One particularly intriguing area of DeFi is the realm of Liquid Staking Derivatives (LSDfi), which introduces a novel approach to utilizing staked assets. In this article, we will delve into some of the top LSDfi projects that are shaping the landscape and driving innovation forward.

Table of Contents

Summary

- Lybra Finance pioneers tokenize staked assets in a dual-token pool (LYT and LYT-s). Users deposit ETH or stETH for eUSD and 8.1% interest.

- Maverick unlocks asset liquidity with liquid tokens, enabling trading while keeping stakes via the AMM framework and reward fees.

- Raft introduces “R” money, smart borrowing with ongoing rewards in the world of LSDfi projects.

- Index Coop diversified indexes avoid direct ETH staking and maintain a 4% base Annual Percentage Yield (APY).

- Gravita offers stablecoin lending via LSDs with a profit-sharing stability pool.

- Alchemix issues alUSD backed by staked assets and dynamic borrowing with earnings.

- unshETH facilitates LSD trading and yield optimization, rewards from pooling various LSDs.

- Pendle trades future yield tokens, separating principal and yield via PT and YT tokens.

- Asymetrix gamifies a no-loss lottery with a staked asset prize pool and engaging rewards which makes it an exclusive option among the LSDfi Projects.

- Flashstake diverts future earnings via fees for immediate access, and FLASH holders benefit.

What are liquid staking derivatives (LSDs)?

Liquid staking derivatives (LSDs) are tokens that represent a share in staked assets on blockchain networks, allowing users to retain the benefits of staking while having the flexibility to trade or use these tokens in various DeFi applications.

What are LSDfi projects?

LSDfi is a set of protocols built on liquid staking derivatives (LSD), which involve different parts of the DeFi system. These rules might include regular DeFi parts like decentralized trading and lending platforms. They could also affect more advanced projects that use the unique features of LSD.

LSD is very important for making the whole DeFi system grow. LSDfi is like the next step from LSD, which helps make money and makes it easier to work with LSD projects. The liquid staking projects create a strong base for LSDfi in DeFi.

Top LSDfi projects

Lybra.Finance

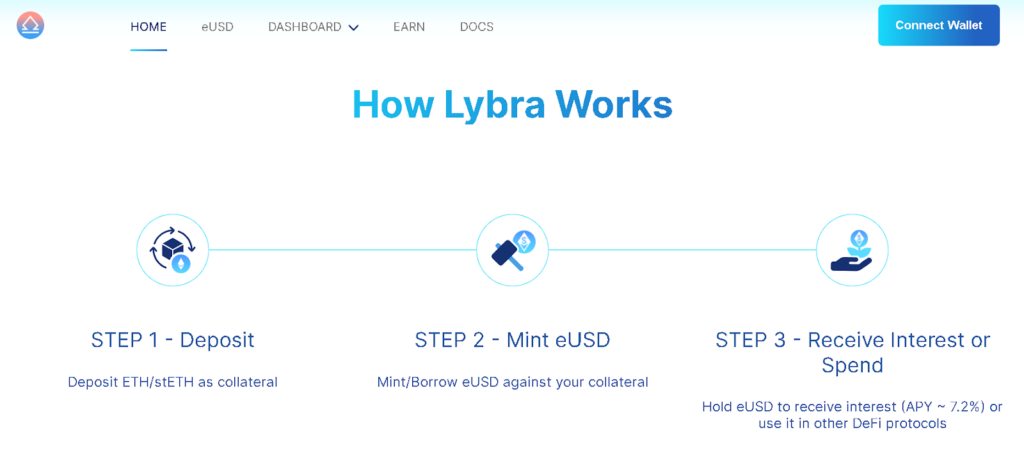

- Lybra.Finance is a pioneering platform among all LSDfi projects aiming to tokenize staked assets and offer them as a liquidity pool. It serves as a platform for an interest-bearing stablecoin protocol.

- Lybra employs a dual-token model consisting of LYT (Lybra Token) and LYT-s, representing staked assets.

- The users can deposit ETH or Lido Staked ETH (stETH) as collateral. In return for this collateral, users can avail of Lybra’s stablecoin (eUSD). This lending mechanism permits borrowing against collateral up to a collateral ratio of 150%.

- Furthermore, the additional advantage for those who hold this stablecoin (eUSD) is an automatic interest of 8.1% is accrued.

- Simply retaining this stablecoin allows holders to possess a stable financial asset and amplify its value over time.

