin exists only online. It’s not printed like dollars or euros; instead, it’s created and held electronically. What makes Bitcoin unique is that it’s decentralized, meaning it’s not controlled by any single government or organization. Instead, it’s managed by a network of computers all around the world, making it secure and resistant to censorship.

Cryptocurrency is a broad term that refers to digital or virtual currencies that use cryptography for security. Bitcoin is one example of a cryptocurrency, but there are thousands of others, each with its own unique features and uses. Cryptocurrencies are typically built on blockchain technology, which is a decentralized ledger that records all transactions across a network of computers. This technology ensures that transactions are secure, transparent, and tamper-proof.

An ETF is like a basket that holds a collection of different assets, such as stocks, bonds, or commodities. When you buy shares of an ETF, you’re essentially buying a piece of that basket, which gives you exposure to the underlying assets. A Bitcoin ETF works similarly, but instead of holding traditional assets like stocks or bonds, it holds Bitcoin. This allows investors to invest in Bitcoin without actually owning the cryptocurrency itself. ETFs are traded on stock exchanges, making them accessible to a wide range of investors and providing liquidity.

Table of Contents

Bitcoin ETF

A Bitcoin ETF is like a convenient way for investors to invest in Bitcoin without actually buying and holding the cryptocurrency themselves. Instead of going through the process of setting up a digital wallet and purchasing Bitcoin directly from an exchange, investors can simply buy shares of a Bitcoin ETF through their regular brokerage account, just like they would buy shares of a company’s stock.

Imagine you want to invest in Bitcoin, but you’re not comfortable with the complexities of managing digital wallets or the security risks associated with holding cryptocurrencies. In this case, you can opt for a Bitcoin ETF. Let’s say there’s a Bitcoin ETF called “BTCETF” trading on the stock market. You decide to buy some shares of BTCETF through your brokerage account. Now, you indirectly own Bitcoin through the ETF, and your investment value will rise or fall based on the performance of Bitcoin.

Benefits

- Convenience: Bitcoin ETFs make it easy for investors to gain exposure to Bitcoin without dealing with the technicalities of buying, storing, and securing cryptocurrencies.

- Regulated and Accessible: ETFs are regulated investment vehicles traded on stock exchanges, making them accessible to a wide range of investors through their brokerage accounts.

- Diversification: Some Bitcoin ETFs may hold a diversified portfolio of cryptocurrencies or other assets related to the cryptocurrency market, providing investors with exposure to the broader crypto market.

Also Read ➤ ➤ What Are the Best Mobile Crypto Games To Play?

Crypto ETF

A crypto ETF is similar to a Bitcoin ETF but encompasses a broader range of cryptocurrencies beyond just Bitcoin. It allows investors to gain exposure to a diversified portfolio of cryptocurrencies through a single investment vehicle, making it easier to invest in the broader crypto market without having to pick individual coins.

Imagine you’re interested in investing in various cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin, but you don’t have the expertise to analyze each coin individually or the time to manage multiple wallets. In this scenario, you could invest in a crypto ETF that holds a diversified portfolio of cryptocurrencies.

Benefits

- Diversification: Investing in a crypto ETF allows investors to spread their risk across multiple cryptocurrencies, reducing the impact of volatility in any single coin.

- Simplicity: With a crypto ETF, investors can gain exposure to the entire cryptocurrency market through a single investment, eliminating the need to research and manage multiple coins individually.

- Accessibility: Like Bitcoin ETFs, crypto ETFs are traded on regulated exchanges, making them accessible to a wide range of investors through traditional brokerage accounts.

In summary, Bitcoin and crypto ETFs provide investors with convenient, regulated, and diversified ways to gain exposure to the cryptocurrency market, whether they’re interested in investing specifically in Bitcoin or across a broader range of cryptocurrencies.

Also Read ➤ ➤ Earn Bitcoin For Free

Are Bitcoin ETFs safe?

Like any investment, Bitcoin ETFs carry risks, including market volatility and regulatory uncertainty. However, reputable ETFs are typically managed by experienced professionals and subject to regulatory oversight, which can help mitigate some risks. It’s essential for investors to conduct their research and understand the risks before investing.

Can I buy a Bitcoin ETF in my brokerage account?

Yes, most Bitcoin ETFs are traded on stock exchanges like traditional stocks, making them accessible to investors through brokerage accounts. Investors can buy and sell shares of Bitcoin ETFs through their brokerage accounts just like they would with other securities.

How do I choose the right Bitcoin ETF for my investment?

When selecting a Bitcoin ETF, investors should consider factors such as fees, liquidity, regulatory compliance, and the reputation of the fund manager. It’s essential to research different ETFs and consult with a financial advisor if needed to make an informed investment decision.

What is a crypto ETF, and how does it differ from a Bitcoin ETF?

A crypto ETF is similar to a Bitcoin ETF but encompasses a broader range of cryptocurrencies beyond just Bitcoin. While a Bitcoin ETF tracks the price of Bitcoin, a crypto ETF may include multiple cryptocurrencies in its portfolio, providing investors with exposure to the broader crypto market.

Also Read ➤ ➤ Best 10 Crypto Casinos | Stay safe and EXPLORE!

