Key Takeaways:

- According to Nomics, over 12,000 cryptocurrency projects have barely seen any trade activity in recent months.

- A significant number of digital tokens are sitting dormant as “even good enterprises” struggle to survive in market gloom that could continue for months.

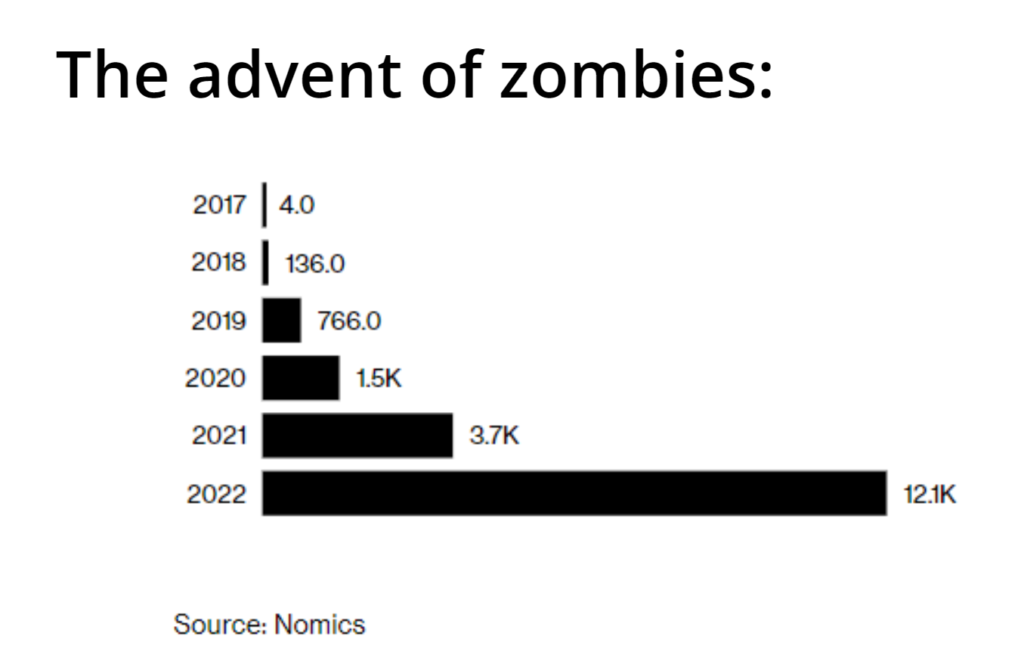

A study by Nomics found that 12,100 cryptocurrency projects have stopped operating as a result of the current bad market. In comparison, there were 1,500 in 2020 and 3,700 in 2021.

According to data supplier Nomics, many crypto tokens have virtually stopped trading this year. They aren’t exactly dead, but like zombies, they aren’t quite active either.

The new asset class has shrunk from the size it attained in 2021 as a result of a number of issues. These include record-high global inflation and measures taken by central banks to lower it.

It also didn’t help that a war broke out between Russia and Ukraine, ventures like Luna failed, and businesses like Voyager Digital, Celsius, and Three Arrows Capital declared bankruptcy.

In general, digital assets are a utility in practically all blockchain applications. Tokens serve as rewards for network validators.

Startups released these tokens in massive quantities when the cryptocurrency market boomed last year. They immediately entered the crypto industry as a result of the bullish market.

Before finally finding stability, the largest coins, like Bitcoin and Ether, saw significant drops. However, the downturn has dealt many investments backing start-ups, riskier, and occasionally dubious ventures the equal of a fatal punch.

The Advent of Zombies:

According to Jacob Joseph, a research analyst at the research firm CryptoCompare, “there was sufficient money, attention, and liquidity for new and current projects during the bull market of 2021.” The continued bear market, however, will make it difficult for even worthwhile initiatives to continue operating as they will no longer have access to funding and resources.

In 2022, the crypto industry was shaken by unfavorable macroeconomic conditions. The central banks took hawkish actions, including raising interest rates, in response to a high inflation rate. Investors were compelled to rotate away from risky assets like cryptocurrencies by the decision.

A rise in interest rates from several central banks is anticipated by many investors. This is done while awaiting the outcome of a Federal Reserve meeting where a potential interest rate increase will be discussed. This implies that people won’t be able to invest as much in the digital economy.

The Meme Tokens Are The Most Negatively affected Initiatives:

Nick Gauther, a co-founder of Nomics, agreed with the same sentiment. The CEO noted that ventures intended for fun and memes are the ones most adversely impacted. Elonmoon, a blockchain platform for moon exploration, is one such initiative. On CoinMarketCap, there is now a cautionary note for the meme token.

BoomSpace, a comparable initiative, no longer runs a website and hasn’t posted anything to its social media profiles since June. 13,800 of the more than 60,000 projects that Nomics monitors scarcely saw any trading activity in the last day.

During the previous bear market, which began in 2018, initial coin offerings boomed, in contrast to this. Then, to generate money, entrepreneurs created coins—often illegally, it turns out.

Most initial coin offerings (ICOs) didn’t even have functioning prototypes, much fewer consumers; when they failed, only investors were hurt. Additionally, the market was smaller: in 2018, 136 tokens in total turned into zombies, while 766 coins did so in 2019, a much lower number than this year.

The present environment encourages startups to adopt a more cautious approach, possibly retaining more commonly traded and valuable coins like Ether or even cash as a backup. During the boom, many ventures maintained their own tokens as a reserve.

Crypto ventures, according to Gauthier, “will need to make sure they’re ready for the lows as much as they want to ride the highs.”

Aaron Brown, a crypto specialist, noted that the transformation of cryptos into zombies takes time. He continued by saying that a token typically does not show any signs of becoming one. According to Brown, the industry is drawing interest from all corners due to the initial costs of projects being frequently minimal.

However, with many seeing little relief from the gloomy market climate, John Griffin, a finance professor at the University of Texas at Austin, predicted that the number of zombies will certainly rise.

In contrast to other businesses, it is less obvious in the crypto world when currencies become zombies and projects end up being effectively dead.