- Beyond the gains derived from holding, individuals who possess this stablecoin can also accrue earnings through participating in liquidity pools associated with eUSD.

- Additionally, they can embrace strategies involving ETH-leveraged long positions. By utilizing eUSD to purchase more ETH, individuals can tactically enhance their exposure to Ethereum’s value trends.

- Ensuring security and smart contract audit remains a top priority to maintain user trust and safeguard the platform from vulnerabilities.

Maverick Protocol

- The Maverick protocol establishes a fresh framework unlike other LSDfi projects to foster a dynamic market environment, yielding advantages for traders, liquidity providers, DAO treasuries, and developers.

- Maverick focuses on unlocking the liquidity of staked assets by issuing liquid tokens, enabling users to trade them in various DeFi protocols without compromising their staking positions.

- Maverick employs a bridge mechanism to convert staked assets into liquid assets, allowing users to transition between the two states seamlessly.

- By providing liquidity to staked assets, Maverick empowers users to capitalize on trading opportunities and access capital without the need to unstake.

- Maverick protocol functions with an Automated Market Maker (AMM) framework.

- Furthermore, Maverick presents the opportunity to participate in liquidity provision by utilizing your LSD/LST tokens, acquiring rewards originating from its associated fees.

- With an optimistic vision, the protocol actively strives to position itself as a premier decentralized exchange that handles LSTs.

- Furthermore, Maverick confronts the challenges confronted by liquidity providers (LPs) within Uniswap V3.

- These challenges include addressing position management complexities, lacking clear guidelines for LPs, and enhancing capital efficiency.

Raft

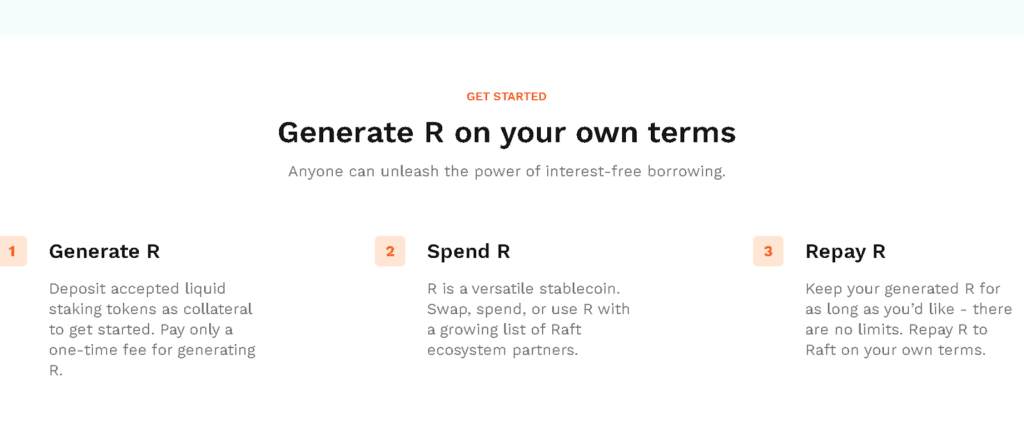

- Raft is a system in the world of LSDfi projects that allows you to create a type of money called “R” by putting in special tokens that show you’re involved in staking.

- This lets you smartly borrow money while still getting rewards for staking.

- “R” is a kind of stable money connected to Ethereum, and it’s cleverly linked to certain staking tokens like stETH and rETH.

- You need to borrow a minimum of 3,000 R, and your collateral should be worth at least 120% of that amount.

- You can exchange R on platforms like Balancer, Uniswap, Paraswap, or 1inch.

- Currently, about $45 million worth of stETH is being used as security in the system, and on average, people have collateral worth 173% of their borrowed amount.

- Flash minting lets you create R money without needing collateral and get rid of it all in one go. This way, you pay less for transaction fees.

- There’s also a useful feature called one-stop leverage, which helps you use your stETH to earn more by increasing your ETH staking rate by up to 6 times (maximum 24% instead of 4%).

- The project plans to expand its integrations with various DeFi platforms and explore new ways to enhance liquidity provision.

