Futures proprietary trading firms are companies that allow traders to trade futures contracts using the firm’s capital rather than their own. These firms typically evaluate traders through structured challenges or performance criteria, after which successful participants gain access to funded accounts. Among others in space, Alpha futures is a futures trading and proprietary trading platform designed to provide traders with access to global futures markets and professional funding opportunities. Read on this Alpha Futures Review to know more about it as a futures proprietary trading firms.

Table of Contents

What is Alpha Futures?

Alpha Futures operates as a futures proprietary trading firm focused on giving traders structured access to global futures markets through firm-provided capital. The platform emphasizes a professional trading environment built around regulated CME Group futures instruments, covering equity index futures, commodity futures, and select cryptocurrency futures contracts such as MBT and MET, where applicable.

Alpha Futures positions its offering around institutional-grade trading tools, clearly defined risk management rules, and evaluation-based funding pathways, allowing traders to progress toward funded accounts based on performance rather than personal capital size.

Trading access is delivered through multiple supported execution platforms, enabling flexibility in workflow while maintaining strict drawdown controls, predefined objectives, and account rules that align trader behavior with sustainable risk practices. Overall, Alpha Futures frames itself as a performance-driven prop firm combining capital access, disciplined risk frameworks, and exchange-listed futures exposure for retail and aspiring professional traders.

Alpha Futures: Key Features

- CME Group–Listed Futures Market Access

Alpha Futures provides traders access to exchange-listed futures instruments from the CME Group, including products traded on CME, CBOT, NYMEX, and COMEX. This positions the platform squarely within regulated futures markets rather than CFDs or synthetic instruments, aligning trader activity with real market liquidity and exchange rules. - Support for Cryptocurrency Futures Contracts

In addition to traditional futures, Alpha Futures allows trading in Micro Bitcoin (MBT) and Micro Ether (MET) futures, enabling exposure to crypto price movements through regulated futures contracts instead of spot or perpetual markets. This lowers contract size while maintaining exchange transparency. - Evaluation-Based Proprietary Trading Model

Alpha Futures operates on a performance-based evaluation structure, where traders must meet defined profit objectives and risk parameters before progressing to a qualified or funded account. This model emphasizes risk discipline and consistency, rather than short-term gains, as the primary criteria for capital access. - Multiple Professional Trading Platforms

The firm’s core platform is ProjectX, a web-based trading environment designed for futures prop traders. In addition, users can trade via Quantower and Tradovate, with NinjaTrader integration also supported through shared credentials, and TradingView accessible via the Tradovate connection. - Standardized Trading Hours and Session Structure

Alpha Futures follows exchange-aligned trading sessions, with a defined trading day reset and mandatory position closure times. This structure mirrors professional futures trading practices and reduces overnight exposure risk. - Rule Transparency and Documentation

All trading conditions, restrictions, and account rules are clearly documented in Alpha Futures’ official help resources, allowing traders to understand expectations before participation. This transparency reduces ambiguity and reinforces the firm’s rule-driven operating model.

Also, you may read 10 Best Futures Prop Trading Firms

How Alpha Futures works: A step-by-step guide

- Select an evaluation plan and account size

Alpha Futures offers multiple evaluation options, including Standard, Advanced, and ZERO plans. Each plan differs in structure, rules, and pricing, allowing traders to choose an account that best fits their trading style and risk tolerance. - Begin with a subscription-based evaluation

Traders start by purchasing an evaluation account on a monthly subscription basis. The subscription renews monthly until the trader passes the evaluation and automatically stops once the evaluation is successfully completed. - Trade under predefined evaluation rules

During the evaluation phase, traders must reach the stated profit target while adhering to Alpha Futures’ risk and consistency rules. The primary failure condition is breaching the maximum loss limit, which results in the evaluation ending. - Understand daily risk protections (plan-dependent)

Certain plans include a Daily Loss Guard, which acts as a soft protection. If triggered, trading is paused until the next trading day rather than resulting in an immediate account failure. Standard and Advanced evaluations emphasize overall maximum loss limits instead of daily restrictions. - Pass the evaluation and qualify for funding

Once the profit target and consistency requirements are met, the evaluation account is closed, and the trader becomes eligible to move forward to the Qualified Account stage. - Activate the Qualified Account

To activate a Qualified Account, traders must:- Complete identity verification (KYC) through the dashboard

- Sign the proprietary trading agreement within the allowed timeframe

- Pay a one-time activation fee (no recurring monthly fees apply to qualified accounts)

After completion, the Qualified Account is typically issued within a short processing window.