The Main Agenda – Best Crypto and Bitcoin ETF

Grayscale Bitcoin Trust (GBTC)

Grayscale Bitcoin Trust (GBTC) is a unique Exchange-Traded Fund (ETF) that offers investors exposure to Bitcoin through a trust structure. Unlike traditional ETFs, Grayscale Bitcoin Trust does not directly hold Bitcoin but instead holds shares of Bitcoin. These shares are traded on stock exchanges like traditional stocks, providing investors with a convenient way to invest in Bitcoin without the complexities of managing digital wallets. Grayscale Bitcoin Trust’s unique point lies in its status as one of the first and largest Bitcoin investment vehicles available to institutional and retail investors, offering exposure to Bitcoin’s price movements through a regulated and familiar investment vehicle.

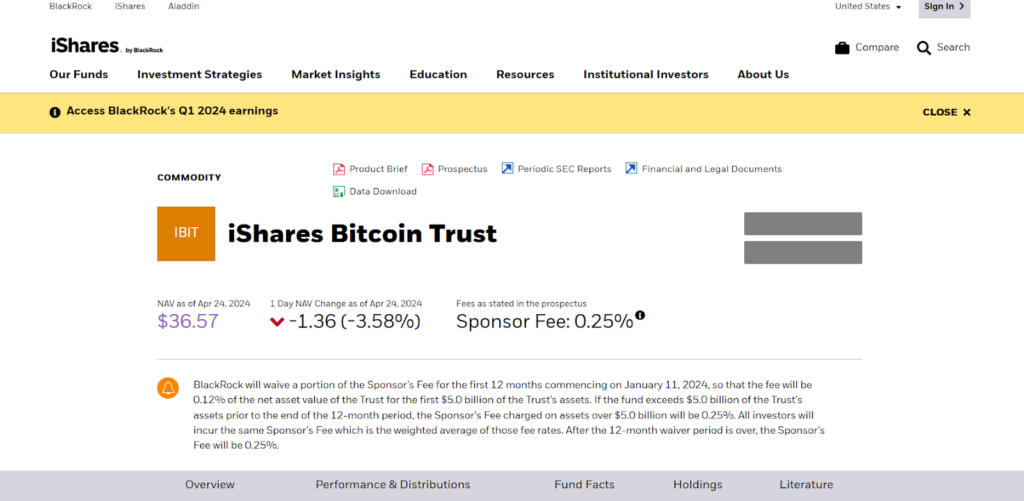

iShares Bitcoin Trust ETF (IBIT)

iShares Bitcoin Trust ETF (IBIT) is another ETF that provides investors with exposure to Bitcoin. Like Grayscale Bitcoin Trust, iShares Bitcoin Trust holds Bitcoin indirectly through a trust structure, allowing investors to buy and sell shares of the trust on stock exchanges. The unique point of iShares Bitcoin Trust lies in its association with iShares, a leading provider of ETFs globally, offering investors a familiar and trusted brand for accessing Bitcoin exposure. IBIT aims to track the price of Bitcoin, providing investors with a simple and accessible way to invest in the digital currency through a regulated and liquid investment vehicle.

Also Read ➤ ➤ Privacy-First Crypto Trading: How VPNs Ensure Your Online Anonymity | Check out NOW!

Invesco Galaxy Bitcoin ETF (BTCO)

Invesco Galaxy Bitcoin ETF (BTCO) is an Exchange-Traded Fund (ETF) that aims to provide investors with exposure to Bitcoin’s price movements. Unlike traditional ETFs, which typically hold a diversified portfolio of assets, BTCO focuses solely on Bitcoin. The unique point of Invesco Galaxy Bitcoin ETF lies in its active management strategy, where the fund manager actively trades Bitcoin futures contracts to track the price of Bitcoin. This active management approach allows the ETF to potentially generate higher returns compared to passive ETFs that simply track the price of Bitcoin.

Bitwise Bitcoin ETF Trust (BITB)

Bitwise Bitcoin ETF Trust (BITB) is another ETF designed to provide investors with exposure to Bitcoin. BITB holds Bitcoin directly, making it different from ETFs that hold Bitcoin indirectly through futures contracts or trusts. The unique point of Bitwise Bitcoin ETF Trust lies in its focus on institutional investors, offering them a regulated and liquid investment vehicle for accessing Bitcoin exposure. Additionally, BITB employs strict security measures to safeguard investors’ assets, ensuring the safety and integrity of the fund.

Amplify Transformational Data Sharing ETF (BLOK)

Amplify Transformational Data Sharing ETF (BLOK) is an ETF that focuses on companies involved in blockchain technology and cryptocurrencies. Unlike ETFs that directly hold cryptocurrencies like Bitcoin, BLOK invests in companies that are developing or using blockchain technology. This unique approach allows investors to gain exposure to the potential growth of blockchain technology without directly owning cryptocurrencies. BLOK’s portfolio includes companies involved in blockchain infrastructure, applications, and services, offering investors a diversified way to invest in the blockchain space.

Also Read ➤ ➤ What according to REDDIT is the next trend in Crypto Space? | Check NOW!