Index Coop

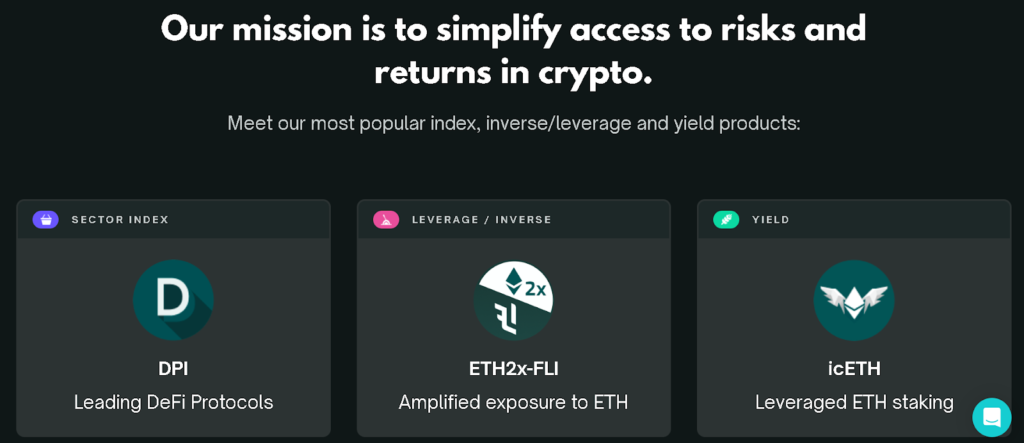

- Index Coop introduces a decentralized indexing protocol that leverages liquid staking derivatives to create tokenized indexes of staked assets.

- Index Coop operates as a DAO overseeing various DeFi pools, each with its own ERC20 token representing pool shares.

- These tokens act like indexes, allowing users to access multiple assets at once, reducing gas fees and simplifying investments.

- The well-known DeFi Pulse is one of Index Coop’s most recognized indexes.

- Interest Compounding ETH Index (icETH) leverages staking via Aave, using deposited icETH funds to buy stETH as collateral for borrowing ETH.

- Diversified Staked ETH (dsETH) splits assets among safe staking protocols: rETH, wstETH, and sETH2.

- These indexes aim to provide exposure to LSDs without directly staking ETH.

- Index Coop doesn’t stake ETH itself nor employs yield-boosting strategies like Farming, maintaining a base APY of around 4%, similar to ETH staking.

- Users face no minting or redeeming fees, but a streaming fee ranges from 0.25% to 0.75%.

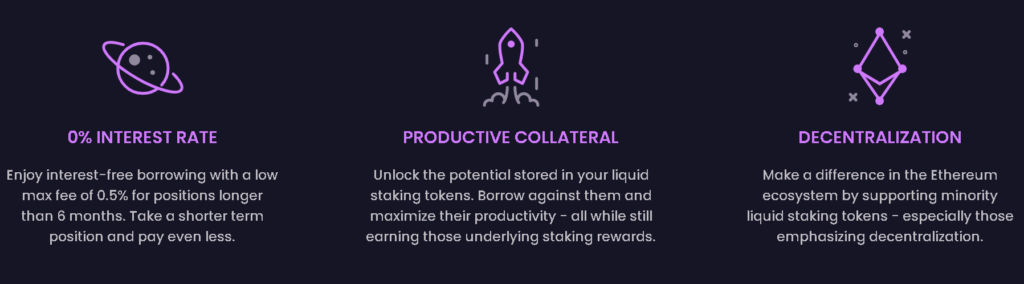

Gravita

- Like other LSDfi projects, Gravita is a protocol for lending stablecoins: you provide Leveraged Staking Derivatives (LSDs) to create USD-pegged GRAI.

- Gravita accommodates WETH, wstETH, and rETH for these operations.

- Gravita’s unique feature is a “stability pool.” By depositing GRAI into this pool, you can share in liquidation profits. When a position is liquidated, its collateral goes to the stability pool, and some GRAI is burned.

- As a participant in the stability pool, you get a discounted share of that collateral. Currently, the pool contains 5.2 million GRAI.

- When borrowing funds from Gravita, a fee of 0.50% applies. However, part of the fee is returned if you redeem GRAI within 6 months.

- The faster you repay, the larger the refund, although a week’s interest is still charged in any scenario.

- Note with a 3% redemption fee, if you cash in $1 worth of GRAI, you’ll receive $0.97 worth of LSD collateral.

- Currently, Gravita doesn’t possess its token. Be cautious regarding any announcements about Initial DEX Offerings (IDO) or airdrops, as these could be fraudulent.