- Trade with firm capital and request payouts

Qualified traders trade using firm-provided capital while following ongoing risk rules. Payout eligibility and frequency depend on the selected plan, with options ranging from bi-weekly to weekly payout cycles. Minimum and maximum payout thresholds apply, and approved withdrawals are processed within the firm’s stated timeframes.

Also, you may read Alpha Capital Review

Alpha Futures Challenge Structure Overview

- One-step evaluation model– Traders prove their skills through a single evaluation and can qualify for up to $450,000 in simulated trading capital.

- Large trader base and payouts– Alpha Futures reports 75,000+ qualified analysts, 500,000+ total analysts, and over $25 million paid in performance fees.

- Fast performance fee processing– Performance fee requests are typically processed in an average of around 5 hours.

- High payout limits– Traders can withdraw up to $15,000 per payout request on Standard and Advanced accounts, which is higher than many competing futures prop firms.

- Trader-friendly drawdown rules– Uses an end-of-day (EOD) trailing maximum loss limit instead of strict intraday trailing drawdowns, giving traders more flexibility while managing risk.

- No daily drawdown on key plans– Standard and Advanced evaluations do not have daily drawdown limits and rely only on the maximum loss rule.

- Simple and transparent evaluation rules– No minimum trading days and no hidden rules; traders only need to trade profitably while staying within the maximum loss limit.

- Fast and accessible support– Support is available via Discord, email, and the help center, with a focus on quick response times.

- Professional exposure opportunities– Qualified traders may gain exposure through the Alpha Group, including potential opportunities with Alpha Prime’s professional trading team in London.

- Plans for different experience levels- Standard accounts are suited for traders building discipline and consistency, while Advanced accounts are designed for experienced traders seeking fewer restrictions.

Alpha Futures ZERO Plan

| Rule / Feature | 50K ZERO Plan – Evaluation | 50K ZERO Plan – Qualified | 100K ZERO Plan – Evaluation | 100K ZERO Plan – Qualified |

|---|---|---|---|---|

| Monthly Price | $99 / month | — | $199 / month | — |

| Minimum Trading Days | 1 | 5 | 1 | 5 |

| Profit Target | $3,000 | None | $6,000 | None |

| Maximum Position Size | 3 Contracts | Scaling plan to 3 contracts | 6 Contracts | Scaling plan to 6 contracts |

| Maximum Drawdown | $2,000 | $2,000 | $4,000 | $4,000 |

| Profit Split | None | 90% | None | 90% |

| Resets | $79 | None | $159 | None |

| Daily Loss Guard | $1,000 | $1,000 | $2,000 | $2,000 |

| Consistency Rule | None | 40% | None | 40% |

| Max Allocation | None | 3 Accounts | None | 3 Accounts |

| Hold Through News | Yes | Yes (with restrictions) | Yes | Yes (with restrictions) |