Global X Blockchain ETF (BKCH)

Global X Blockchain ETF (BKCH) is another ETF that provides exposure to companies involved in blockchain technology. BKCH invests in companies that are actively researching, investing in, or utilizing blockchain technology. The unique point of Global X Blockchain ETF lies in its focus on companies that are at the forefront of blockchain innovation, offering investors exposure to the potential growth of this transformative technology. BKCH’s portfolio includes companies from various sectors, including financial services, technology, and supply chain management, providing investors with a diversified way to invest in blockchain technology.

Bitwise Crypto Industry Innovators ETF (BITQ)

Bitwise Crypto Industry Innovators ETF (BITQ) is an ETF that focuses on companies driving innovation in the cryptocurrency and blockchain industry. Unlike ETFs that directly hold cryptocurrencies, BITQ invests in companies that are involved in cryptocurrency mining, blockchain infrastructure, and digital asset exchanges. The unique point of Bitwise Crypto Industry Innovators ETF lies in its focus on companies that are at the forefront of the cryptocurrency industry, offering investors exposure to the potential growth of this emerging sector. BITQ’s portfolio includes companies that are leading the way in cryptocurrency innovation, providing investors with a diversified way to invest in the cryptocurrency industry.

Also Read ➤ ➤ Why Crypto loans are good in a BULL run? – Guide

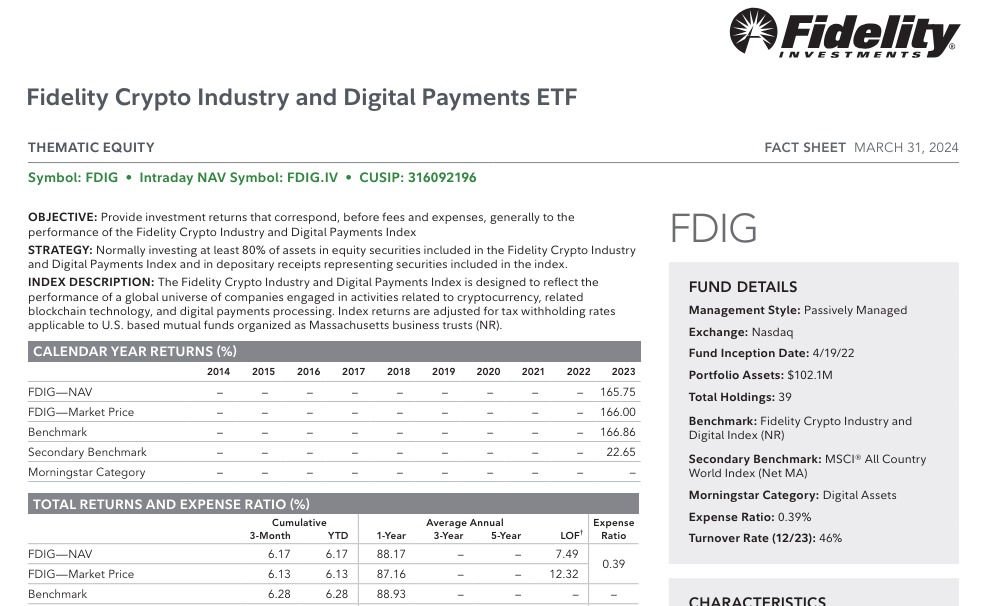

Fidelity Crypto Industry and Digital Payments ETF (FDIG)

Fidelity Crypto Industry and Digital Payments ETF (FDIG) is an ETF that focuses on companies involved in the cryptocurrency industry and digital payments. FDIG invests in companies that are developing or using blockchain technology for digital payments and financial services. The unique point of Fidelity Crypto Industry and Digital Payments ETF lies in its focus on companies that are driving innovation in the cryptocurrency and digital payments space. FDIG’s portfolio includes companies from various sectors, including financial technology, e-commerce, and digital payments, providing investors with exposure to the potential growth of this transformative industry.

Also Read ➤ ➤ How To Choose Right Crypto Exchange For You?- Guide

Conclusion

In conclusion, the best Bitcoin and crypto ETFs offer investors convenient, regulated, and diversified ways to gain exposure to the cryptocurrency market. Whether investors are specifically interested in Bitcoin or prefer a broader exposure to various cryptocurrencies and blockchain technologies, there are ETFs available to suit their preferences and investment goals.

These ETFs provide an accessible entry point for investors who may be hesitant to navigate the complexities of directly owning cryptocurrencies or managing digital wallets. By trading on regulated stock exchanges, these ETFs offer liquidity and transparency, making them suitable for a wide range of investors.

Additionally, the unique features of each ETF cater to different investor preferences. Whether it’s the active management strategy of Invesco Galaxy Bitcoin ETF (BTCO), the focus on blockchain technology companies in Amplify Transformational Data Sharing ETF (BLOK), or the direct holding of Bitcoin in Bitwise Bitcoin ETF Trust (BITB), investors have options to choose from based on their investment strategies.

Overall, Bitcoin and crypto ETFs serve as valuable tools for investors looking to participate in the growing cryptocurrency market while leveraging the familiarity and regulatory oversight of traditional investment vehicles.