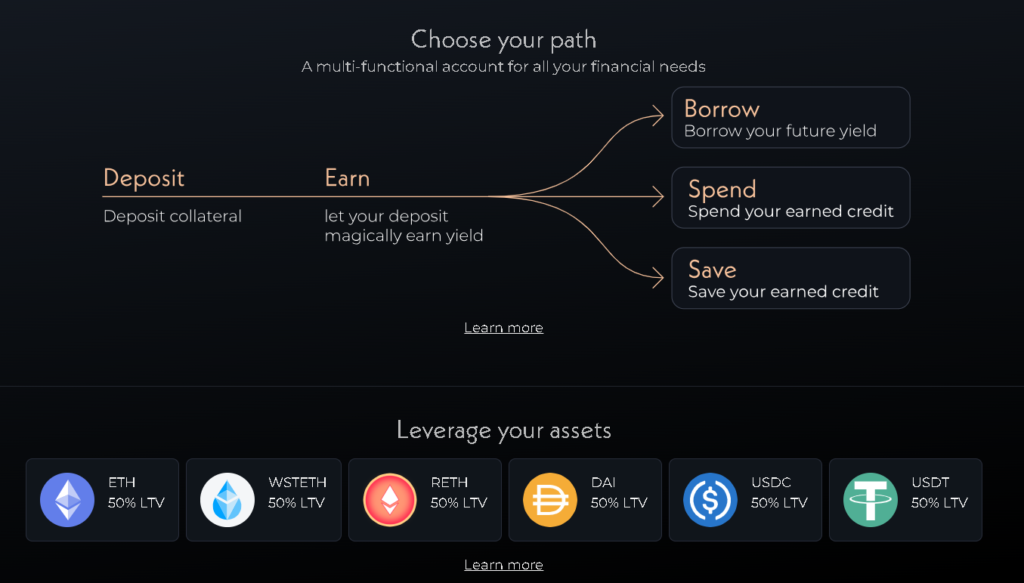

Alchemix

- Alchemix issues alUSD, a synthetic stablecoin backed by staked assets, allowing users to access liquidity while maintaining staking positions.

- Alchemix is a special lending system where you borrow a token based on the same token you give as collateral.

- Instead of using regular tokens, they use different versions of Ethereum (including LSDs) for the things you put in and borrow.

- You can only borrow up to half (50%) of the value of what you put in. For instance, if you give 1 wstETH, you’ll get 0.5 alETH.

- They take the tokens you give and use them to earn money, which helps pay off your loan.

- The good thing is that you can still use your tokens normally while paying off the loan, and there are no extra charges for paying back early.

- You can also use the alETH tokens to earn more money by doing yield farming on Saddle Finance.

- You can earn about 20% interest there. Or, you can use your alETH on Alchemix itself and get around 6% interest.

- You can even change your alETH back into regular Ethereum at a 1:1 ratio. Then you can do whatever you want with it – like earn more or use it as collateral to get even more alETH.

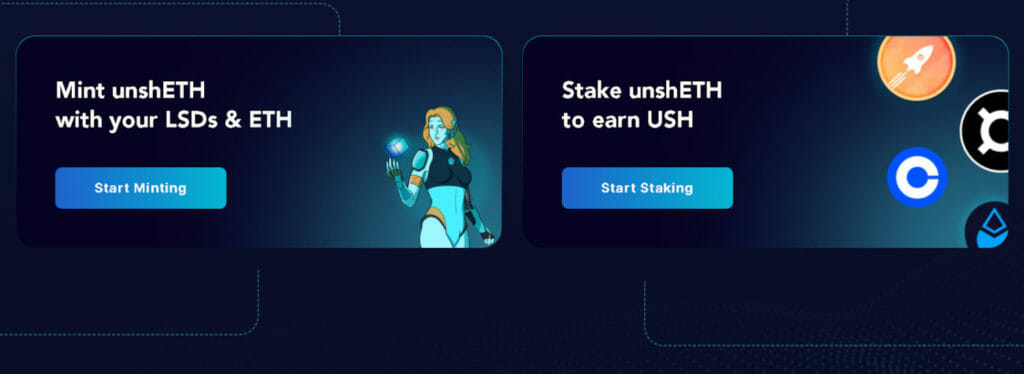

unshETH

- UnshETH is a platform for trading and making the most of LSD tokens on Ethereum and BNB Chain.

- By June 12, unshETH had about $31 million in Total Value Locked (TVL), which makes it stand amongst the biggest LSDfi Projects.