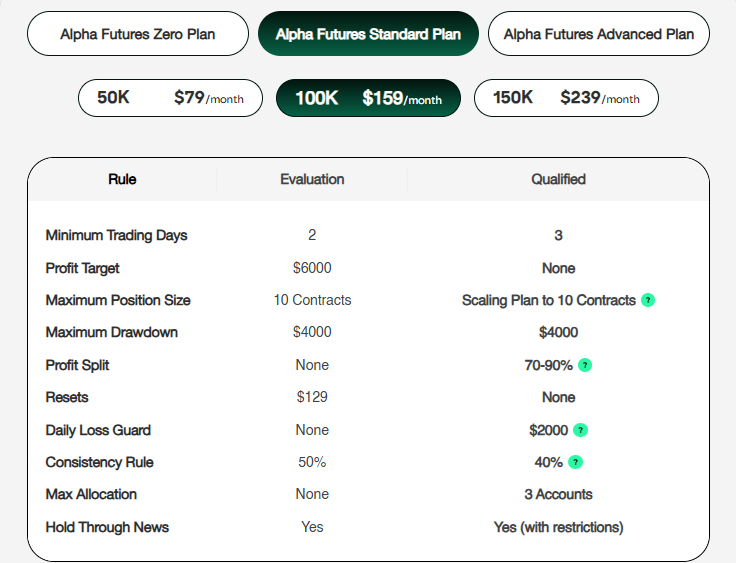

Alpha Futures Standard Plan

| Rule / Feature | 50K Standard | 100K Standard | 150K Standard |

|---|---|---|---|

| Monthly Price | $79 / month | $159 / month | $239 / month |

| Minimum Trading Days | Eval: 2Qual: 3 | Eval: 2Qual: 3 | Eval: 2Qual: 3 |

| Profit Target | Eval: $3,000Qual: None | Eval: $6,000Qual: None | Eval: $9,000Qual: None |

| Max Position Size | Eval: 5 contractsQual: Scaling to 5 | Eval: 10 contractsQual: Scaling to 10 | Eval: 15 contractsQual: Scaling to 15 |

| Maximum Drawdown | Eval: $2,000Qual: $2,000 | Eval: $4,000Qual: $4,000 | Eval: $6,000Qual: $6,000 |

| Profit Split | Eval: —Qual: 70–90% | Eval: —Qual: 70–90% | Eval: —Qual: 70–90% |

| Reset Fee | Eval: $59Qual: None | Eval: $129Qual: None | Eval: $199Qual: None |

| Daily Loss Guard | Eval: NoneQual: $1,000 | Eval: NoneQual: $2,000 | Eval: NoneQual: $3,000 |

| Consistency Rule | Eval: 50%Qual: 40% | Eval: 50%Qual: 40% | Eval: 50%Qual: 40% |

| Max Allocation | Eval: —Qual: 3 accounts | Eval: —Qual: 3 accounts | Eval: —Qual: 3 accounts |

| Hold Through News | Eval: YesQual: Yes (restrictions) | Eval: YesQual: Yes (restrictions) | Eval: YesQual: Yes (restrictions) |

Alpha Futures Advanced Plan

| Rule / Feature | 50K Advanced | 100K Advanced | 150K Advanced |

|---|---|---|---|

| Monthly Price | $139 / month | $279 / month | $419 / month |

| Minimum Trading Days | Eval: 2Qual: 5 | Eval: 2Qual: 5 | Eval: 2Qual: 5 |

| Profit Target | Eval: $4,000Qual: None | Eval: $8,000Qual: None | Eval: $12,000Qual: None |

| Max Position Size | Eval: 5 contractsQual: 5 (no scaling) | Eval: 10 contractsQual: 10 (no scaling) | Eval: 15 contractsQual: 15 (no scaling) |

| Maximum Drawdown | Eval: $1,750Qual: $1,750 | Eval: $3,500Qual: $3,500 | Eval: $5,250Qual: $5,250 |

| Profit Split | Eval: —Qual: 90% | Eval: —Qual: 90% | Eval: —Qual: 90% |

| Reset Fee | Eval: $139Qual: None | Eval: $279Qual: None | Eval: $419Qual: None |

| Daily Loss Guard | Eval: NoneQual: None | Eval: NoneQual: None | Eval: NoneQual: None |

| Consistency Rule | Eval: 50%Qual: None | Eval: 50%Qual: None | Eval: 50%Qual: None |

| Max Allocation | Eval: —Qual: 3 accounts | Eval: —Qual: 3 accounts | Eval: —Qual: 3 accounts |

| Hold Through News | Eval: YesQual: Yes | Eval: YesQual: Yes | Eval: YesQual: Yes |

- All analysts pay a One-Time Activation Fee of $149 per Qualified Account upon passing Standard and Advanced Evaluations offered through an Analyst Account.

Alpha Futures: Security & Safety

Alpha Futures focuses on policy transparency and risk awareness rather than custodial claims. Its Privacy Policy clearly explains how user data is collected, used, and disclosed during website use, evaluations, and account setup, with users consenting to these practices by accessing the platform.

All trading is conducted in a simulated environment, meaning traders do not deposit personal trading capital with the firm. This reduces custody and withdrawal risk and aligns with Alpha Futures’ role as a proprietary trading firm, not a broker or exchange.

The platform provides explicit risk disclosures, stating that futures trading carries significant risk and that simulated performance does not guarantee real results. User participation is governed by formal Terms and Conditions, which define responsibilities, trading rules, and liability limits, ensuring clear expectations for both parties.

Alpha Futures also relies on formal legal agreements to protect both the firm and its users. Overall, Alpha Futures focuses on legal clarity, risk awareness, and non-custodial account structures as the foundation of its security and safety approach.

Also, you may read Best Risk Management Strategies for Crypto Trading

Partnership and Affiliate Programs

Alpha Futures runs an Affiliate Program that allows individuals to earn recurring commissions by sharing a unique referral link or code. Affiliates receive a 15% commission on subscription purchases made through their link, and this commission recurs for as long as the subscriptions remain active.

Affiliates also earn 15% on reset fees from referred accounts, with no cap on total earnings. Participants can generate their affiliate link directly from the dashboard and share it on social media or other channels. Affiliate payout requests can be made from the dashboard, and are processed within a defined timeframe.

Alpha Creator Program

Alpha Futures also operates an Alpha Creator Program aimed at content creators. Participants are rewarded for generating content about Alpha Futures—either by clipping official content or creating original posts on platforms such as Facebook, Instagram, YouTube, X (Twitter), or TikTok.

Creators can earn $1 for every 1,000 views, with a monthly view rewards pool and capped monthly earnings per creator. The program includes additional bounties and can award non-monetary benefits such as accounts or merchandise as part of participation incentives.

Also, you may read Top 10 Crypto Affiliate Programs – Earn Passive Income

Support and Community Ecosystem

- Multiple support channels– Email and web-based support available via the Contact Us page.

- FAQ section– Covers common questions on accounts, rules, risk, and evaluations.

- Discord community– Official Discord for announcements, trader interaction, and community support.

- Analyst Interviews– Insights and experiences shared directly by Alpha Futures analysts.

- Introduction to Futures– Beginner-focused resources explaining futures trading basics.

- Forex to Futures– Guides designed to help forex traders transition into futures markets.

- Status Updates– Official updates on platform performance, changes, and announcements.

- Merchandise and community engagement– Branded merch and social interaction to strengthen community involvement.

Conclusion

Alpha Futures presents a straightforward futures prop trading model built around simulated accounts, clear rules, and trader-friendly risk mechanics. Its one-step evaluations, end-of-day maximum loss limits, and high payout caps distinguish it from many competing firms, while multiple plan options allow traders to choose based on experience level. With access to CME Group futures, professional trading platforms, fast performance fee processing, and an active support ecosystem, Alpha Futures focuses on clarity, flexibility, and scalability for traders seeking funded futures opportunities without capital custody risk.

What is the consistency rule?

In Evaluation accounts, profits from any single day must not exceed 50% of net profits. In Qualified accounts for Standard and Zero, a 40% rule applies on profit days to be eligible for payout. Advanced Qualified accounts have no consistency rule.

Is futures trading risky?

Yes. Futures trading contains substantial risk, and traders could lose more than their initial investment. This risk disclosure is stated on the official FAQ page.

What are the trading hours?

Trading starts at 6:00 PM EST and ends at 4:20 PM EST the next trading day. Open positions must be closed by 4:20 PM EST each day.