- You can put in different types of LSDs (from Lido, Frax, Ankr, Coinbase, RocketPool, and Swell) and regular ETH or WETH. In exchange, you’ll get unshETH tokens.

- Each unshETH token corresponds to the value of 1 ETH, but it’s a mix of all the LSDs the platform holds.

- So, when you take out unshETH, you get a bit of everything instead of the exact tokens you gave.

- The staking rewards include usual ETH staking rewards (about 4.3%), Fees from swapping tokens (0.02% per swap for most pairs), farming rewards – where you get extra USH governance tokens (about 5.3% in June 2023)

- Furthermore, small fees from making or taking out unshETH and the basic APR (interest) on unshETH is around 10.3%, but it can go higher if you stake for longer.

- Moreover, Farming lets you put your unshETH tokens in certain places to earn more tokens.

- If you’re into swapping, unshETH offers AMM liquidity pools for all the big LSDs, ETH, and WETH.

Pendle

- Pendle lets you separate the part that makes you money from the money it makes, and then you can trade what you think you’ll earn in the future.

- When you put in 0.5 stETH, you get two tokens: 0.5 PT-stETH (the main part) and 0.5 YT-stETH (the money it makes).

- Both PT and YT have a date when they stop being worth much. While you have PT and YT, you can turn them back into the original thing that makes money, like stETH, before they lose value.

- Since you’re splitting the main and money-making parts, you can choose only to have one of the tokens.

- You can buy PT for less on AMM, but when you change it back to the original money-making thing, you’ll get a bit less if you don’t have YT.

- Contrastingly, YT tokens let you get the rewards from this, but you can’t get the original staked ETH.

- With these two tokens, you can Trade them on the AMM or put them in Pendle Pools to earn fees and rewards in a token called PENDLE (up to 43% interest per year).

- If the price of ETH goes up, you can buy PT stETH at a lower price and then change them back to ETH when the price gets to what you’re hoping for. Hence, make a small profit.

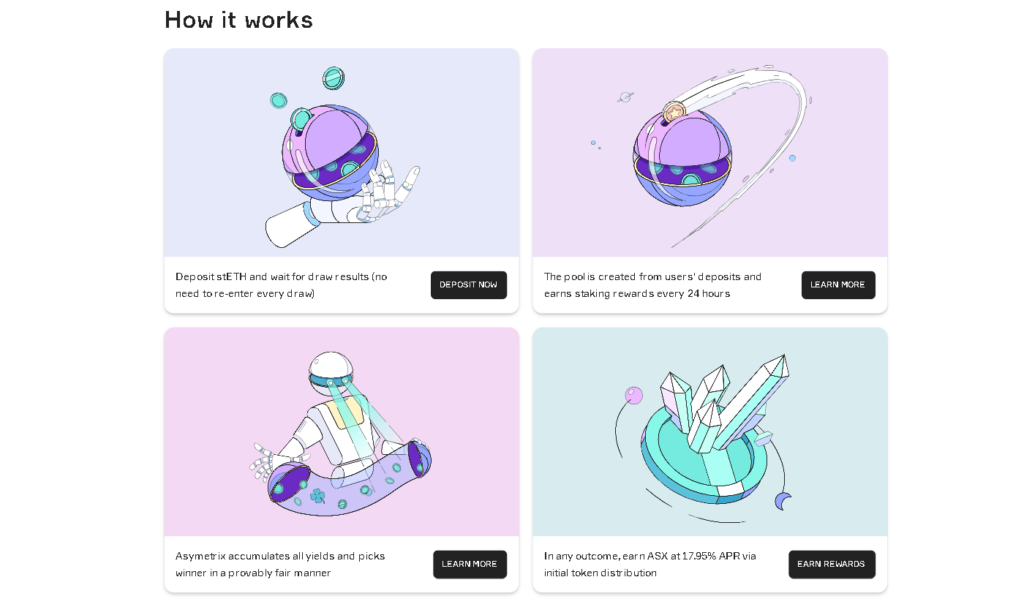

Asymetrix

- Distinct to other LSDfi projects, Asymetrix makes liquid staking fun with its special lottery game.

- Here’s how it works:

- You give some stETH to a pool

- All the staking money it makes in a week becomes the prize fund.

- At the end of the week, they pick three lucky winners (from the people who added to the pool) to share the prize money. They make sure it’s random using something called Chainlink VRF.

- The top winner gets half (50%) of all the money the staking earned.

- The second winner gets 30%, and the third gets 20%.

- It’s called a “no-loss” game because everyone who puts money in also gets ASX tokens, which they can earn interest on (about 18.40% a year).

- You don’t need to join and leave the pool every time. You can keep your stETH there and be part of the game every week.

- Right now, around June 2023, there are almost 10,400 ETH in the pool, and they’re giving out over 6 ETH in prizes each round.

- You must put in at least 0.01 stETH as a minimum amount. There’s no maximum amount.

- You can do it anytime if you want to take your money out. You can take it all out and still play in the next week’s game with the chances you’ve earned, or you can take some of it out, and your chances will change immediately.

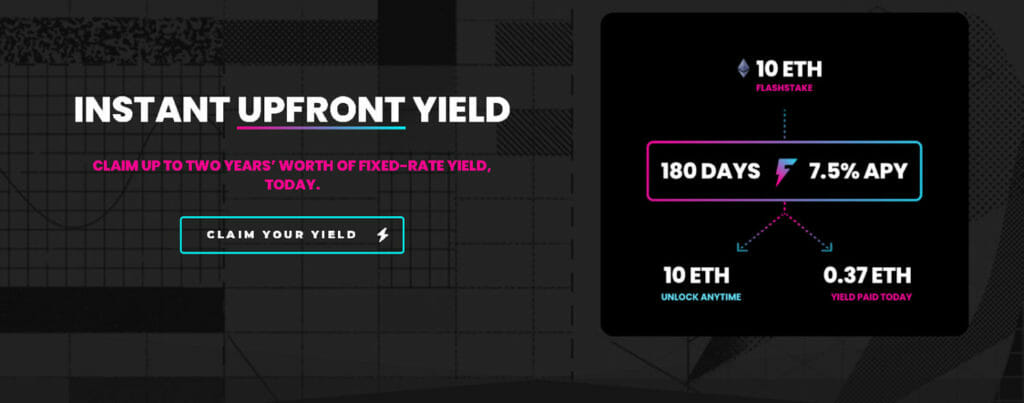

Flashstake

- Flashstake splits earned money from the initial deposit. You can claim all future earnings immediately, without delay, by paying a small fee.

- FLASH token holders receive a portion of this fee as usable funds.

- If you have 1 ETH (which would grow to 1.04 ETH at a 4% yearly interest rate when staked in Lido), you can instead use Flashstake.

- You can lock it up for 365 days and right away get 0.04 wstETH. Your ETH still gets staked, and if you take it out before 365 days, you’ll need to give back the money it would’ve earned based on the interest rate at that time.

- This plan makes sense if you think more people will start staking ETH, and the interest rate will keep dropping – which it has been doing for a while.

- The way they calculate the yearly interest is more complex, involving 31,536,000 (which is how many seconds are in a year).

- How much you can do with Flashstake and the interest you can earn depend on what you’re using (like stETH or rETH) and how much you’re putting in.

- The bigger the amount and the longer you leave, the lower the interest rate.

- For example, with stETH, if you put in 1 ETH for 90 days, you can earn about 5.12%, but if you put in 10 ETH for a whole year, you can get about 4.88%. With rETH, if you put in 1 rETH, the most you can get in 90 days is 4.24%.

Conclusion

Each project brings its unique approach to enhancing liquidity, optimizing yield, and creating new user opportunities. As the DeFi space continues to innovate, LSDfi projects hold the potential to reshape the way users interact with staking assets and the broader financial ecosystem. Users must research and understand LSDfi projects thoroughly to make informed decisions and take advantage of their benefits.

Why would someone use Liquid Staking Derivatives (LSDs) instead of traditional staking?

LSDs provide users with greater flexibility and utility for their staked assets. Unlike traditional staking, where assets are locked up, LSDs allow users to trade, borrow, or earn additional yields without sacrificing participation in the staking ecosystem.

What are some risks associated with using Liquid Staking Derivatives?

While LSDs offer benefits, they also come with risks. The value of these derivatives can fluctuate, affecting users’ potential rewards. Additionally, using derivatives involves smart contract risks and potential vulnerabilities. Users should carefully assess the platform’s security measures and protocols before engaging in LSD activities.

What are the common use cases for Liquid Staking Derivatives (LSDs)?

LSDs can be used for yield farming, collateralizing loans, earning extra income through lending, and managing risk by hedging staking positions. They allow users to access the benefits of staking rewards while engaging in various DeFi activities.